Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer this question: CASH FLOW 8. Referring to ACMs statement of cash flow for 2017 and 2019, assess ACMs cash flow situation noting both

Please answer this question:

CASH FLOW

8. Referring to ACMs statement of cash flow for 2017 and 2019, assess ACMs cash flow situation noting both inflows and outflows?

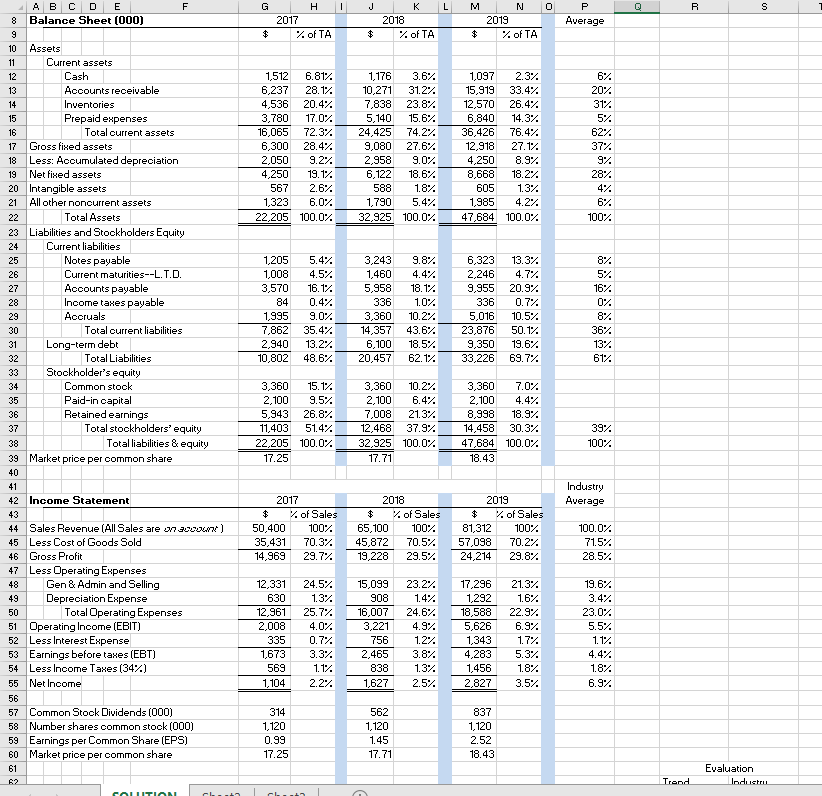

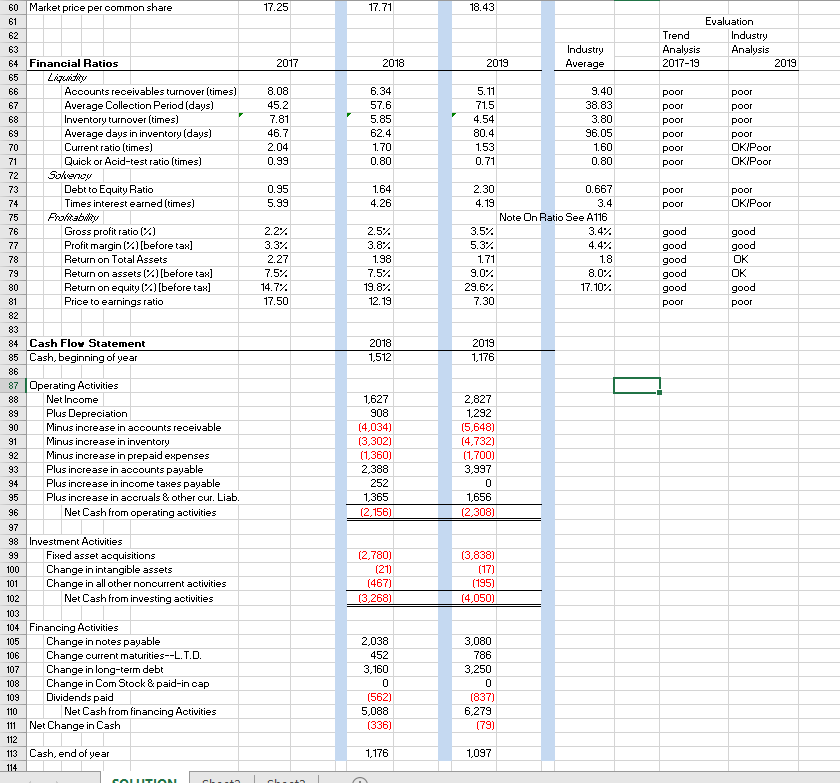

G 1 J L Q R S . 2017 % of TA K 2018 % of TA N 2019 % of TA P Average $ $ 1,512 6.81% 6,237 28.1% 4,536 20.4% 3,780 17.0% 16,065 72.3% 6,300 28.4% 2,050 9.2%. 4,250 19.17 567 2.6%. 1,323 6.0% 22,205 100.0% 1.176 3.6% 10,271 31.27 7,838 23.8% 5,140 15.6% 24,425 74.2% 9,080 27.6% 2,958 9.07. 6,122 18.6% 588 1.8% 1,790 5.4% 32,925 100.0% 1,097 2.37 15,919 33.42 12,570 26.4% 6,840 14.3% 36,426 76.4% 12,918 27.17 4,250 8.92 8,668 18.2% 605 1.37 1.985 4.2% 47,684 100.0% 6%. 20% 31% 5%. 62% 37% 97 28% 6% 100% A B C D E F 8 Balance Sheet (000) 9 10 Assets 11 Current assets 12 Cash 13 Accounts receivable 14 Inventories 15 Prepaid expenses 16 Total current assets 17 Gross fixed assets 18 Less: Accumulated depreciation 19 Net fixed assets 20 Intangible assets 21 All other noncurrent assets 22 Total Assets 23 Liabilities and Stockholders Equity 24 Current liabilities 25 Notes payable 26 Current maturities--L.T.D. 27 Accounts payable 28 Income taxes payable 29 Accruals Total current liabilities 31 Long-term debt 32 Total Liabilities Stookholder's equity 34 Common stock 35 Paid-in capital 36 Retained earnings 37 Total stookholders' equity 38 Total liabilities & equity 39 Market price per common share 87. 5% 16% 1,205 1008 3,570 84 1,995 7,862 2,940 10,802 5.4% 4.5%. 16.1% 0.4% 9.07 35.4% 13.2%. 48.6% 3,243 1,460 5,958 336 3,360 14,357 6.100 20,457 9.8% 4.4% 18.1% 10% 10.2% 43.6% 18.5% 62.17 6,323 2,246 9,955 336 5,016 23,876 9,350 33,226 13.3%. 