Please answers all the parts of the question in order, with all the components intact, and completely. For a question I post only parts are answered so I would like for the whole thing to be answered and not just a few parts.

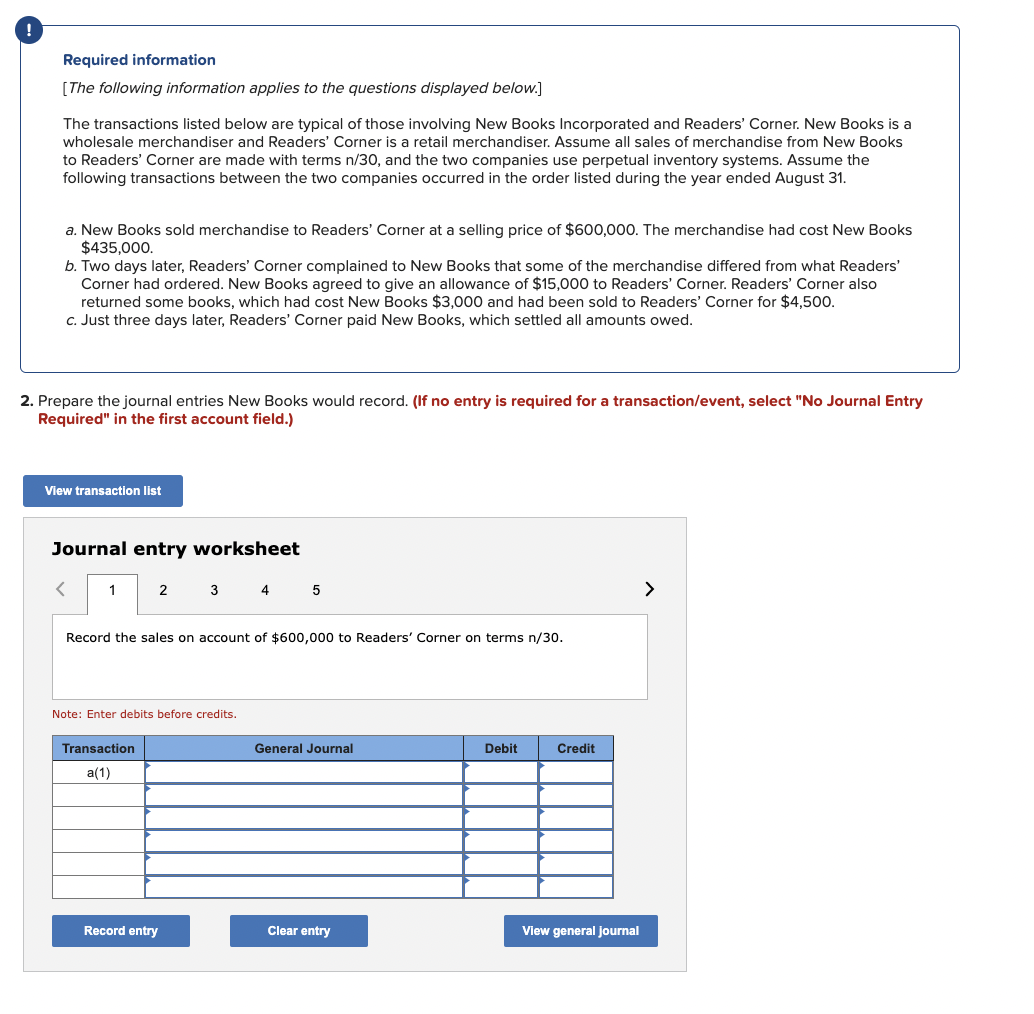

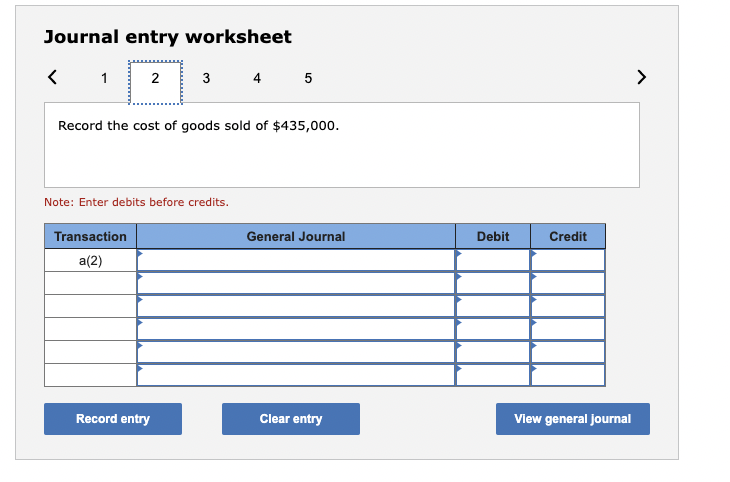

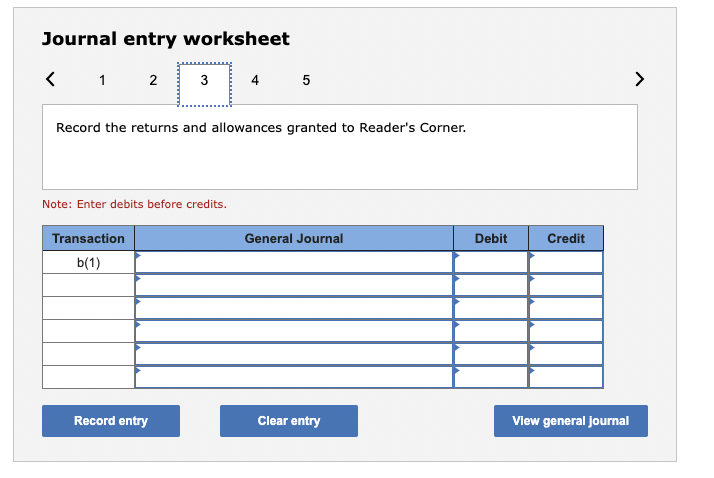

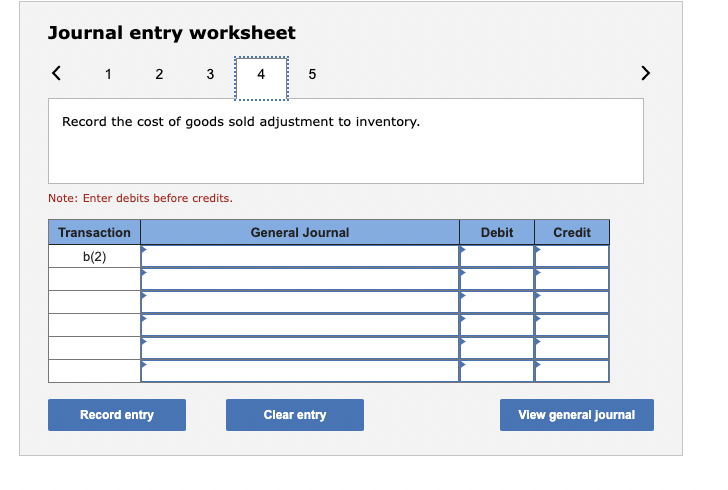

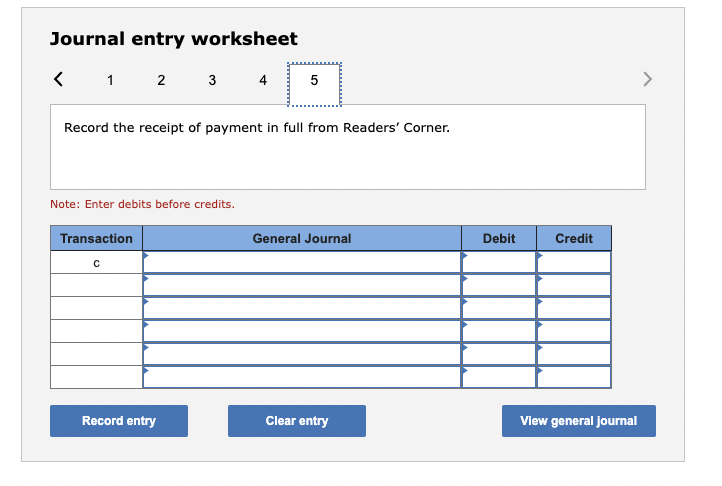

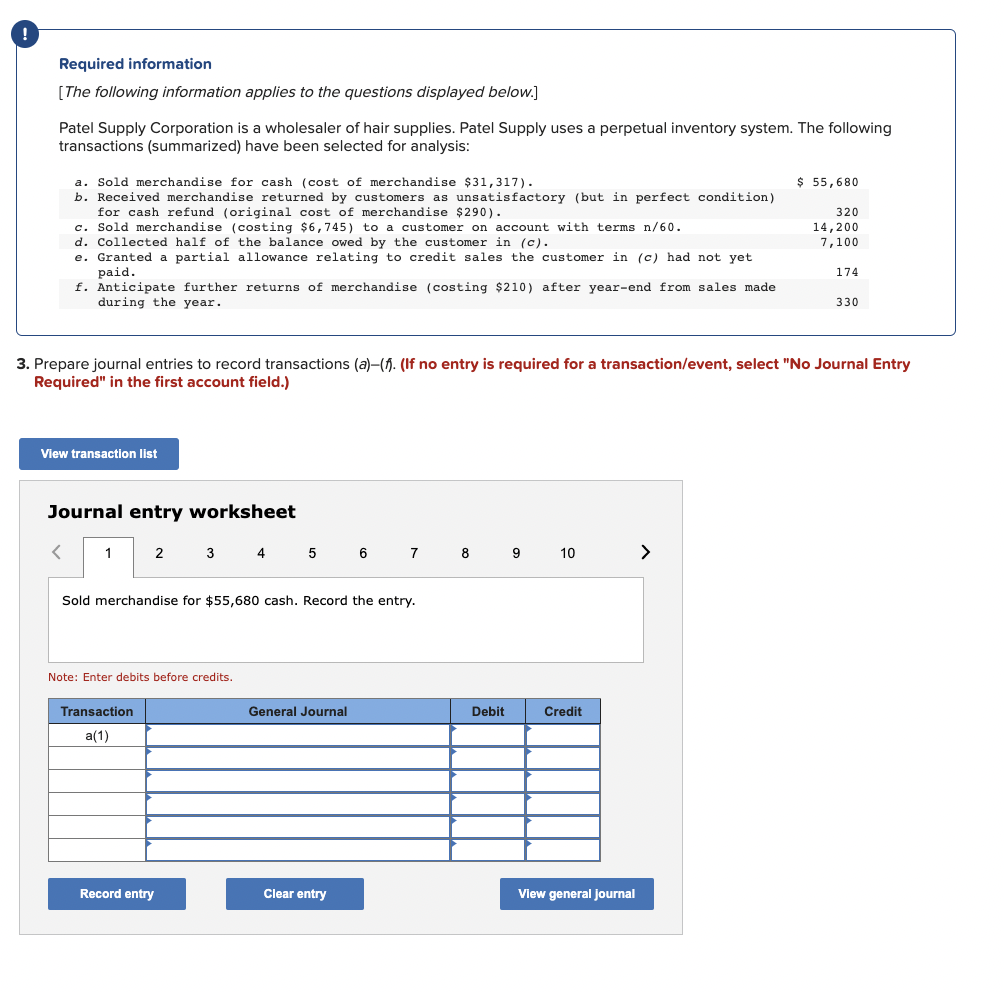

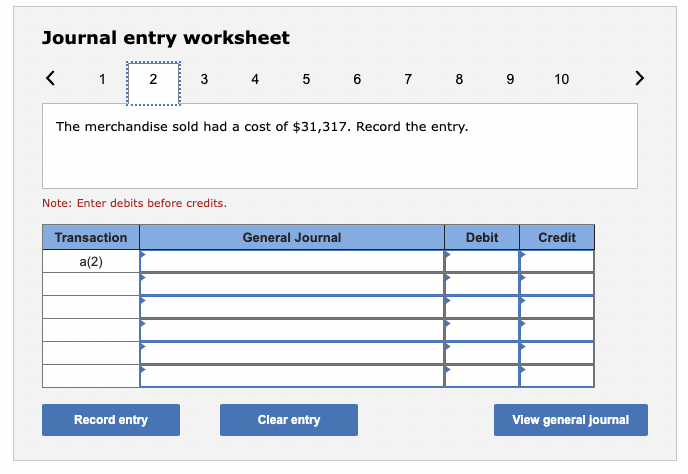

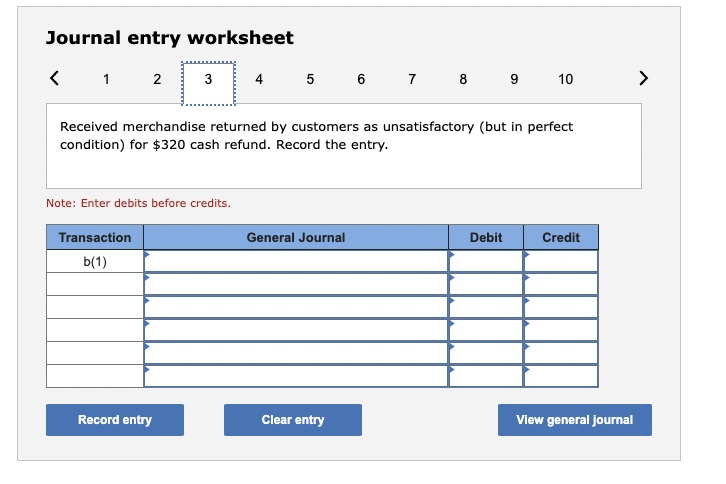

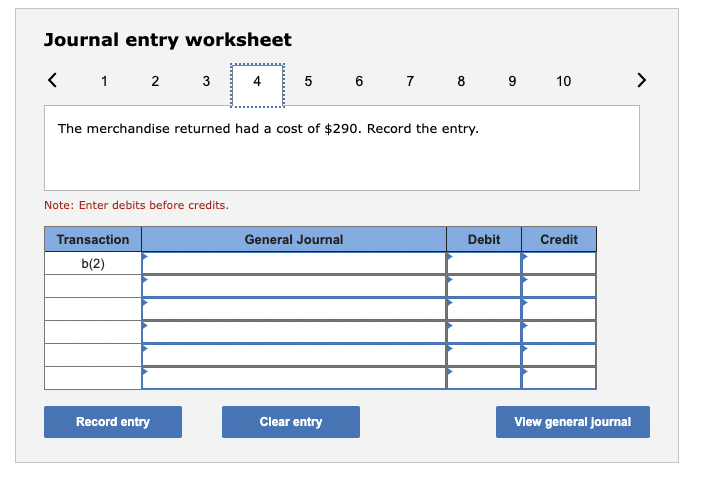

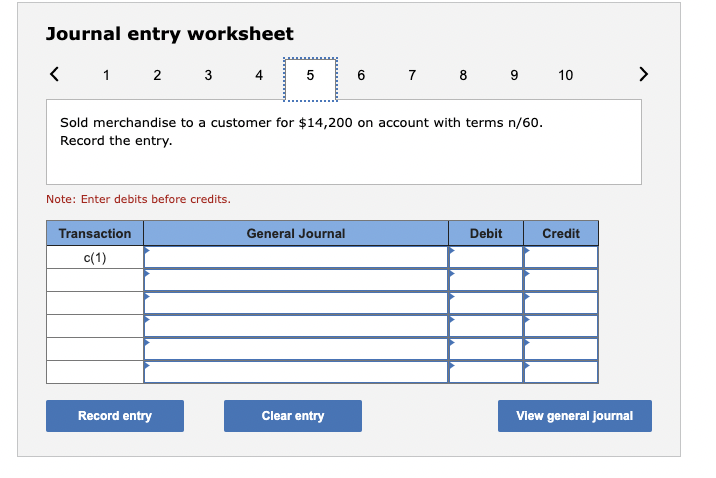

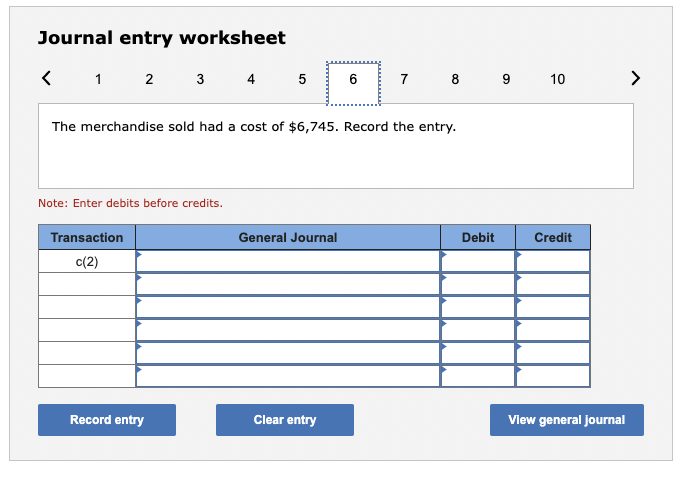

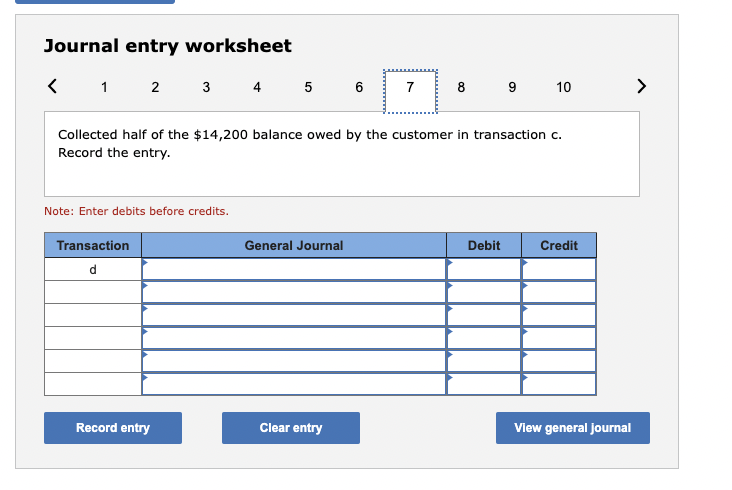

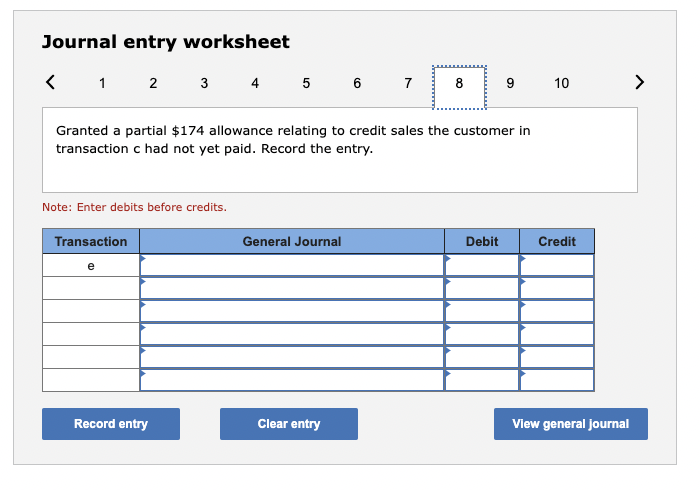

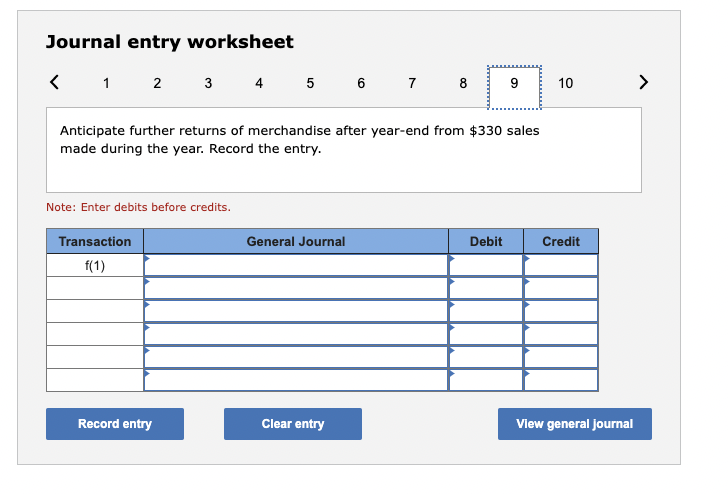

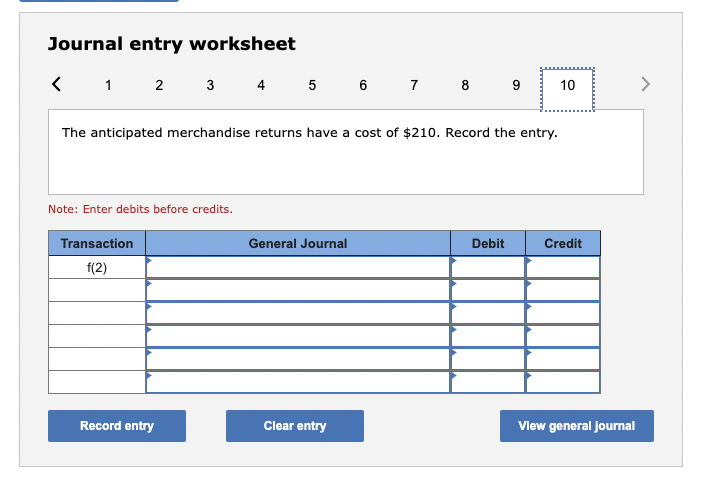

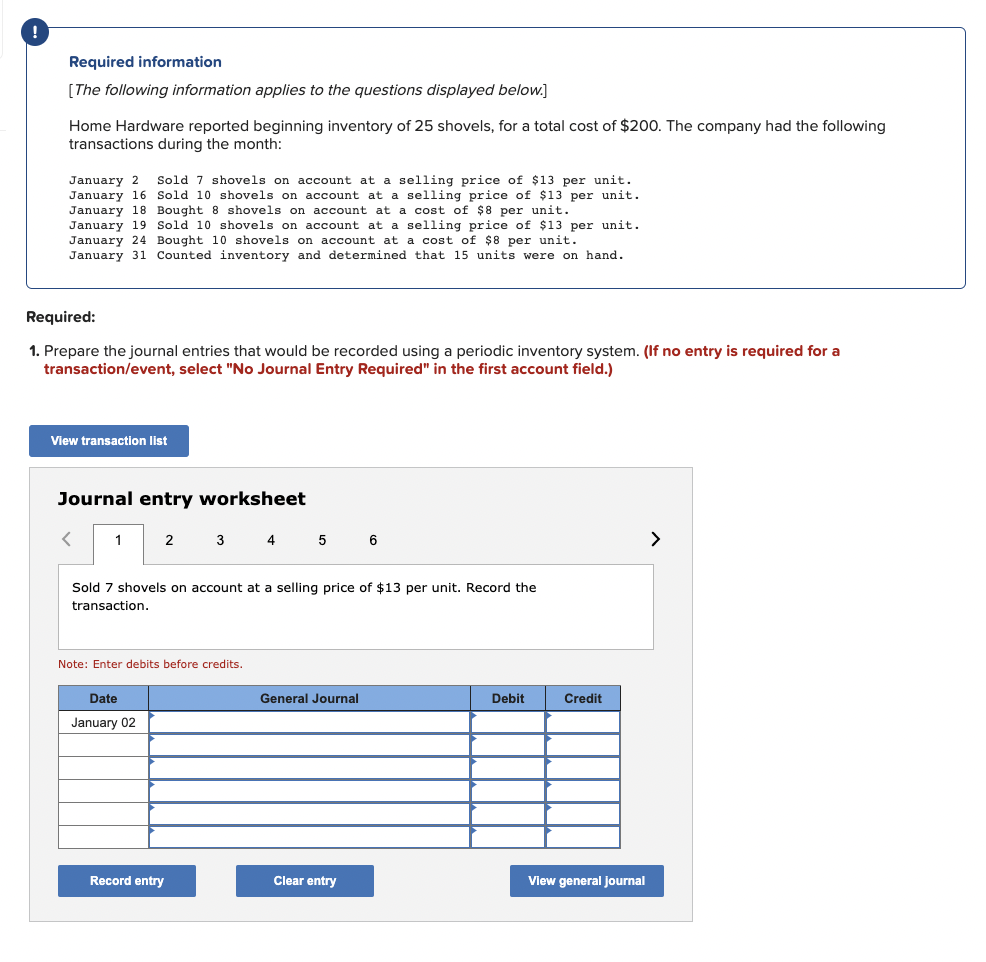

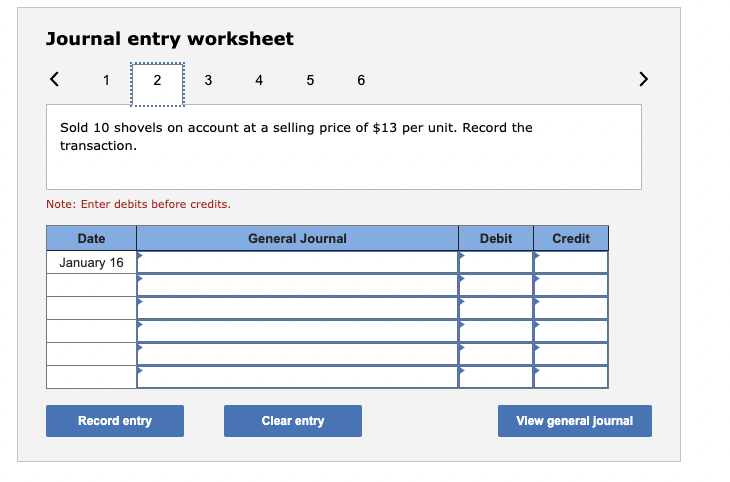

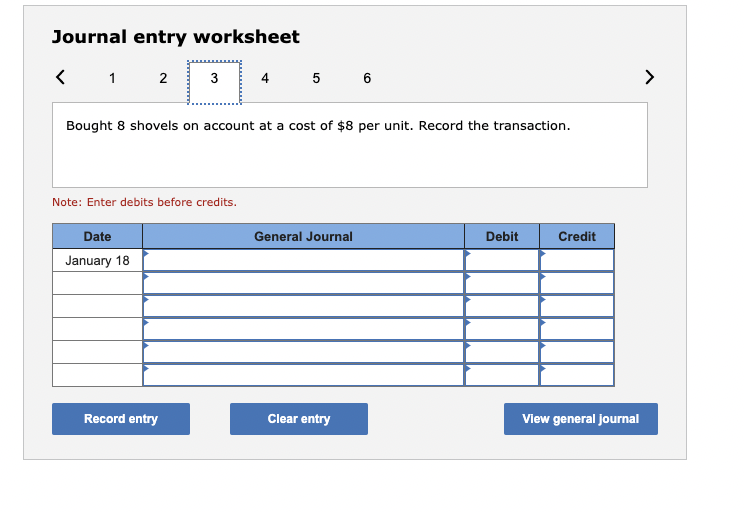

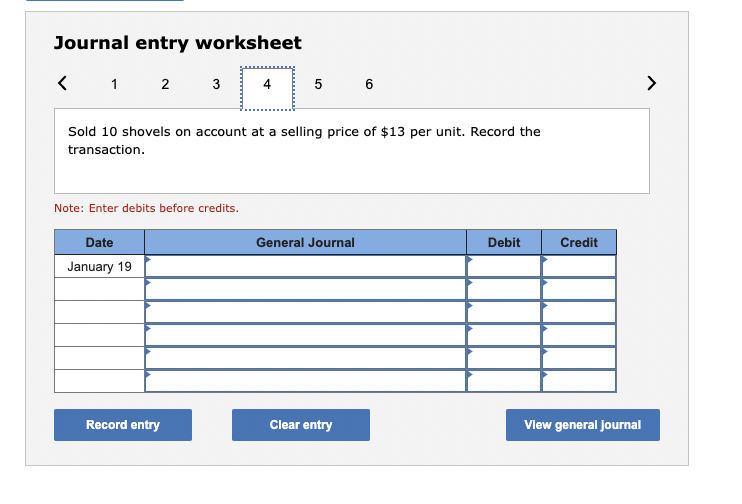

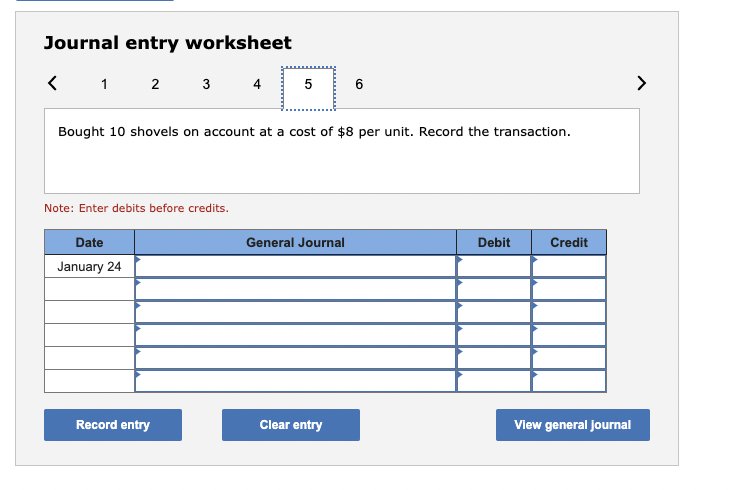

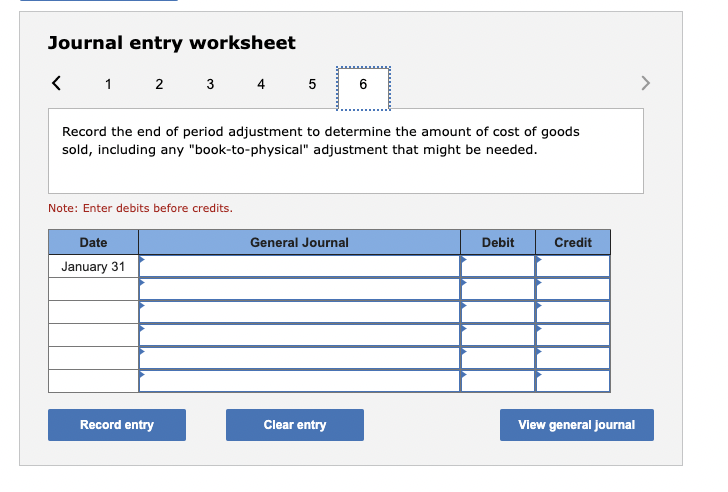

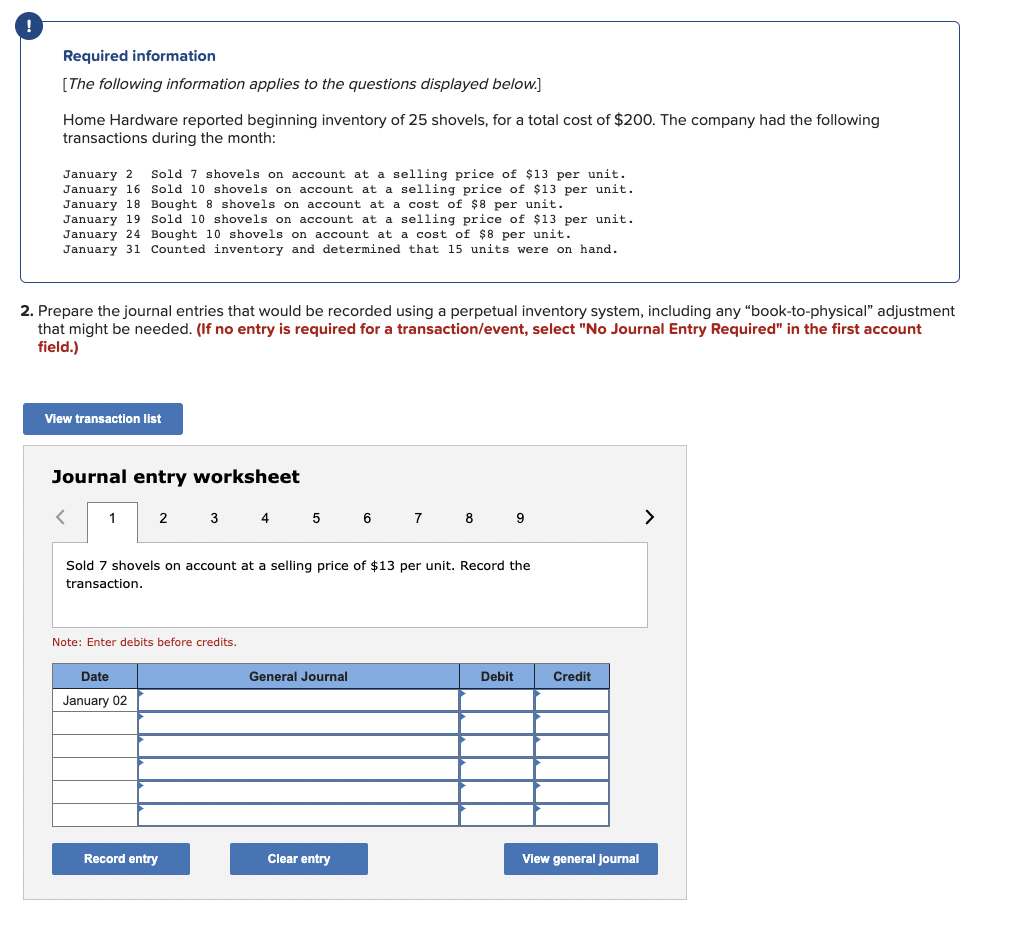

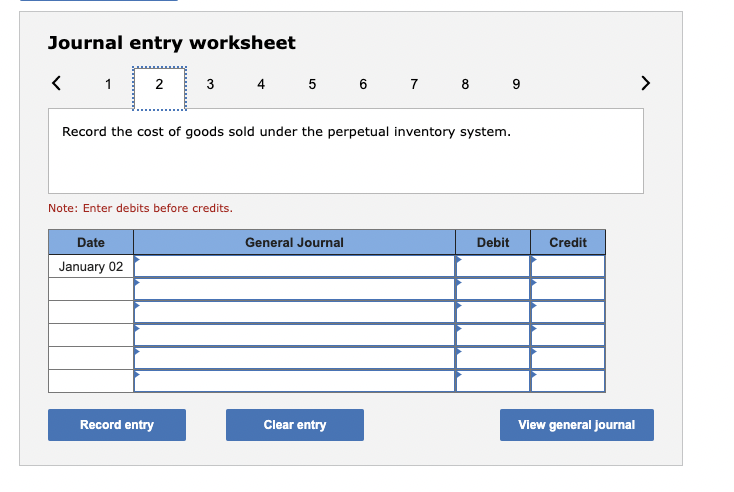

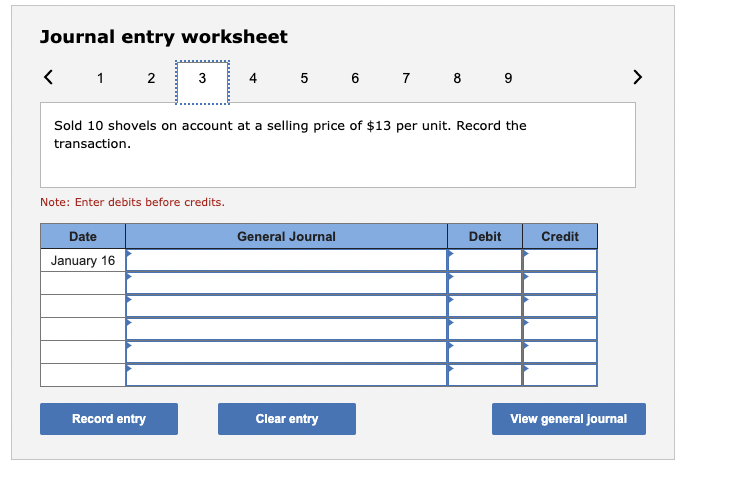

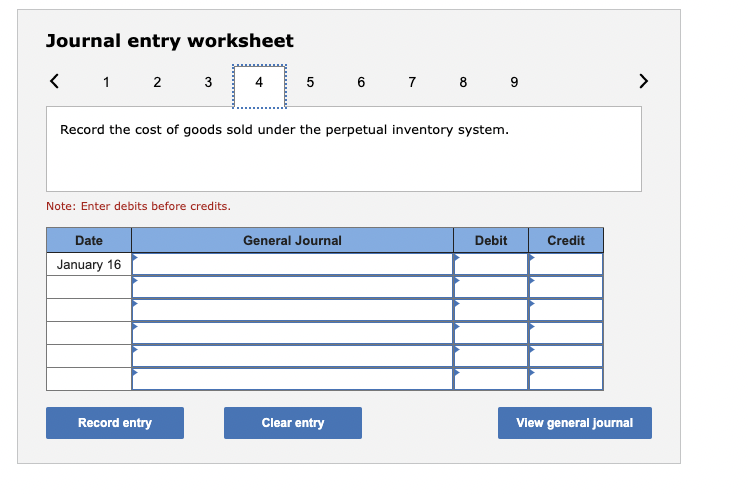

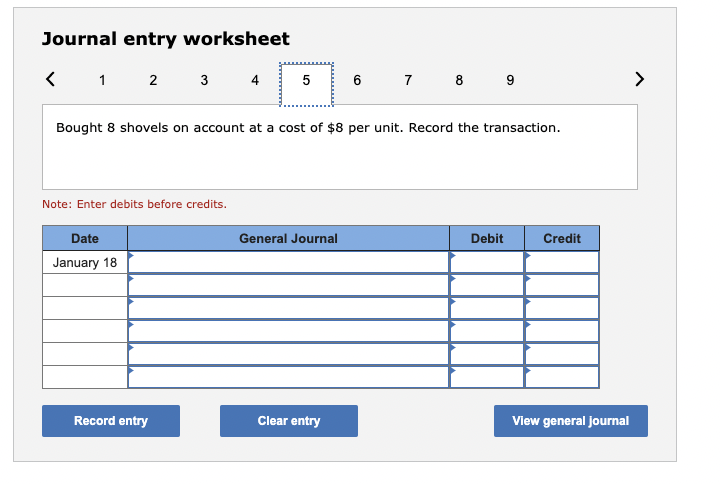

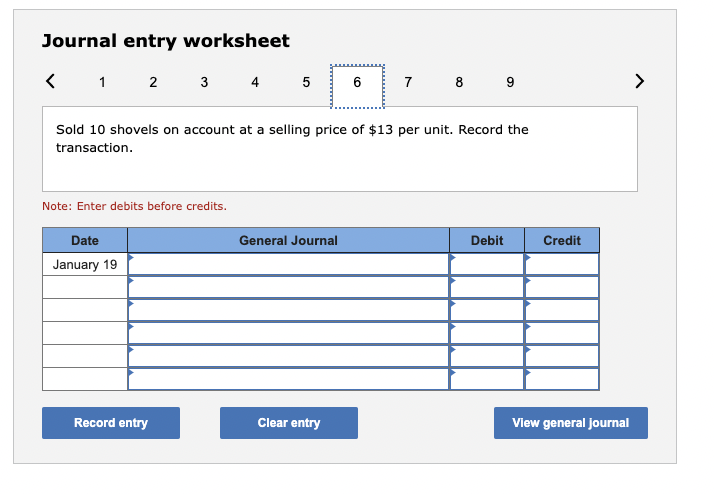

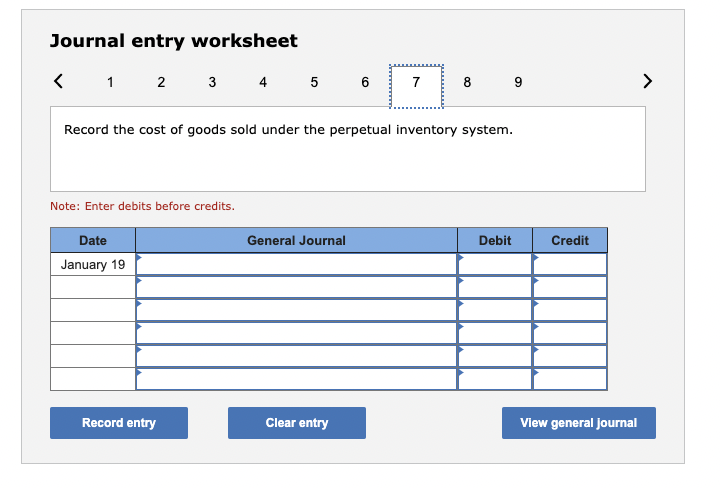

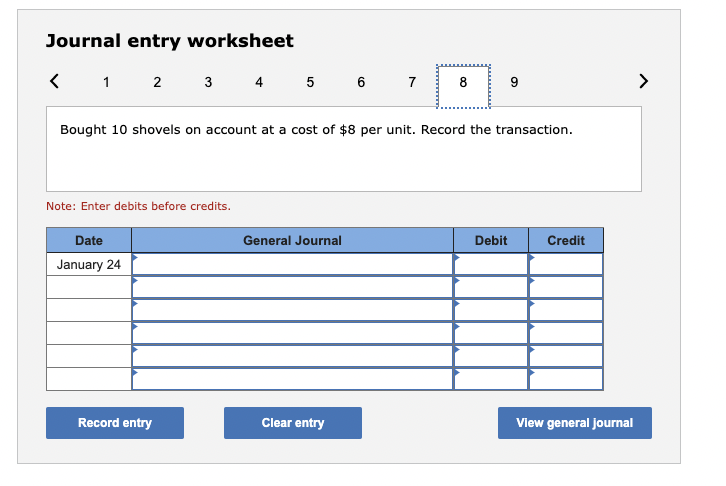

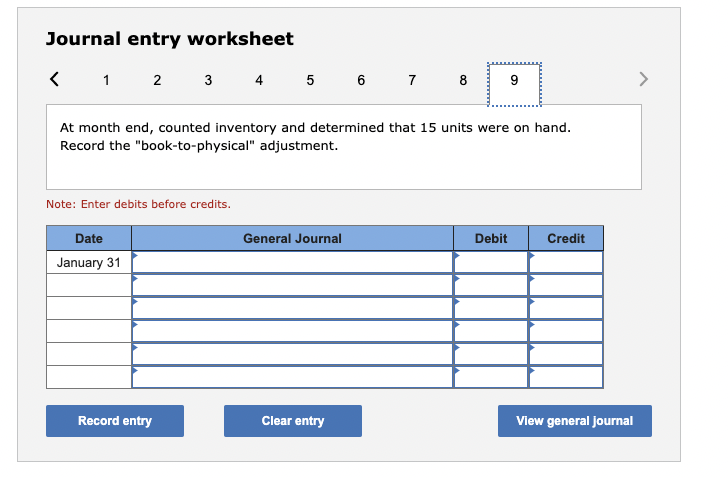

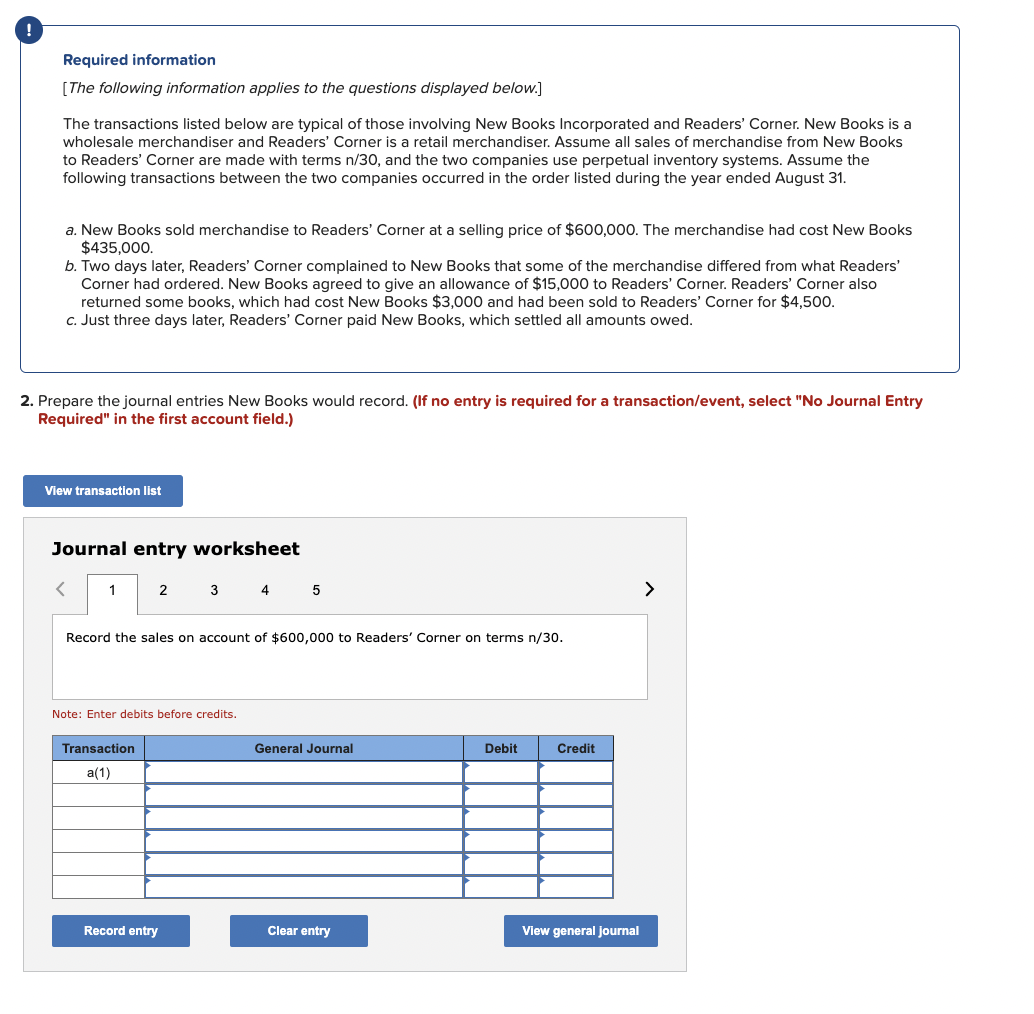

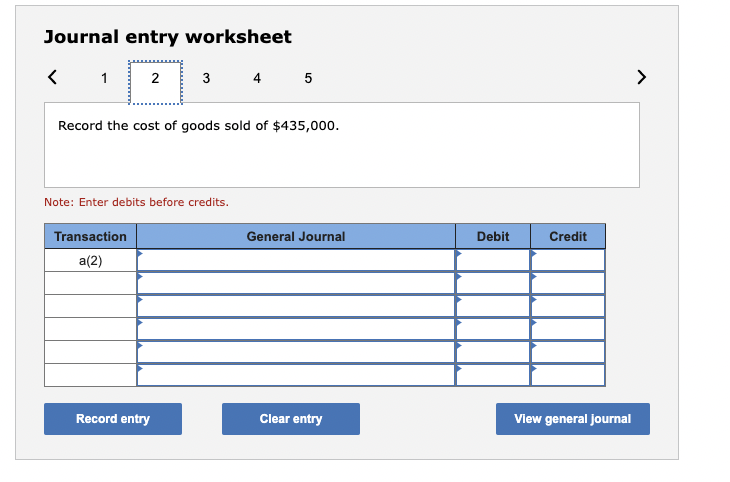

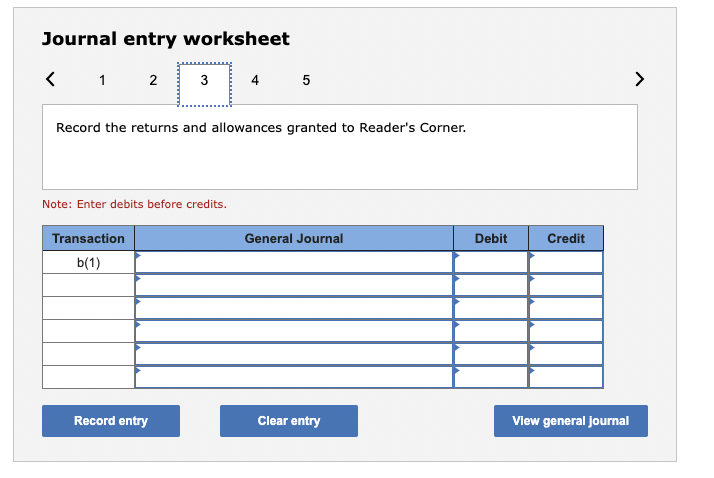

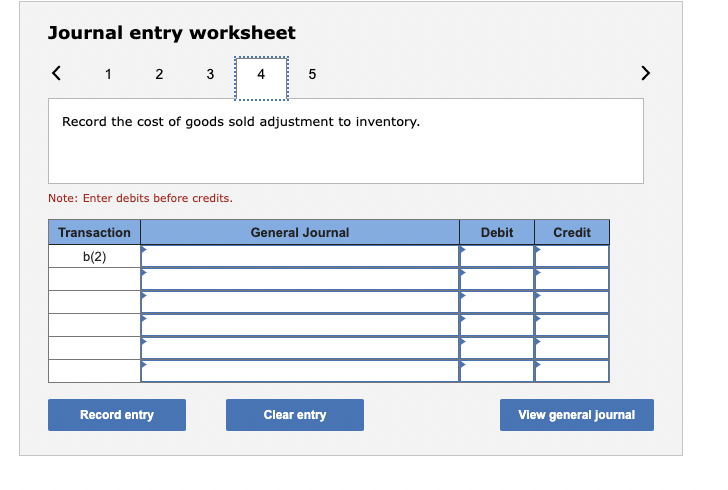

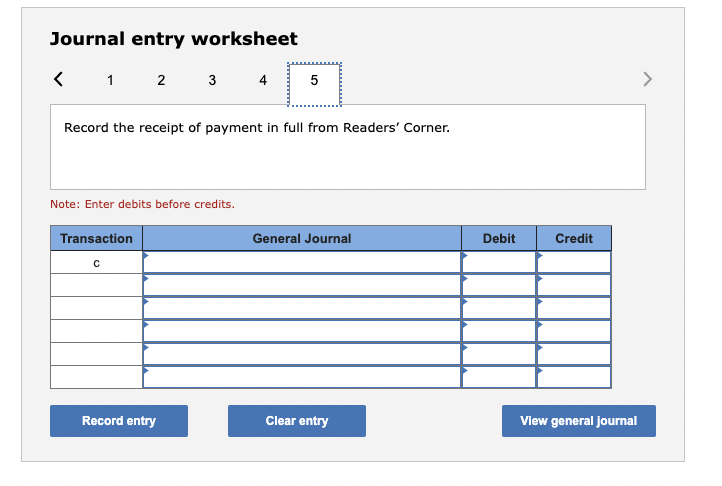

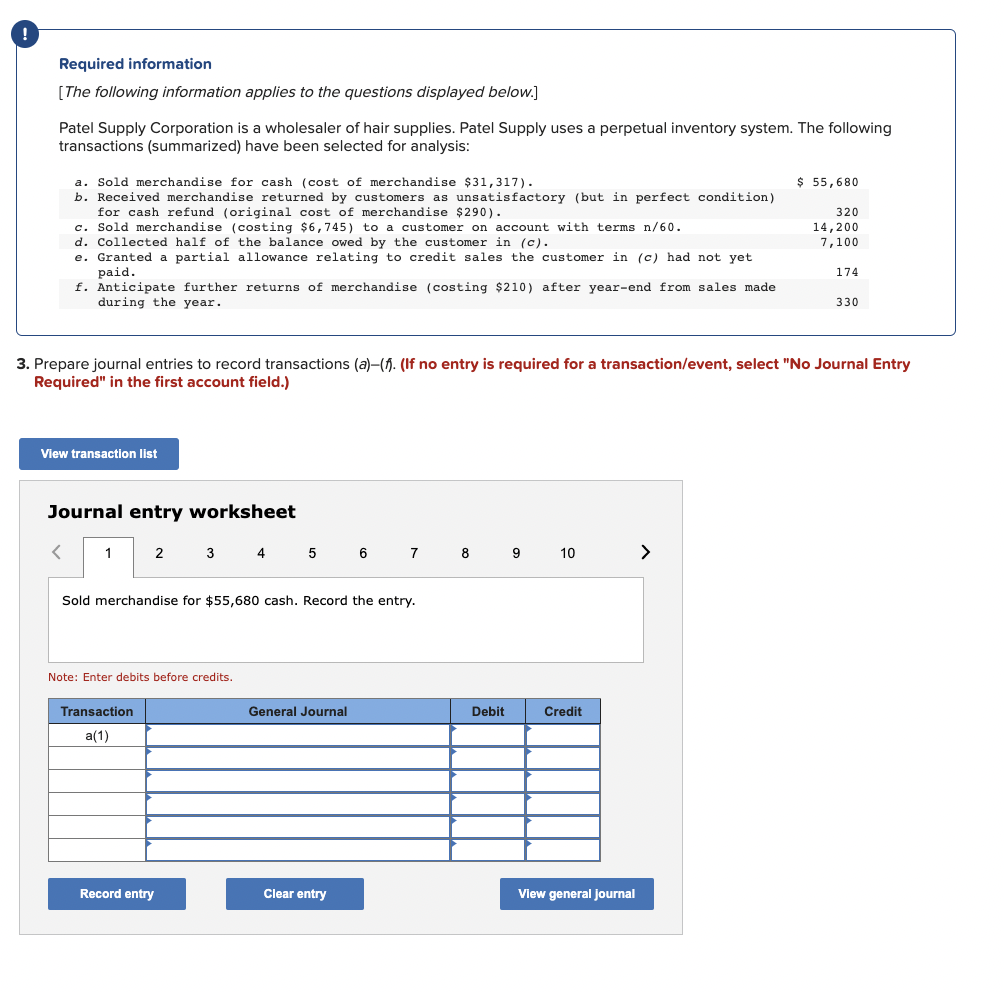

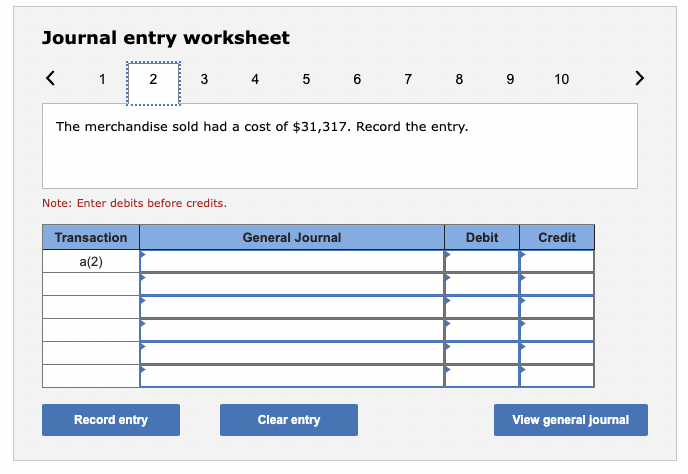

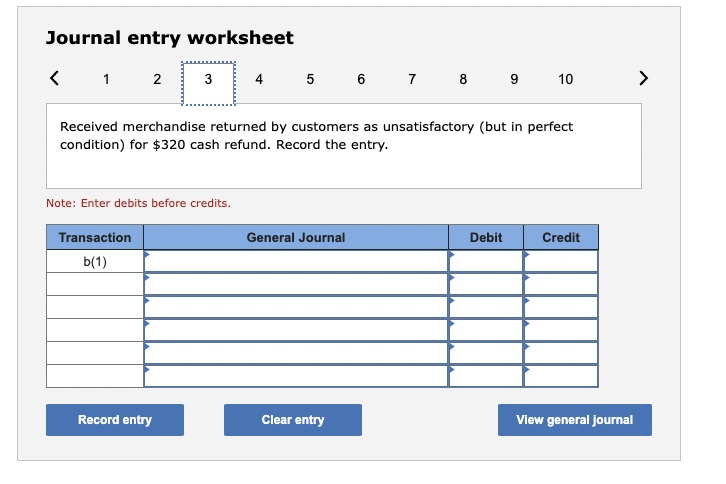

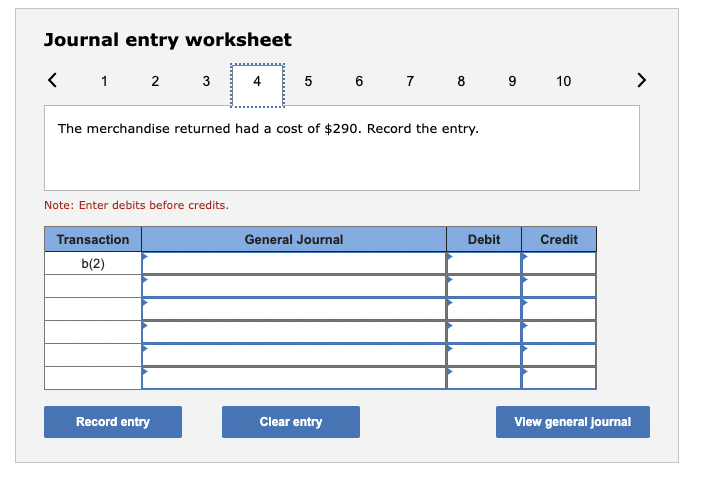

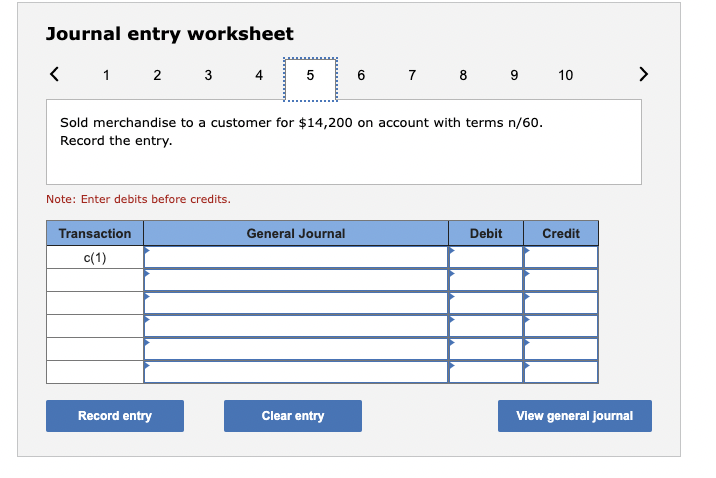

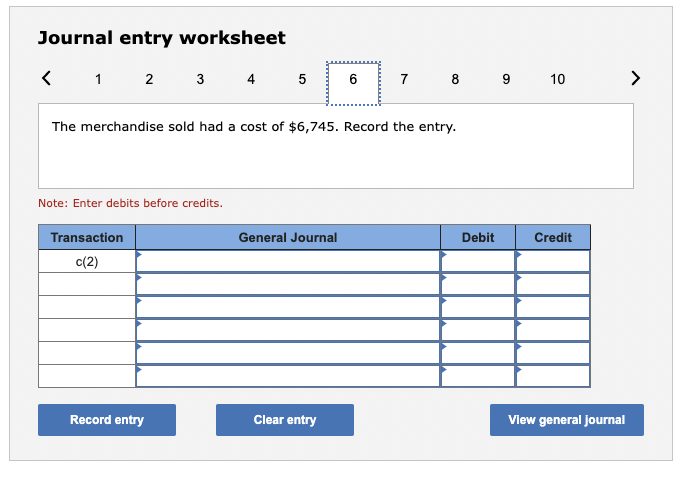

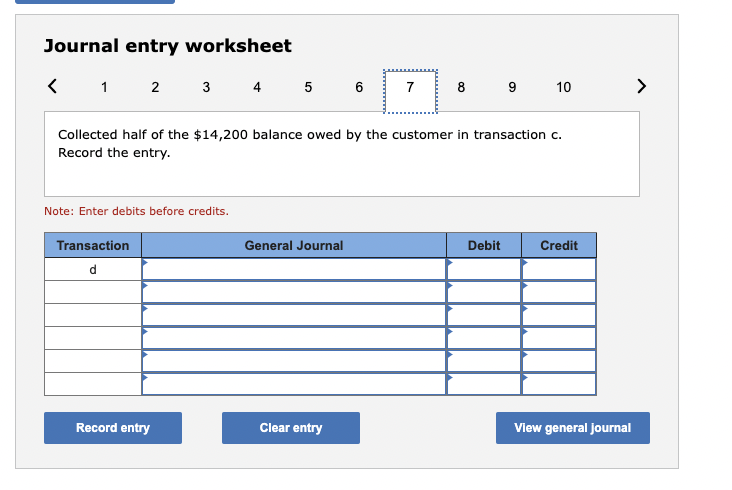

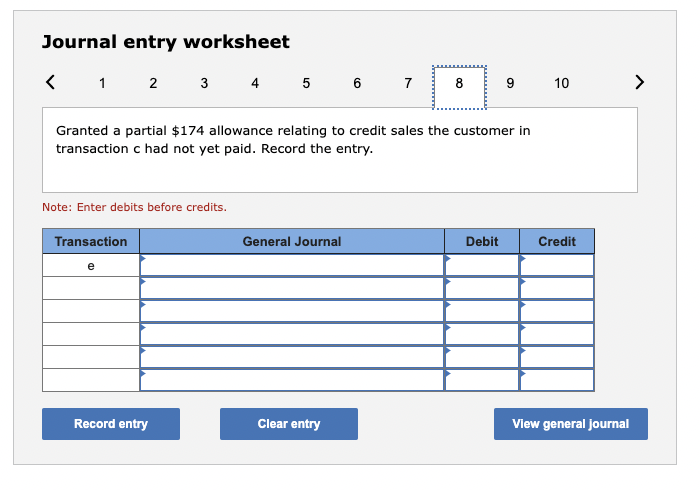

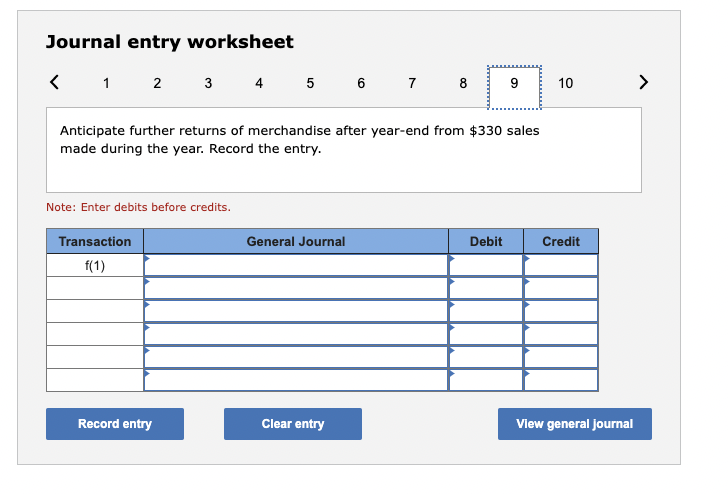

