Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer within 12 hrs and as well as it should be correct and in detail and it's a topic related to management Accounting. Prepare

please answer within 12 hrs and as well as it should be correct and in detail and it's a topic related to management Accounting.

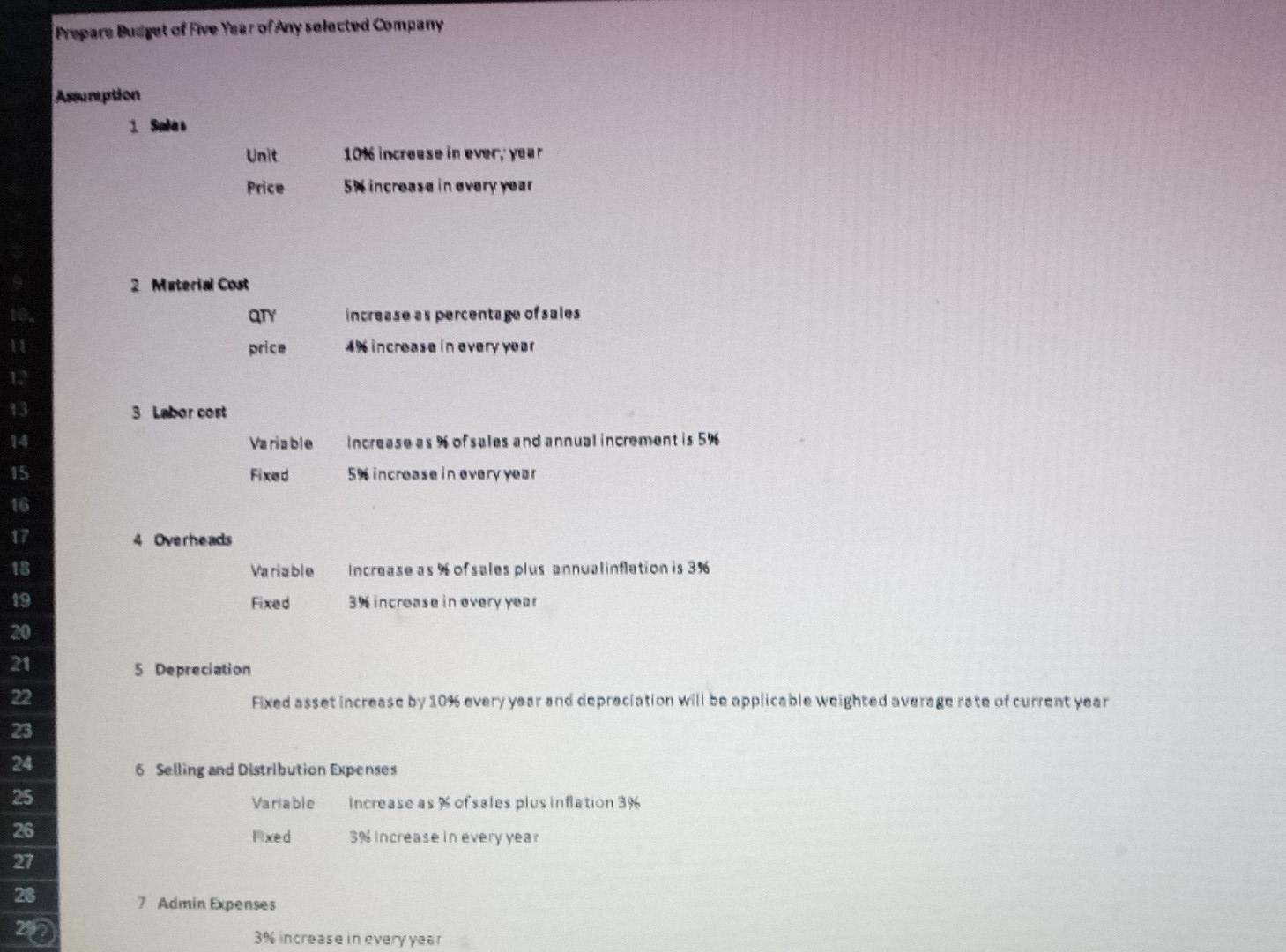

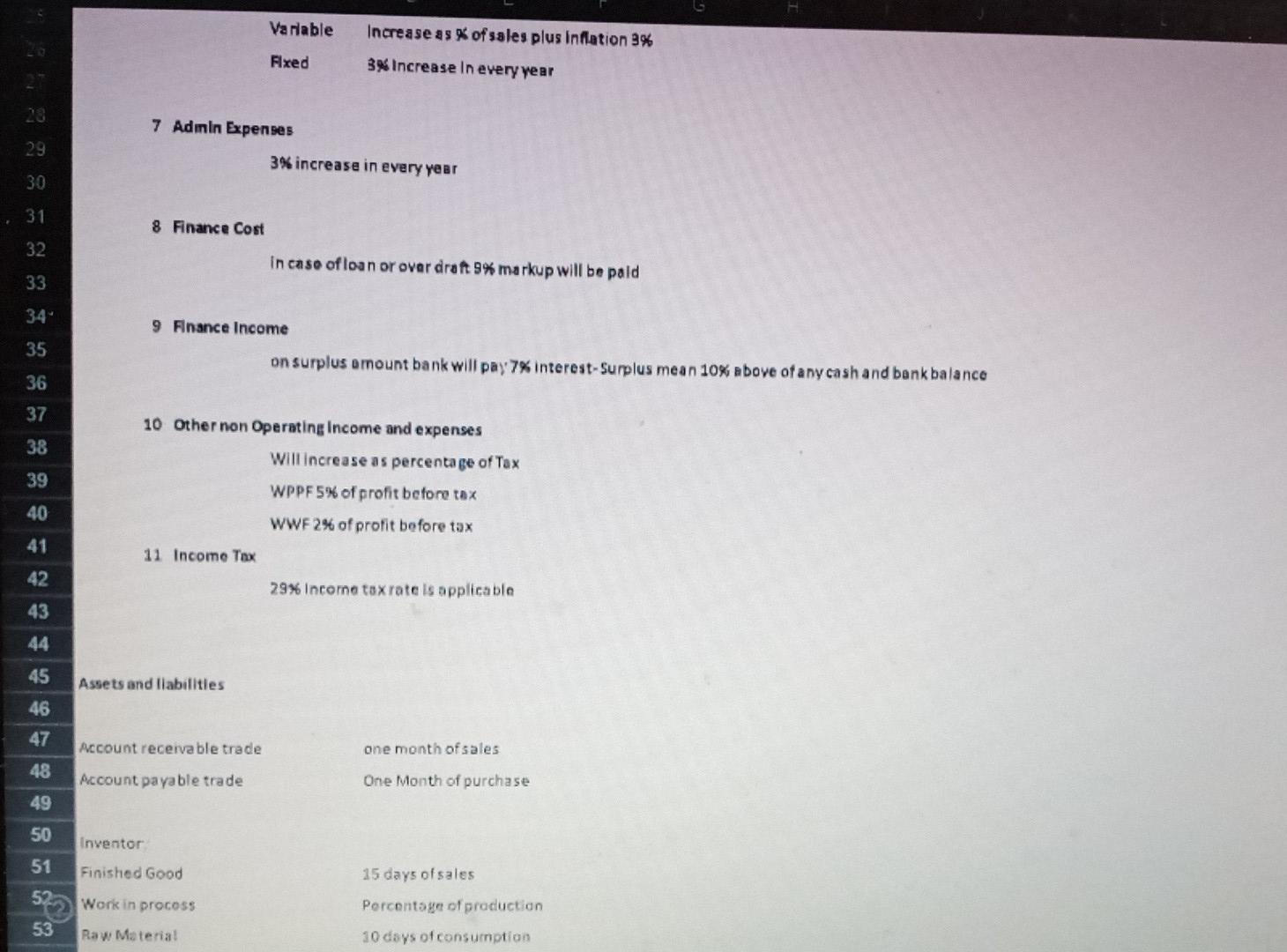

Prepare Ridget of Five Year ofAny selected Company Asumption 1 Salas Unit 10% increase in ever, year SN increase in every year Price 2 Material Cost QTY increase as percentage of sales price 4 increase in every year 13 3 Labor cost Variable Increase as % of sales and annual increment is 5% 15 Fixed 5% increase in every year 16 4 Overheads 18 Variable Increase as of sales plus annualinflation is 3% 19 Fixed 3% increase in every year 20 21 22 5 Depreciation Fixed asset Increase by 10% every year and depreciation will be applicable weighted average rate of current year 23 24 6 Selling and Distribution Expenses Variable Increase as x of sales plus inflation 396 25 26 Fixed 3. Increase in every year 27 28 7 Admin Expenses 20 3% increase in every year Variable Increase as % of sales plus inflation 3% Fixed 3% Increase in every year 29 7 Admin Expenses 3% increase in every year 30 31 8 Finance Cost 32 in caso of loan or over draft 9% markup will be paid 33 34 9 Finance Income 35 on surplus amount bank will pay 7% interest-Surplus mean 10% above of any cash and bank balance 36 37 38 39 10 Other non Operating Income and expenses Will increase as percentage of Tax WPPF 5% of profit before tax WWF2% of profit before tax 40 11 Income Tax 42 43 29% Income tax rate is applicable 44 Assets and liabilities 45 46 47 Account receivable trade one month of sales 48 Account