Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer this this with explanation according to international accounting. plz zoom into the image to see the questions as the questions are available in

please answer this this with explanation according to international accounting.

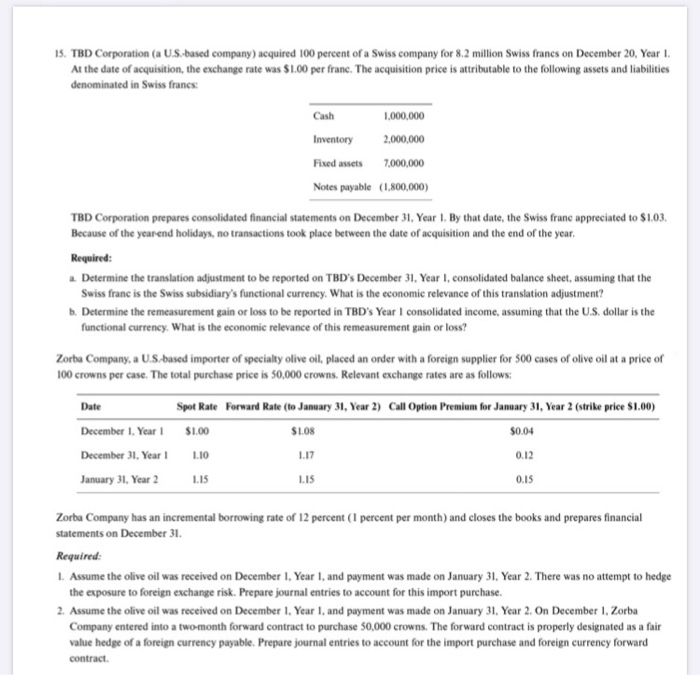

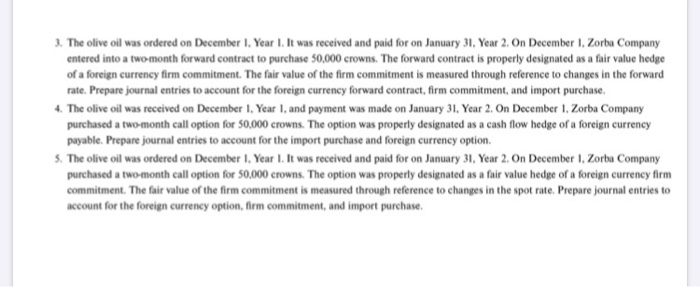

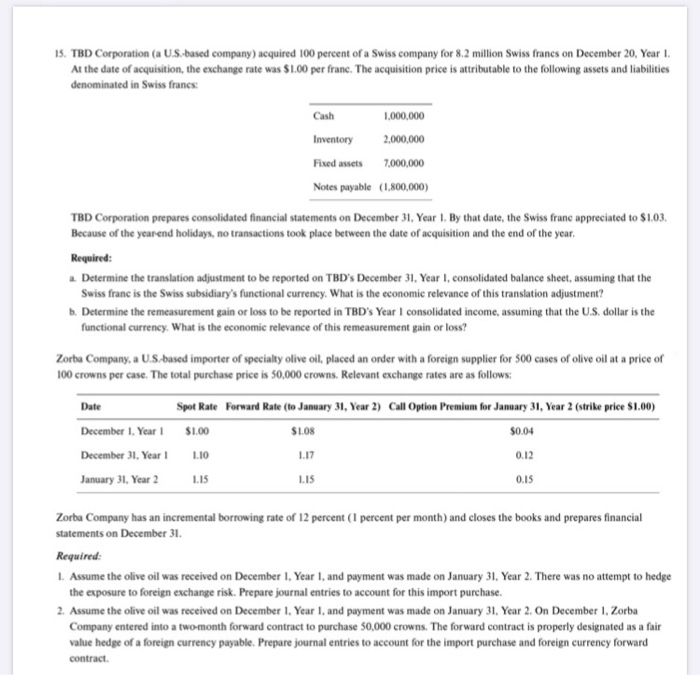

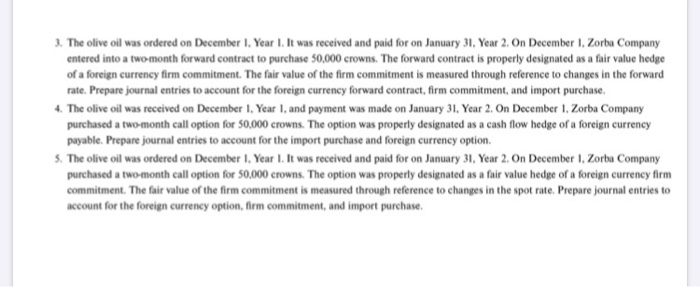

plz zoom into the image to see the questions as the questions are available in this clarity only 15. TBD Corporation (a US-based company) acquired 100 percent of a Swiss company for 8.2 million Swiss francs on December 20, Year I. At the date of acquisition, the exchange rate was $1.00 per frane. The acquisition price is attributable to the following assets and liabilities denominated in Swiss francs: Cash 1,000,000 Inventory 2,000,000 Fixed assets 7,000,000 Notes payable (1,800,000) TBD Corporation prepares consolidated financial statements on December 31, Year 1. By that date, the Swiss franc appreciated to $1.03. Because of the year end holidays, no transactions took place between the date of acquisition and the end of the year, Required: a. Determine the translation adjustment to be reported on TBD's December 31, Year I, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary's functional currency. What is the economic relevance of this translation adjustment? b. Determine the remeasurement gain or loss to be reported in TBD's Year I consolidated income, assuming that the U.S. dollar is the functional currency. What is the economic relevance of this remeasurement gain or loss? Zorba Company, a U.S.based importer of specialty olive oil, placed an order with a foreign supplier for 500 cases of olive oil at a price of 100 crowns per case. The total purchase price is 50,000 crowns. Relevant exchange rates are as follows: Date Spot Rate Forward Rate (to January 31, Year 2) Call Option Premium for January 31, Year 2 (strike price $1.00) $1.08 $0.04 December 1 Year December 31, Year January 31, Year 2 $1.00 1.10 0 15 1.17 0.12 L.IS 0.15 Zorba Company has an incremental borrowing rate of 12 percent (1 percent per month) and closes the books and prepares financial statements on December 31. Required: 1. Assume the olive oil was received on December 1, Year I, and payment was made on January 31, Year 2. There was no attempt to hedge the exposure to foreign exchange risk. Prepare journal entries to account for this import purchase. 2. Assume the olive oil was received on December 1 Year 1, and payment was made on January 31, Year 2. On December 1, Zorba Company entered into a two-month forward contract to purchase 50,000 crowns. The forward contract is properly designated as a fair value hedge of a foreign currency payable. Prepare journal entries to account for the import purchase and foreign currency forward contract 3. The olive oil was ordered on December 1 Year I. It was received and paid for on January 31, Year 2. On December 1, Zorba Company entered into a two month forward contract to purchase 50,000 crowns. The forward contract is properly designated as a fair value hedge of a foreign currency firm commitment. The fair value of the firm commitment is measured through reference to changes in the forward rate. Prepare journal entries to account for the foreign currency forward contract, firm commitment, and import purchase. 4. The olive oil was received on December 1 Year 1, and payment was made on January 31, Year 2. On December 1, Zorba Company purchased a two-month call option for 50,000 crowns. The option was properly designated as a cash flow hedge of a foreign currency payable. Prepare journal entries to account for the import purchase and foreign currency option 5. The olive oil was ordered on December 1 Year 1. It was received and paid for on January 31, Year 2. On December 1, Zorba Company purchased a two-month call option for 50,000 crowns. The option was properly designated as a fair value hedge of a foreign currency firm commitment. The fair value of the firm commitment is measured through reference to changes in the spot rate. Prepare journal entries to account for the foreign currency option, firm commitment, and import purchase

