Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer this this is not only one question it's more than one, please answer those questions 267% By using common size income statements, firms

please answer this

this is not only one question it's more than one, please answer those questions

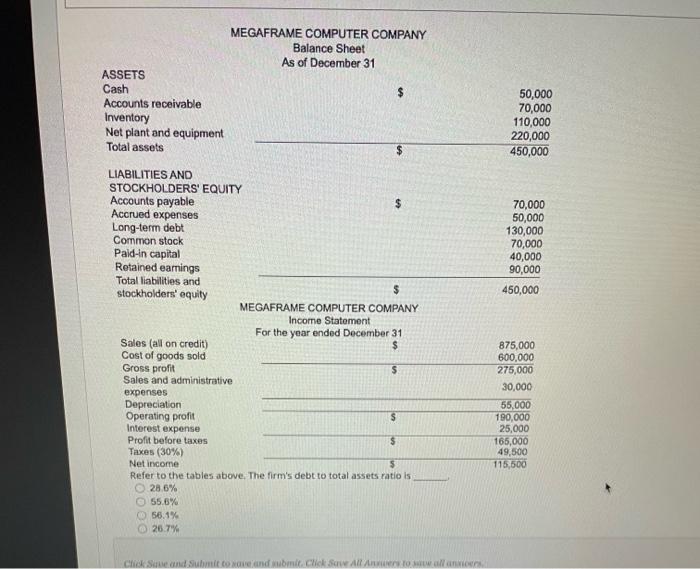

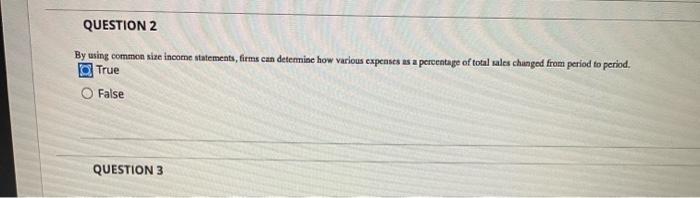

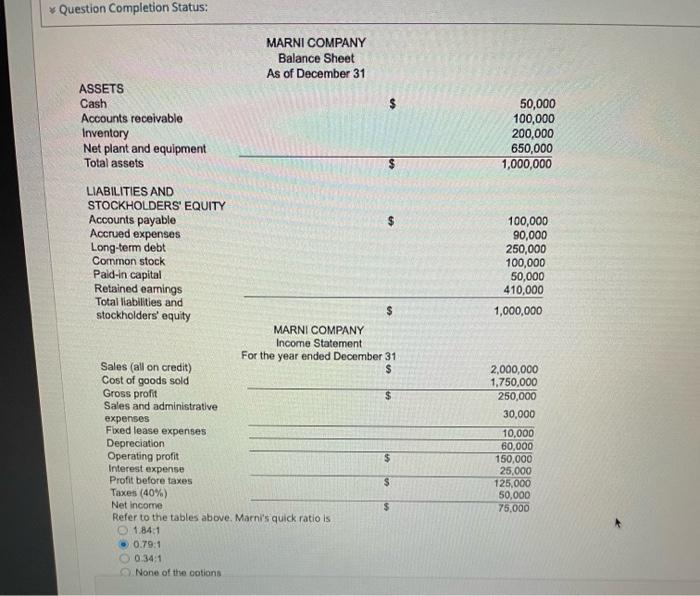

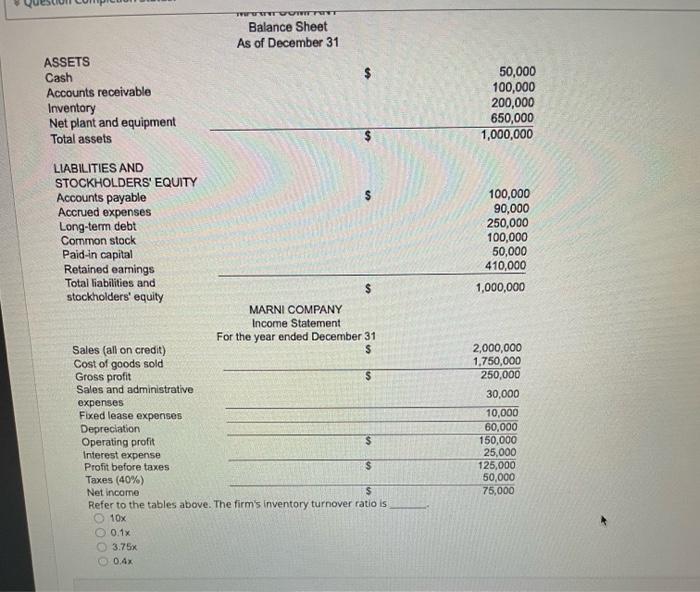

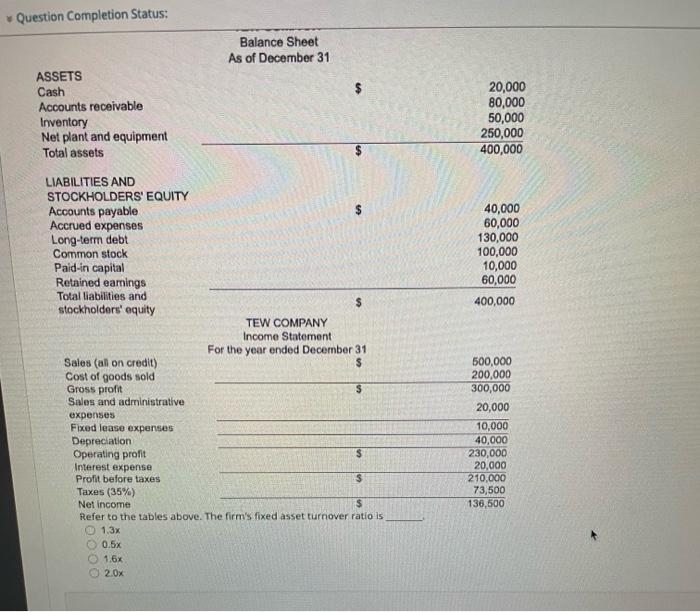

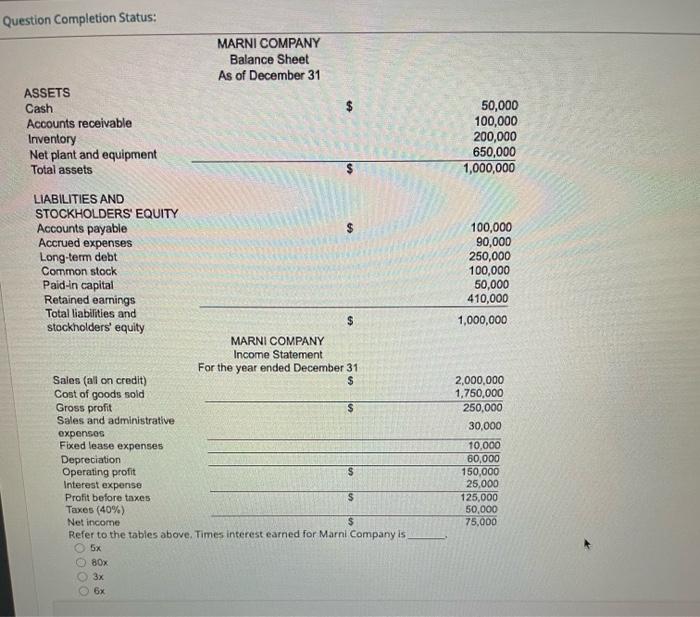

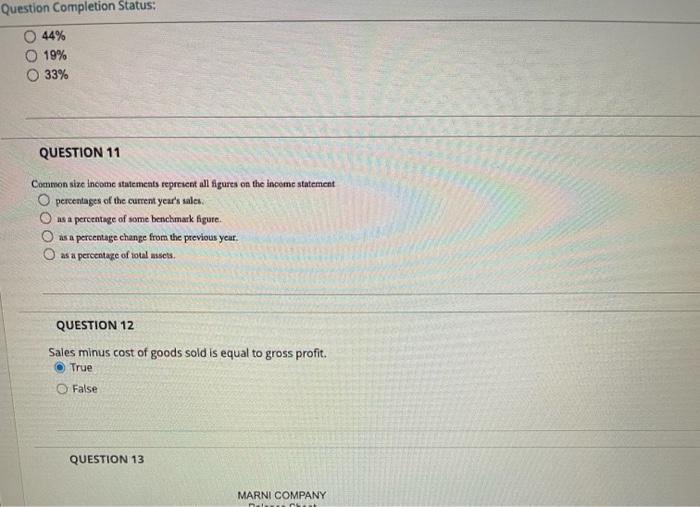

