Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer this question thanks.. Wells Company reports the following sales forecast: September, $58,000; October, $70,000; and November, $84,000. All sales are on account. Collections

please answer this question thanks..

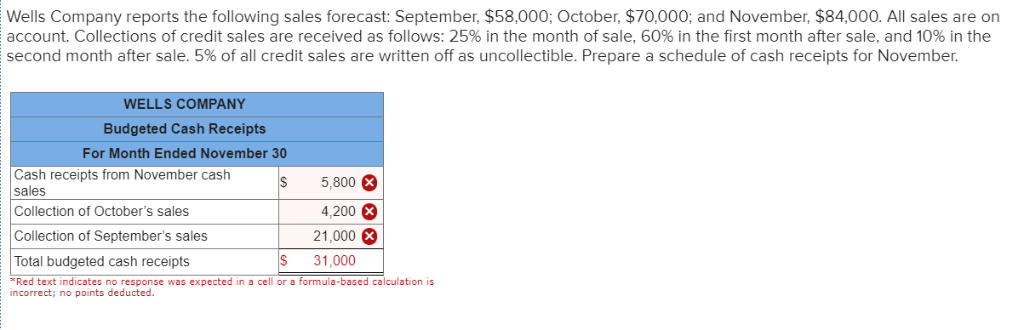

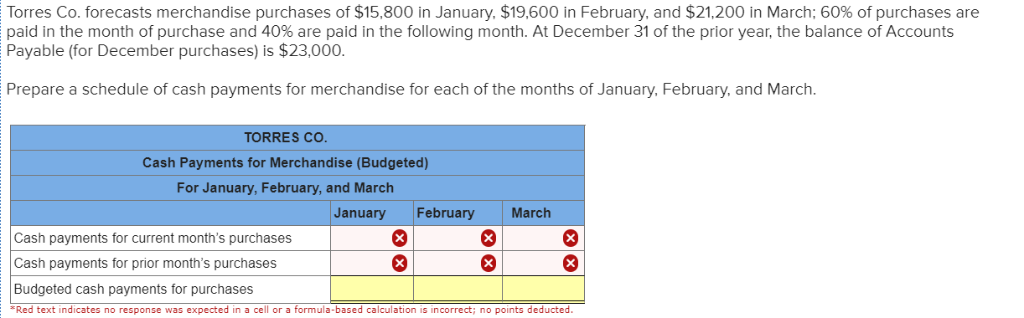

Wells Company reports the following sales forecast: September, $58,000; October, $70,000; and November, $84,000. All sales are on account. Collections of credit sales are received as follows: 25% in the month of sale, 60% in the first month after sale, and 10% in the second month after sale. 5% of all credit sales are written off as uncollectible. Prepare a schedule of cash receipts for November WELLS COMPANY Budgeted Cash Receipts For Month Ended November 30 Cash receipts from November cash sales Collection of October's sales 5,800 X S 4,200 X Collection of September's sales 21,000 Total budgeted cash receipts 31,000 Red text indicates no response was expected in incorrect; no points deducted. cell or a formula-based calculation is Torres Co. forecasts merchandise purchases of $15,800 in January, $19,600 in February, and $21,200 in March; 60% of purchases are paid in the month of purchase and 40% are paid in the following month. At December 31 of the prior year, the balance of Accounts Payable (for December purchases) is $23,000. Prepare a schedule of cash payments for merchandise for each of the months of January, February, and March TORRES CO Cash Payments for Merchandise (Budgeted) For January, February, and Ma rch January February March Cash payments for current month's purchases X Cash payments for prior month's purchases X Budgeted cash payments for purchases Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started