Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer this question. Problem 13-1 (L0 Profit allocation based on various factors. Rockford, Skeeba, and Tapinski are partners in a business which manufactures specialty

Please answer this question.

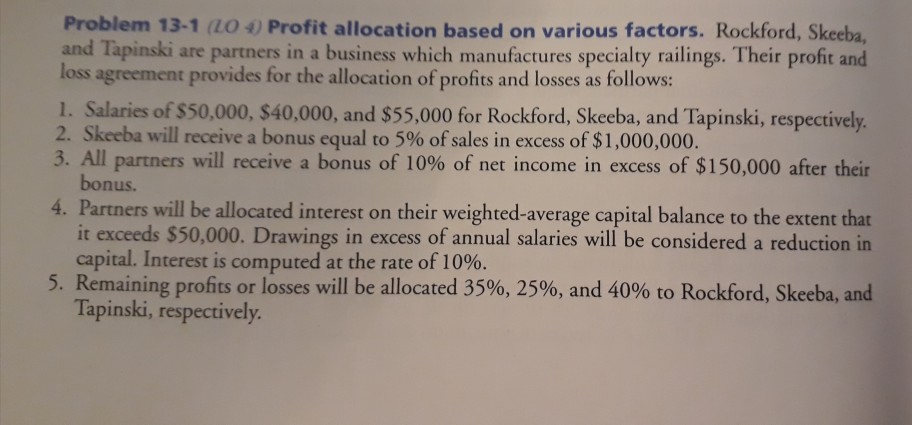

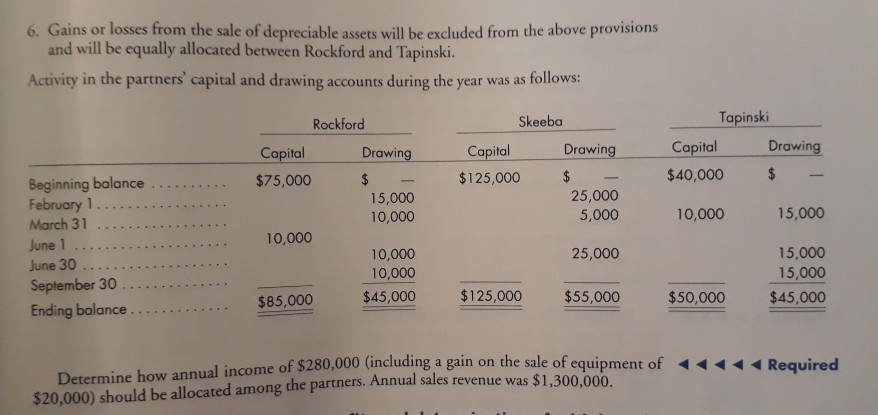

Problem 13-1 (L0 Profit allocation based on various factors. Rockford, Skeeba, and Tapinski are partners in a business which manufactures specialty railings. Their profit and loss agreement provides for the allocation of profits and losses as follows: Skeeba will receive a bonus equal to 5% of sales in excess of $1,000,000. bonus. it exceeds $50,000. Drawings in excess of annual salaries will be considered a reduction in 1. Salaries of $50,000, $40,000, and $55,000 for Rockford, Skeeba, and Tapinski, respectively 2. 3. All partners will receive a bonus of 10% of net income in excess of $150,000 after their 4. Partners will be allocated interest on their weighted-average capital balance to the extent that capital. Interest is computed at the rate of 10%. 5. Remaining profits or losses will be allocated 35%, 25%, and 40% to Rockford, Skeeba, and Tapinski, respectivelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started