Please answer yellow spaces and explain step by step. Thanks!

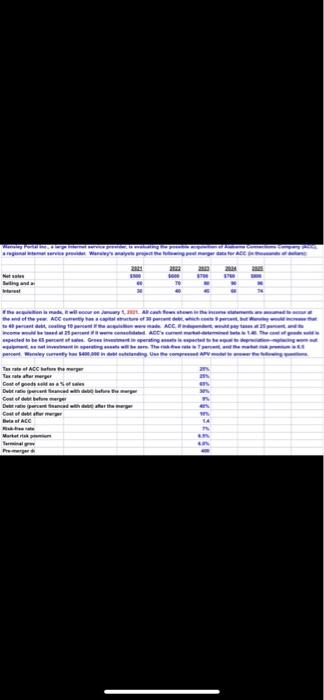

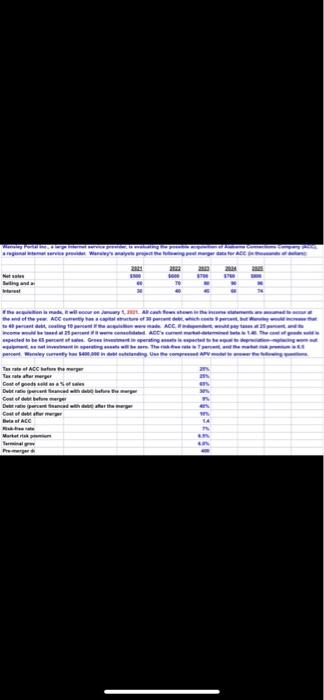

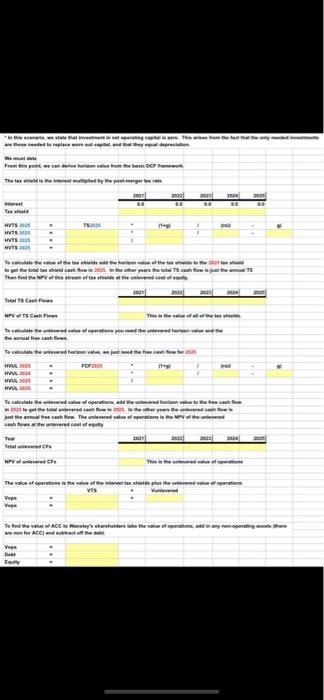

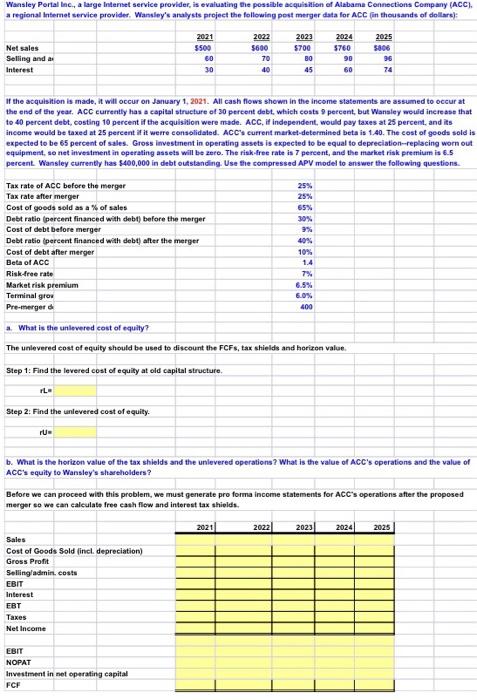

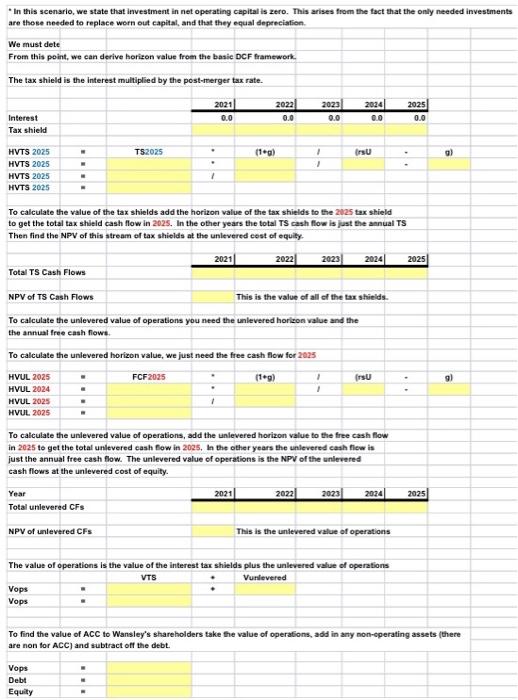

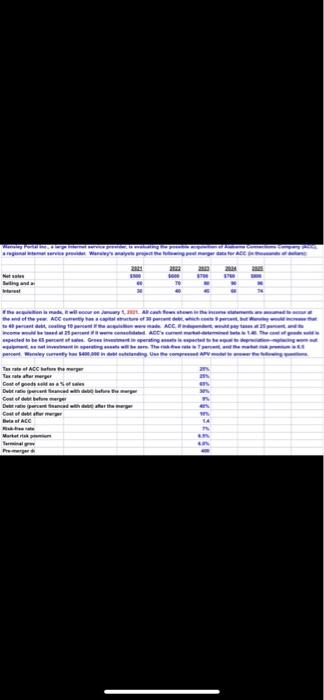

Besint inets teay Vees vith Yeps feter Repuly = Wansley Porial lnc, a large Internst service provider, is evaluating the possible acquisition of Aabama Connections Company (ACC), "In this scenario, we state that investment in net operating capital is zero. This arises from the fact that the only needed investments are these needed to replace worn out capital, and that they equal depecciation. We must dete From this point, we can derive horizon value froen the basic DCF framework. The tax shield is the interest multiplied by the post-merger tax rate. To calculate the value of the tax shields add the horizon value of the tax shields to the 2025 tax shield to get the total tax shieid cash flow in 2025. In the other years the total TS cash flow is just the annual TS Then find the NPV of this stream of tax shields at the unievered eest of equily. 2021 2022 2023 2024 2025 Total TS Cash Flows NPV of TS Cash Flows This is the value of all ef the tax shields. To calculate the unievered value of operations you need the unlevered horicon value and the the anniat free eash fows. To calculate the unievered horizon value, we just need the free cash flow for 2025 HVUL 2025 FCF2025 (1+g) (rsu HVUL 2024 HVUL 2025 HVUL. 2025 To caleulate the unievered value of operations, add the unievered horizon value to the free cash flow in 2025 to get the total unlevered cash Bow in 2025, ht the other years the unlevered eash flow is just the annual free cash flow. The unlevered value of operations is the NPV of the unlevered cash flows at the unievered cost of equity. Year 2021 2022 2023 2024 2025 Total urilevered CFs NPV of unlevered CFs This is the unitvered value of operations The value of operations is the value of the interest tax shields plus the unlevered value of operations To find the value of ACC to Wansley's shareholders take the value of operations, add