Question

please anwser question (b) below: To provide analysis for and advice to an Australian-based, high net worth (HNW) client, who is considering the purchase of

please anwser question (b) below:

To provide analysis for and advice to an Australian-based, high net worth (HNW) client, who is considering the purchase of a structured financial product (SFP) issued by a UK- based investment bank. Your client wishes to be advised on the financial risks to which they would be exposed in association with investment in this SFP. You have the following information on this SFP, as well as information on key financial variables (as of the end of June 2018, the date you will assume for undertaking your calculations):

Face value of GBP 50,000, with term to maturity of three years, priced in GBP at a discount to face value. Discount rate (DISC) (% p.a.) = 3-yr spot + 3-yr spread 120 bp

3-yr spot is the 3-year spot rate on UK Government liabilities, 3-yr spread is the difference between the yield on 3-year UK Treasury Gilts and UK BBB-rated corporate bonds

The 3-yr spread at the end of June 2018 was 1.1 per cent, while the historical default rate on BBB-rated corporate bonds is 0.9 per cent

Payoff at maturity is max{GBP50,000, [FTSET/FTSE0 x GBP50,000]}

FTSET represents the value of the FTSE All Shares Index (GBP basis) at maturity of the investment product and FTSE0 the value of the FTSE All Shares Index (GBP basis) at inception of the investment in the structured product (i.e., the end of June 2018)

The Australian dollar-UK Pound exchange rate (AUD/GBP, the price of 1 GBP in AUD) at the end of June 2018 was 1.7869