payable trade One Month of purchase 49 50 Inventor 51 Finished Good 15 days of sales 52 Work in process 53 Porcentage of production 30 days of consumption Raw Material Prepare Ridget of Five Year ofAny selected Company Asumption 1 Salas Unit 10% increase in ever, year SN increase in every year Price 2 Material Cost QTY increase as percentage of sales price 4 increase in every year 13 3 Labor cost Variable Increase as % of sales and annual increment is 5% 15 Fixed 5% increase in every year 16 4 Overheads 18 Variable Increase as of sales plus annualinflation is 3% 19 Fixed 3% increase in every year 20 21 22 5 Depreciation Fixed asset Increase by 10% every year and depreciation will be applicable weighted average rate of current year 23 24 6 Selling and Distribution Expenses Variable Increase as x of sales plus inflation 396 25 26 Fixed 3. Increase in every year 27 28 7 Admin Expenses 20 3% increase in every year Variable Increase as % of sales plus inflation 3% Fixed 3% Increase in every year 29 7 Admin Expenses 3% increase in every year 30 31 8 Finance Cost 32 in caso of loan or over draft 9% markup will be paid 33 34 9 Finance Income 35 on surplus amount bank will pay 7% interest-Surplus mean 10% above of any cash and bank balance 36 37 38 39 10 Other non Operating Income and expenses Will increase as percentage of Tax WPPF 5% of profit before tax WWF2% of profit before tax 40 11 Income Tax 42 43 29% Income tax rate is applicable 44 Assets and liabilities 45 46 47 Account receivable trade one month of sales 48 Account payable trade One Month of purchase 49 50 Inventor 51 Finished Good 15 days of sales 52 Work in process 53 Porcentage of production 30 days of consumption Raw MaterialStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started