Please answer to these questions if you know how to do it!!!

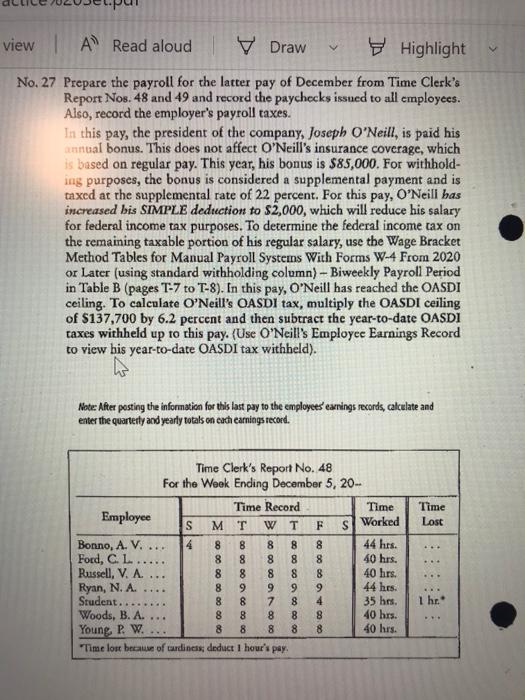

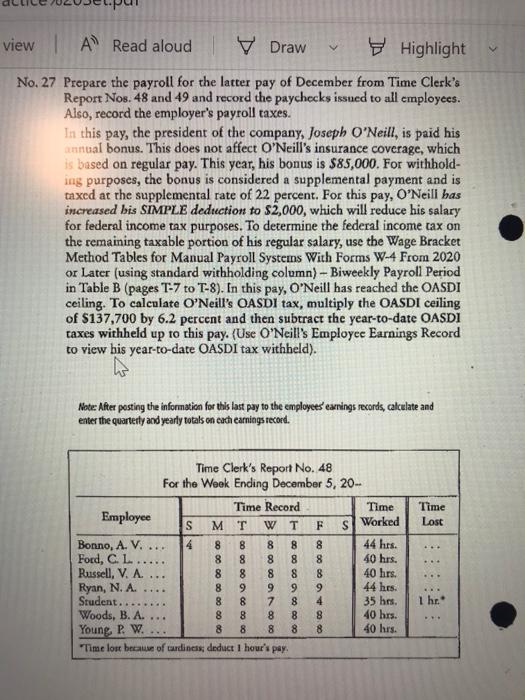

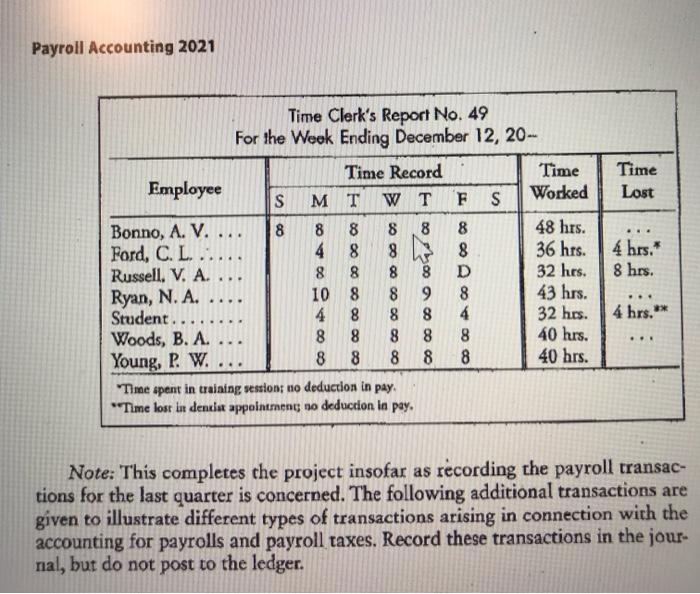

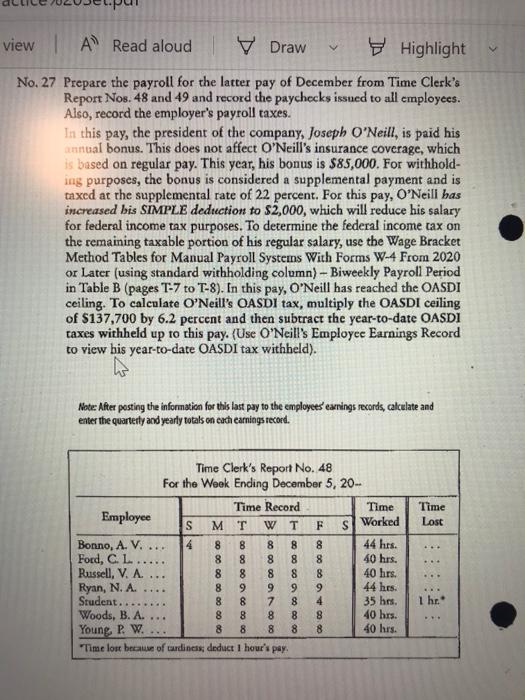

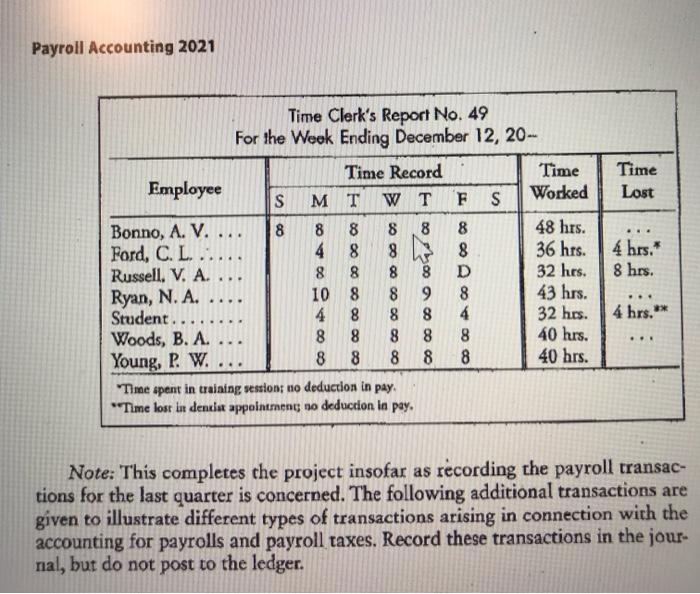

view | A Read aloud V Draw Highlight No. 27 Prepare the payroll for the latter pay of December from Time Clerk's Report Nos. 48 and 49 and record the paychecks issued to all employees. Also, record the employer's payroll taxes. In this pay, the president of the company, Joseph O'Neill, is paid his unnual bonus. This does not affect O'Neill's insurance coverage, which is based on regular pay. This year, his bonus is $85,000. For withhold- ing purposes, the bonus is considered a supplemental payment and is taxed at the supplemental rate of 22 percent. For this pay, O'Neill has increased bis SIMPLE dedtection to $2,000, which will reduce his salary for federal income tax purposes. To determine the federal income tax on the remaining taxable portion of his regular salary, use the Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later (using standard withholding column) - Biweekly Payroll Period in Table B (pages T-7 to T-8). In this pay, O'Neill has reached the OASDI ceiling. To calculate O'Neill's QASDI tax, multiply the OASDI ceiling of $137,700 by 6.2 percent and then subtract the year-to-date OASDI taxes withheld up to this pay. (Use O'Neill's Employee Earnings Record to view his year-to-date OASDI tax withheld). Note: After pasting the information for this last pay to the employees earrings records, calculate and enter the quarterly and yearly totals on each earnings record. Time Lost sWorked Time Clerk's Report No. 48 For the Week Ending December 5, 20- Time Record Time Employee S M T W T F Bonno, A. V. ... 