Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer this two question. i am in the middle of the exam. please make sure the answer is right. thank you. Question 13 (1

please answer this two question. i am in the middle of the exam. please make sure the answer is right. thank you.

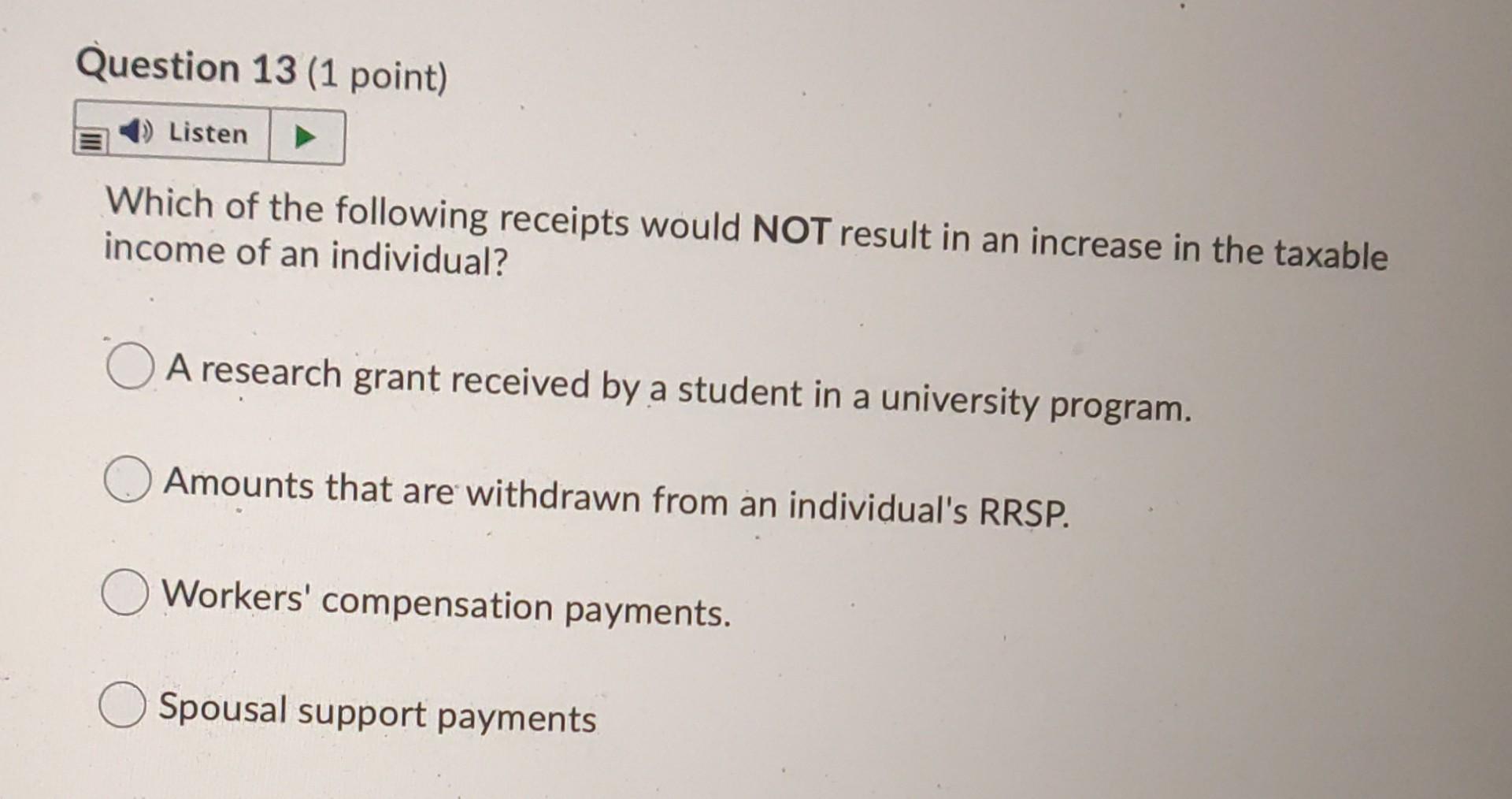

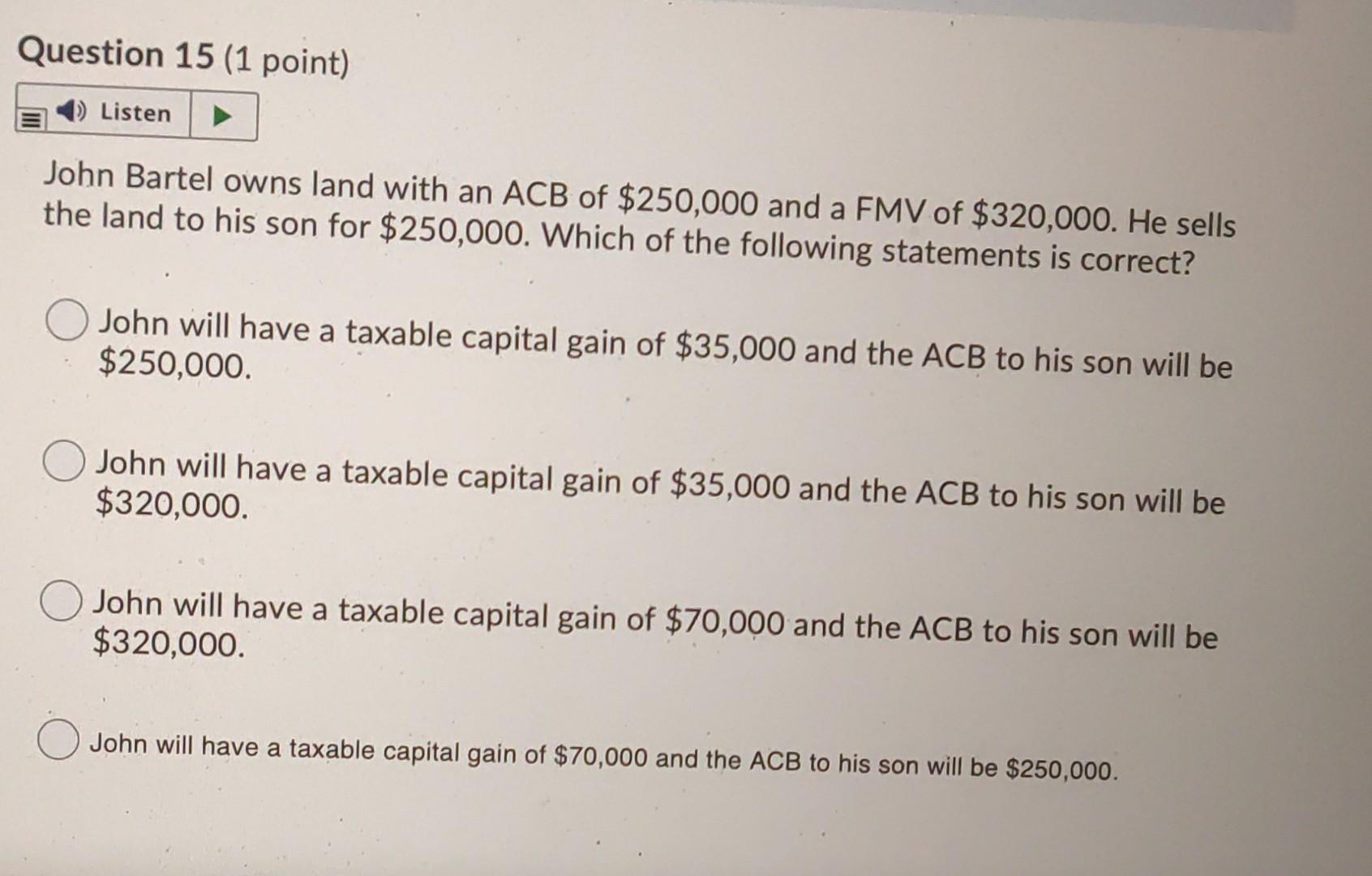

Question 13 (1 point) Listen Which of the following receipts would NOT result in an increase in the taxable income of an individual? A research grant received by a student in a university program. Amounts that are withdrawn from an individual's RRSP. Workers' compensation payments. Spousal support payments Question 15 (1 point) Listen John Bartel owns land with an ACB of $250,000 and a FMV of $320,000. He sells the land to his son for $250,000. Which of the following statements is correct? John will have a taxable capital gain of $35,000 and the ACB to his son will be $250,000. John will have a taxable capital gain of $35,000 and the ACB to his son will be $320,000. John will have a taxable capital gain of $70,000 and the ACB to his son will be $320,000. John will have a taxable capital gain of $70,000 and the ACB to his son will be $250,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started