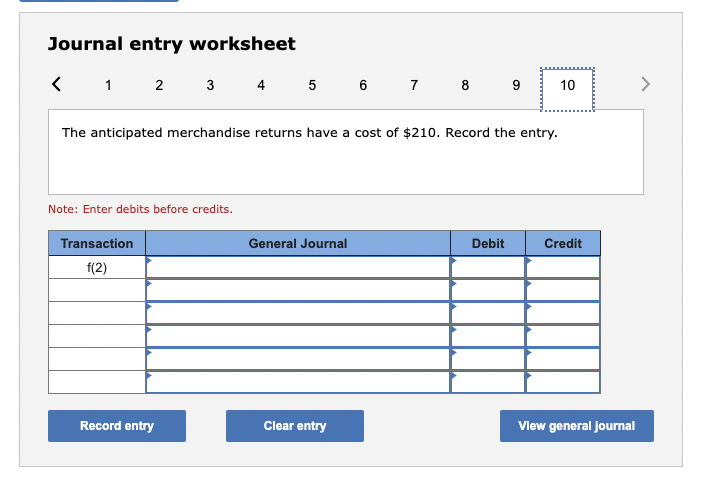

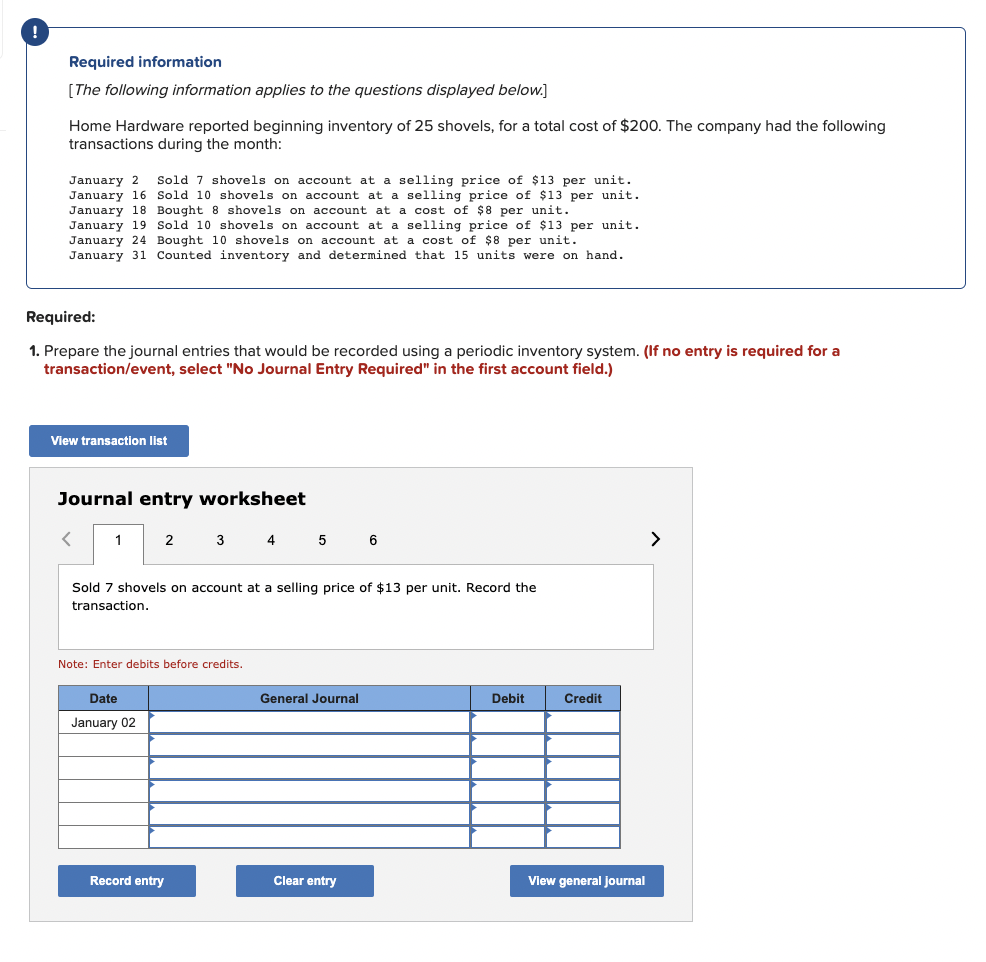

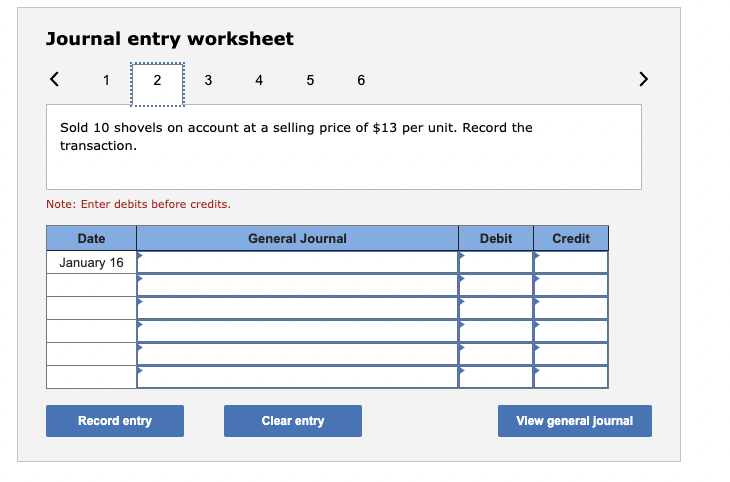

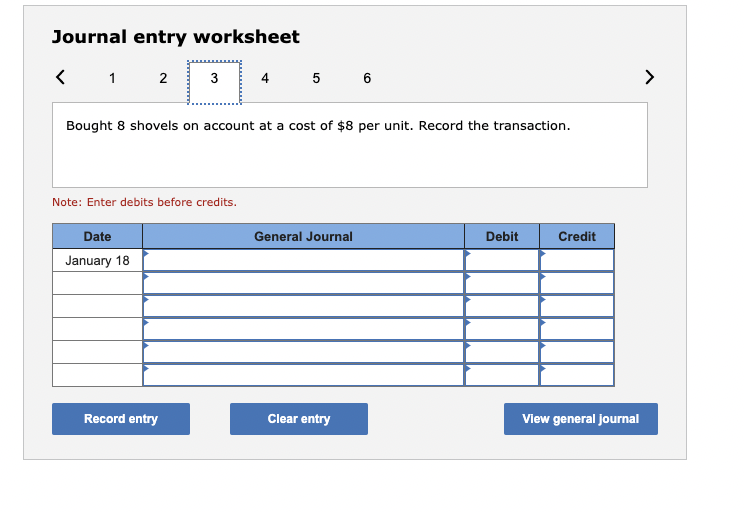

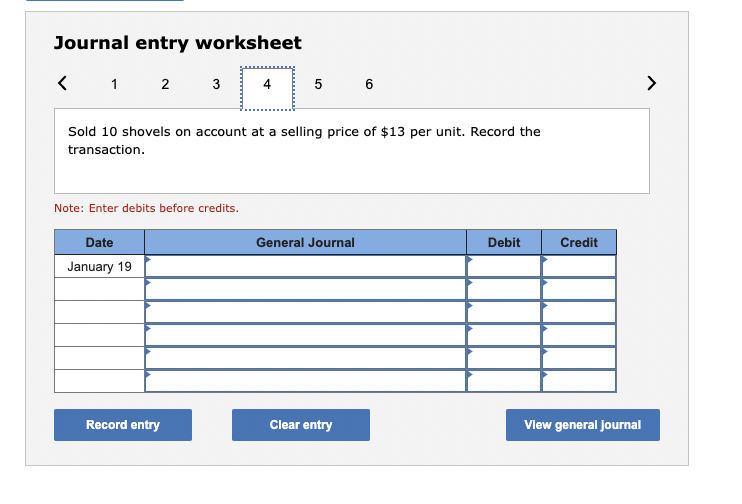

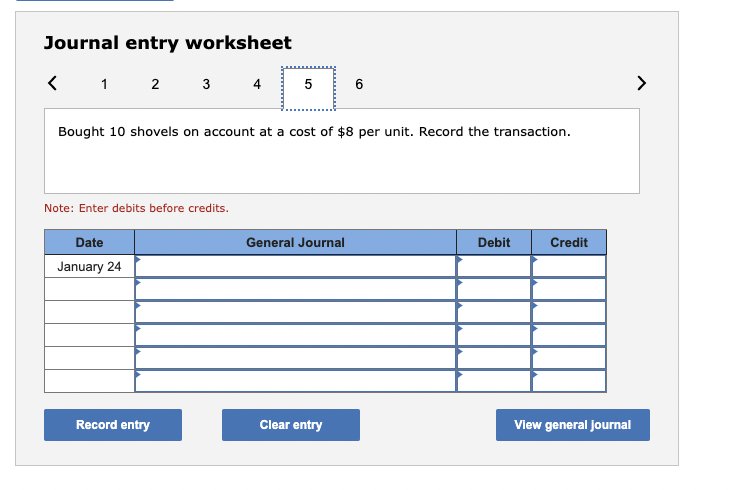

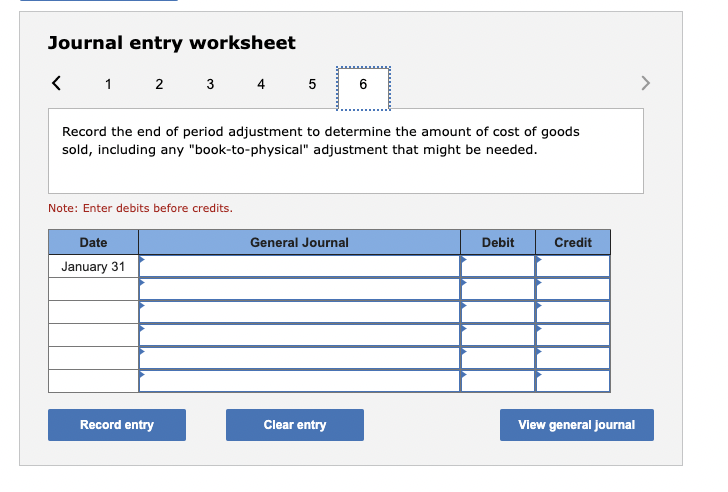

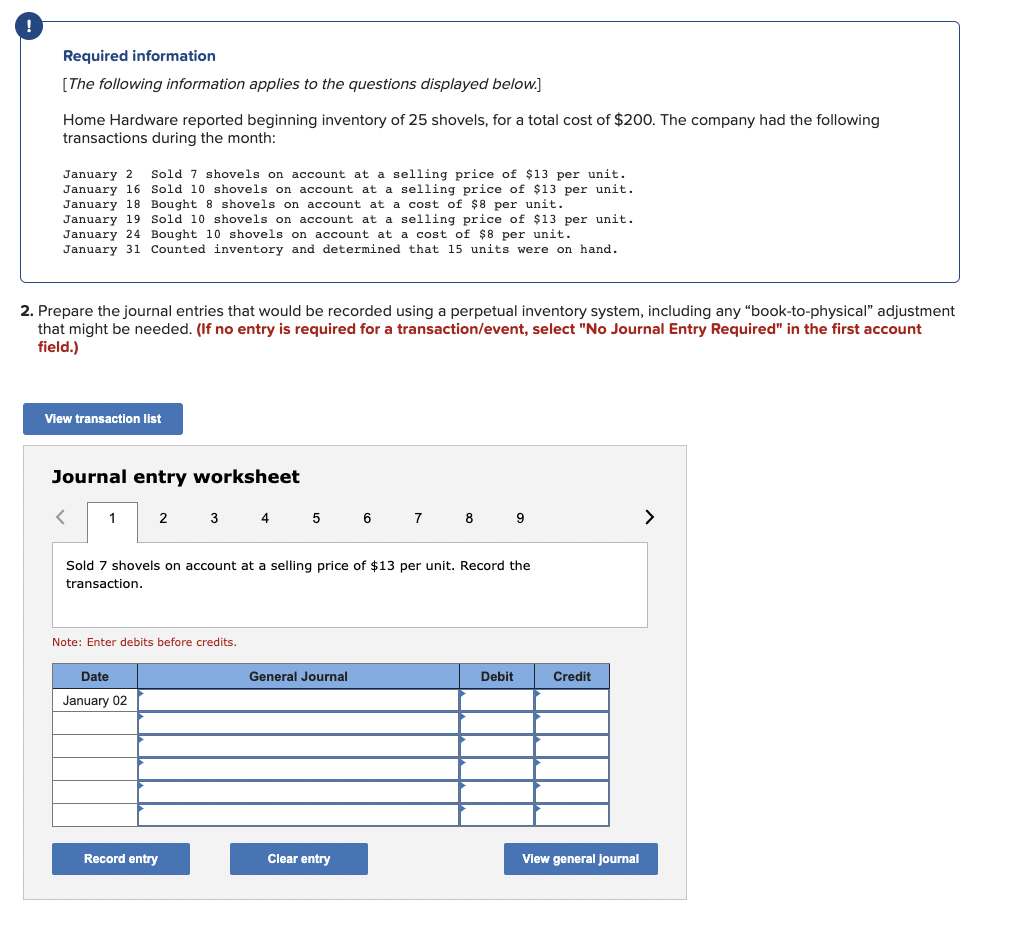

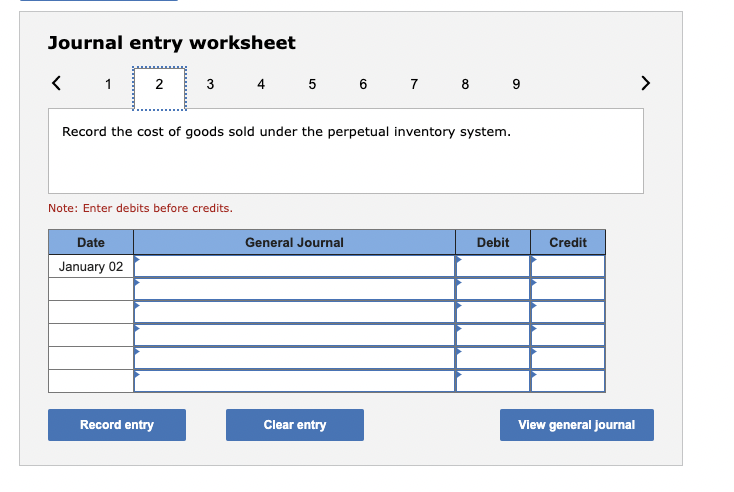

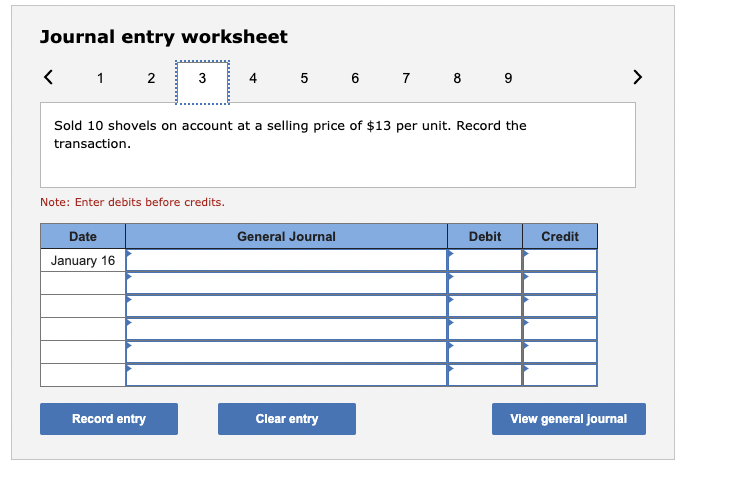

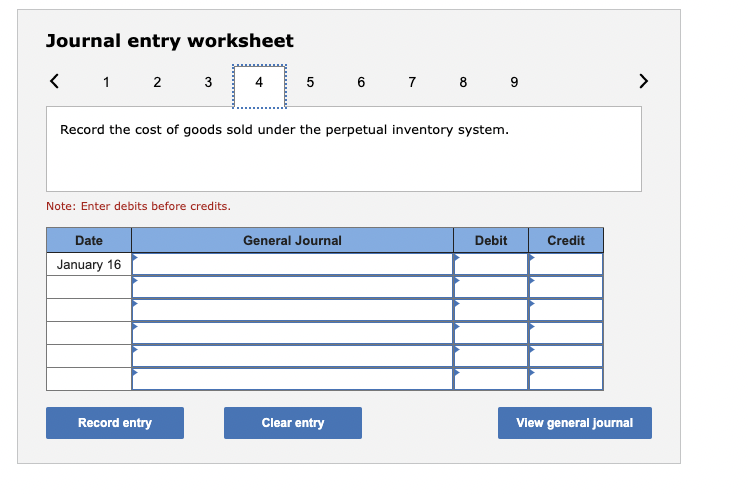

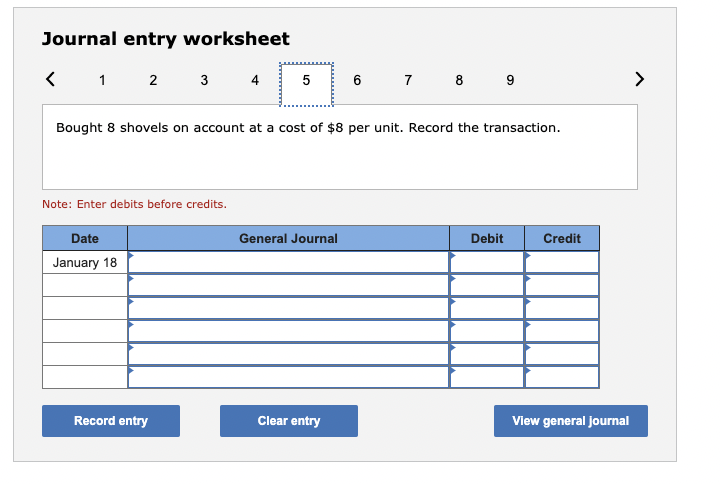

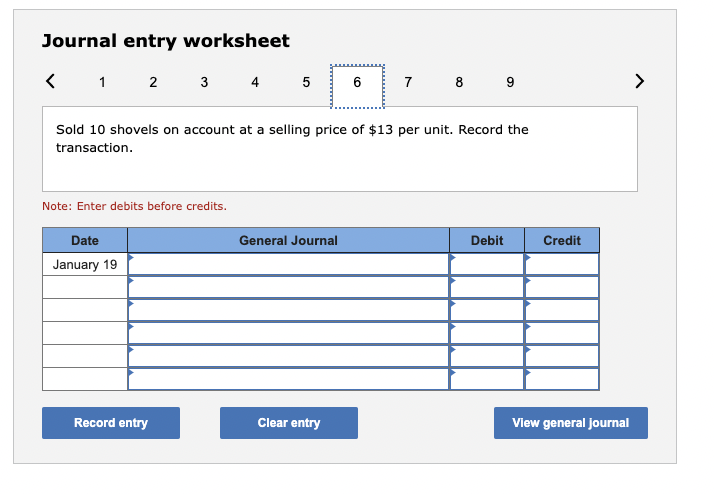

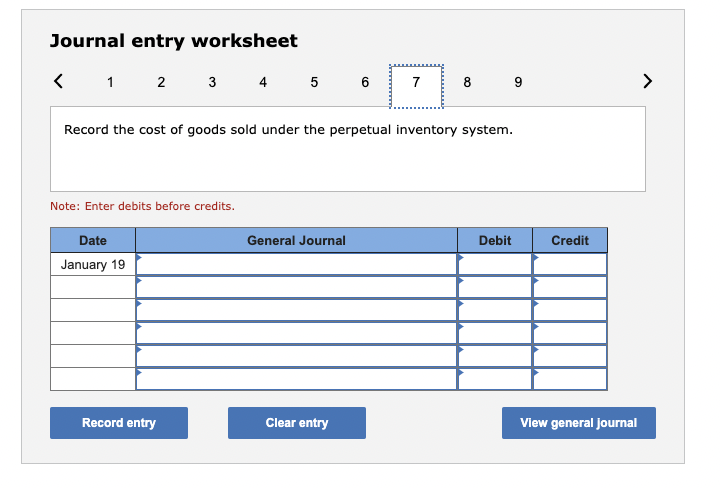

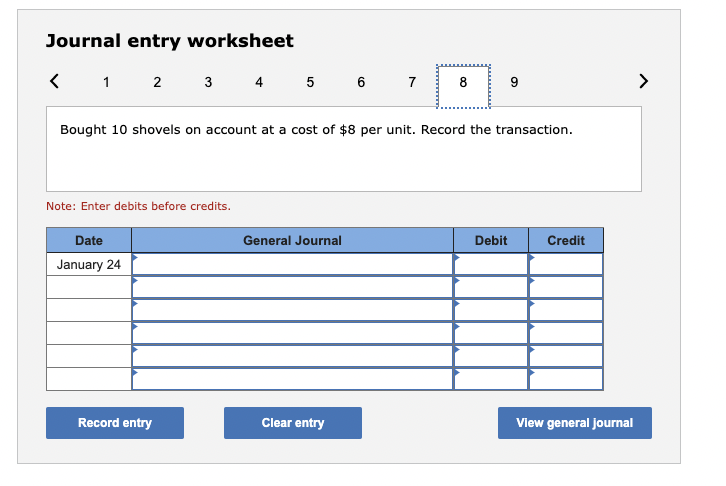

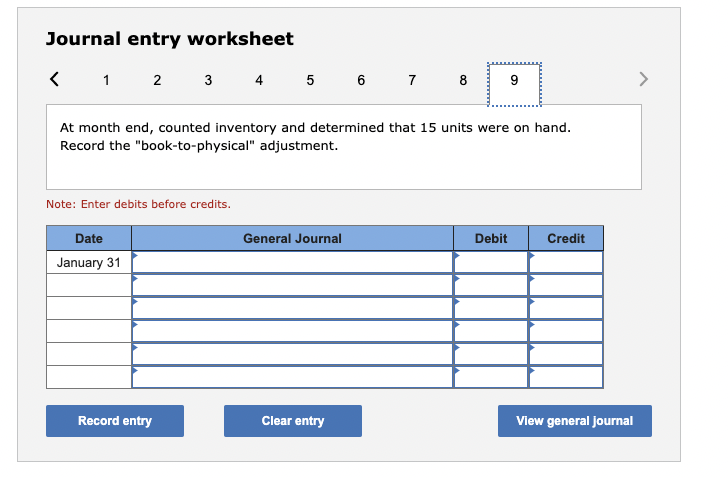

Required information [The following information applies to the questions displayed below.] The transactions listed below are typical of those involving New Books Incorporated and Readers' Corner. New Books is a wholesale merchandiser and Readers' Corner is a retail merchandiser. Assume all sales of merchandise from New Books to Readers' Corner are made with terms n/30, and the two companies use perpetual inventory systems. Assume the following transactions between the two companies occurred in the order listed during the year ended August 31. a. New Books sold merchandise to Readers' Corner at a selling price of $600,000. The merchandise had cost New Books $435,000. b. Two days later, Readers' Corner complained to New Books that some of the merchandise differed from what Readers' Corner had ordered. New Books agreed to give an allowance of $15,000 to Readers' Corner. Readers' Corner also returned some books, which had cost New Books $3,000 and had been sold to Readers' Corner for $4,500. c. Just three days later, Readers' Corner paid New Books, which settled all amounts owed. Prepare the journal entries New Books would record. