please answer this question.

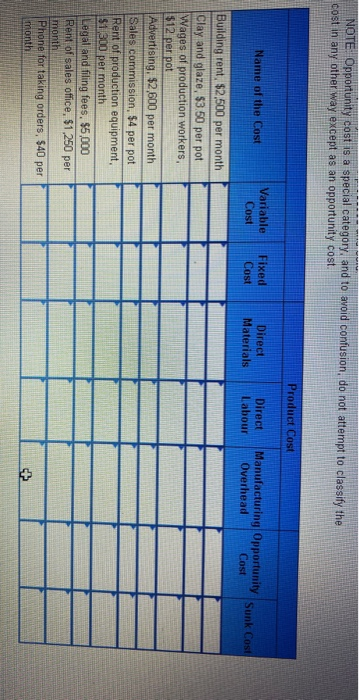

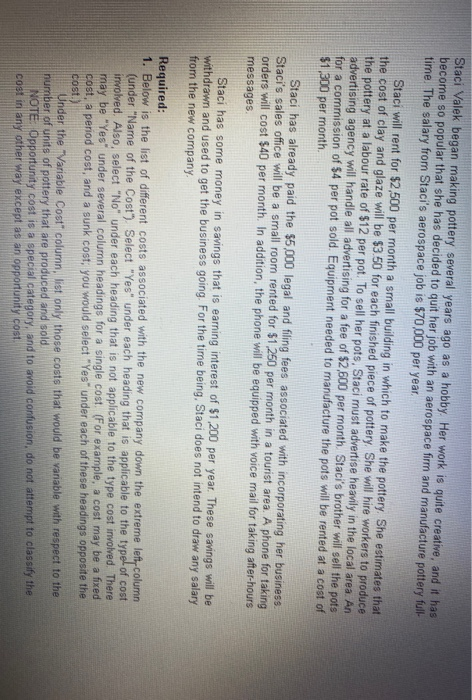

Staci Valek began making pottery several years ago as a hobby. Her work is quite creative, and it has become so popular that she has decided to quit her job with an aerospace firm and manufacture pottery full- time. The salary from Staci's aerospace job is $70,000 per year. Staci will rent for $2,500 per month a small building in which to make the pottery. She estimates that the cost of clay and glaze will be $3.50 for each finished piece of pottery. She will hire workers to produce the pottery at a labour rate of $12 per pot. To sell her pots, Staci must advertise heavily in the local area. An advertising agency will handle all advertising for a fee of $2,600 per month. Staci's brother will sell the pots for a commission of $4 per pot sold Equipment needed to manufacture the pots will be rented at a cost of $1,300 per month Staci has already paid the $5,000 legal and filing fees associated with incorporating her business. Staci's sales office will be a small room rented for $1.250 per month in a tourist area. A phone for taking orders will cost $40 per month. In addition, the phone will be equipped with voice mail for taking after-hours messages Staci has some money in savings that is earning interest of $1,200 per year. These savings will be withdrawn and used to get the business going. For the time being, Staci does not intend to draw any salary from the new company Required: 1. Below is the list of different costs associated with the new company down the extreme left column (under "Name of the Cost"). Select "Yes" under each heading that is applicable to the type of cost involved. Also, select "No" under each heading that is not applicable to the type cost involved. There may be "Yes" under several column headings for a single cost. (For example, a cost may be a fixed cost, a period cost, and a sunk cost, you would select "Yes" under each of these headings opposite the cost. Under the Variable Cost" column, list only those costs that would be variable with respect to the number of units of pottery that are produced and sold NOTE: Opportunity cost is a special category, and to avoid confusion, do not attempt to classify the cost in any other way except as an opportunity cost. NOTE: Opportunity cost is a special category, and to avoid confusion, do not attempt to classify the cost in any other way except as an opportunity cost Product Cost Name of the Cost Variable Cost Fixed Cost Direct Materials Direct Labour Manufacturing Opportunity Overhead Cost " Sunk Cost Building rent. $2,500 per month Clay and glaze, $3.50 per pot Wages of production workers, $12 per pot Advertising, $2,600 per month Sales commission, $4 per pot Rent of production equipment, $1,300 per month Legal and filing fees, $5,000 Rent of sales office, $1,250 per month Phone for taking orders, $40 per month