please answer this part only

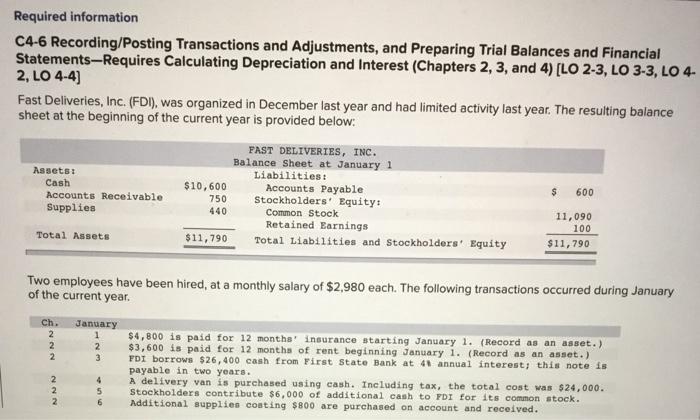

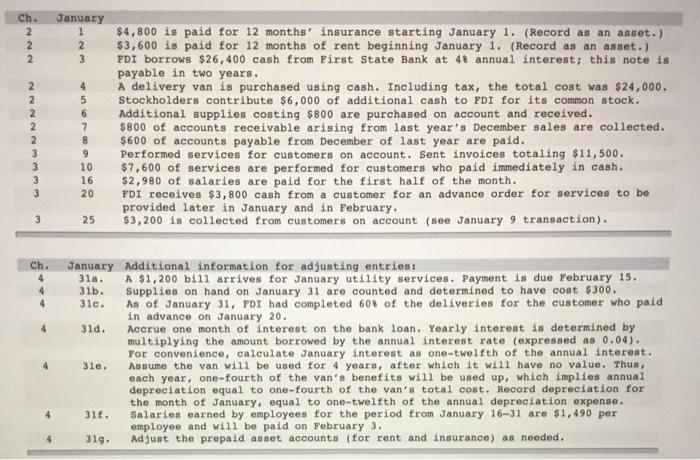

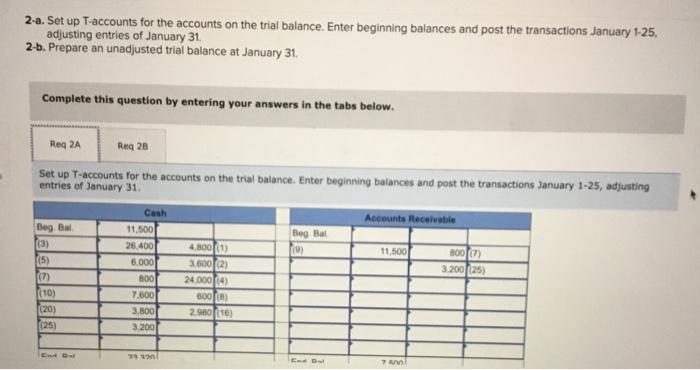

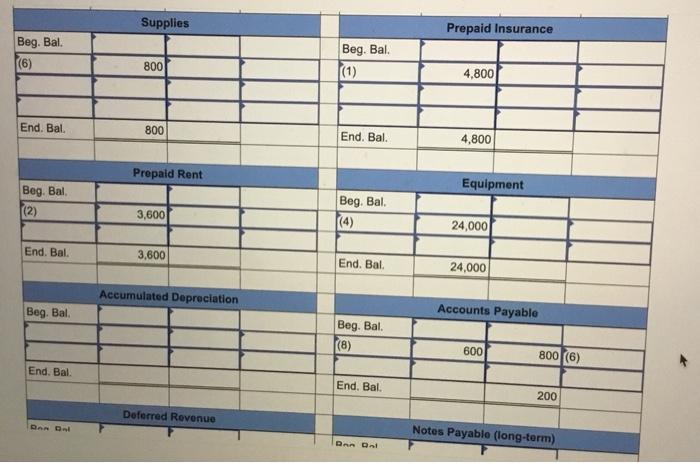

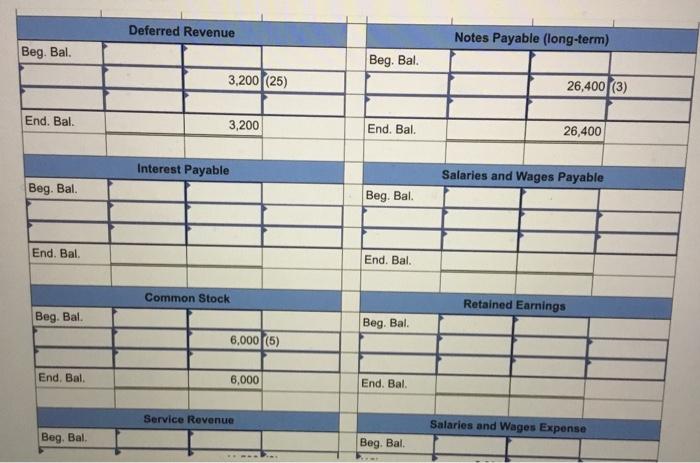

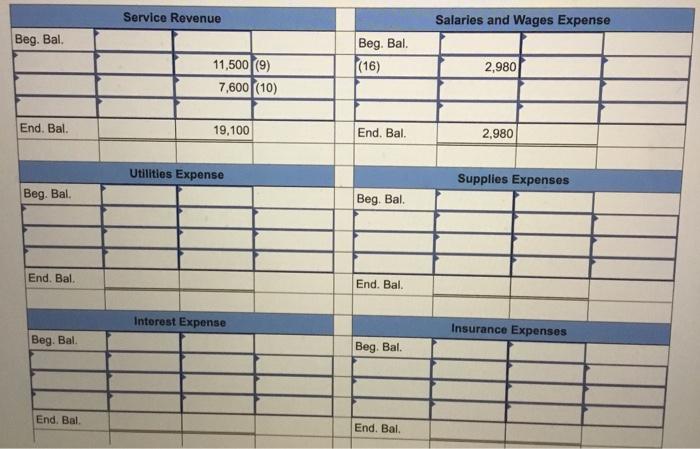

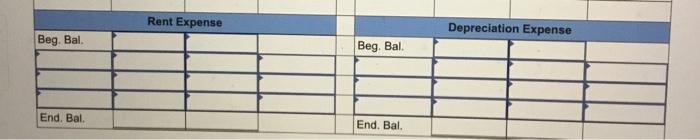

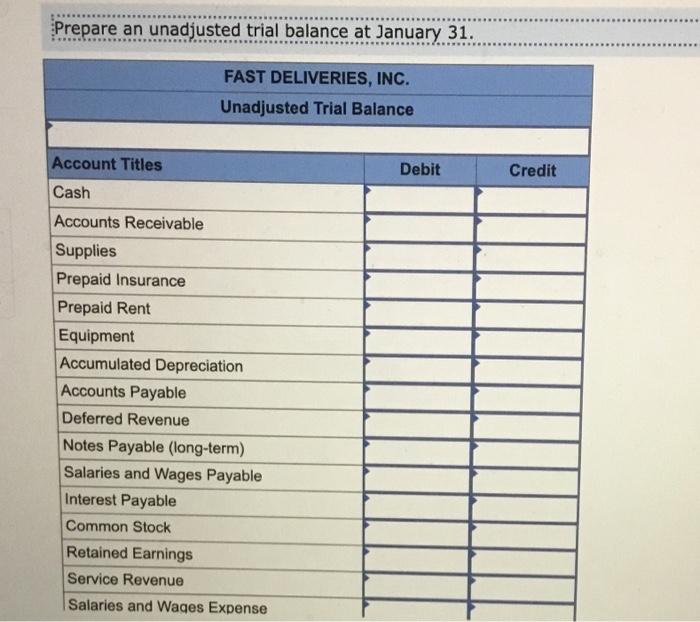

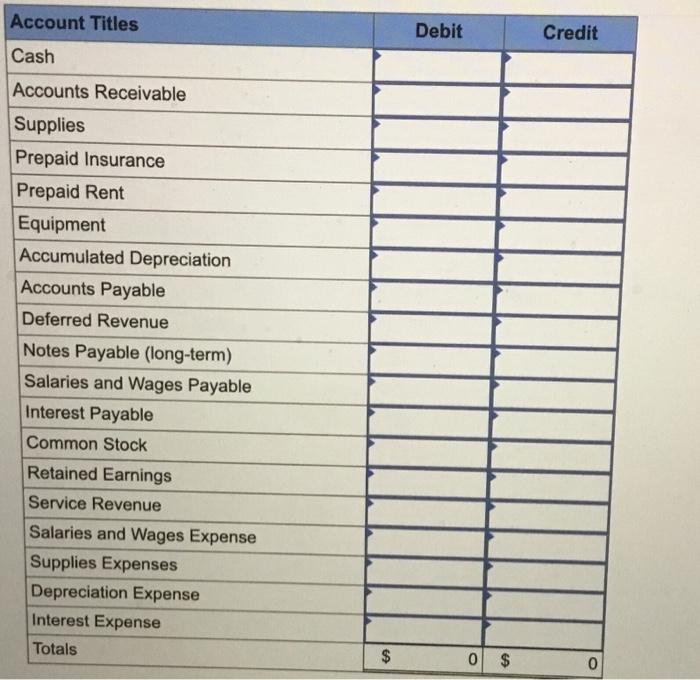

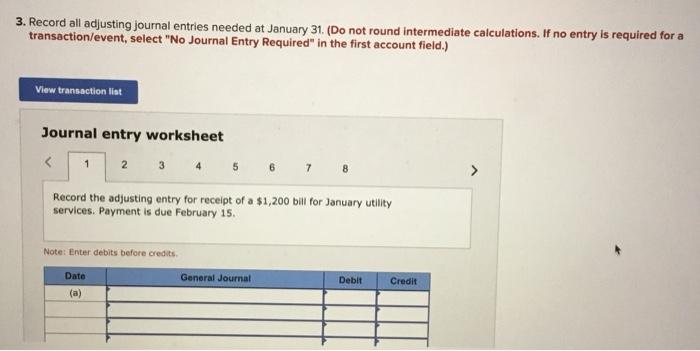

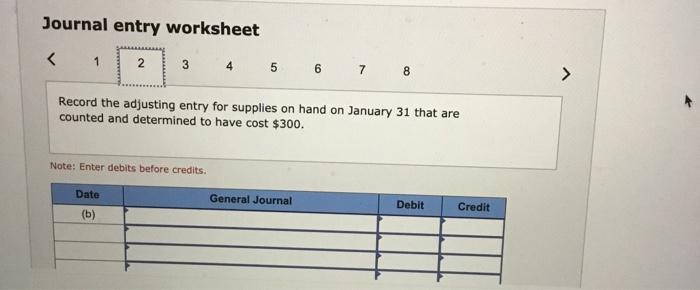

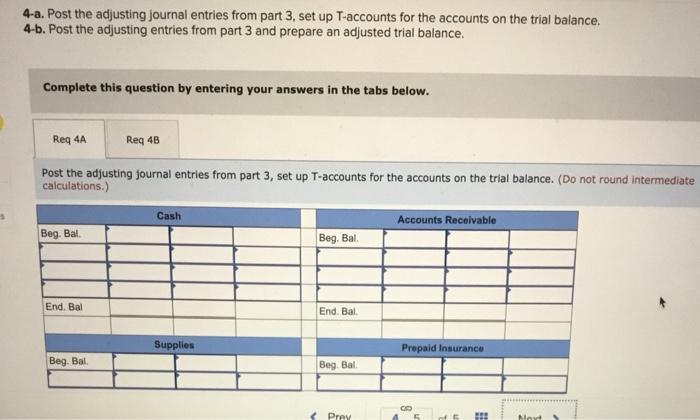

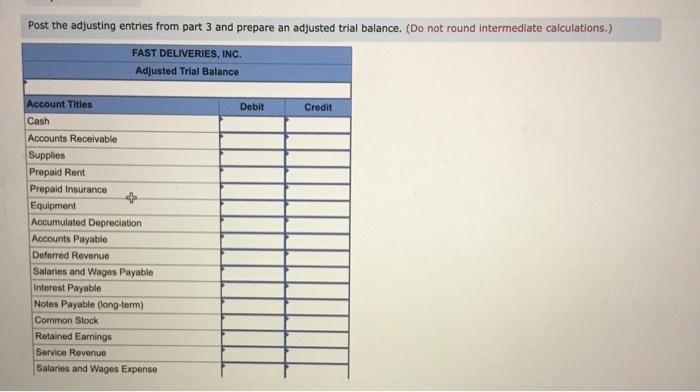

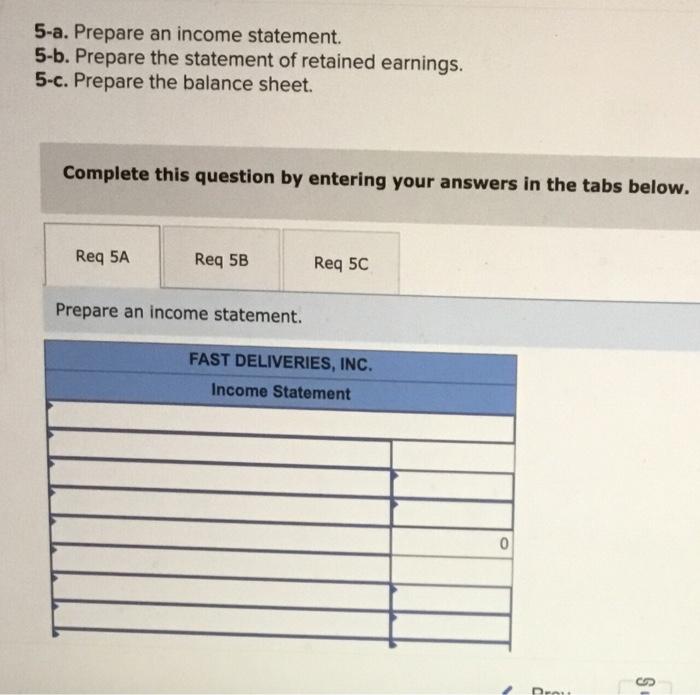

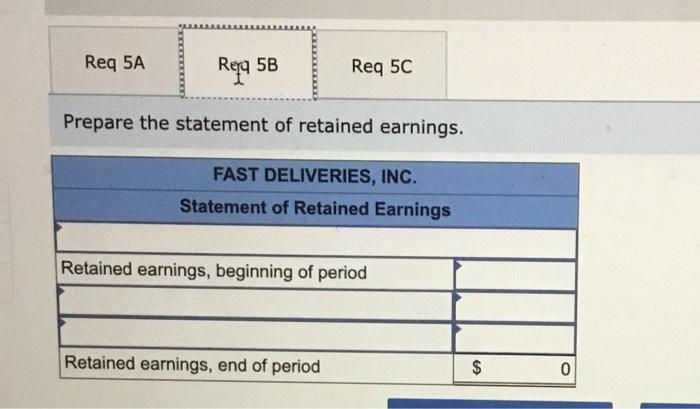

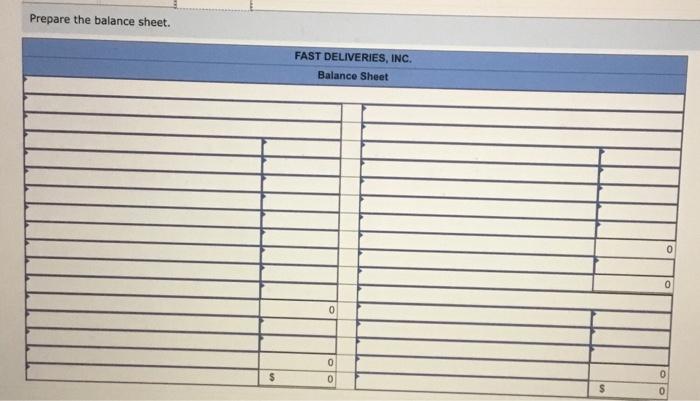

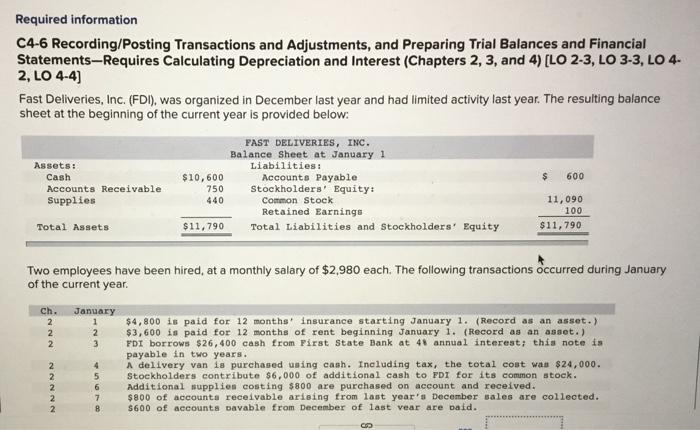

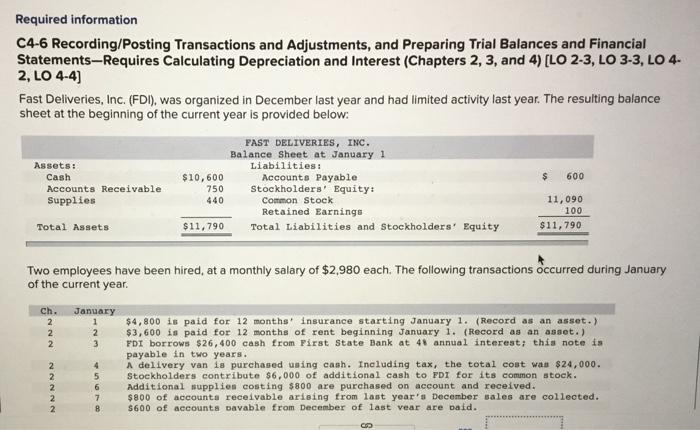

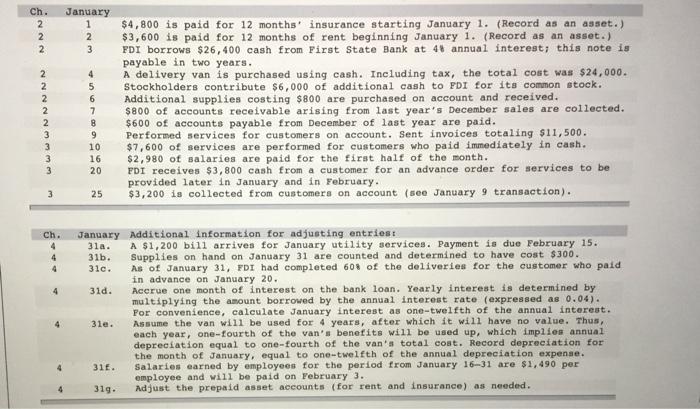

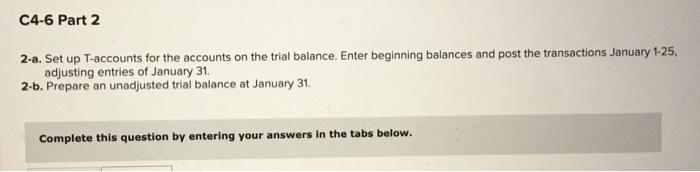

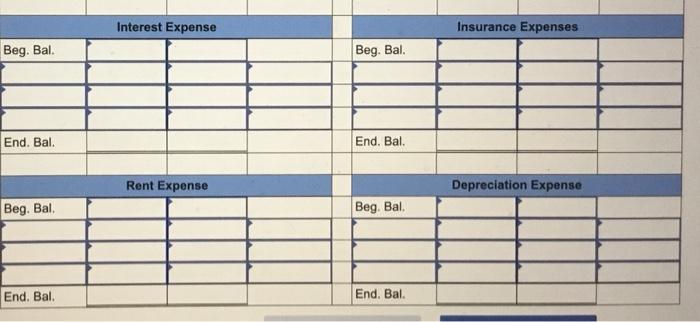

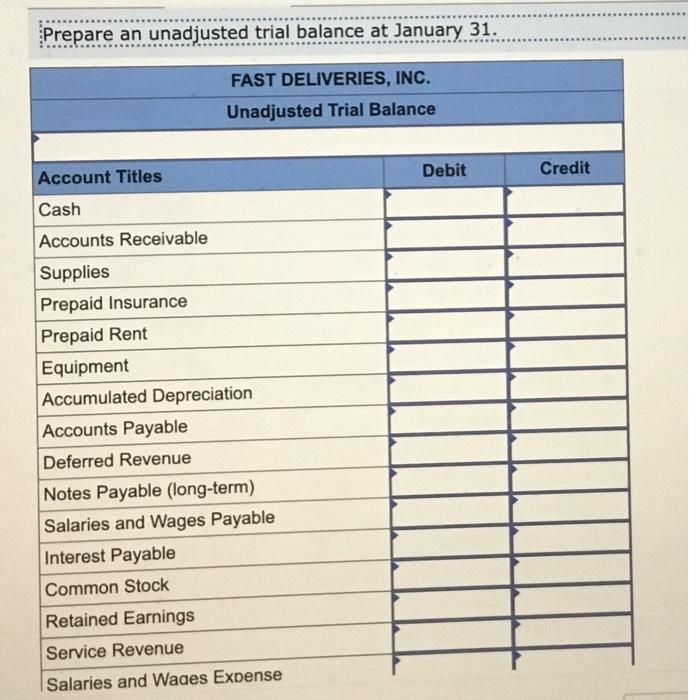

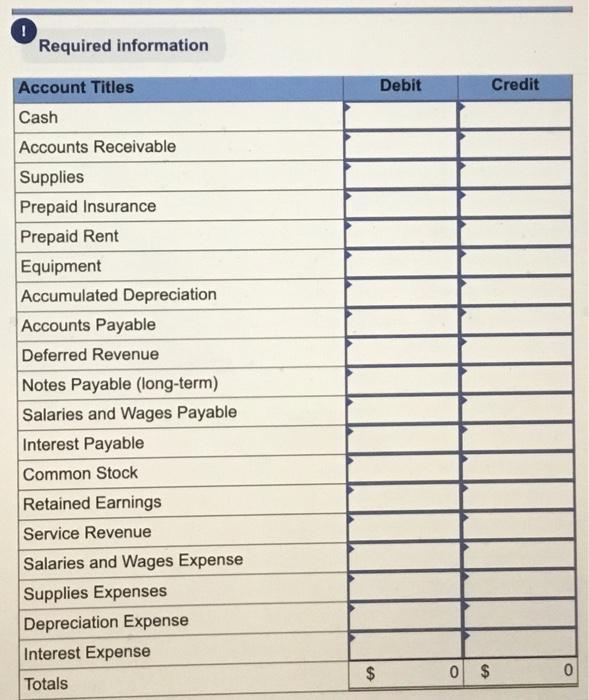

