Question

Please answer this question for me and read all the assumptions below: Assumptions: 1) Assume that $25,000 of inventory will be sold in week 2,

Please answer this question for me and read all the assumptions below:

Assumptions:

1) Assume that $25,000 of inventory will be sold in week 2, and the gross margin is 25% of sales price.

2) Inventory sales increase by $5000 each week for the following three weeks. Sales proportion of credit vs. cash will be 60% cash vs 40% credit. For simplicity, assume sales are made on the first day of the week.

3) Add a weekly expenses of $3,000 for wages and other expenses. This will be paid from the cash account at the end of each week. Shall be subtracted from the Net Worth beginning.

4) The receivable and payable amount for week one will be received and paid at first day of week 5.

5) Accruals will be due for payment every quarter, so it will be due after the 5 weeks.

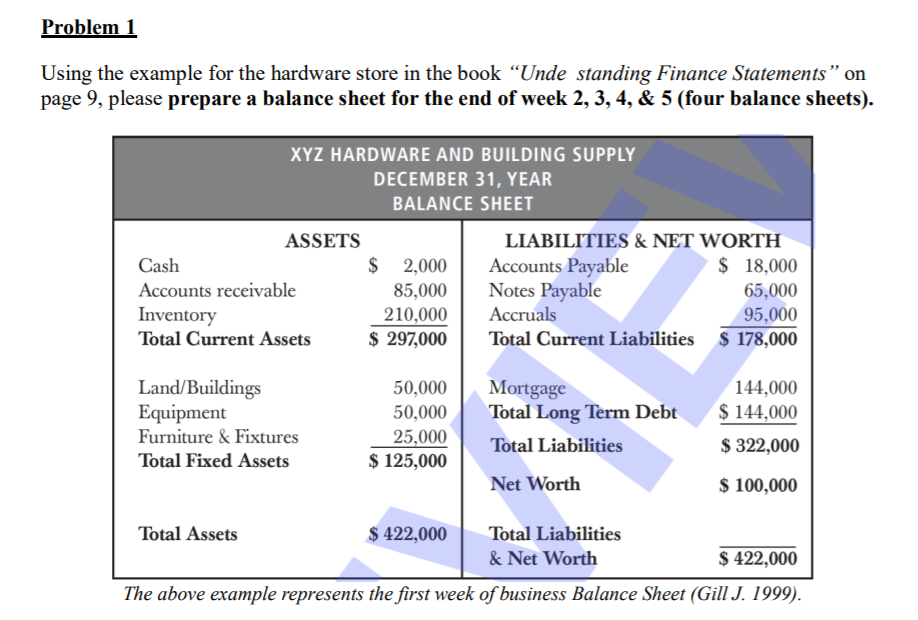

Problem 1 Using the example for the hardware store in the book "Unde standing Finance Statements" on page 9, please prepare a balance sheet for the end of week 2, 3, 4, & 5 (four balance sheets) XYZ HARDWARE AND BUILDING SUPPLY DECEMBER 31, YEAR BALANCE SHEET ASSETS LIABILITIES & NET WORTH Accounts Payable Notes Payable Accruals Cash 2,000 18,000 Accounts receivable 85,000 65,000 95,000 $ 178,000 Inventory Total Current Assets 210,000 297,000 Total Current Liabilities Land/Buildings Equipment Mortgage Total Long Term Debt 144,000 50,000 50,000 $ 144,000 Furniture & Fixtures 25,000 125,000 322,000 Total Liabilities Total Fixed Assets $ 100,000 Net Worth Total Assets $ 422,000 Total Liabilities $ 422,000 & Net Worth The above example represents the first week of business Balance Sheet (Gill J. 1999)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started