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the sales on account of $600,000 to Readers' Corner on terms n/30. Note: Enter debits before credits. Journal entry worksheet 5 Record the cost of goods sold of $435,000. Note: Enter debits before credits. Journal entry worksheet Record the returns and allowances granted to Reader's Corner. Note: Enter debits before credits. Journal entry worksheet Record the cost of goods sold adjustment to inventory. Note: Enter debits before credits. Journal entry worksheet 1 Record the receipt of payment in full from Readers' Corner. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Patel Supply Corporation is a wholesaler of hair supplies. Patel Supply uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $31,317 ). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $290 ). c. Sold merchandise (costing $6,745 ) to a customer on account with terms n/60. d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $210 ) after year-end from sales made during the year. Prepare journal entries to record transactions (a)-(f). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet 7 The merchandise sold had a cost of $31,317. Record the entry. Note: Enter debits before credits. Journal entry worksheet 8 Received merchandise returned by customers as unsatisfactory (but in perfect condition) for $320 cash refund. Record the entry. Note: Enter debits before credits. Journal entry worksheet 6 7 8 The merchandise returned had a cost of $290. Record the entry. Note: Enter debits before credits. Journal entry worksheet Sold merchandise to a customer for $14,200 on account with terms n/60. Record the entry. Note: Enter debits before credits. Journal entry worksheet 1 8 The merchandise sold had a cost of $6,745. Record the entry. Note: Enter debits before credits. Journal entry worksheet 1 2 4 Collected half of the $14,200 balance owed by the customer in transaction c. Record the entry. Note: Enter debits before credits. Journal entry worksheet Granted a partial $174 allowance relating to credit sales the customer in transaction c had not yet paid. Record the entry. Note: Enter debits before credits. Journal entry worksheet 2 7 Anticipate further returns of merchandise after year-end from $330 sales made during the year. Record the entry. Note: Enter debits before credits. Journal entry worksheet 1 2 5 6 The anticipated merchandise returns have a cost of $210. Record the entry. