Please answer this question in this format! Thank you!

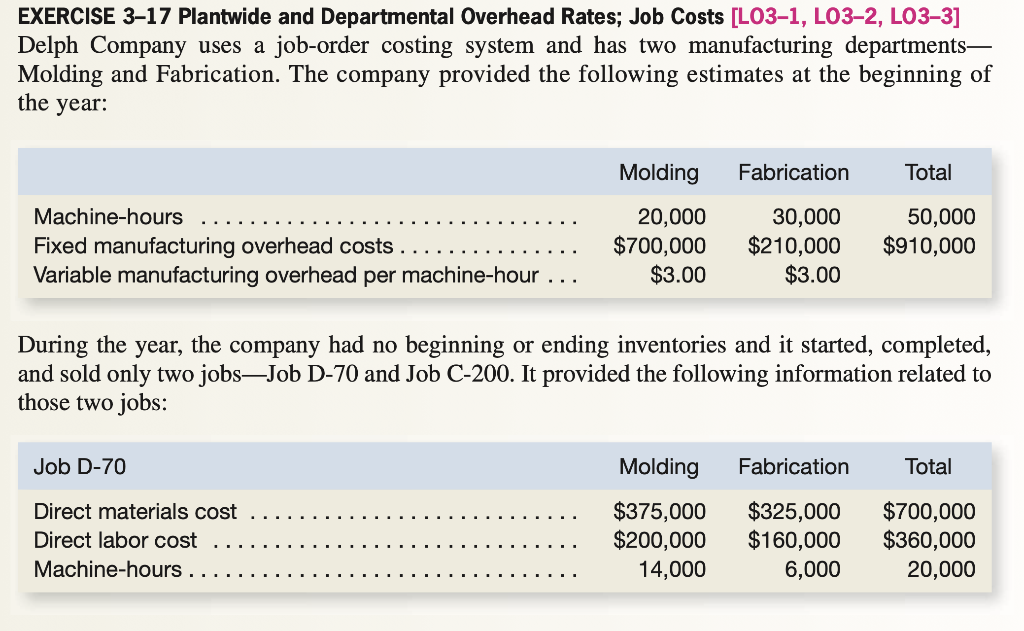

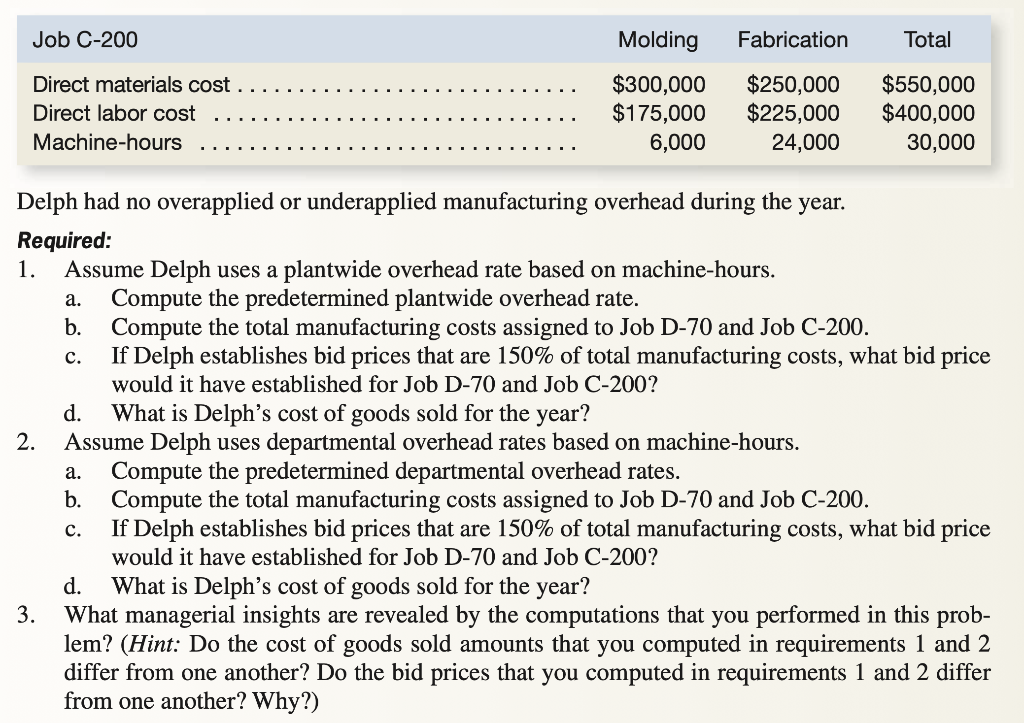

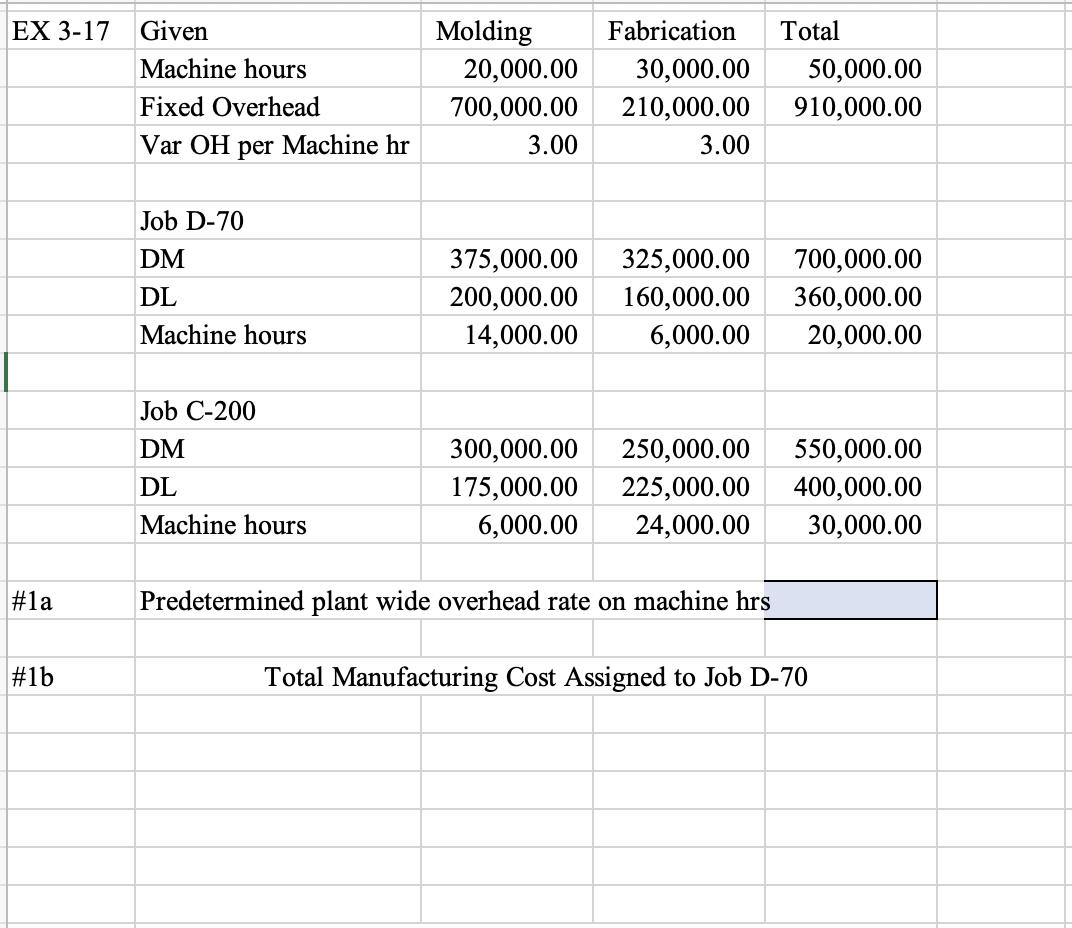

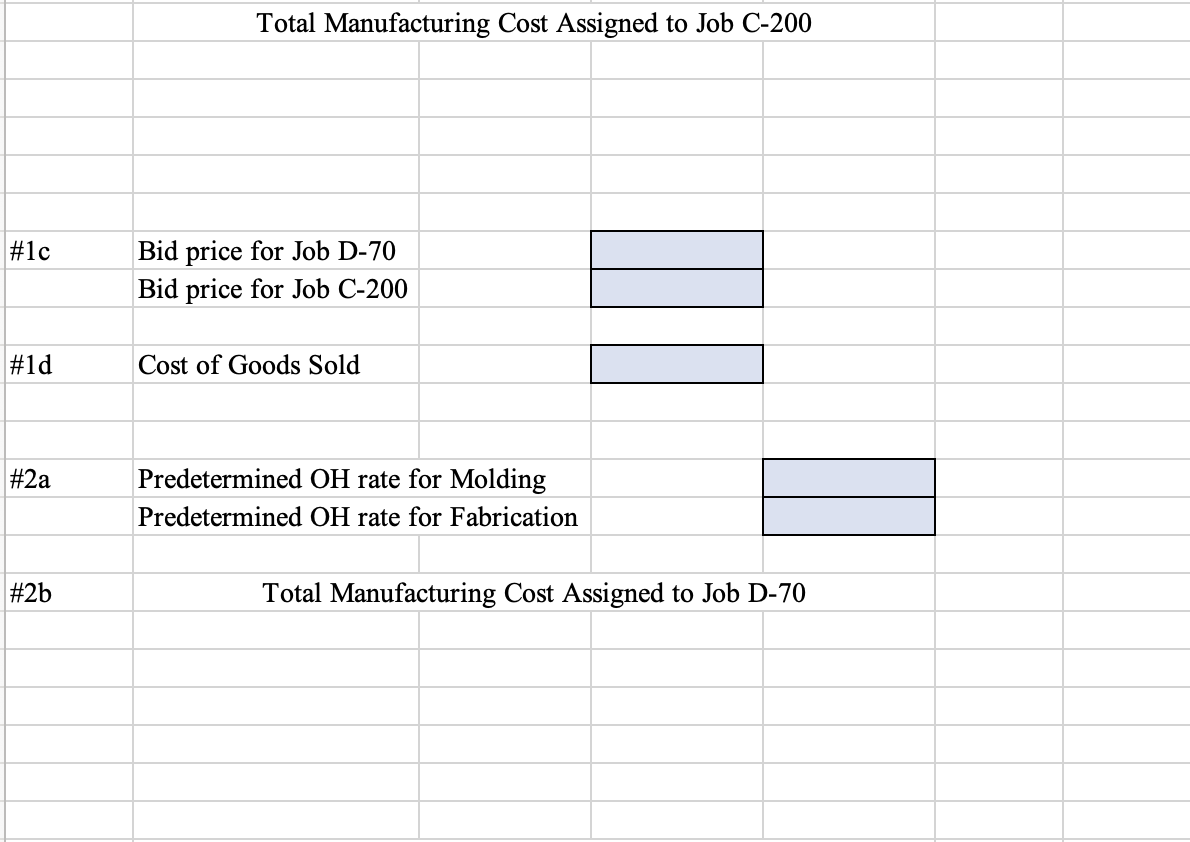

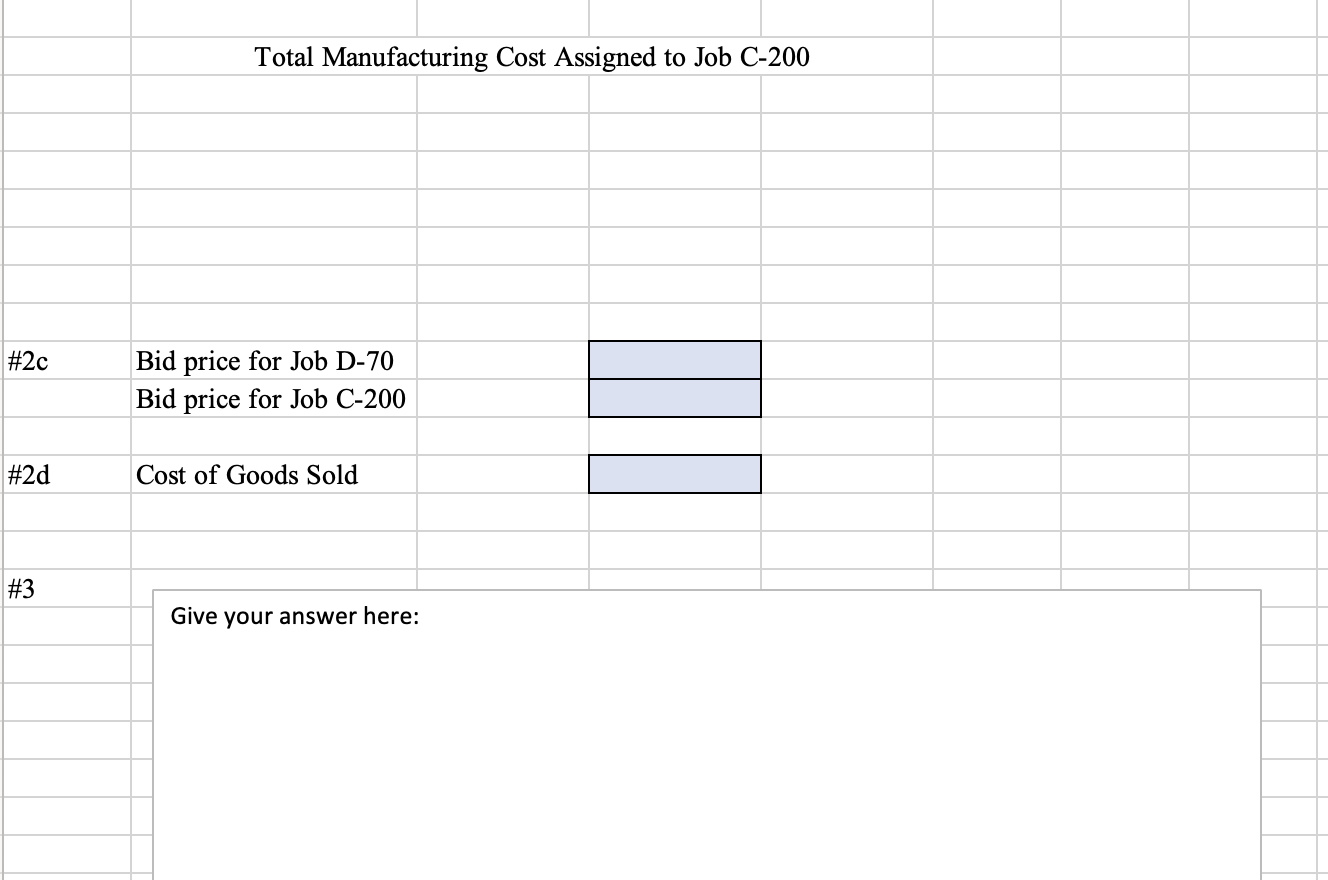

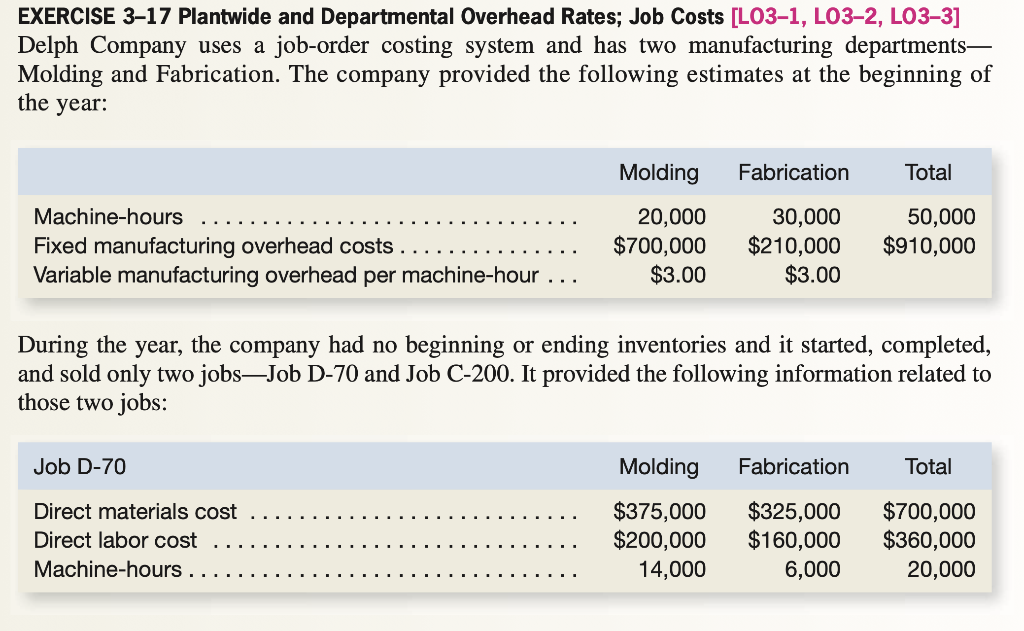

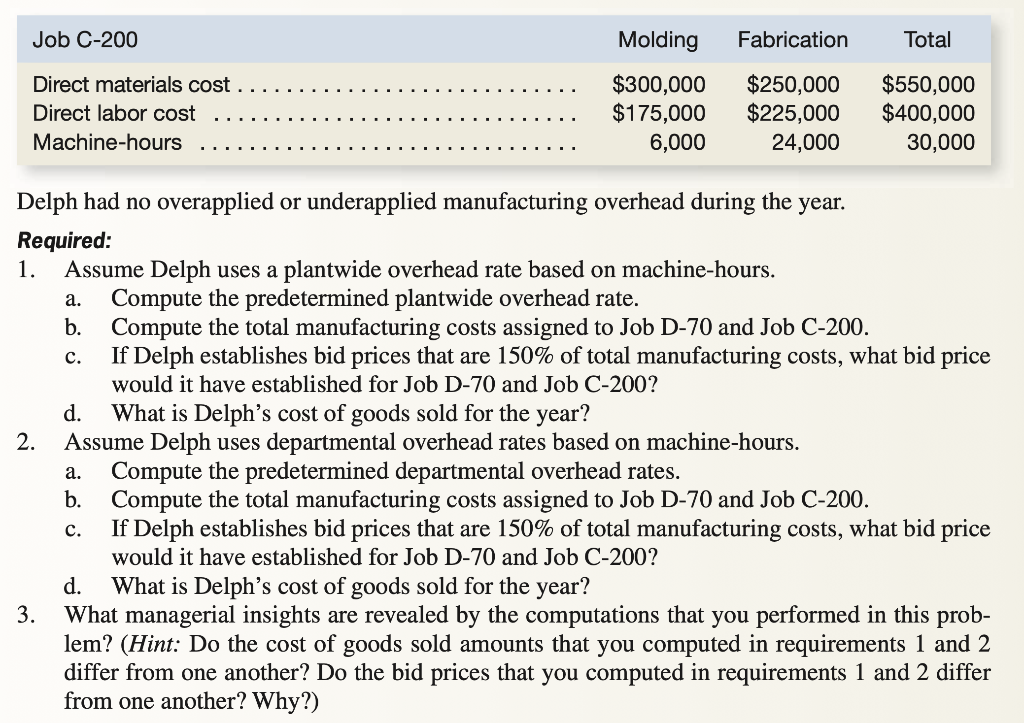

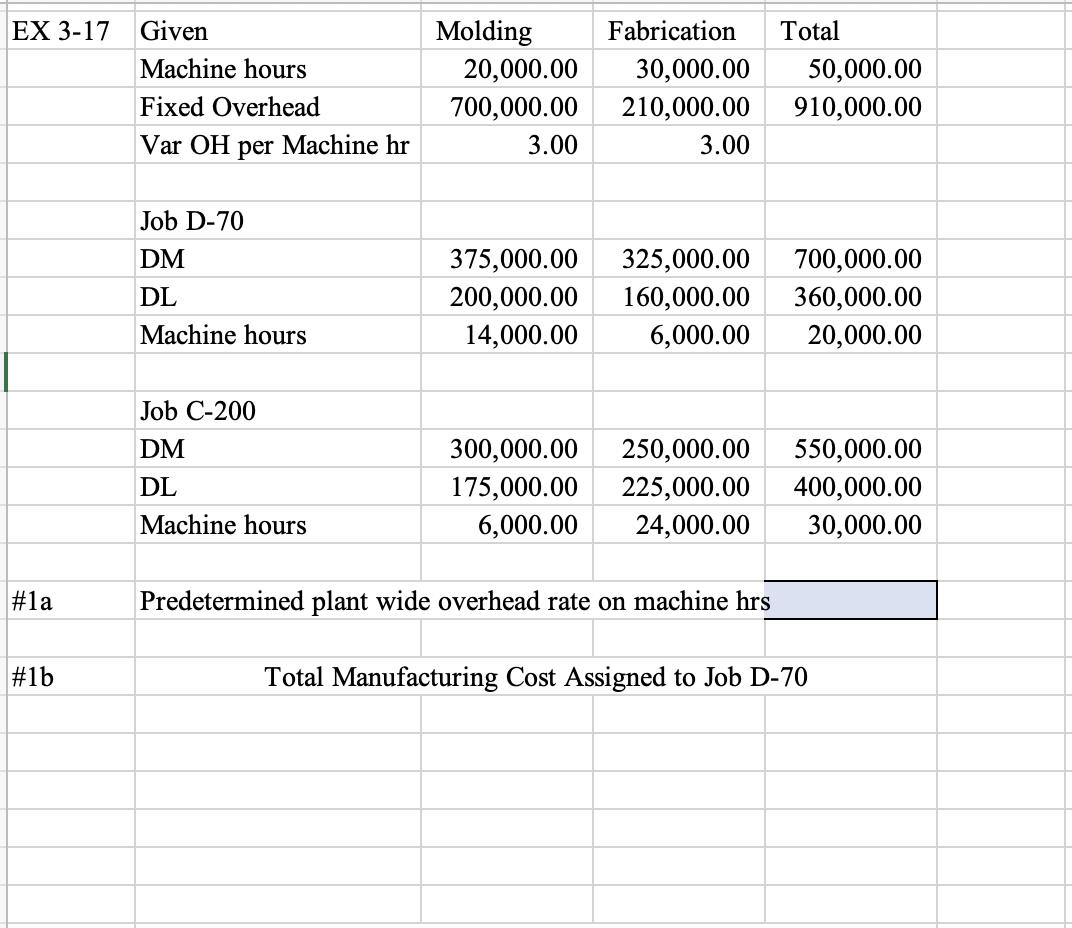

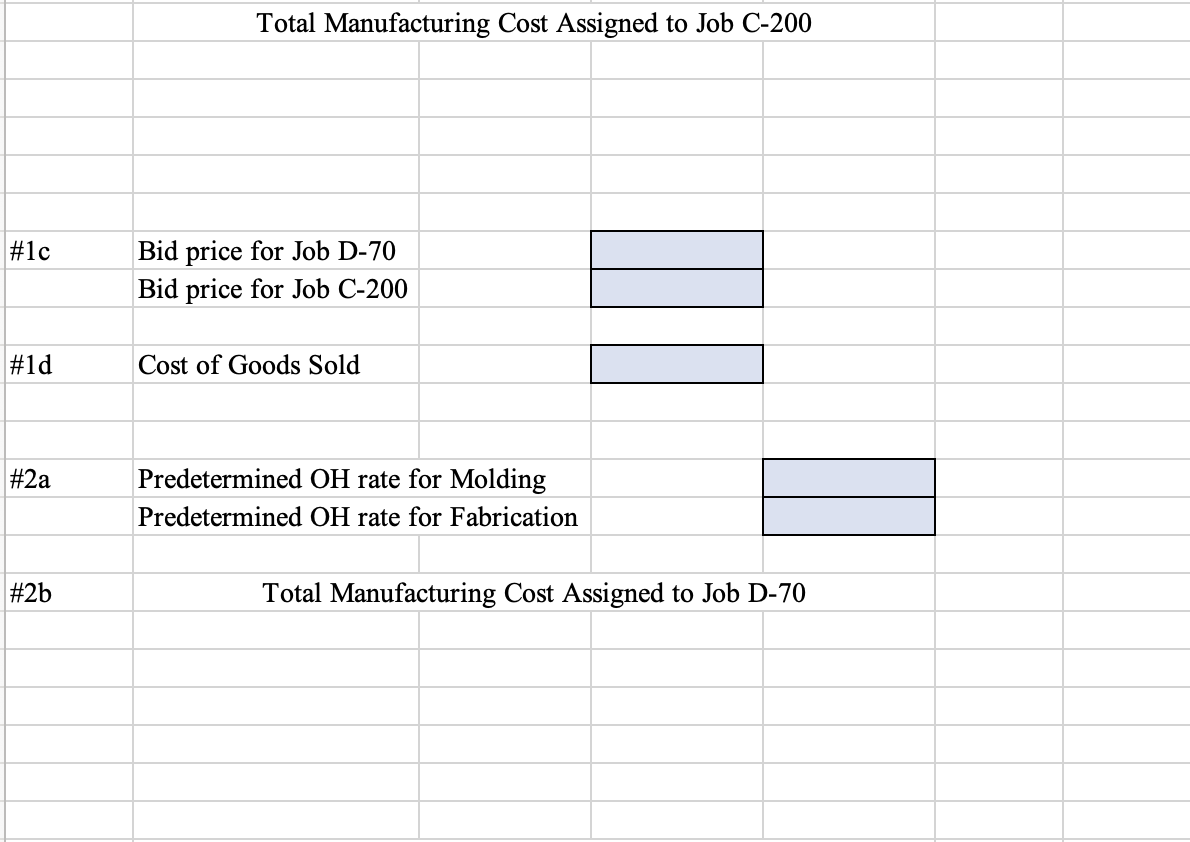

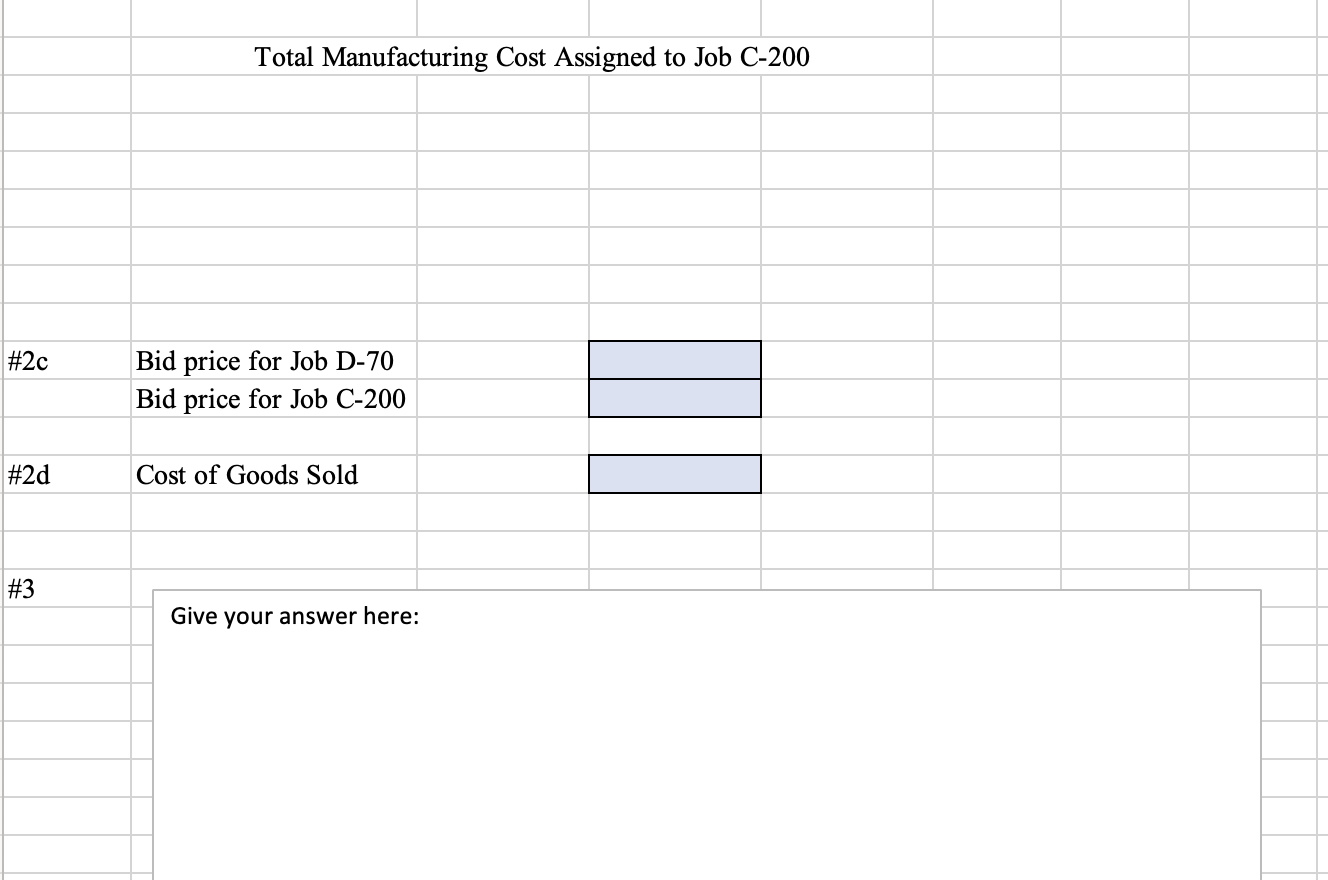

EXERCISE 3-17 Plantwide and Departmental Overhead Rates; Job Costs [L03-1, L03-2, LO3-3] Delph Company uses a job-order costing system and