Answered step by step

Verified Expert Solution

Question

1 Approved Answer

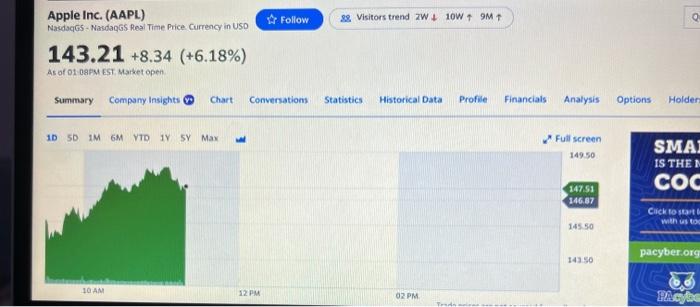

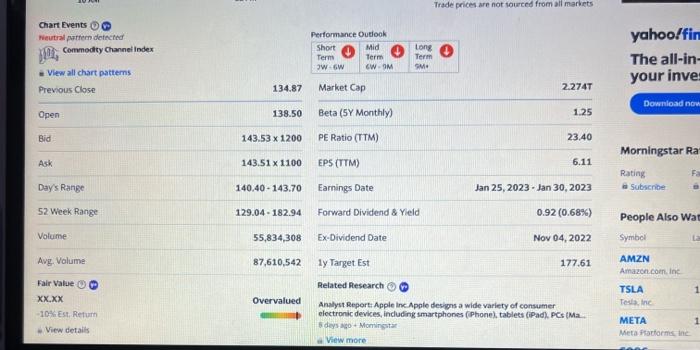

please answer using APPLE and what i attached please answee all parts using APPLE A. Choose a stock that interests you. Utilizing Bloomberg, Yahoo Finance,

please answer using APPLE and what i attached

please answee all parts using APPLE

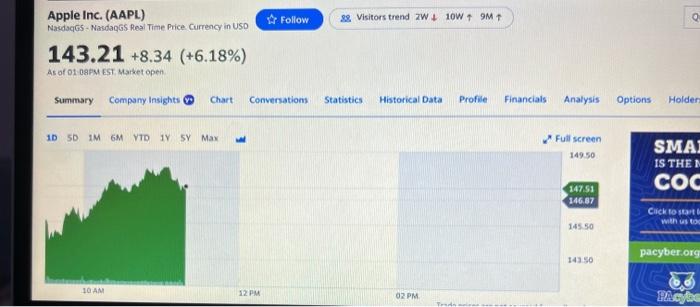

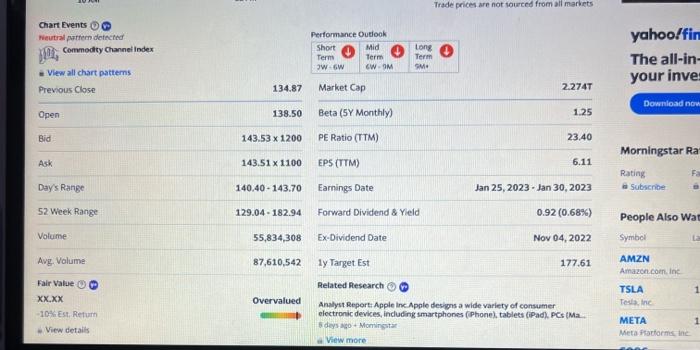

A. Choose a stock that interests you. Utilizing Bloomberg, Yahoo Finance, or Google Finance, etc. as a source of data, collect the following information: a. The stock's Beta b. Use the lyr market risk premium from Kenneth French's website c. The risk-free rate (rRF) d. The last dividend paid (D0) e. The annual expected growth rate of dividends (g) B. Use the Discounted Dividend Model for Constant Growth Stocks and solve for the intrinsic stock price (P0) Based on your above calculations, compare the calculated price with the current market price and indicate whether the stock price is overvalued, undervalued, or at Tquilibrium? Explain. C. Now, assume that your company has just released a new product and will be experiencing supernormal growth of 25% for the next three years. In Excel, use the information in "A" and the Discounted Dividend Model for Nonconstant Growth Stocks and solve for the intrinsic stock price (P0). Apple Inc. (AAPL) Nacdacics - NasdaqGS Real Time Price Currency in USD 4. Follow 28 Visitors trend 2W+10W+9M+ as of 01 0abvi EST Market open Summary Company Insights (v. Chart Convenations Statistics Historical Data Profile Financials Analysis Options Holder 10 SD 1M6M YTD 1Y 5Y Max 4 Full screen Trade prices are not sourced from all markets erformance Outiook Morningstar Ra Rating a subscribe People Also Wat Related Pesearch Analyst Reporti Apple inc Apple designs a wide variety of consumer electronic devices, induding smartphones (Phone), tablets (iPad). PCs (Ma. bideys ago + Monsingstar a View more A. Choose a stock that interests you. Utilizing Bloomberg, Yahoo Finance, or Google Finance, etc. as a source of data, collect the following information: a. The stock's Beta b. Use the lyr market risk premium from Kenneth French's website c. The risk-free rate (rRF) d. The last dividend paid (D0) e. The annual expected growth rate of dividends (g) B. Use the Discounted Dividend Model for Constant Growth Stocks and solve for the intrinsic stock price (P0) Based on your above calculations, compare the calculated price with the current market price and indicate whether the stock price is overvalued, undervalued, or at Tquilibrium? Explain. C. Now, assume that your company has just released a new product and will be experiencing supernormal growth of 25% for the next three years. In Excel, use the information in "A" and the Discounted Dividend Model for Nonconstant Growth Stocks and solve for the intrinsic stock price (P0). Apple Inc. (AAPL) Nacdacics - NasdaqGS Real Time Price Currency in USD 4. Follow 28 Visitors trend 2W+10W+9M+ as of 01 0abvi EST Market open Summary Company Insights (v. Chart Convenations Statistics Historical Data Profile Financials Analysis Options Holder 10 SD 1M6M YTD 1Y 5Y Max 4 Full screen Trade prices are not sourced from all markets erformance Outiook Morningstar Ra Rating a subscribe People Also Wat Related Pesearch Analyst Reporti Apple inc Apple designs a wide variety of consumer electronic devices, induding smartphones (Phone), tablets (iPad). PCs (Ma. bideys ago + Monsingstar a View more Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started