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Home Hardware reported beginning inventory of 25 shovels, for a total cost of $200. The company had the following transactions during the month: January 2 Sold 7 shovels on account at a selling price of $13 per unit. January 16 sold 10 shovels on account at a selling price of $13 per unit. January 18 Bought 8 shovels on account at a cost of $8 per unit. January 19 Sold 10 shovels on account at a selling price of $13 per unit. January 24 Bought 10 shovels on account at a cost of $8 per unit. January 31 Counted inventory and determined that 15 units were on hand. Required: 1. Prepare the journal entries that would be recorded using a periodic inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 3456 Sold 7 shovels on account at a selling price of $13 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Sold 10 shovels on account at a selling price of $13 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Bought 8 shovels on account at a cost of $8 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Sold 10 shovels on account at a selling price of $13 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 1 Bought 10 shovels on account at a cost of $8 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 1 2 Record the end of period adjustment to determine the amount of cost of goods sold, including any "book-to-physical" adjustment that might be needed. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Home Hardware reported beginning inventory of 25 shovels, for a total cost of $200. The company had the following transactions during the month: January 2 Sold 7 shovels on account at a selling price of $13 per unit. January 16 Sold 10 shovels on account at a selling price of $13 per unit. January 18 Bought 8 shovels on account at a cost of $8 per unit. January 19 Sold 10 shovels on account at a selling price of $13 per unit. January 24 Bought 10 shovels on account at a cost of $8 per unit. January 31 Counted inventory and determined that 15 units were on hand. Prepare the journal entries that would be recorded using a perpetual inventory system, including any "book-to-physical" adjustment that might be needed. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 23456789> Sold 7 shovels on account at a selling price of $13 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 5678 Record the cost of goods sold under the perpetual inventory system. Note: Enter debits before credits. Journal entry worksheet 9 Sold 10 shovels on account at a selling price of $13 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 78 Record the cost of goods sold under the perpetual inventory system. Note: Enter debits before credits. Journal entry worksheet 1 Bought 8 shovels on account at a cost of $8 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Sold 10 shovels on account at a selling price of $13 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 1 Record the cost of goods sold under the perpetual inventory system. Note: Enter debits before credits. Journal entry worksheet 1 Bought 10 shovels on account at a cost of $8 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 1256 At month end, counted inventory and determined that 15 units were on hand. Record the "book-to-physical" adjustment. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] The transactions listed below are typical of those involving New Books Incorporated and Readers' Corner. New Books is a wholesale merchandiser and Readers' Corner is a retail merchandiser. Assume all sales of merchandise from New Books to Readers' Corner are made with terms n/30, and the two companies use perpetual inventory systems. Assume the following transactions between the two companies occurred in the order listed during the year ended August 31. a. New Books sold merchandise to Readers' Corner at a selling price of $600,000. The merchandise had cost New Books $435,000. b. Two days later, Readers' Corner complained to New Books that some of the merchandise