8 8 8 8 44 hrs. Ford, C. 8 8 8 8 40 hrs. Russell, V. A 8 8 8 8 8 40 hrs. Ryan, N.A. 8 9 9 9 9 44 hrs. Student.. 8 8 7 8 4 35 hrs. Woods, B. A. 8 8 8 8 8 40 hrs. Young P. W. 8 8 8 8 8 40 hrs. "Time lost because of cardines deduct 1 hour's pay 1 he Payroll Accounting 2021 . Time Clerk's Report No. 49 For the Wook Ending December 12, 20- Time Record Time Time Employee S MT W T F S Worked Lost Bonno, A. V. ... 8 8 8 8 8 8 48 hrs. Ford, C. L. ..... 4 8 8 h 8 36 hrs. 4 hrs.* Russell, V. A. 8 8 8 8 D 32 hrs. 8 hrs. Ryan, N. A. ... 10 8 8 9 8 43 hrs. 4 8 8 32 hrs. 4 hrs." Woods, B. A. 8 8 8 8 8 40 hrs. Young, P. W. ... 8 8 8 8 40 hrs. "Time spent in training session no deduction in pay "Time lost in dencia appointments no deduction in pay. ... Student ... .. Note: This completes the project insofar as recording the payroll transac- tions for the last quarter is concerned. The following additional transactions are given to illustrate different types of transactions arising in connection with the accounting for payrolls and payroll taxes. Record these transactions in the jour- nal, but do not post to the ledger. view | A Read aloud V Draw Highlight No. 27 Prepare the payroll for the latter pay of December from Time Clerk's Report Nos. 48 and 49 and record the paychecks issued to all employees. Also, record the employer's payroll taxes. In this pay, the president of the company, Joseph O'Neill, is paid his unnual bonus. This does not affect O'Neill's insurance coverage, which is based on regular pay. This year, his bonus is $85,000. For withhold- ing purposes, the bonus is considered a supplemental payment and is taxed at the supplemental rate of 22 percent. For this pay, O'Neill has increased bis SIMPLE dedtection to $2,000, which will reduce his salary for federal income tax purposes. To determine the federal income tax on the remaining taxable portion of his regular salary, use the Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later (using standard withholding column) - Biweekly Payroll Period in Table B (pages T-7 to T-8). In this pay, O'Neill has reached the OASDI ceiling. To calculate O'Neill's QASDI tax, multiply the OASDI ceiling of $137,700 by 6.2 percent and then subtract the year-to-date OASDI taxes withheld up to this pay. (Use O'Neill's Employee Earnings Record to view his year-to-date OASDI tax withheld). Note: After pasting the information for this last pay to the employees earrings records, calculate and enter the quarterly and yearly totals on each earnings record. Time Lost sWorked Time Clerk's Report No. 48 For the Week Ending December 5, 20- Time Record Time Employee S M T W T F Bonno, A. V. ... 8 8 8 8 44 hrs. Ford, C. 8 8 8 8 40 hrs. Russell, V. A 8 8 8 8 8 40 hrs. Ryan, N.A. 8 9 9 9 9 44 hrs. Student.. 8 8 7 8 4 35 hrs. Woods, B. A. 8 8 8 8 8 40 hrs. Young P. W. 8 8 8 8 8 40 hrs. "Time lost because of cardines deduct 1 hour's pay 1 he Payroll Accounting 2021 . Time Clerk's Report No. 49 For the Wook Ending December 12, 20- Time Record Time Time Employee S MT W T F S Worked Lost Bonno, A. V. ... 8 8 8 8 8 8 48 hrs. Ford, C. L. ..... 4 8 8 h 8 36 hrs. 4 hrs.* Russell, V. A. 8 8 8 8 D 32 hrs. 8 hrs. Ryan, N. A. ... 10 8 8 9 8 43 hrs. 4 8 8 32 hrs. 4 hrs." Woods, B. A. 8 8 8 8 8 40 hrs. Young, P. W. ... 8 8 8 8 40 hrs. "Time spent in training session no deduction in pay "Time lost in dencia appointments no deduction in pay. ... Student ... .. Note: This completes the project insofar as recording the payroll transac- tions for the last quarter is concerned. The following additional transactions are given to illustrate different types of transactions arising in connection with the accounting for payrolls and payroll taxes. Record these transactions in the jour- nal, but do not post to the ledger