Answered step by step

Verified Expert Solution

Question

1 Approved Answer

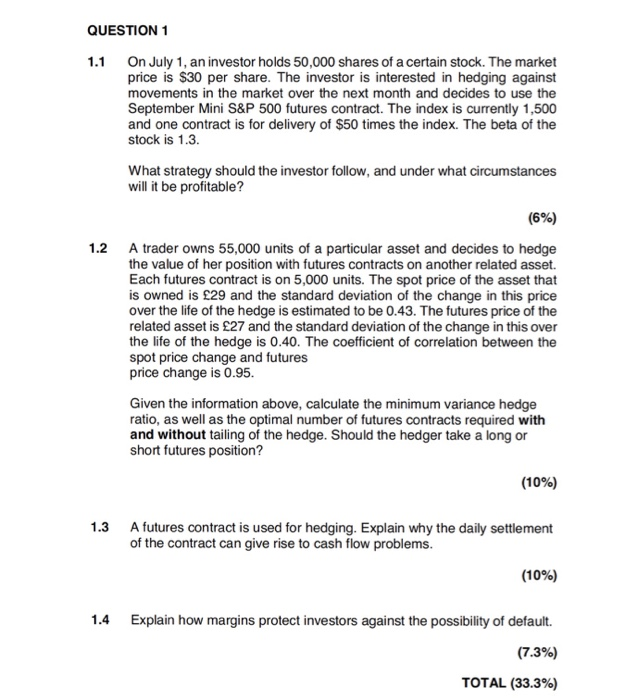

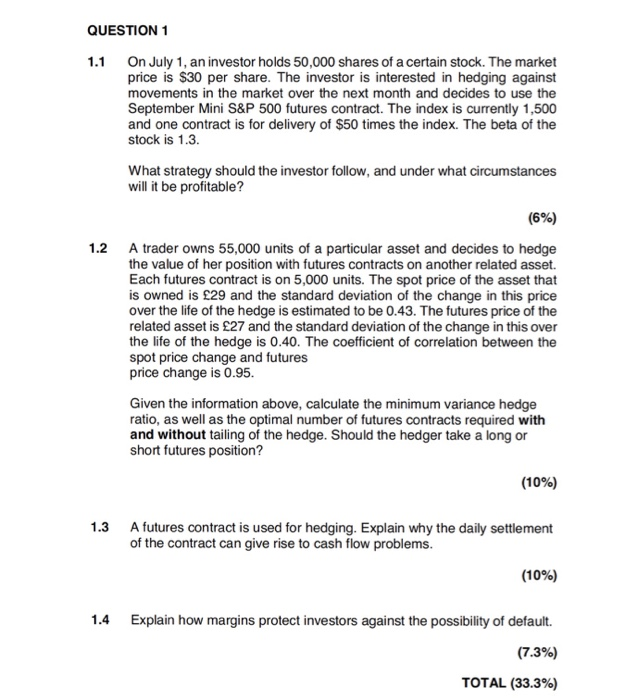

Please anwer the question as detaied as possible QUESTION 1 1.1 On July 1, an investor holds 50,000 shares of a certain stock. The market

Please anwer the question as detaied as possible

QUESTION 1 1.1 On July 1, an investor holds 50,000 shares of a certain stock. The market price is S30 per share. The investor is interested in hedging against movements in the market over the next month and decides to use the September Mini S&P 500 futures contract. The index is currently 1,500 and one contract is for delivery of $50 times the index. The beta of the stock is 1.3 What strategy should the investor follow, and under what circumstances will it be profitable? (6%) 1.2 A trader owns 55,000 units of a particular asset and decides to hedge the value of her position with futures contracts on another related asset. Each futures contract is on 5,000 units. The spot price of the asset that is owned is 29 and the standard deviation of the change in this price over the life of the hedge is estimated to be 0.43. The futures price of the related asset is 27 and the standard deviation of the change in this over the life of the hedge is 0.40. The coefficient of correlation between the spot price change and futures price change is 0.95. Given the information above, calculate the minimum variance hedge ratio, as well as the optimal number of futures contracts required with and without tailing of the hedge. Should the hedger take a long or short futures position? (10%) A futures contract is used for hedging. Explain why the daily settlement (1096) 1.3 of the contract can give rise to cash flow problems 1.4 Explain how margins protect investors against the possibility of default. (7.3%) TOTAL (33.3%) QUESTION 1 1.1 On July 1, an investor holds 50,000 shares of a certain stock. The market price is S30 per share. The investor is interested in hedging against movements in the market over the next month and decides to use the September Mini S&P 500 futures contract. The index is currently 1,500 and one contract is for delivery of $50 times the index. The beta of the stock is 1.3 What strategy should the investor follow, and under what circumstances will it be profitable? (6%) 1.2 A trader owns 55,000 units of a particular asset and decides to hedge the value of her position with futures contracts on another related asset. Each futures contract is on 5,000 units. The spot price of the asset that is owned is 29 and the standard deviation of the change in this price over the life of the hedge is estimated to be 0.43. The futures price of the related asset is 27 and the standard deviation of the change in this over the life of the hedge is 0.40. The coefficient of correlation between the spot price change and futures price change is 0.95. Given the information above, calculate the minimum variance hedge ratio, as well as the optimal number of futures contracts required with and without tailing of the hedge. Should the hedger take a long or short futures position? (10%) A futures contract is used for hedging. Explain why the daily settlement (1096) 1.3 of the contract can give rise to cash flow problems 1.4 Explain how margins protect investors against the possibility of default. (7.3%) TOTAL (33.3%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started