4.7% 20.9% 0.7% 10.5% 50.17 19.6% 69.72 36% 137 61% 3,360 15.17 2,100 9.5% 5,943 26.8% 11,403 51.4% 22,205 100.0% 17.25 3,360 10.2% 2,100 6.4% 7,008 21.3% 12,468 37.97 32,925 100.0% 17.71 3,360 7.07. 2,100 4.4% 8,998 18.9% 14,458 30.3% 47,684 100.0% 18.43 39% 100% Industry Average 2017 $ 7. of Sales 50,400 100%. 35,431 70.3% 14,969 29.7% 2018 7. of Sales 65,100 100% 45,872 70.5% 19,228 29.5% 2019 $ %. of Sales 81,312 100% 57,098 70.2% 24,214 29.8% 100.0% 71.5% 28.5% 41 42 Income Statement 43 44 Sales Revenue (All Sales are an accoun) 45 Less Cost of Goods Sold 46 Gross Profit 47 Less Operating Expenses 48 Gen & Admin and Selling 49 Depreciation Expense 50 Total Operating Expenses 51 Operating Income (EBIT) 52 Less Interest Expense 53 Earnings before taxes (EBT) 54 Less Income Taxes (342) 55 Net Income 56 57 Common Stock Dividends (000) 58 Number shares common stock (000) 59 Earnings per Common Share (EPS) 60 Market price per common share 61 62 12,331 630 12,961 2,008 335 1,673 569 1,104 24.5% 1.3% 25.7% 4.0% 0.7% 3.3%. 1.17 2.2% 15,099 908 16,007 3,221 756 2,465 838 1,627 23.2%. 1.4% 24.6% 4.9% 1.2%. 3.8% 1.37 2.5% 17,296 1,292 18,588 5,626 1,343 4,283 1,456 2,827 21.3% 1.6% 22.9% 6.9% 1.7% 5.3% 1.8% 3.5% 19.6% 3.4% 23.0% 5.5%. 1.1%. 4.4% 1.8% 6.97 314 1,120 0.99 17.25 562 1,120 1.45 17.71 837 1,120 2.52 18.43 Evaluation Industru Trend CAUTION 17.25 17.71 18.43 Evaluation Industry Analysis Trend Analysis 2017-19 Industry Average 2017 2018 2019 2019 8.08 45.2 7.81 46.7 2.04 0.99 6.34 57.6 5.85 62.4 1.70 0.80 5.11 71.5 4.54 80.4 1.53 0.71 9.40 38.83 3.80 96.05 1.60 0.80 poor poor poor poor poor poor poor poor poor poor OK/Poor OK/Poor 0.95 5.99 1.64 4.26 2.30 4.19 poor poor poor OKIPoor 2.2% 3.37 2.27 7.5% 14.7% 17.50 2.5% 3.8% 1.98 7.5% 19.8%. 12.19 3.5%. 