Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer using tables matching the question. Required information Problem 2-20A (Algo) Showing how events affect the horizontal financial statements model LO 2-1 [The following

Please answer using tables matching the question.

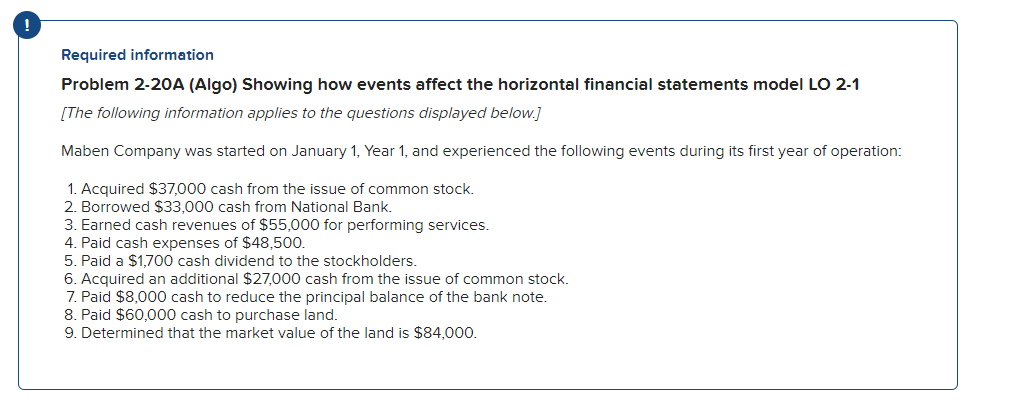

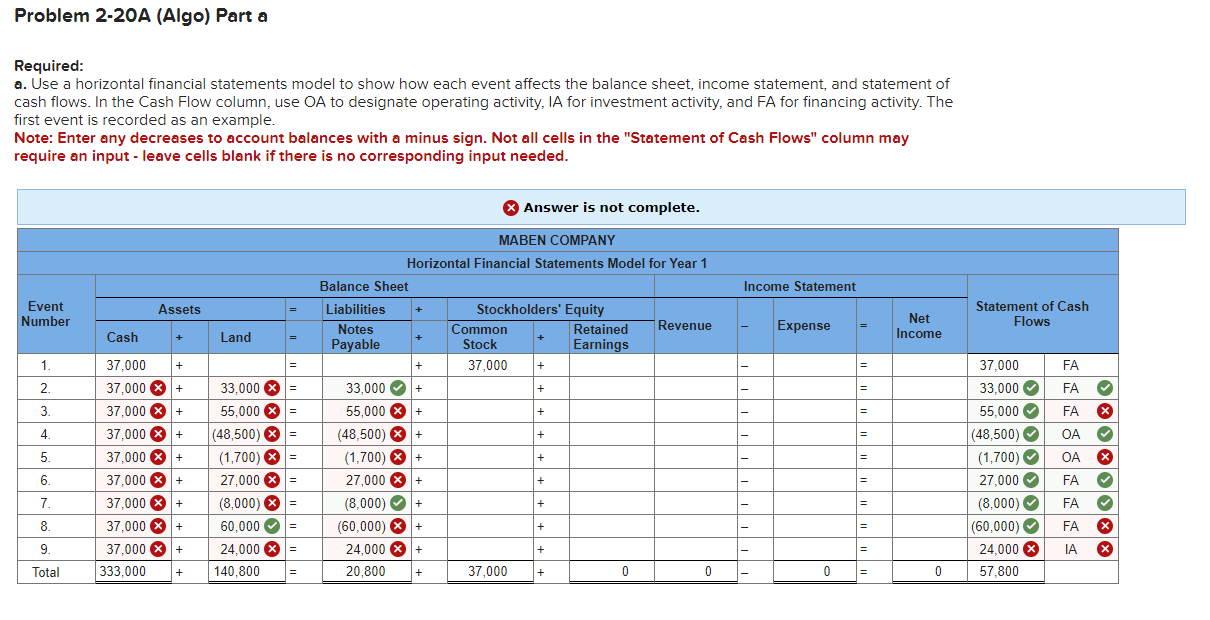

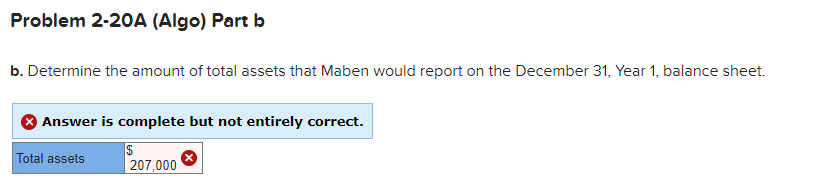

Required information Problem 2-20A (Algo) Showing how events affect the horizontal financial statements model LO 2-1 [The following information applies to the questions displayed below.] Maben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $37,000 cash from the issue of common stock. 2. Borrowed $33,000 cash from National Bank. 3. Earned cash revenues of $55,000 for performing services. 4. Paid cash expenses of $48,500. 5. Paid a $1,700 cash dividend to the stockholders. 6. Acquired an additional $27,000 cash from the issue of common stock. 7. Paid $8,000 cash to reduce the principal balance of the bank note. 8 . Paid $60,000 cash to purchase land. 9. Determined that the market value of the land is $84,000. Required: a. Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. In the Cash Flow column, use OA to designate operating activity, IA for investment activity, and FA for financing activity. The first event is recorded as an example. Note: Enter any decreases to account balances with a minus sign. Not all cells in the "Statement of Cash Flows" column may require an input - leave cells blank if there is no corresponding input needed. b. Determine the amount of total assets that Maben would report on the December 31, Year 1, balance sheet. Answer is complete but not entirely correct

Required information Problem 2-20A (Algo) Showing how events affect the horizontal financial statements model LO 2-1 [The following information applies to the questions displayed below.] Maben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $37,000 cash from the issue of common stock. 2. Borrowed $33,000 cash from National Bank. 3. Earned cash revenues of $55,000 for performing services. 4. Paid cash expenses of $48,500. 5. Paid a $1,700 cash dividend to the stockholders. 6. Acquired an additional $27,000 cash from the issue of common stock. 7. Paid $8,000 cash to reduce the principal balance of the bank note. 8 . Paid $60,000 cash to purchase land. 9. Determined that the market value of the land is $84,000. Required: a. Use a horizontal financial statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. In the Cash Flow column, use OA to designate operating activity, IA for investment activity, and FA for financing activity. The first event is recorded as an example. Note: Enter any decreases to account balances with a minus sign. Not all cells in the "Statement of Cash Flows" column may require an input - leave cells blank if there is no corresponding input needed. b. Determine the amount of total assets that Maben would report on the December 31, Year 1, balance sheet. Answer is complete but not entirely correct Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started