Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer with work demonstrated and the formulas used, thank you so much. I appreciate your time and help. Number 17 and number 19. Thank

Please answer with work demonstrated and the formulas used, thank you so much. I appreciate your time and help. Number 17 and number 19. Thank you.

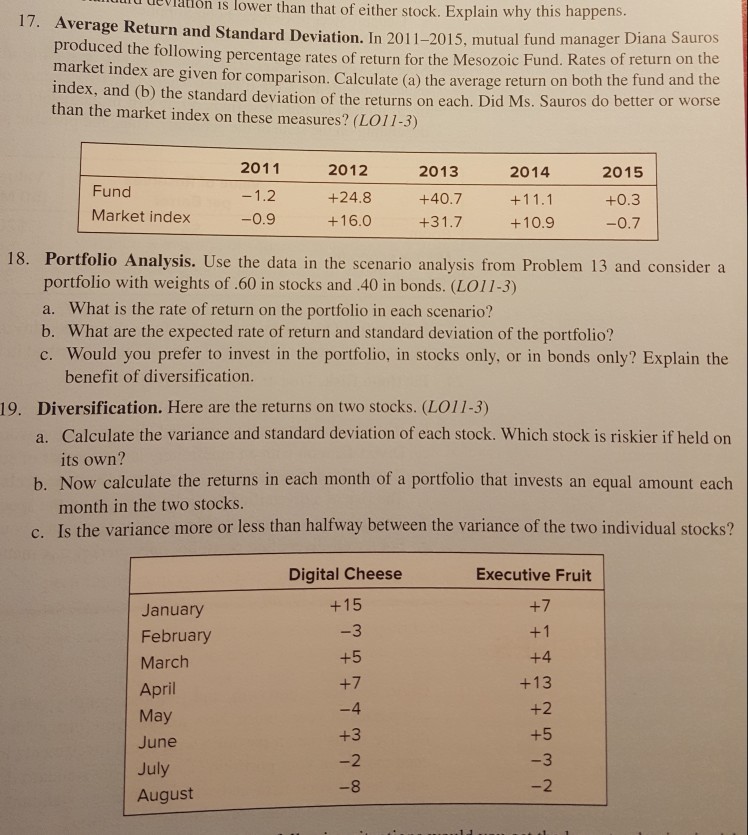

than that of either stock. Explain why this happens. u uevlation is lower 17. Average Return and Standard Deviation. In 2011-2015, mutual fund manager Dian produced the follo market index lowing percentage rates of return for the Mesozoic Fund. Rates of return on the are given for comparison. Calculate (a) the average return on both the fund and the index, and (b) the standard deviation of the returns on each. Did Ms. Sauros do better or worse than the market index on these measures? (LO11-3) Fund Market index 2011 1.2 -0.9 2012 +24.8 +16.0 2013 +40.7 +31.7 2014 +11.1 +10.9 2015 +0.3 0.7 18. Portfolio Analysis. Use the data in the scenario analysis from Problem 13 and consider a portfolio with weights of .60 in stocks and .40 in bonds. (LO11-3) b. What are the expected rate of return and standard deviation of the portfolio? c. Would you prefer to invest in the portfolio, in stocks only, or in bonds only? Explain the benefit of diversification. Diversification. Here are the returns on two stocks. (LO11-3) a. 19. Calculate the variance and standard deviation of each stock. Which stock is riskier if held on its own? b. Now calculate the returns in each month of a portfolio that invests an equal amount each month in the two stocks. c. Is the variance more or less than halfway between the variance of the two individual stocks? Digital Cheese Executive Fruit +15 +7 January February March April May June July August +13 +2 +7 +3 -2 -8 3 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started