Please answer within the hour

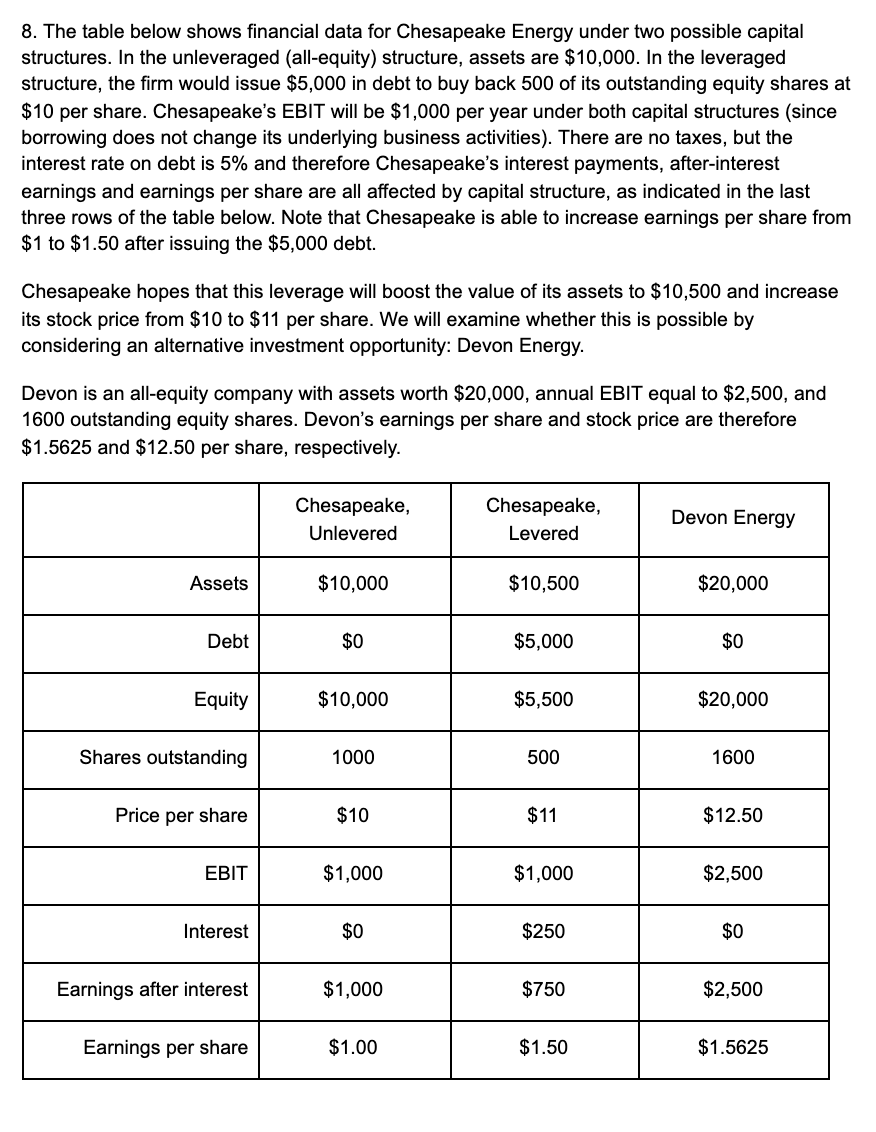

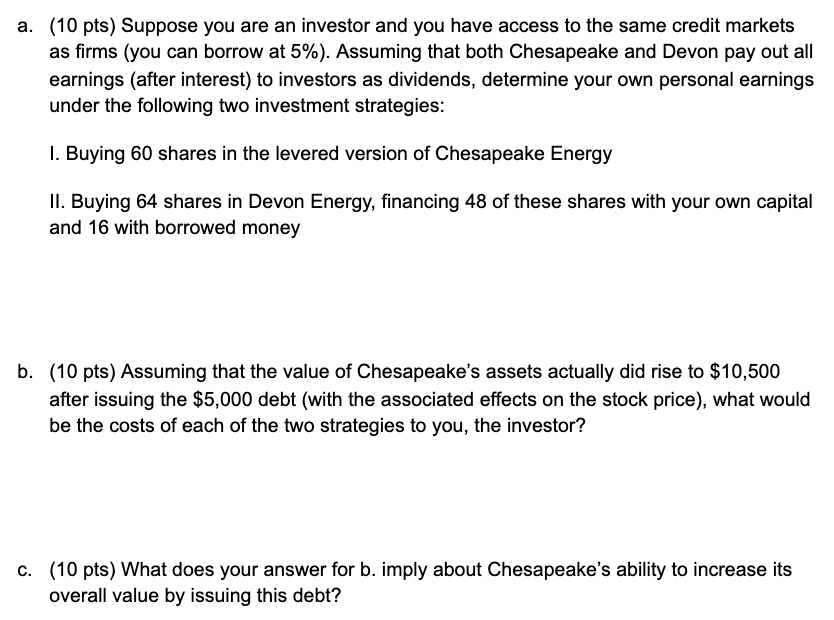

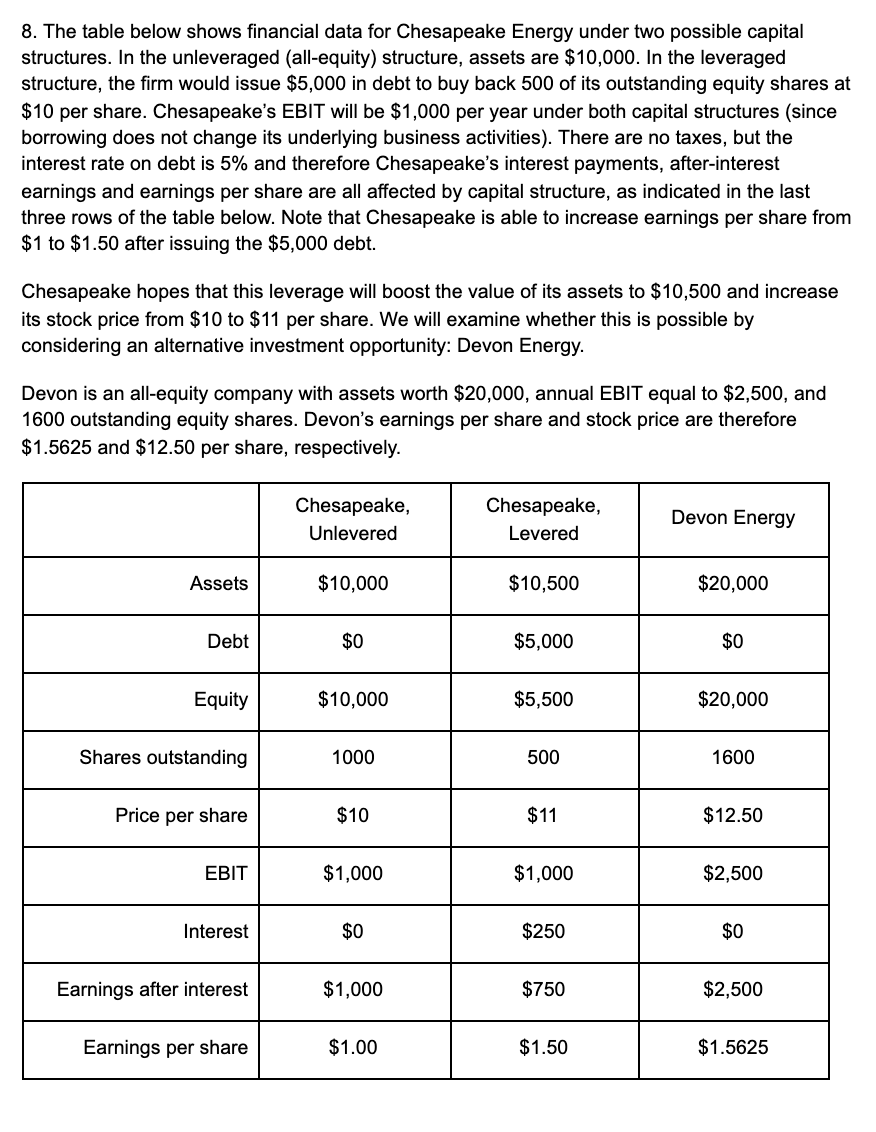

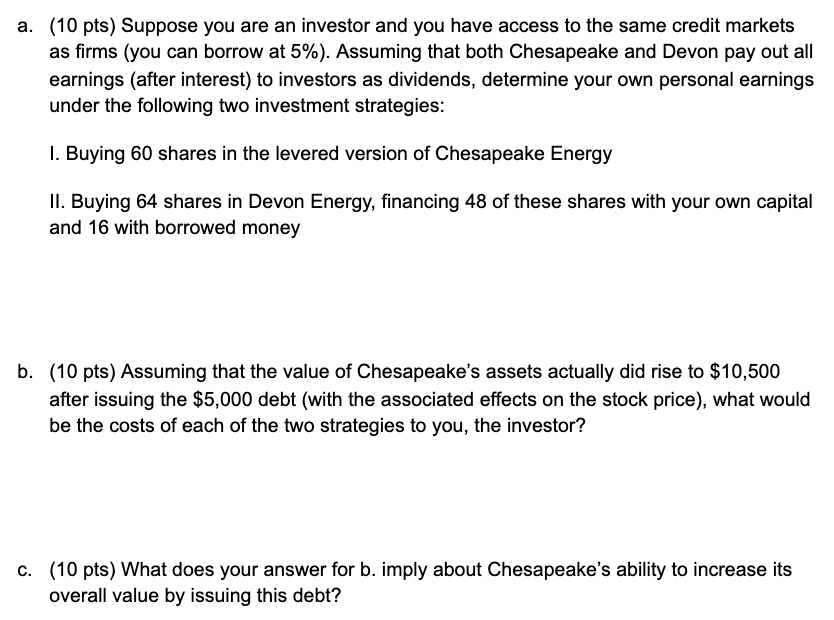

8. The table below shows financial data for Chesapeake Energy under two possible capital structures. In the unleveraged (all-equity) structure, assets are $10,000. In the leveraged structure, the firm would issue $5,000 in debt to buy back 500 of its outstanding equity shares at $10 per share. Chesapeake's EBIT will be $1,000 per year under both capital structures (since borrowing does not change its underlying business activities). There are no taxes, but the interest rate on debt is 5% and therefore Chesapeake's interest payments, after-interest earnings and earnings per share are all affected by capital structure, as indicated in the last three rows of the table below. Note that Chesapeake is able to increase earnings per share from $1 to $1.50 after issuing the $5,000 debt. Chesapeake hopes that this leverage will boost the value of its assets to $10,500 and increase its stock price from $10 to $11 per share. We will examine whether this is possible by considering an alternative investment opportunity: Devon Energy. Devon is an all-equity company with assets worth $20,000, annual EBIT equal to $2,500, and 1600 outstanding equity shares. Devon's earnings per share and stock price are therefore $1.5625 and $12.50 per share, respectively. Chesapeake, Unlevered Chesapeake, Levered Devon Energy Assets $10,000 $10,500 $20,000 Debt $0 $5,000 $0 Equity $10,000 $5,500 $20,000 Shares outstanding 1000 500 1600 Price per share $10 $11 $12.50 EBIT $1,000 $1,000 $2,500 Interest $0 $250 $0 Earnings after interest $1,000 $750 $2,500 Earnings per share $1.00 $1.50 $1.5625 a. (10 pts) Suppose you are an investor and you have access to the same credit markets as firms (you can borrow at 5%). Assuming that both Chesapeake and Devon pay out all earnings (after interest) to investors as dividends, determine your own personal earnings under the following two investment strategies: 1. Buying 60 shares in the levered version of Chesapeake Energy II. Buying 64 shares in Devon Energy, financing 48 of these shares with your own capital and 16 with borrowed money b. (10 pts) Assuming that the value of Chesapeake's assets actually did rise to $10,500 after issuing the $5,000 debt (with the associated effects on the stock price), what would be the costs of each of the two strategies to you, the investor? c. (10 pts) What does your answer for b. imply about Chesapeake's ability to increase its overall value by issuing this debt? 8. The table below shows financial data for Chesapeake Energy under two possible capital structures. In the unleveraged (all-equity) structure, assets are $10,000. In the leveraged structure, the firm would issue $5,000 in debt to buy back 500 of its outstanding equity shares at $10 per share. Chesapeake's EBIT will be $1,000 per year under both capital structures (since borrowing does not change its underlying business activities). There are no taxes, but the interest rate on debt is 5% and therefore Chesapeake's interest payments, after-interest earnings and earnings per share are all affected by capital structure, as indicated in the last three rows of the table below. Note that Chesapeake is able to increase earnings per share from $1 to $1.50 after issuing the $5,000 debt. Chesapeake hopes that this leverage will boost the value of its assets to $10,500 and increase its stock price from $10 to $11 per share. We will examine whether this is possible by considering an alternative investment opportunity: Devon Energy. Devon is an all-equity company with assets worth $20,000, annual EBIT equal to $2,500, and 1600 outstanding equity shares. Devon's earnings per share and stock price are therefore $1.5625 and $12.50 per share, respectively. Chesapeake, Unlevered Chesapeake, Levered Devon Energy Assets $10,000 $10,500 $20,000 Debt $0 $5,000 $0 Equity $10,000 $5,500 $20,000 Shares outstanding 1000 500 1600 Price per share $10 $11 $12.50 EBIT $1,000 $1,000 $2,500 Interest $0 $250 $0 Earnings after interest $1,000 $750 $2,500 Earnings per share $1.00 $1.50 $1.5625 a. (10 pts) Suppose you are an investor and you have access to the same credit markets as firms (you can borrow at 5%). Assuming that both Chesapeake and Devon pay out all earnings (after interest) to investors as dividends, determine your own personal earnings under the following two investment strategies: 1. Buying 60 shares in the levered version of Chesapeake Energy II. Buying 64 shares in Devon Energy, financing 48 of these shares with your own capital and 16 with borrowed money b. (10 pts) Assuming that the value of Chesapeake's assets actually did rise to $10,500 after issuing the $5,000 debt (with the associated effects on the stock price), what would be the costs of each of the two strategies to you, the investor? c. (10 pts) What does your answer for b. imply about Chesapeake's ability to increase its overall value by issuing this debt