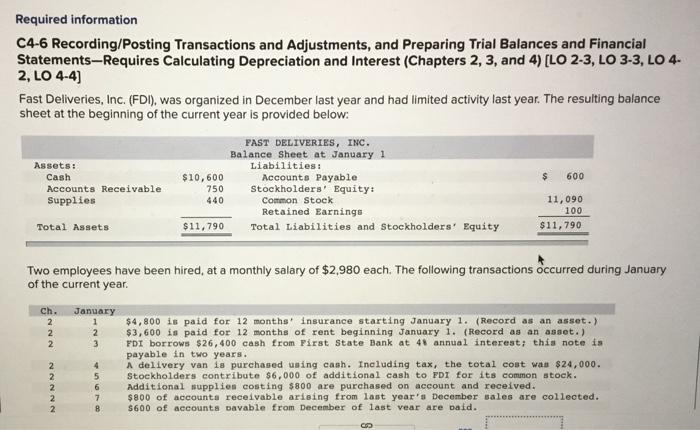

Required information C4-6 Recording/Posting Transactions and Adjustments, and Preparing Trial Balances and Financial Statements-Requires Calculating Depreciation and Interest (Chapters 2, 3, and 4) [LO 2-3, LO 3-3, LO 4- 2, LO 4-4) Fast Deliveries, Inc. (FDI), was organized in December last year and had limited activity last year. The resulting balance sheet at the beginning of the current year is provided below: Assets: Cash Accounts Receivable Supplies FAST DELIVERIES, INC. Balance sheet at January 1 Liabilities: $10,600 Accounts Payable 750 Stockholders' Equity: 440 Common Stock Retained Earnings $11,790 Total Liabilities and Stockholders' Equity $ 600 Total Assets 11,090 100 $11,790 Two employees have been hired, at a monthly salary of $2,980 each. The following transactions occurred during January of the current year. Ch. 2 2 2 January 1 2 3 $4,800 is paid for 12 months insurance starting January 1. (Record as an asset.) $3,600 is paid for 12 months of rent beginning