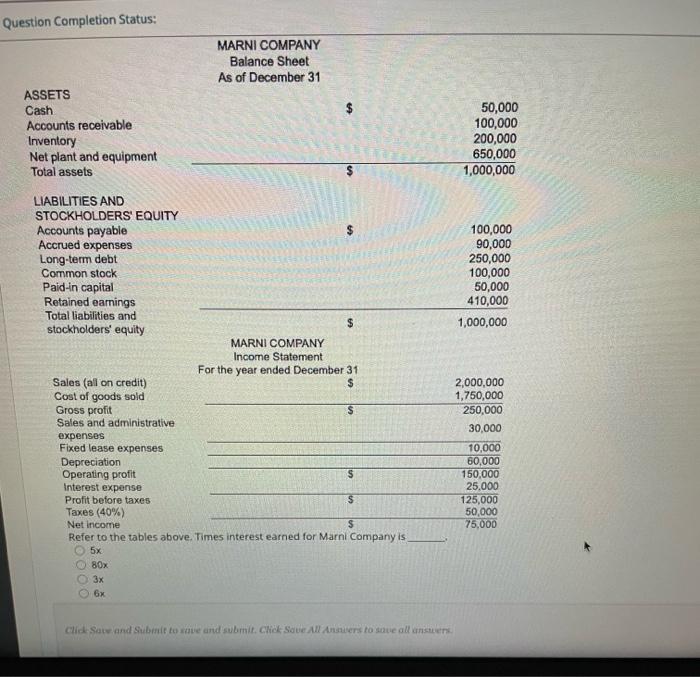

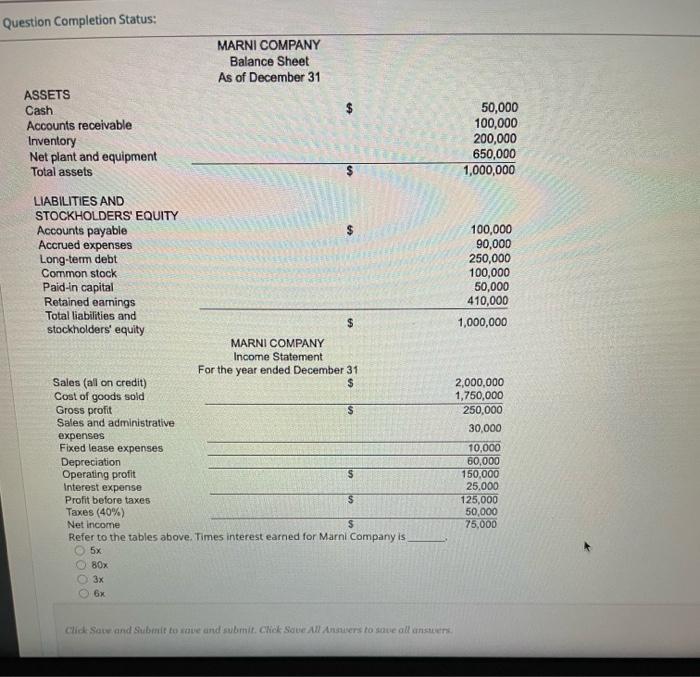

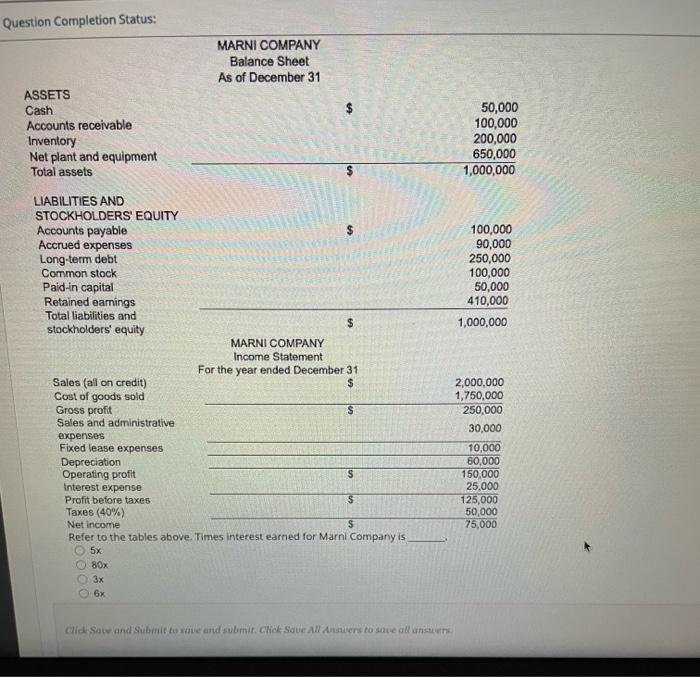

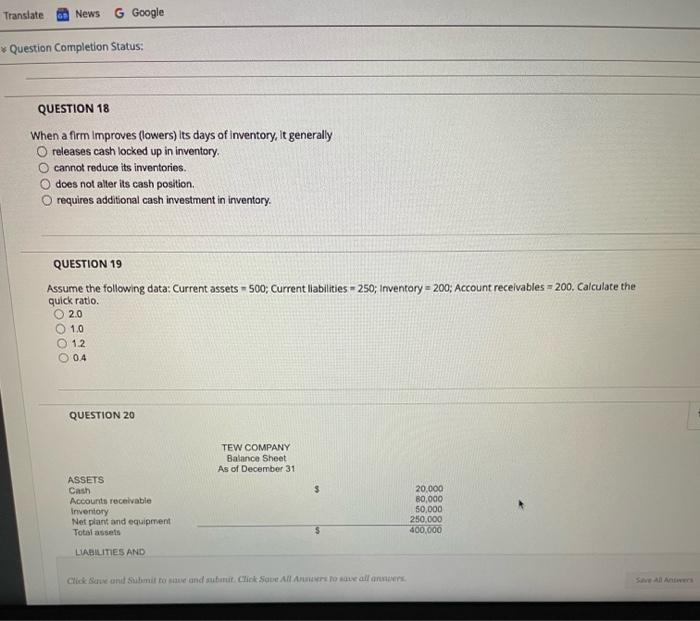

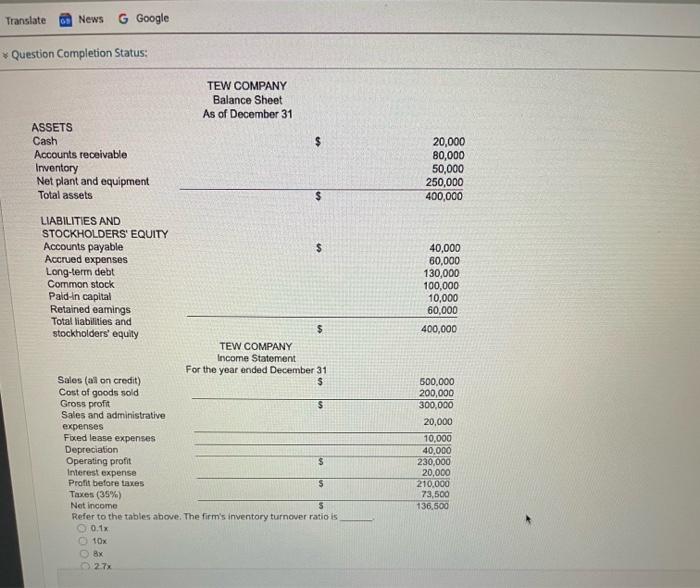

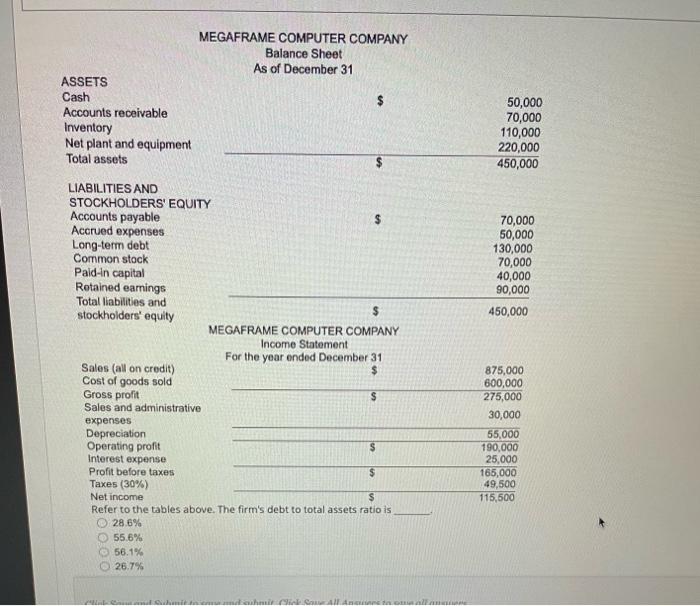

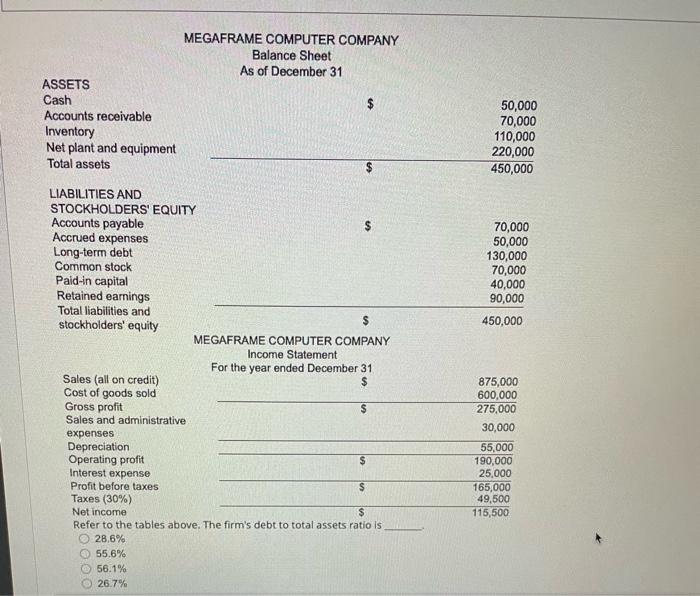

267% By using common size income statements, firms can deternine how various expenses as a pereentage of total rales chunged from period to period. True False Question Completion Status: 0.34:1 None of the cotions 0.4x The income statement is the major device for measuring the