plz zoom into the image to see the questions as the questions are available in this clarity only 15. TBD Corporation (a US-based company) acquired 100 percent of a Swiss company for 8.2 million Swiss francs on December 20, Year I. At the date of acquisition, the exchange rate was $1.00 per frane. The acquisition price is attributable to the following assets and liabilities denominated in Swiss francs: Cash 1,000,000 Inventory 2,000,000 Fixed assets 7,000,000 Notes payable (1,800,000) TBD Corporation prepares consolidated financial statements on December 31, Year 1. By that date, the Swiss franc appreciated to $1.03. Because of the year end holidays, no transactions took place between the date of acquisition and the end of the year, Required: a. Determine the translation adjustment to be reported on TBD's December 31, Year I, consolidated balance sheet, assuming that the Swiss franc is the Swiss subsidiary's functional currency. What is the economic relevance of this translation adjustment? b. Determine the remeasurement gain or loss to be reported in TBD's Year I consolidated income, assuming that the U.S. dollar is the functional currency. What is the economic relevance of this remeasurement gain or loss? Zorba Company, a U.S.based importer of specialty olive oil, placed an order with a foreign supplier for 500 cases of olive oil at a price of 100 crowns per case. The total purchase price is 50,000 crowns. Relevant exchange rates are as follows: Date Spot Rate Forward Rate (to January 31, Year 2) Call Option Premium for January 31, Year 2 (strike price $1.00) $1.08 $0.04 December 1 Year December 31, Year January 31, Year 2 $1.00 1.10 0 15 1.17 0.12 L.IS 0.15 Zorba Company has an incremental borrowing rate of 12 percent (1 percent per month) and closes the books and prepares financial statements on December 31. Required: 1. Assume the olive oil was received on December 1, Year I, and payment was made on January 31, Year 2. There was no attempt to hedge the exposure to foreign exchange risk. Prepare journal entries to account for this import purchase. 2. Assume the olive oil was received on December 1 Year 1, and payment was made on January 31, Year 2. On December 1, Zorba Company entered into a two-month forward contract to purchase 50,000 crowns. The forward contract is properly designated as a fair value hedge of a foreign currency payable. Prepare journal entries to account for the import purchase and foreign currency forward contract 3. The olive oil was ordered on December 1 Year I. It was received and paid for on January 31, Year 2. On December 1, Zorba Company entered into a two month forward contract to purchase 50,000 crowns. The forward contract is properly designated as a fair value hedge of a foreign currency firm commitment. The fair value of the firm commitment is measured through reference to changes in the forward rate. Prepare journal entries to account for the foreign currency forward contract, firm commitment, and import purchase. 4. The olive oil was received on December 1 Year 1, and payment was made on January 31, Year 2. On December 1, Zorba Company purchased a two-month call option for 50,000 crowns. The option was properly designated as a cash flow hedge of a foreign currency payable. Prepare journal entries to account for the import purchase and foreign currency option 5. The olive oil was ordered on December 1 Year 1. It was received and paid for on January 31, Year 2. On December 1, Zorba Company purchased a two-month call option for 50,000 crowns. The option was properly designated as a fair value hedge of a foreign currency firm commitment. The fair value of the firm commitment is measured through reference to changes in the spot rate. Prepare journal entries to account for the foreign currency option, firm commitment, and import purchase

please answer this this with explanation according to international accounting.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started