Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answr all 3 asap, will upvote Lasik Vision inc. recently analyzed the project whose cash flows are shown below. However, before Lasik decided to

please answr all 3 asap, will upvote

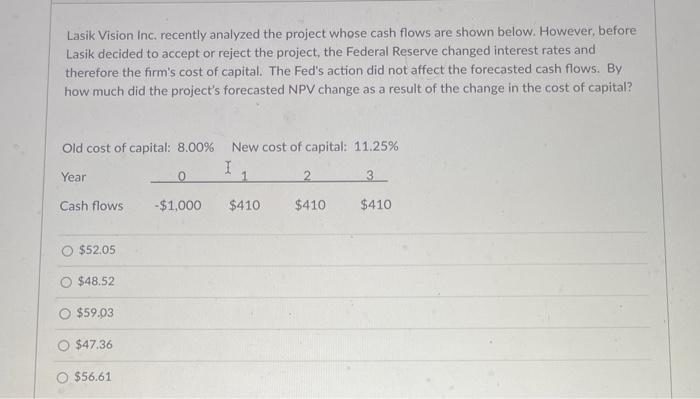

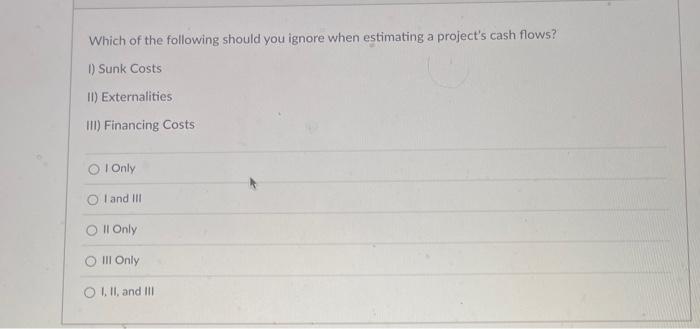

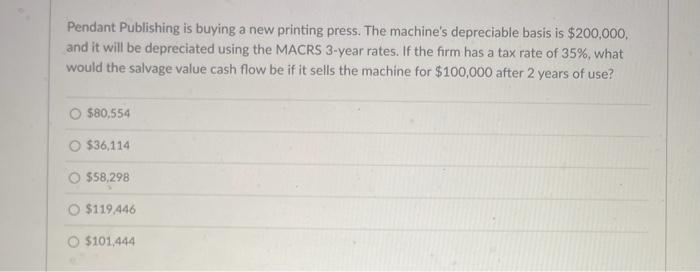

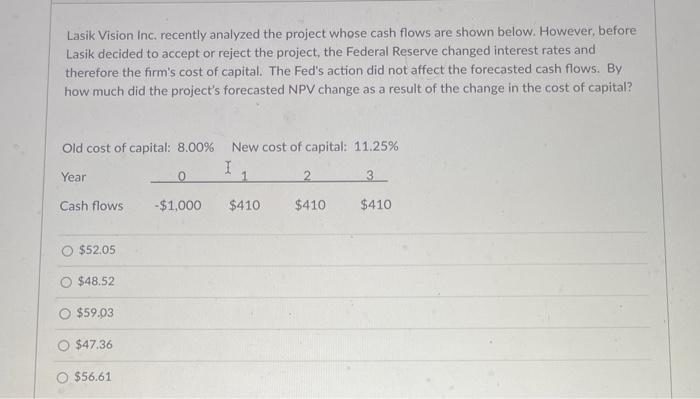

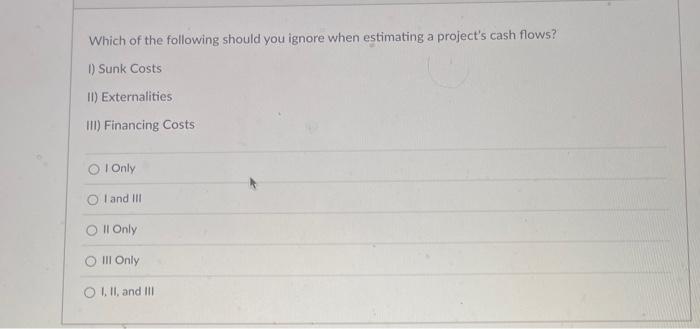

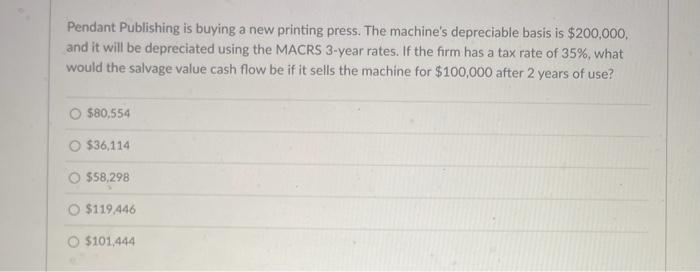

Lasik Vision inc. recently analyzed the project whose cash flows are shown below. However, before Lasik decided to accept or reject the project, the Federal Reserve changed interest rates and therefore the firm's cost of capital. The Fed's action did not affect the forecasted cash flows. By how much did the project's forecasted NPV change as a result of the change in the cost of capital? Old cost of capital: 8.00% New cost of capital: 11.25% $52,05 $48.52 $59.03 $47.36 $56.61 Which of the following should you ignore when estimating a project's cash flows? 1) Sunk Costs II) Externalities III) Financing Costs I Only I and III II Only III Only I. II, and III Pendant Publishing is buying a new printing press. The machine's depreciable basis is $200,000. and it will be depreciated using the MACRS 3 -year rates. If the firm has a tax rate of 35%, what would the salvage value cash flow be if it sells the machine for $100,000 after 2 years of use? $80,554 $36,114 $58,298 $119.446 $101,444

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started