differed from what Readers' Corner had ordered. New Books agreed to give an allowance of $15,000 to Readers' Corner. Readers' Corner also returned some books, which had cost New Books $3,000 and had been sold to Readers' Corner for $4,500. c. Just three days later, Readers' Corner paid New Books, which settled all amounts owed. Prepare the journal entries New Books would record. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the sales on account of $600,000 to Readers' Corner on terms n/30. Note: Enter debits before credits. Journal entry worksheet 5 Record the cost of goods sold of $435,000. Note: Enter debits before credits. Journal entry worksheet Record the returns and allowances granted to Reader's Corner. Note: Enter debits before credits. Journal entry worksheet Record the cost of goods sold adjustment to inventory. Note: Enter debits before credits. Journal entry worksheet 1 Record the receipt of payment in full from Readers' Corner. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Patel Supply Corporation is a wholesaler of hair supplies. Patel Supply uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $31,317 ). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $290 ). c. Sold merchandise (costing $6,745 ) to a customer on account with terms n/60. d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $210 ) after year-end from sales made during the year. Prepare journal entries to record transactions (a)-(f). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet 7 The merchandise sold had a cost of $31,317. Record the entry. Note: Enter debits before credits. Journal entry worksheet 8 Received merchandise returned by customers as unsatisfactory (but in perfect condition) for $320 cash refund. Record the entry. Note: Enter debits before credits. Journal entry worksheet 6 7 8 The merchandise returned had a cost of $290. Record the entry. Note: Enter debits before credits. Journal entry worksheet Sold merchandise to a customer for $14,200 on account with terms n/60. Record the entry. Note: Enter debits before