Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Answer, will rate! Exercise 1 - Recording depreciation schedules: Or Inc.'s fiscal year ends on December 31. On June 30, 2016, Or Inc. purchased

Please Answer, will rate!

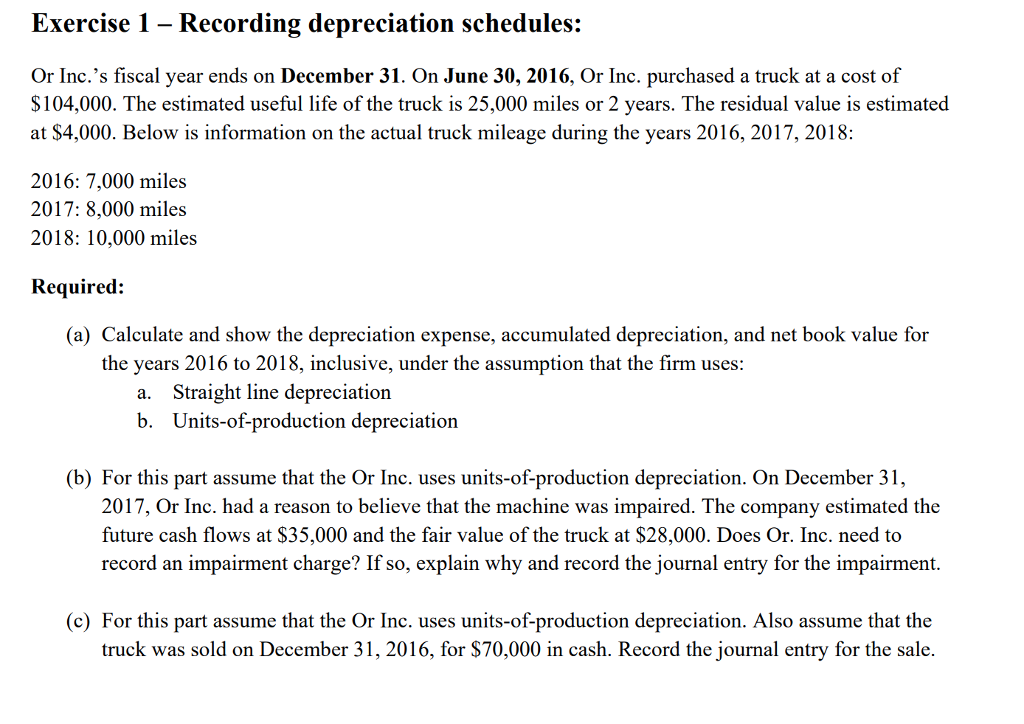

Exercise 1 - Recording depreciation schedules: Or Inc.'s fiscal year ends on December 31. On June 30, 2016, Or Inc. purchased a truck at a cost of $104,000. The estimated useful life of the truck is 25,000 miles or 2 years. The residual value is estimated at $4,000. Below is information on the actual truck mileage during the years 2016, 2017, 2018: 2016: 7,000 miles 2017: 8,000 miles 2018: 10,000 miles Required: (a) Calculate and show the depreciation expense, accumulated depreciation, and net book value for the years 2016 to 2018, inclusive, under the assumption that the firm uses: Straight line depreciation Units-of-production depreciation a. b. (b) For this part assume that the Or Inc. uses units-of-production depreciation. On December 3 2017, Or Inc. had a reason to believe that the machine was impaired. The company estimated the future cash flows at $35,000 and the fair value of the truck at $28,000. Does Or. Inc. need to record an impairment charge? If so, explain why and record the journal entry for the impairment. (c) For this part assume that the Or Inc. uses units-of-production depreciation. Also assume that the truck was sold on December 31, 2016, for $70,000 in cash. Record the journal entry for the saleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started