Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer using formulas and show work 10. Sammie's Club wants to buy a 320,000-square-feet distribution facility on the northern edge of a large midwestern

please answer using formulas and show work

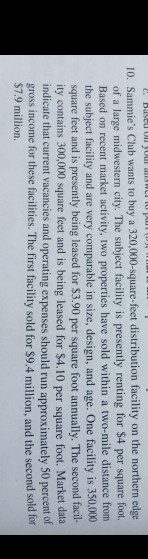

10. Sammie's Club wants to buy a 320,000-square-feet distribution facility on the northern edge of a large midwestern city. The subject facility is presently renting for $4 per square foot. Based on recent market activity, two properties have sold within a two-mile distance from the subject facility and are very comparable in size, design, and age. One facility is 350,000 square feet and is presently being leased for $3.90 per square foot annually. The second facil ity contains 300,000 square feet and is being leased for $4.10 per square foot. Market data indicate that current vacancies and operating expenses should run approximately 50 percent of gross income for these facilities. The first facility sold for $9.4 million, and the second sold for $7.9 million. sing a going-in or direct capitalizatio value for the subject distribution facility? a. n rate approach to value, how would you estimate . What additional information would be desirable before the final direct rate (R) is selectedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started