Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer this question based on MALAYSIA. its a taxation question. the question should be answer under malaysia tax rule. 6 a) Rara Ismail is

Please answer this question based on MALAYSIA.

its a taxation question. the question should be answer under malaysia tax rule.

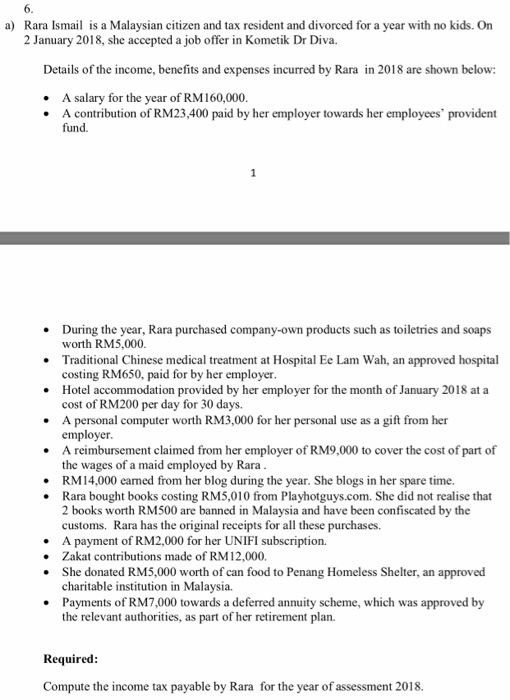

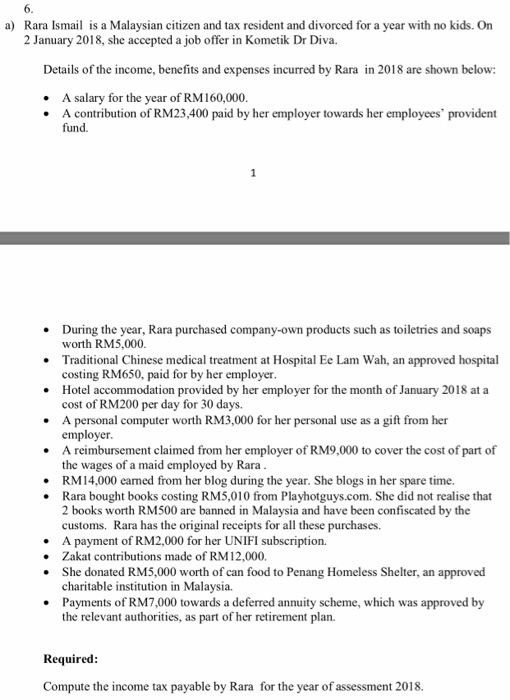

6 a) Rara Ismail is a Malaysian citizen and tax resident and divorced for a year with no kids. On 2 January 2018, she accepted a job offer in Kometik Dr Diva. Details of the income, benefits and expenses incurred by Rara in 2018 are shown below: A salary for the year of RM 160,000. A contribution of RM23,400 paid by her employer towards her employees' provident fund 1 During the year, Rara purchased company-own products such as toiletries and soaps worth RM5,000 Traditional Chinese medical treatment at Hospital Ee Lam Wah, an approved hospital costing RM650, paid for by her employer. Hotel accommodation provided by her employer for the month of January 2018 at a cost of RM200 per day for 30 days. A personal computer worth RM3,000 for her personal use as a gift from her employer A reimbursement claimed from her employer of RM9,000 to cover the cost of part of the wages of a maid employed by Rara RM14,000 eamed from her blog during the year. She blogs in her spare time. Rara bought books costing RM5,010 from Playhotguys.com. She did not realise that 2 books worth RM500 are banned in Malaysia and have been confiscated by the customs. Rara has the original receipts for all these purchases. A payment of RM2,000 for her UNIFI subscription. Zakat contributions made of RM12,000. She donated RM5,000 worth of can food to Penang Homeless Shelter, an approved charitable institution in Malaysia Payments of RM7,000 towards a deferred annuity scheme, which was approved by the relevant authorities, as part of her retirement plan. Required: Compute the income tax payable by Rara for the year of assessment 2018. 6 a) Rara Ismail is a Malaysian citizen and tax resident and divorced for a year with no kids. On 2 January 2018, she accepted a job offer in Kometik Dr Diva. Details of the income, benefits and expenses incurred by Rara in 2018 are shown below: A salary for the year of RM 160,000. A contribution of RM23,400 paid by her employer towards her employees' provident fund 1 During the year, Rara purchased company-own products such as toiletries and soaps worth RM5,000 Traditional Chinese medical treatment at Hospital Ee Lam Wah, an approved hospital costing RM650, paid for by her employer. Hotel accommodation provided by her employer for the month of January 2018 at a cost of RM200 per day for 30 days. A personal computer worth RM3,000 for her personal use as a gift from her employer A reimbursement claimed from her employer of RM9,000 to cover the cost of part of the wages of a maid employed by Rara RM14,000 eamed from her blog during the year. She blogs in her spare time. Rara bought books costing RM5,010 from Playhotguys.com. She did not realise that 2 books worth RM500 are banned in Malaysia and have been confiscated by the customs. Rara has the original receipts for all these purchases. A payment of RM2,000 for her UNIFI subscription. Zakat contributions made of RM12,000. She donated RM5,000 worth of can food to Penang Homeless Shelter, an approved charitable institution in Malaysia Payments of RM7,000 towards a deferred annuity scheme, which was approved by the relevant authorities, as part of her retirement plan. Required: Compute the income tax payable by Rara for the year of assessment 2018 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started