in any non-sperating assets (there are non tor ACC ) and subtract off the debt. \begin{tabular}{l|l|} \hline Vops & = \\ Debt & = \\ Equity & = \end{tabular} Besint inets teay Vees vith Yeps feter Repuly = Wansley Porial lnc, a large Internst service provider, is evaluating the possible acquisition of Aabama Connections Company (ACC), "In this scenario, we state that investment in net operating capital is zero. This arises from the fact that the only needed investments are these needed to replace worn out capital, and that they equal depecciation. We must dete From this point, we can derive horizon value froen the basic DCF framework. The tax shield is the interest multiplied by the post-merger tax rate. To calculate the value of the tax shields add the horizon value of the tax shields to the 2025 tax shield to get the total tax shieid cash flow in 2025. In the other years the total TS cash flow is just the annual TS Then find the NPV of this stream of tax shields at the unievered eest of equily. 2021 2022 2023 2024 2025 Total TS Cash Flows NPV of TS Cash Flows This is the value of all ef the tax shields. To calculate the unievered value of operations you need the unlevered horicon value and the the anniat free eash fows. To calculate the unievered horizon value, we just need the free cash flow for 2025 HVUL 2025 FCF2025 (1+g) (rsu HVUL 2024 HVUL 2025 HVUL. 2025 To caleulate the unievered value of operations, add the unievered horizon value to the free cash flow in 2025 to get the total unlevered cash Bow in 2025, ht the other years the unlevered eash flow is just the annual free cash flow. The unlevered value of operations is the NPV of the unlevered cash flows at the unievered cost of equity. Year 2021 2022 2023 2024 2025 Total urilevered CFs NPV of unlevered CFs This is the unitvered value of operations The value of operations is the value of the interest tax shields plus the unlevered value of operations To find the value of ACC to Wansley's shareholders take the value of operations, add in any non-sperating assets (there are non tor ACC ) and subtract off the debt. \begin{tabular}{l|l|} \hline Vops & = \\ Debt & = \\ Equity & = \end{tabular}