Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer this question all 4 questions 8.Land was acquired in 2021 for a future building site at a cost of $40,000. The assessed valuation

please answer this question all 4 questions

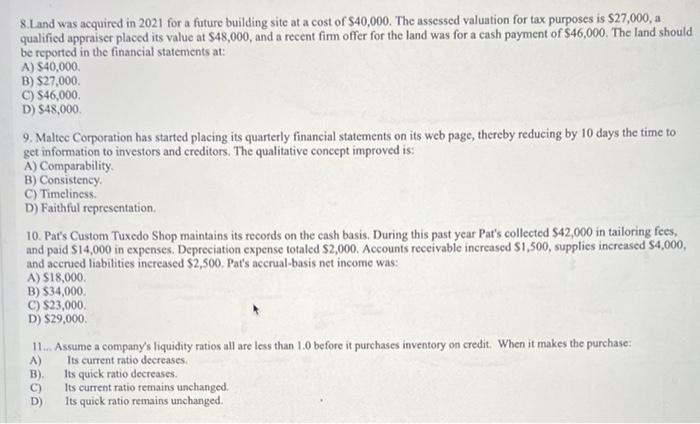

8.Land was acquired in 2021 for a future building site at a cost of $40,000. The assessed valuation for tax purposes is $27,000, a qualified appraiser placed its value at $48,000, and a recent firm offer for the land was for a cash payment of $46,000. The land should be reported in the financial statements at: A) S40,000 B) $27,000 C) $46,000 D) $48,000 9. Maltoc Corporation has started placing its quarterly financial statements on its web page, thereby reducing by 10 days the time to get information to investors and creditors. The qualitative concept improved is A) Comparability B) Consistency C) Timeliness D) Faithful representation 10. Pat's Custom Tuxedo Shop maintains its records on the cash basis. During this past year Pat's collected $42,000 in tailoring fees, and paid $14,000 in expenses. Depreciation expense totaled $2,000. Accounts receivable increased S1,500, supplies increased $4,000, and accrued liabilities increased $2,500. Pat's accrual basis net income was: A) S18,000 B) $34,000 C) $23,000 D) $29,000 11. Assume a company's liquidity ratios all are less than 10 before it purchases inventory on credit. When it makes the purchase: Its current ratio decreases B) Its quick ratio decreases C) Its current ratio remains unchanged. Its quick ratio remains unchanged. = A) D)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started