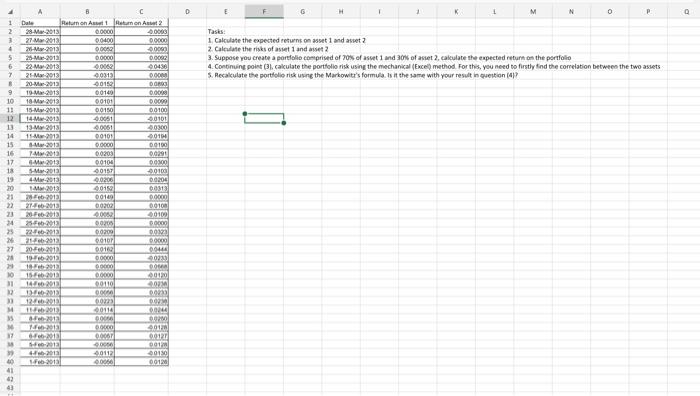

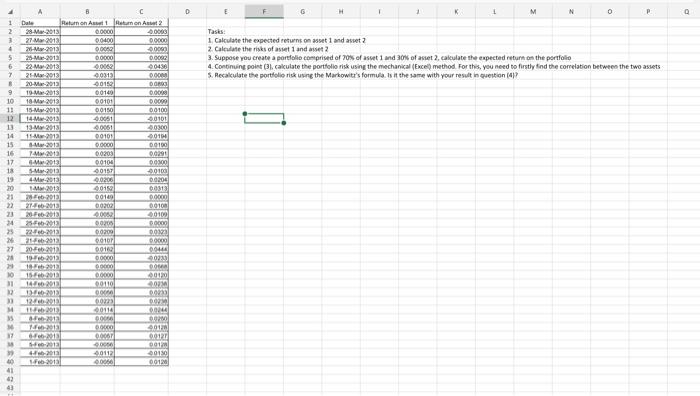

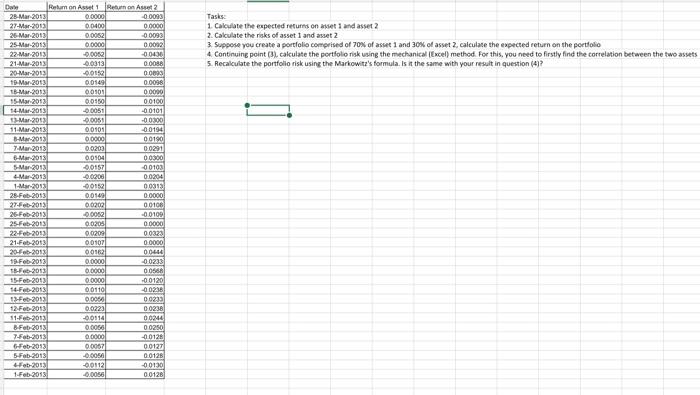

Please answer using excell

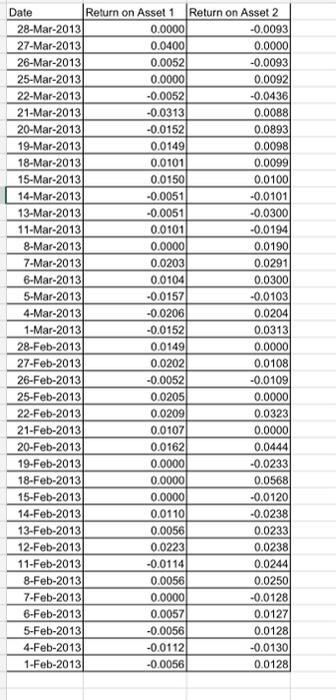

1. Calculate the expected returns on asset 1 and aspet 2 2. Calculate the risks of asiet 1 and aises 2 3. Suppose you create a portelese comprised of jos of ascet 1 and 3ons of astet 2 , cakulate the eapected recurt on the portfolio 4. Cononuing point (3), cakulate the portiolio risk using the mechanical (Exce) method. For this, you need to firtly tind the correlation betwees the two assets 5. Recakulate the portiolie rick using the Markowiti's formula. Is it the 19me with your result in guetion (d)? 1. Cakulate the expected returns on awet 1 and asset 2 2. Calculate the riaks of asset 1 and asset 2 3. 5uppose you create a portiolio comprised of 700 of arset 1 and 30% of asset 2 , calculase the expected return on the poettolio 4. Continuing point (3). calculate the portfolo nisk using the mechanical (Excel) method. For this, you need to firstly find the correlation between the two assets 5. Recalculate the portfollo risk using the Markowitz's formula. Is it the same with your result in question (4) ? 1. Calculate the expected returns on asset 1 and asset 2 2. Calculate the risks of asset 1 and asset; 3. Suppose you create a portfolio comprised of 70% of asset 1 and 30% of asset 2, calculate the expected return on the portfolio 4. Continuing point (3), calculate the portfolio risk using the mechanical (Excel) method. For this, you need to firstly find the correlation between the two assets 5. Recalculate the portfolio risk using the Markowitz's formula. Is it the same with your result in question (4)? 1. Calculate the expected returns on asset 1 and aspet 2 2. Calculate the risks of asiet 1 and aises 2 3. Suppose you create a portelese comprised of jos of ascet 1 and 3ons of astet 2 , cakulate the eapected recurt on the portfolio 4. Cononuing point (3), cakulate the portiolio risk using the mechanical (Exce) method. For this, you need to firtly tind the correlation betwees the two assets 5. Recakulate the portiolie rick using the Markowiti's formula. Is it the 19me with your result in guetion (d)? 1. Cakulate the expected returns on awet 1 and asset 2 2. Calculate the riaks of asset 1 and asset 2 3. 5uppose you create a portiolio comprised of 700 of arset 1 and 30% of asset 2 , calculase the expected return on the poettolio 4. Continuing point (3). calculate the portfolo nisk using the mechanical (Excel) method. For this, you need to firstly find the correlation between the two assets 5. Recalculate the portfollo risk using the Markowitz's formula. Is it the same with your result in question (4) ? 1. Calculate the expected returns on asset 1 and asset 2 2. Calculate the risks of asset 1 and asset; 3. Suppose you create a portfolio comprised of 70% of asset 1 and 30% of asset 2, calculate the expected return on the portfolio 4. Continuing point (3), calculate the portfolio risk using the mechanical (Excel) method. For this, you need to firstly find the correlation between the two assets 5. Recalculate the portfolio risk using the Markowitz's formula. Is it the same with your result in question (4)