Please answer with formulas/step by step!

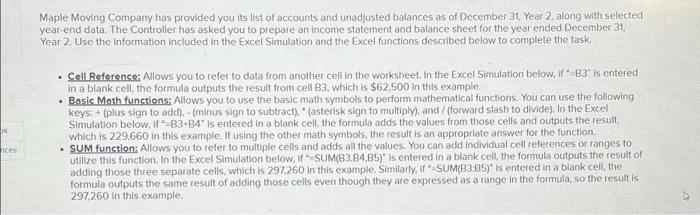

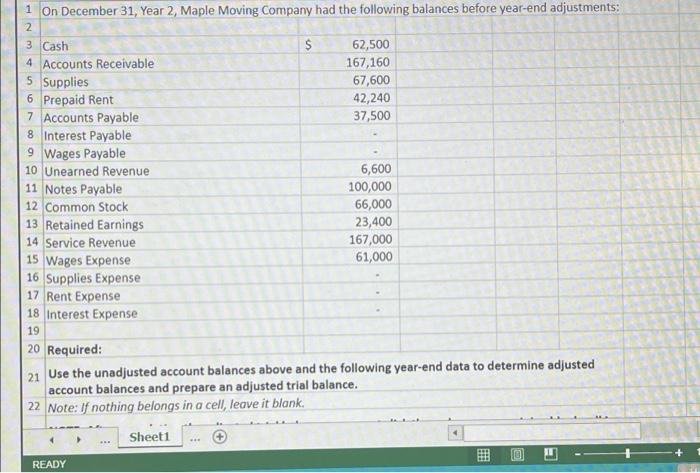

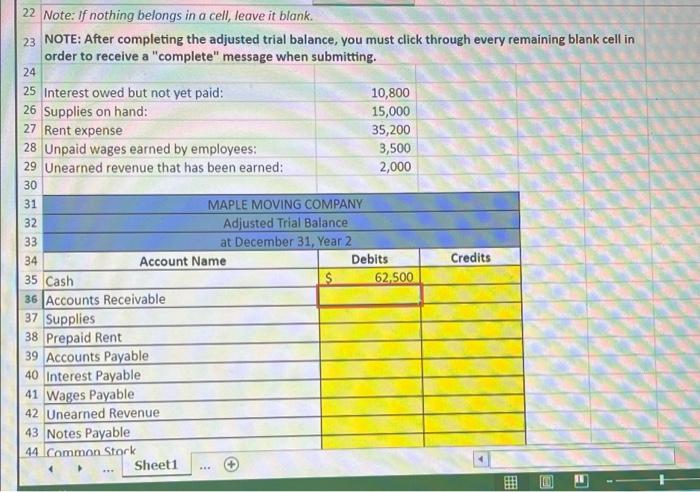

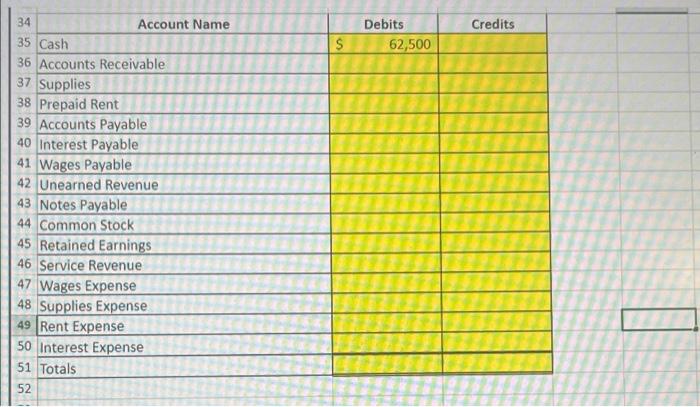

Maple Moving Company has provided you its list of accounts and unadjusted balances as of December 31. Year 2 along with selected year-end data. The Controller has asked you to prepare an income statement and balance sheet for the year ended December 31, Year 2. Use the information included in the Excel Simulation and the Excel functions described below to complete the task, IK Coll Reference: Allows you to refer to data from another cell in the worksheet. In the Excel Simulation below, if =B3" is entered in a blank cell, the formula outputs the result from cell B3, which is $62,500 in this example, Bosic Moth functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add).- (minus sign to subtract), asterisk sign to multiply), and / (forward slash to divide), la the Excel Simulation below. 1-B3-B4" is entered in a blank cell, the formulo adds the values from those cells and outputs the result which is 229,660 in this example. If using the other math symbols, the result is an appropriate answer for the function SUM function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges to utilize this function. In the Excel Simulation below. ir SUM(B3,B4,B5) is entered in a blank cell, the formula outputs the result of adding those three separate cells, which is 297 260 in this example. Similarly, if " SUMB3:85)" is entered in a blank cell, the formula outputs the same result of adding those cells even though they are expressed as a range in the formula, so the result is 297,260 in this example. hice 1 On December 31, Year 2, Maple Moving Company had the following balances before year-end adjustments: 2 3 Cash $ 62,500 4 Accounts Receivable 167,160 5 Supplies 67,600 6 Prepaid Rent 42,240 7 Accounts Payable 37,500 8 Interest Payable 9 Wages Payable 10 Unearned Revenue 6,600 11 Notes Payable 100,000 12 Common Stock 66,000 13 Retained Earnings 23,400 14 Service Revenue 167,000 15 Wages Expense 61,000 16 Supplies Expense 17 Rent Expense 18 Interest Expense 19 20 Required: 21 Use the unadjusted account balances above and the following year-end data to determine adjusted account balances and prepare an adjusted trial balance. 22 Note: If nothing belongs in a cell, leave it blank. Sheet1 E READY 22 Note: If nothing belongs in a cell, leave it blank. 23 NOTE: After completing the adjusted trial balance, you must click through every remaining blank cell in order to receive a "complete" message when submitting. 24 Credits 25 Interest owed but not yet paid: 10,800 26 Supplies on hand: 15,000 27 Rent expense 35,200 28 Unpaid wages earned by employees: 3,500 29 Unearned revenue that has been earned: 2,000 30 31 MAPLE MOVING COMPANY 32 Adjusted Trial Balance 33 at December 31, Year 2 34 Account Name Debits 35 Cash $ 62,500 36 Accounts Receivable 37 Supplies 38 Prepaid Rent 39 Accounts Payable 40 Interest Payable 41 Wages Payable 42 Unearned Revenue 43 Notes Payable 44 Common Stock Sheet1 BE Credits $ Debits 62,500 34 Account Name 35 Cash 36 Accounts Receivable 37 Supplies 38 Prepaid Rent 39 Accounts Payable 40 Interest Payable 41 Wages Payable 42 Unearned Revenue 43 Notes Payable 44 Common Stock 45 Retained Earnings 46 Service Revenue 47 Wages Expense 48 Supplies Expense 49 Rent Expense 50 Interest Expense 51 Totals 52