5.37 1.71 9.07 29.6% 7.30 0.667 3.4 Note On Ratio See A116 3.4% 4.4% 1.8 8.0% 17.10%. good good good good good poor good good OK OK good poor 2018 1,512 2019 1,176 60 Market price per common share 61 62 63 64 Financial Ratios 65 Liitty 66 Accounts receivables turnover (times) 67 Average Collection Period (days) 68 Inventory turnover (times) 69 Average days in inventory (days) 70 Current ratio (times) 71 Quick or Acid-test ratio (times) 72 Sextury 73 Debt to Equity Ratio 74 Times interest earned (times) 75 Fortably 76 Gross profit ratio 1%) 77 Profit margin (%) [before tax] 78 Return on Total Assets 79 Return on assets (%) [before tax] 80 Return on equity (%) [before tax] 81 Price to earnings ratio 82 83 84 Cash Flow Statement 85 Cash, beginning of year 86 87 Operating Activities Net Income 89 Plus Depreciation 90 Minus increase in accounts receivable 91 Minus increase in inventory 92 Minus increase in prepaid expenses 93 Plus increase in accounts payable 94 Plus increase in income taxes payable 95 Plus increase in accruals & other cur. Liab. 96 Net Cash from operating activities 97 98 Investment Activities 99 Fixed asset acquisitions 100 Change in intangible assets 101 Change in all other noncurrent activities 102 Net Cash from investing activities 103 104 Financing Activities 105 Change in notes payable 106 Change ourrent maturities--L.T.D. 107 Change in long-term debt 108 Change in Com Stook & paid-in cap 109 Dividends paid 110 Net Cash from financing Activities 111 Net Change in Cash 112 113 Cash, end of year 114 1,627 908 (4,034) (3,302) (1,360) 2,388 252 1,365 (2,156) 2,827 1,292 (5,648) (4,732) (1,700) 3,997 1,656 (2,308) (2,780) (21) (467) (3,268) (3,838) (17) (195) (4,050) 2,038 452 3,160 0 (562) 5,088 (336) 3,080 786 3,250 0 (837) 6,279 (79) 1,176 1,097 CALITIANStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started