credits. Journal entry worksheet 1 8 The merchandise sold had a cost of $6,745. Record the entry. Note: Enter debits before credits. Journal entry worksheet 1 2 4 Collected half of the $14,200 balance owed by the customer in transaction c. Record the entry. Note: Enter debits before credits. Journal entry worksheet Granted a partial $174 allowance relating to credit sales the customer in transaction c had not yet paid. Record the entry. Note: Enter debits before credits. Journal entry worksheet 2 7 Anticipate further returns of merchandise after year-end from $330 sales made during the year. Record the entry. Note: Enter debits before credits. Journal entry worksheet 1 2 5 6 The anticipated merchandise returns have a cost of $210. Record the entry. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Home Hardware reported beginning inventory of 25 shovels, for a total cost of $200. The company had the following transactions during the month: January 2 Sold 7 shovels on account at a selling price of $13 per unit. January 16 sold 10 shovels on account at a selling price of $13 per unit. January 18 Bought 8 shovels on account at a cost of $8 per unit. January 19 Sold 10 shovels on account at a selling price of $13 per unit. January 24 Bought 10 shovels on account at a cost of $8 per unit. January 31 Counted inventory and determined that 15 units were on hand. Required: 1. Prepare the journal entries that would be recorded using a periodic inventory system. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 3456 Sold 7 shovels on account at a selling price of $13 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Sold 10 shovels on account at a selling price of $13 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Bought 8 shovels on account at a cost of $8 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Sold 10 shovels on account at a selling price of $13 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 1 Bought 10 shovels on account at a cost of $8 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 1 2 Record the end of period adjustment to determine the amount of cost of goods sold, including any "book-to-physical" adjustment that might be needed. