Answered step by step

Verified Expert Solution

Question

1 Approved Answer

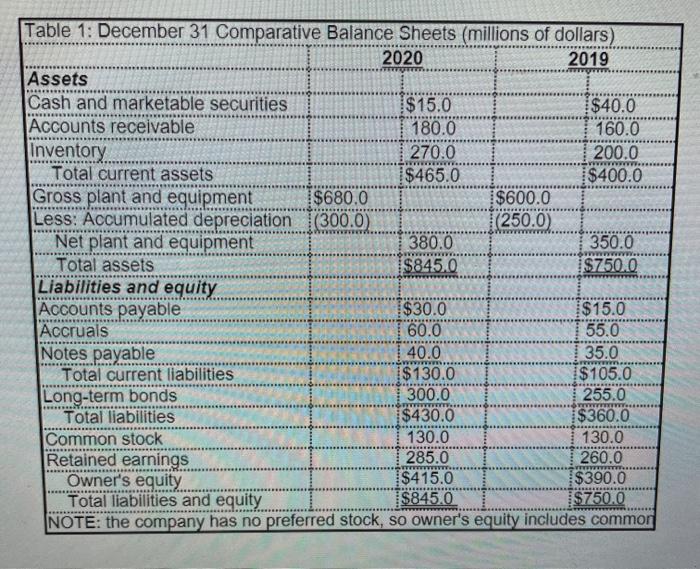

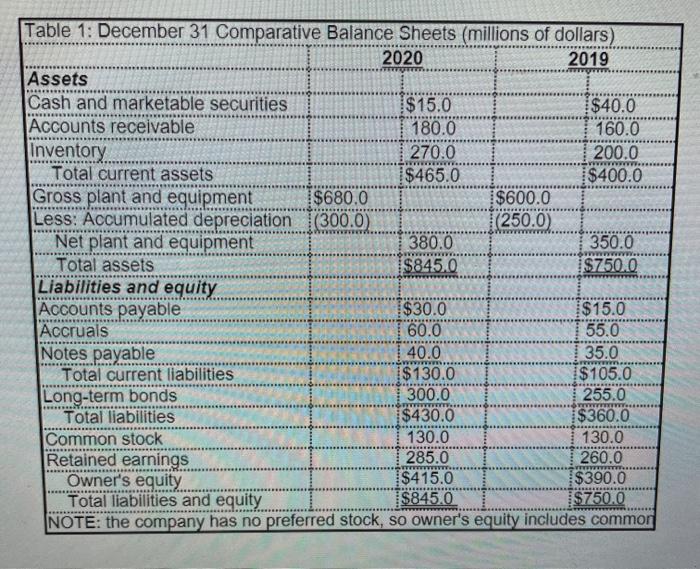

please answer this question: the stock is selling for $23 in the market as of 12/31/2020. Compute the PE ratio as of 12/31/2020 and how

please answer this question: the stock is selling for $23 in the market as of 12/31/2020. Compute the PE ratio as of 12/31/2020 and how would uou interpret this number?

Table 1: December 31 Comparative Balance Sheets (millions of dollars) 2020 2019 Assets Cash and marketable securities $15.0 $40.0 Accounts receivable 180.0 160.0 Inventory 270.0 200.0 Total current assets $465.0 $400.0 Gross plant and equipment $680.0 $600.0 Less: Accumulated depreciation (300.0) (250.0) Net plant and equipment 380.0 350.0 Total assets $845.0 $750.0 Liabilities and equity Accounts payable $30.0 $15.0 Accruals 60.0 55.0 Notes payable 40.0 35.0 Total current liabilities $130.0 $105.0 Long-term bonds 300.0 255.0 Total liabilities $430.0 $360.0 Common stock 130.0 130.0 Retained earnings 285.0 260.0 Owner's equity. $415.0 $390.0 Total liabilities and equity $845.0 $750.0 NOTE: the company has no preferred stock, so owner's equity includes common Table 1: December 31 Comparative Balance Sheets (millions of dollars) 2020 2019 Assets Cash and marketable securities $15.0 $40.0 Accounts receivable 180.0 160.0 Inventory 270.0 200.0 Total current assets $465.0 $400.0 Gross plant and equipment $680.0 $600.0 Less: Accumulated depreciation (300.0) (250.0) Net plant and equipment 380.0 350.0 Total assets $845.0 $750.0 Liabilities and equity Accounts payable $30.0 $15.0 Accruals 60.0 55.0 Notes payable 40.0 35.0 Total current liabilities $130.0 $105.0 Long-term bonds 300.0 255.0 Total liabilities $430.0 $360.0 Common stock 130.0 130.0 Retained earnings 285.0 260.0 Owner's equity. $415.0 $390.0 Total liabilities and equity $845.0 $750.0 NOTE: the company has no preferred stock, so owner's equity includes common

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started