Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer those three multiple choice question. I will only vote up if all of three questions are answer correctly. 1. 2. 3. Based on

please answer those three multiple choice question. I will only vote up if all of three questions are answer correctly.

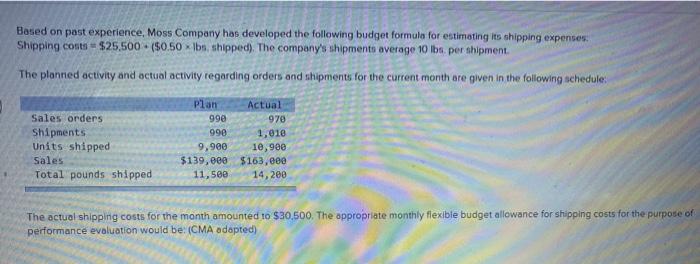

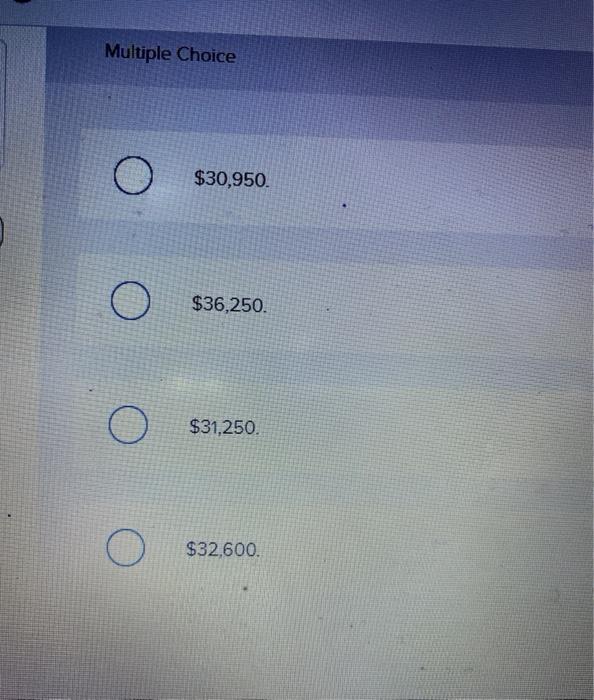

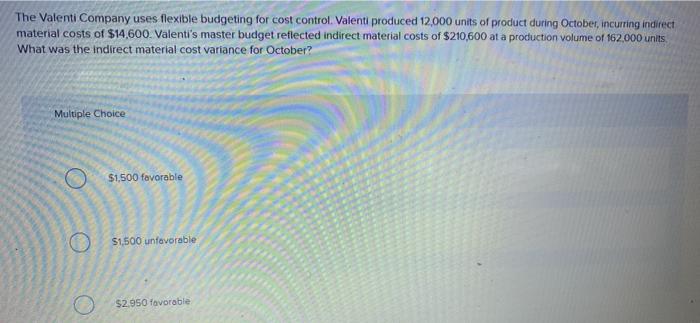

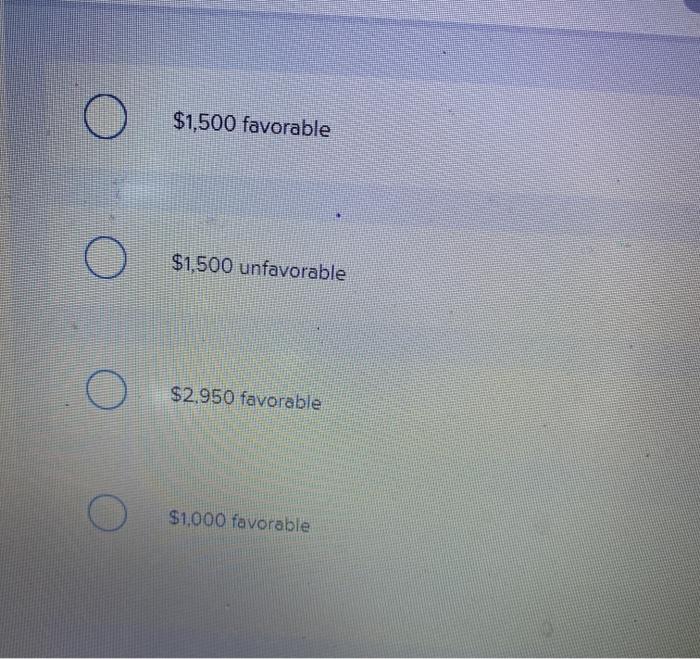

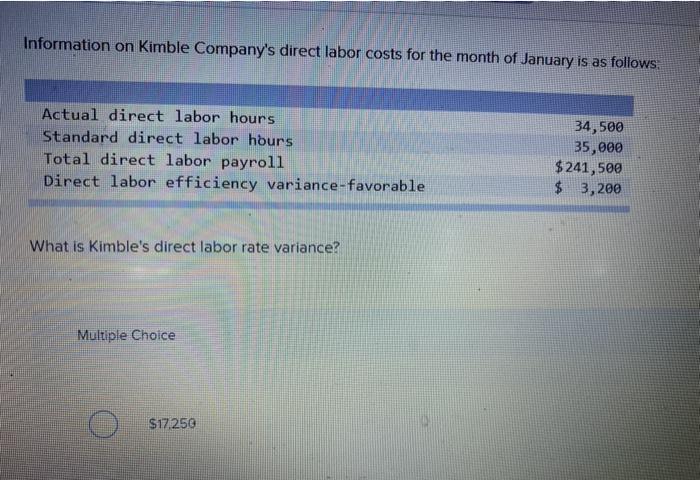

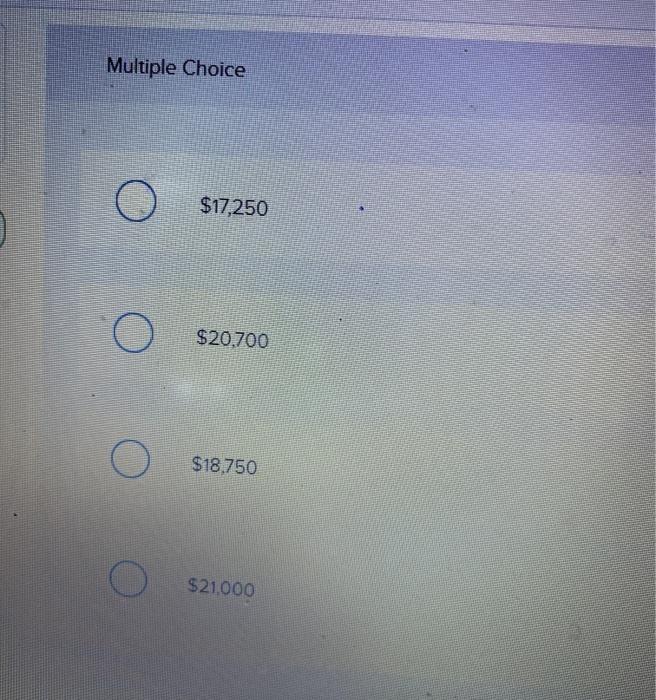

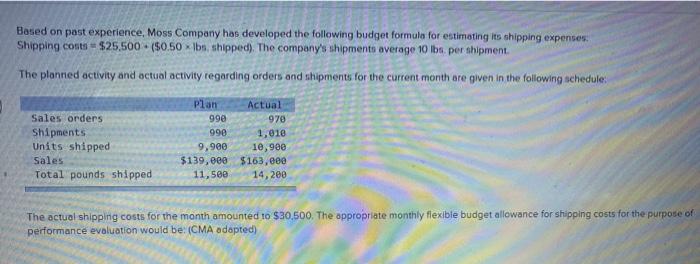

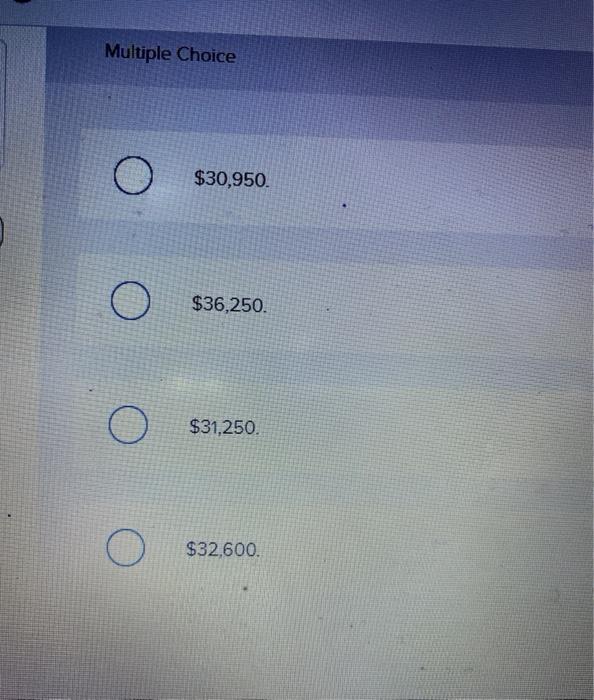

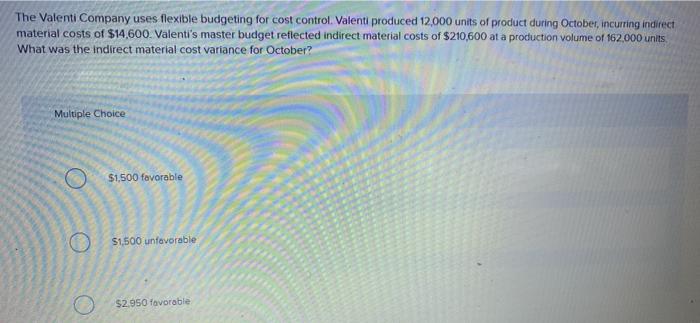

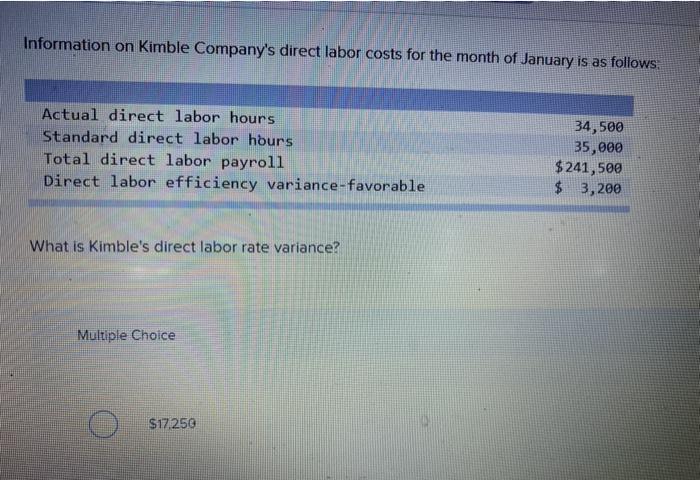