January 1. (Record as an asset.) FDI borrows $26,400 cash from First State Bank at 41 annual interest; this note is payable in two years. A delivery van is purchased using cash. Including tax, the total cost was $24,000. Stockholders contribute $6,000 of additional cash to FDI for its common stock. Additional supplies costing $800 are purchased on account and received. NNN 4 5 6 ch. NNN January 1 2 3 4 5 6 7 8 9 10 16 20 $4,800 is paid for 12 months' insurance starting January 1. (Record as an asset.) $3,600 is paid for 12 months of rent beginning January 1. (Record as an asset.) FDI borrows $26,400 cash from First State Bank at 48 annual interest; this note is payable in two years. A delivery van is purchased using cash. Including tax, the total cost was $24,000. Stockholders contribute $6,000 of additional cash to FDI for its common stock. Additional supplies costing $800 are purchased on account and received. $800 of accounts receivable arising from last year's December sales are collected. $600 of accounts payable from December of last year are paid. Performed services for customers on account. Sent invoices totaling $11,500. $7,600 of services are performed for customers who paid immediately in cash. $2,980 of salaries are paid for the first half of the month. FDI receives $3,800 cash from a customer for an advance order for services to be provided later in January and in February. $3,200 is collected from customers on account (see January 9 transaction). 3 25 Ch. 4 4 4 January Additional information for adjusting entries: 31a. A $1,200 bill arrives for January utility services. Payment is due February 15. 31b. Supplies on hand on January 31 are counted and determined to have cost $300. 31c. As of January 31, FDI had completed 60% of the deliveries for the customer who paid in advance on January 20. 31d. Accrue one month of interest on the bank loan. Yearly interest is determined by multiplying the amount borrowed by the annual interest rate (expressed as 0.04). For convenience, calculate January interest as one-twelfth of the annual interest. 