has two manufacturing departmentsMolding and Fabrication. The company provided the following estimates at the beginning of the year: During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobs_Job D-70 and Job C-200. It provided the following information related to those two jobs: Delph had no overapplied or underapplied manufacturng overhead durng the year. Required: 1. Assume Delph uses a plantwide overhead rate based on machine-hours. a. Compute the predetermined plantwide overhead rate. b. Compute the total manufacturing costs assigned to Job D-70 and Job C-200. c. If Delph establishes bid prices that are 150% of total manufacturing costs, what bid price would it have established for Job D-70 and Job C-200? d. What is Delph's cost of goods sold for the year? 2. Assume Delph uses departmental overhead rates based on machine-hours. a. Compute the predetermined departmental overhead rates. b. Compute the total manufacturing costs assigned to Job D-70 and Job C-200. c. If Delph establishes bid prices that are 150% of total manufacturing costs, what bid price would it have established for Job D-70 and Job C-200? d. What is Delph's cost of goods sold for the year? 3. What managerial insights are revealed by the computations that you performed in this problem? (Hint: Do the cost of goods sold amounts that you computed in requirements 1 and 2 differ from one another? Do the bid prices that you computed in requirements 1 and 2 differ from one another? Why?) Total Manufacturing Cost Assigned to Job C-200 \begin{tabular}{|l|l|} \hline \#1c & Bid price for Job D-70 \\ \hline Bid price for Job C-200 & \\ \hline \end{tabular} \#1d Cost of Goods Sold \begin{tabular}{|l|l|l|} \hline \#2a & Predetermined OH rate for Molding & \\ \hline & Predetermined OH rate for Fabrication & \\ \hline \end{tabular} \#2b Total Manufacturing Cost