Answered step by step

Verified Expert Solution

Question

1 Approved Answer

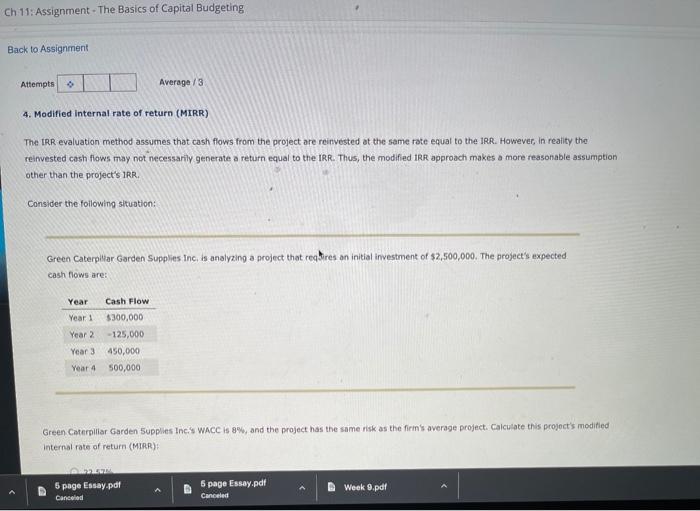

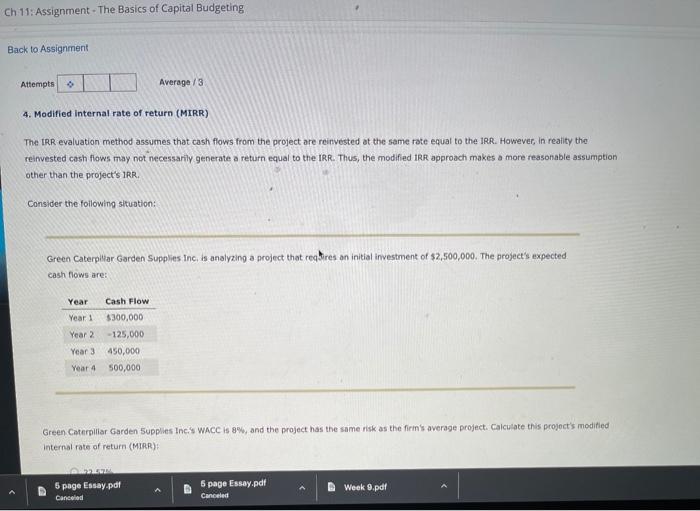

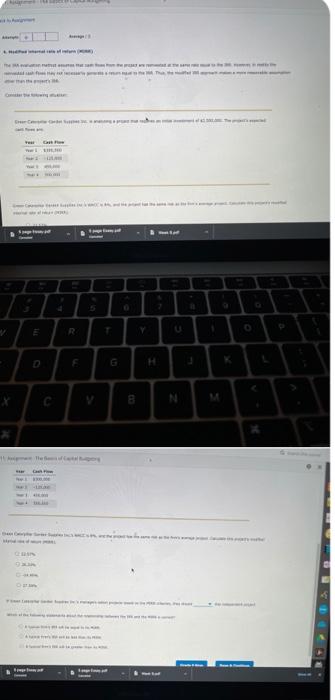

PLEASE ANSWER THIS QUESTION PLEASE ANSWER THIS QUESTION Ch 11: Assignment - The Basics of Capital Budgeting Back to Assignment Attempts Average/3 4. Modified Internal

PLEASE ANSWER THIS QUESTION

PLEASE ANSWER THIS QUESTION

Ch 11: Assignment - The Basics of Capital Budgeting Back to Assignment Attempts Average/3 4. Modified Internal rate of return (MIRR) The IRR evaluation method assumes that cash flows from the project are reinvested at the same rate equal to the IRR. However, in reality the reinvested cash flows may not necessarily generate a return equal to the IRR. Thus, the modified IRR approach makes a more reasonable assumption other than the project's IRR. Consider the following situation: Green Caterpillar Garden Supplies Inc. is analyzing a project that reqres an initial investment of $2,500,000. The project's expected cash flows are: Year Year 1 Year 2 Cash Flow $300,000 - 125,000 450,000 500,000 Year 3 Year 4 Green Caterpillar Garden Supplies Inc.'S WACC is 8%, and the project has the same risk as the firm's average project. Calculate this project's modified internal rate of return (MIRR) 5 page Essay.pdf Canceled 6 page Essay.pdf Canceled B Week 9.pdf R E C N Ch 11: Assignment - The Basics of Capital Budgeting Back to Assignment Attempts Average/3 4. Modified Internal rate of return (MIRR) The IRR evaluation method assumes that cash flows from the project are reinvested at the same rate equal to the IRR. However, in reality the reinvested cash flows may not necessarily generate a return equal to the IRR. Thus, the modified IRR approach makes a more reasonable assumption other than the project's IRR. Consider the following situation: Green Caterpillar Garden Supplies Inc. is analyzing a project that reqres an initial investment of $2,500,000. The project's expected cash flows are: Year Year 1 Year 2 Cash Flow $300,000 - 125,000 450,000 500,000 Year 3 Year 4 Green Caterpillar Garden Supplies Inc.'S WACC is 8%, and the project has the same risk as the firm's average project. Calculate this project's modified internal rate of return (MIRR) 5 page Essay.pdf Canceled 6 page Essay.pdf Canceled B Week 9.pdf R E C N

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started