3le. Assume the van will be used for 4 years, after which it will have no value. Thus, each year, one-fourth of the van'a benefits will be used up, which implies annual depreciation equal to one-fourth of the van's total cost. Record depreciation for the month of January, equal to one-twelfth of the annual depreciation expense. 310. Salaries earned by employees for the period from January 16-31 are $1,490 per employee and will be paid on February 3. 319. Adjust the prepaid asset accounts for rent and insurance) as needed. 4 2-a. Set up T-accounts for the accounts on the trial balance. Enter beginning balances and post the transactions January 1-25, adjusting entries of January 31. 2-b. Prepare an unadjusted trial balance at January 31 Complete this question by entering your answers in the tabs below. Req 2A Reg 28 Set up T-accounts for the accounts on the trial balance. Enter beginning balances and post the transactions January 1-25, adjusting entries of January 31. Cash 11.500 Accounts Receivable Beg Bal (9) 11,500 Beg Bal (3) (5) (7) (10) (20) (125) 21.400 6.000 800 800 (7) 3.200 (25) 4.800 (1) 3.000 (2) 24.000 (4) 600 2.500 (16) 7.600 3,800 3.200 EO 7. Supplies Prepaid Insurance Beg. Bal. (6) 800 Beg. Bal. (1) 4,800 End. Bal. 800 End. Bal. 4,800 Prepaid Rent Equipment Beg Bal (2) Beg. Bal 3,600 24,000 End. Bal. 3,600 End. Bal 24,000 Accumulated Depreciation Beg. Bal Accounts Payable Beg. Bal. (8) 600 800 (6) End. Bal End. Bal. 200 Deferred Revenue BAND Notes Payable (long-term) Deferred Revenue Notes Payable (long-term) Beg. Bal. Beg. Bal. 3,200 (25) 26,400 (3) End. Bal. 3,200 End. Bal. 26,400 Interest Payable Salaries and Wages Payable Beg. Bal. Beg. Bal. End. Bal. End. Bal. Common Stock Retained Earnings Beg. Bal Beg. Bal. 6,000 (5) End, Bal. 6,000 End. Bal. Service Revenue Salaries and Wages Expense Beg. Bal. Beg. Bal Service Revenue Salaries and Wages Expense Beg. Bal. Beg. Bal. (16) 2,980 11,500 (9) 7,600 (10) End. Bal. 19.100 End. Bal. 