Assigned to Job D-70 Total Manufacturing Cost Assigned to Job C-200 \begin{tabular}{|l|l|} \hline \#2c & Bid price for Job D-70 \\ \hline & Bid price for Job C-200 \\ \hline \end{tabular} \#2d Cost of Goods Sold \#3 Give your answer here: EXERCISE 3-17 Plantwide and Departmental Overhead Rates; Job Costs [L03-1, L03-2, LO3-3] Delph Company uses a job-order costing system and has two manufacturing departmentsMolding and Fabrication. The company provided the following estimates at the beginning of the year: During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobs_Job D-70 and Job C-200. It provided the following information related to those two jobs: Delph had no overapplied or underapplied manufacturng overhead durng the year. Required: 1. Assume Delph uses a plantwide overhead rate based on machine-hours. a. Compute the predetermined plantwide overhead rate. b. Compute the total manufacturing costs assigned to Job D-70 and Job C-200. c. If Delph establishes bid prices that are 150% of total manufacturing costs, what bid price would it have established for Job D-70 and Job C-200? d. What is Delph's cost of goods sold for the year? 2. Assume Delph uses departmental overhead rates based on machine-hours. a. Compute the predetermined departmental overhead rates. b. Compute the total manufacturing costs assigned to Job D-70 and Job C-200. c. If Delph establishes bid prices that are 150% of total manufacturing costs, what bid price would it have established for Job D-70 and Job C-200? d. What is Delph's cost of goods sold for the year? 3. What managerial insights are revealed by the computations that you performed in this problem? (Hint: Do the cost of goods sold amounts that you computed in requirements 1 and 2 differ from one another? Do the bid prices that you computed in requirements 1 and 2 differ from one another? Why?) Total Manufacturing Cost Assigned to Job C-200 \begin{tabular}{|l|l|} \hline \#1c & Bid price for Job D-70 \\ \hline Bid price for Job C-200 & \\ \hline \end{tabular} \#1d Cost of Goods Sold \begin{tabular}{|l|l|l|} \hline \#2a & Predetermined OH rate for Molding & \\ \hline & Predetermined OH rate for Fabrication & \\ \hline \end{tabular} \#2b Total Manufacturing Cost Assigned to Job D-70 Total Manufacturing Cost Assigned to Job C-200 \begin{tabular}{|l|l|} \hline \#2c & Bid price for Job D-70 \\ \hline & Bid price for Job C-200 \\ \hline \end{tabular} \#2d Cost of Goods Sold \#3 Give your answer here