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Home Hardware reported beginning inventory of 25 shovels, for a total cost of $200. The company had the following transactions during the month: January 2 Sold 7 shovels on account at a selling price of $13 per unit. January 16 Sold 10 shovels on account at a selling price of $13 per unit. January 18 Bought 8 shovels on account at a cost of $8 per unit. January 19 Sold 10 shovels on account at a selling price of $13 per unit. January 24 Bought 10 shovels on account at a cost of $8 per unit. January 31 Counted inventory and determined that 15 units were on hand. Prepare the journal entries that would be recorded using a perpetual inventory system, including any "book-to-physical" adjustment that might be needed. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 23456789> Sold 7 shovels on account at a selling price of $13 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 5678 Record the cost of goods sold under the perpetual inventory system. Note: Enter debits before credits. Journal entry worksheet 9 Sold 10 shovels on account at a selling price of $13 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 78 Record the cost of goods sold under the perpetual inventory system. Note: Enter debits before credits. Journal entry worksheet 1 Bought 8 shovels on account at a cost of $8 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet Sold 10 shovels on account at a selling price of $13 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 1 Record the cost of goods sold under the perpetual inventory system. Note: Enter debits before credits. Journal entry worksheet 1 Bought 10 shovels on account at a cost of $8 per unit. Record the transaction. Note: Enter debits before credits. Journal entry worksheet 1256 At month end, counted inventory and determined that 15 units were on hand. Record the "book-to-physical" adjustment. Note: Enter debits before credits