2,980 Utilities Expense Supplies Expenses Beg. Bal. Beg. Bal. End. Bal. End. Bal. Interest Expense Insurance Expenses Beg. Bal. Beg. Bal. End. Bal End. Bal. Rent Expense Depreciation Expense Beg. Bal. Beg. Bal End. Bal. End. Bal. Prepare an unadjusted trial balance at January 31. FAST DELIVERIES, INC. Unadjusted Trial Balance Account Titles Debit Credit Cash Accounts Receivable Supplies Prepaid Insurance Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Deferred Revenue Notes Payable (long-term) Salaries and Wages Payable Interest Payable Common Stock Retained Earnings Service Revenue Salaries and Wages Expense Account Titles Debit Credit Cash Accounts Receivable Supplies Prepaid Insurance Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Deferred Revenue Notes Payable (long-term) Salaries and Wages Payable Interest Payable Common Stock Retained Earnings Service Revenue Salaries and Wages Expense Supplies Expenses Depreciation Expense Interest Expense Totals $ 0 $ 0 3. Record all adjusting journal entries needed at January 31. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 1 8 Record the adjusting entry for receipt of a $1,200 bill for January utility services. Payment is due February 15. Note: Enter debits before credits General Journal Dato (a) Debit Credit Journal entry worksheet Record the adjusting entry for supplies on hand on January 31 that are counted and determined to have cost $300. Note: Enter debits before credits. Date General Journal Debit Credit (b) 4-a. Post the adjusting journal entries from part 3, set up T-accounts for the accounts on the trial balance. 4-6. Post the adjusting entries from part 3 and prepare an adjusted trial balance. Complete this question by entering your answers in the tabs below. Reg 4A Req 4B Post the adjusting journal entries from part 3, set up T-accounts for the accounts on the trial balance. (Do not round intermediate calculations.) Cash Accounts Receivable Beg. Bat. Beg. Bal. End, Bal End. Bal Supplies Prepaid Insurance Beg Bal Beg Bal