Based on past experience, Moss Company has developed the following budget formula for estimating its shipping expenses. Shipping costs = $25,500 (50.50 lbs, shipped). The company's shipments average 10 lbs. per shipment The planned activity and actual activity regarding orders and shipments for the current month are given in the following schedule: Plan Sales orders Shipments Units shipped Sales Total pounds shipped Actual 990 970 990 1,010 9,900 10,900 $139,000 $163, eee 11,500 14,200 The actual shipping costs for the month amounted to $30,500. The appropriate monthly flexible budget allowance for shipping costs for the purpose of performance evaluation would be: (CMA adapted) Multiple Choice $30,950. O $36,250. $31,250. O $32,600. The Valenti Company uses flexible budgeting for cost control. Valenti produced 12,000 units of product during October, incurring indirect material costs of $14,600 Valenti's master budget reflected indirect material costs of $210,600 at a production volume of 162.000 units What was the indirect material cost variance for October? Multiple Choice $1,500 favorable O $1,500 unfavorable $2.950 favorable $1,500 favorable $1,500 unfavorable O $2,950 favorable $1,000 favorable Information on Kimble Company's direct labor costs for the month of January is as follows. Actual direct labor hours Standard direct labor hours Total direct labor payroll Direct labor efficiency variance-favorable 34,500 35,000 $241,500 $ 3,200 What is Kimble's direct labor rate variance? Multiple Choice $17.250 Multiple Choice O $17,250 O $20.700 $18,750 $21,000 1.

2.

3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started