Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. A cost imposed on someone who is neither the consumer nor the producer is called a a. corrective tax. b. command and control

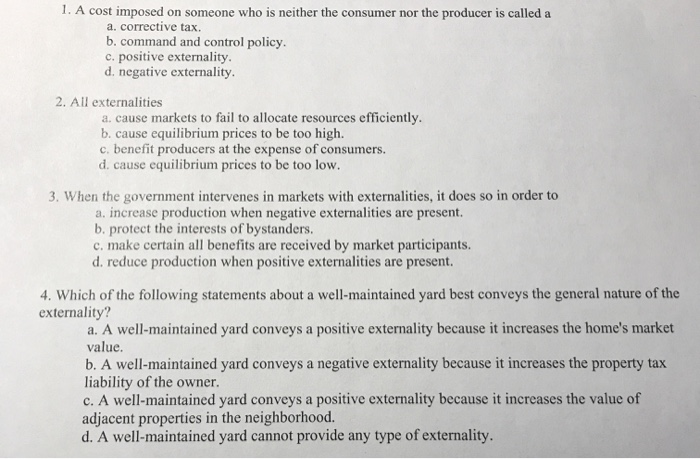

1. A cost imposed on someone who is neither the consumer nor the producer is called a a. corrective tax. b. command and control policy. c. positive externality. d. negative externality. 2. All externalities a. cause markets to fail to allocate resources efficiently. b. cause equilibrium prices to be too high. c. benefit producers at the expense of consumers. d. cause equilibrium prices to be too low. 3. When the government intervenes in markets with externalities, it does so in order to a. increase production when negative externalities are present. b. protect the interests of bystanders. c. make certain all benefits are received by market participants. d. reduce production when positive externalities are present. 4. Which of the following statements about a well-maintained yard best conveys the general nature of the externality? a. A well-maintained yard conveys a positive externality because it increases the home's market value. b. A well-maintained yard conveys a negative externality because it increases the property tax liability of the owner. c. A well-maintained yard conveys a positive externality because it increases the value of adjacent properties in the neighborhood. d. A well-maintained yard cannot provide any type of externality.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 d negative externally When certain goods are consumed such as demerit goods negative effects can a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started