Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please anwer question 2. international taxation lesson question 1. Company X (UK) Company X is a company incorporated and tax resident in UK. It is

please anwer question 2. international taxation lesson question

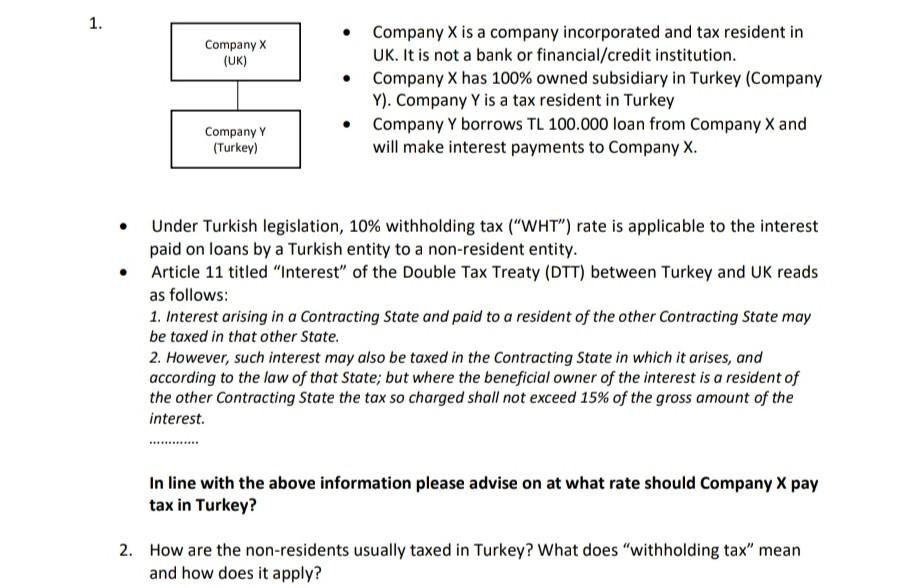

1. Company X (UK) Company X is a company incorporated and tax resident in UK. It is not a bank or financial/credit institution. Company X has 100% owned subsidiary in Turkey (Company Y). Company Y is a tax resident in Turkey Company Y borrows TL 100.000 loan from Company X and will make interest payments to Company X. Company Y (Turkey) . Under Turkish legislation, 10% withholding tax ("WHT") rate is applicable to the interest paid on loans by a Turkish entity to a non-resident entity. Article 11 titled "Interest" of the Double Tax Treaty (DTT) between Turkey and UK reads as follows: 1. Interest arising in a Contracting State and paid to a resident of the other Contracting State may be taxed in that other State. 2. However, such interest may also be taxed in the Contracting State in which it arises, and according to the law of that State; but where the beneficial owner of the interest is a resident of the other contracting State the tax so charged shall not exceed 15% of the gross amount of the interest In line with the above information please advise on at what rate should Company X pay tax in Turkey? 2. How are the non-residents usually taxed in Turkey? What does "withholding tax" mean and how does it applyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started