Answered step by step

Verified Expert Solution

Question

1 Approved Answer

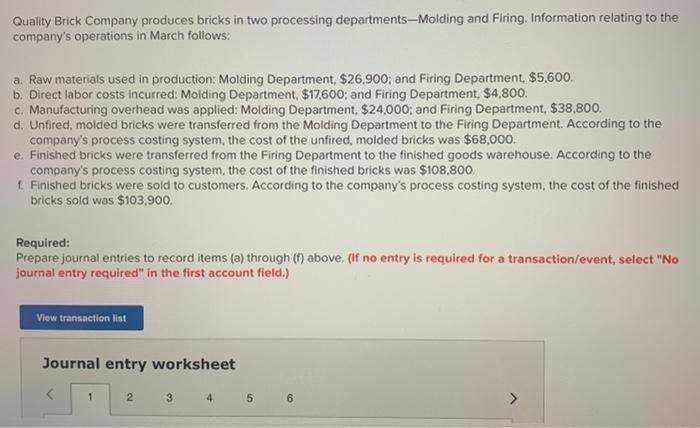

Please anwser all parts to this question. Quality Brick Company produces bricks in two processing departmentsMolding and Firing. Information relating to the company's operations in

Please anwser all parts to this question.

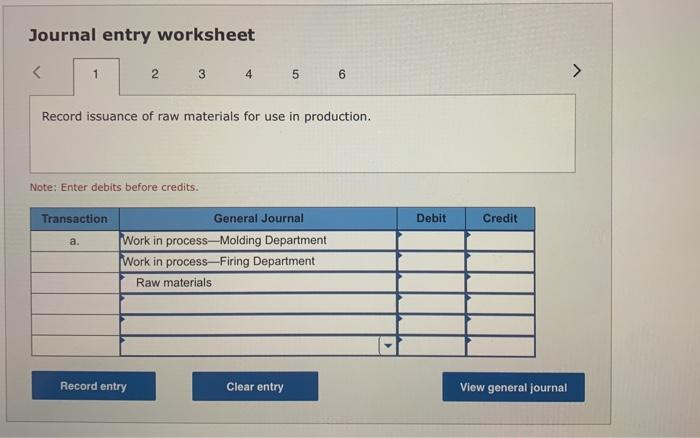

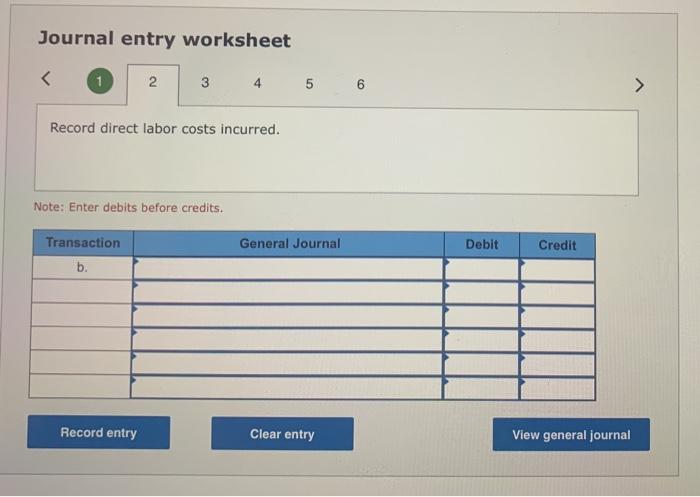

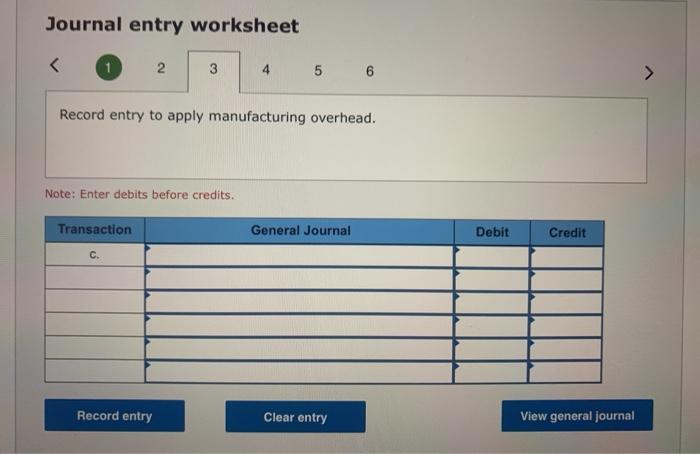

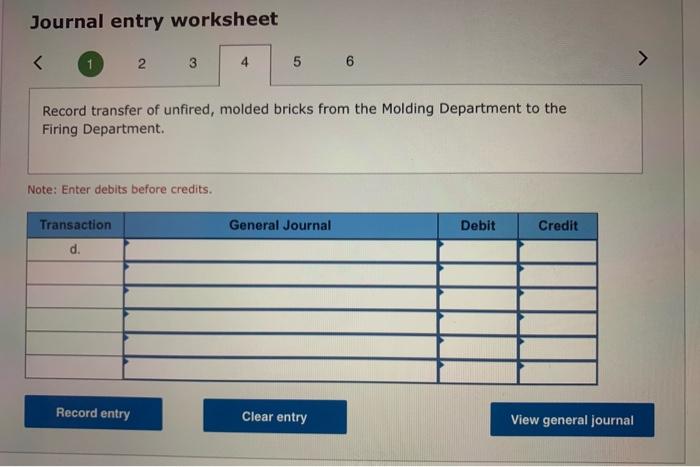

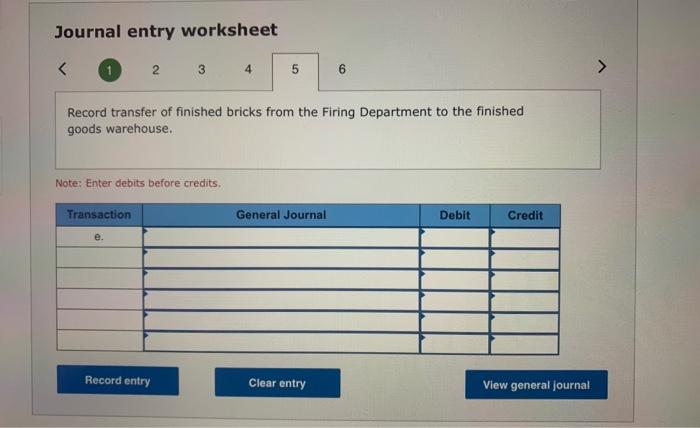

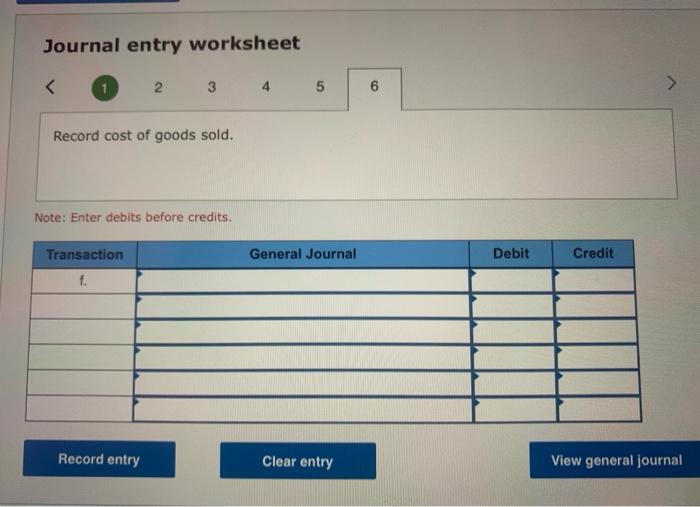

Quality Brick Company produces bricks in two processing departmentsMolding and Firing. Information relating to the company's operations in March follows: a. Raw materials used in production: Molding Department, $26,900; and Firing Department, $5,600, b. Direct labor costs incurred: Molding Department, $17,600; and Firing Department, $4,800. c. Manufacturing overhead was applied: Molding Department, $24,000; and Firing Department, $38,800. d. Unfired, molded bricks were transferred from the Molding Department to the Firing Department. According to the company's process costing system, the cost of the unfired, molded bricks was $68,000. e. Finished bricks were transferred from the Firing Department to the finished goods warehouse. According to the company's process costing system, the cost of the finished bricks was $108,800. 1. Finished bricks were sold to customers. According to the company's process costing system, the cost of the finished bricks sold was $103,900. Required: Prepare journal entries to record items (a) through (1) above. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 6 Journal entry worksheet 1 2 3 4 5 6 Record issuance of raw materials for use in production. Note: Enter debits before credits. Transaction General Journal Debit Credit a. Work in process-Molding Department Work in process-Firing Department Raw materials Record entry Clear entry View general journal Journal entry worksheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started