profitability of a firm over a period of time. True False 2.0x 0.0x 1.6x 2.0x QUESTION 8 Profitability ratios indicate 1. whether the firm is using its assets productively; II. whether the firm is liquid; III. whether the firm is profitable; IV. how highly the firm is valued by investors I only II only III only III and IV only QUESTION 9 Tho analyais of a limn's finumcial ataiements can te un inportant factor in the firti's ahility to borrow inoney. True False 0x0x uestion Completion Status: 44%19%33% QUESTION 11 Coenmon sixe income stutements repreient all figures on the inceme statemient percentages of the current year's sales. is a pereentage of some benchmark figute. as a percentage change from the previous year. as a percentage of wotal assets. QUESTION 12 Sales minus cost of goods sold is equal to gross profit. True False Quection Completion Status: Quection Completion Status: Quection Completion Status: When a firm improves (lowers) its days of inventory, it generally releases cash locked up in inventory. cannot reduce its inventories. does not aller its cash position. requires additional cash investment in inventory. QUESTION 19 Assume the following data: Current assets =500; Current liabilities =250; inventory =200; Account recelvables =200. Calculate the quick ratio. 2.0 1.0 1.2 QUESTION 20 Translate 0 News G Google * Question Completion Status: TEW COMPANY Balance Sheet As of December 31 ASSETS Cash Accounts receivable Inventory Net plant and equipment Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Accrued expenses Long-term debt Common stock Pald-ln capital Retained eamings Total liabilities and stockholders' equity 26.7% 00.1% 26.7% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started