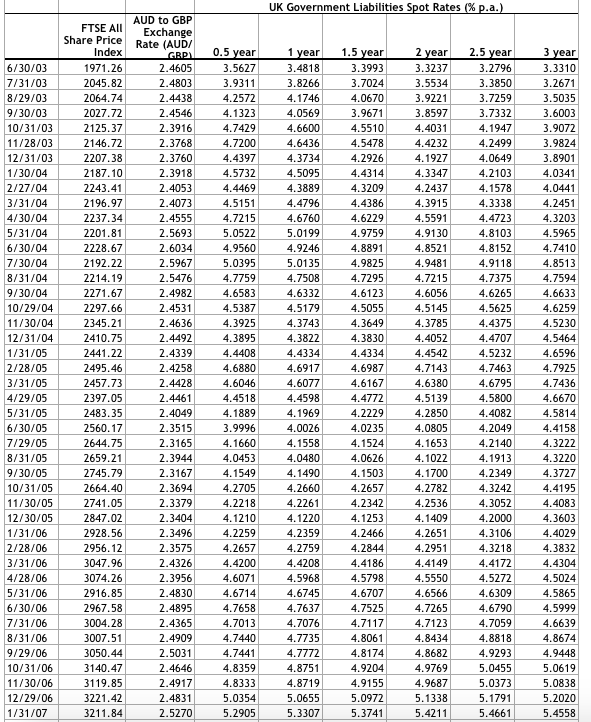

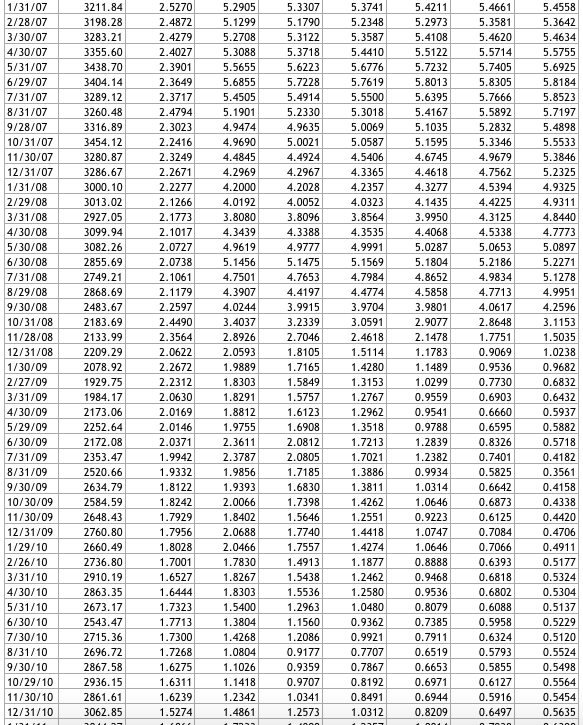

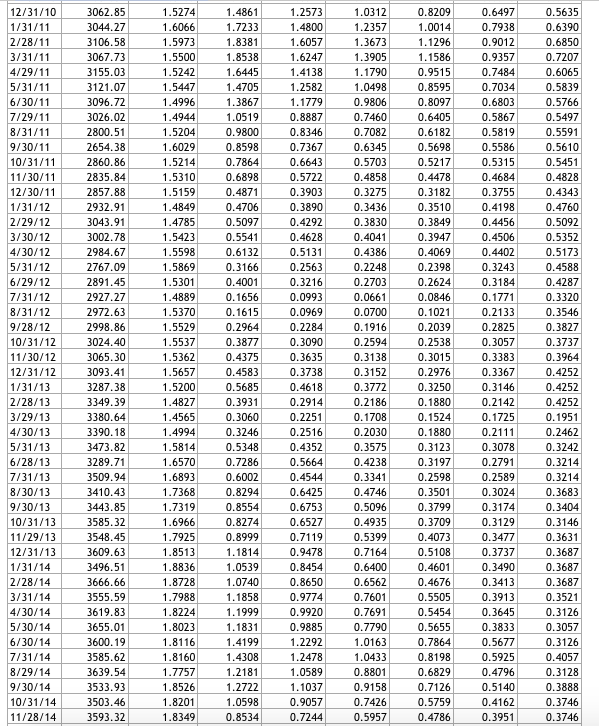

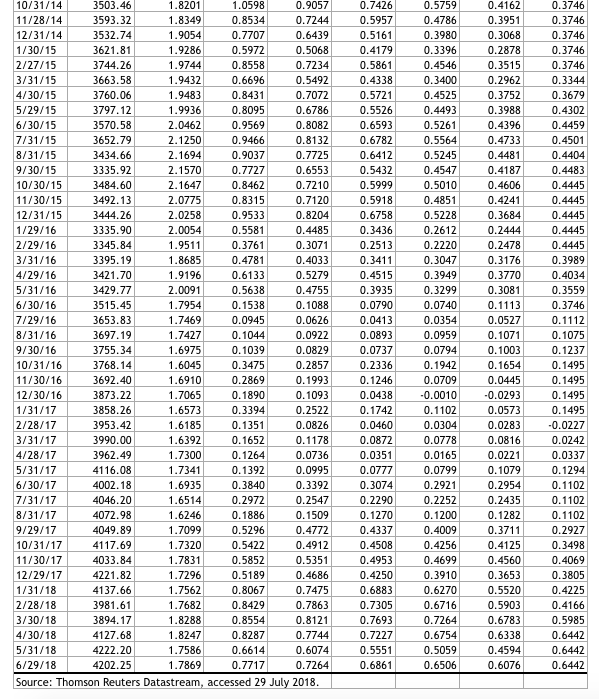

You have been provided with monthly time series data, covering the period from the end of June 2003 to the end of June 2018, on the spot rates on UK Government liabilities (% p.a.) for 0.5, 1, 1.5, 2, 2.5 and 3 years, the AUD/ GBP exchange rate, and the value of the FTSE All Shares Index (GBP basis) (see the spreadsheet BANK 3003 FRA Assignment Data.xlsx).

Requirements: Prepare a brief (less than three-page) report:

(a) Identifies the financial risks to which your HNW client would have exposure if invested in this SFP. (Note: you should tabulate the different financial risks to which an investor would be exposed if they bought the SFP and the sources of each financial risk.)

(b) Quantitatively analyse the risk factors for which you have data. (Hint: provide individual quantitative analysis of each risk factor, but also provide information on relationships between key risk factors.)

(c) Given your analysis of the data available to you, which financial risks do you think are likely to be of most concern to the client? Provide a brief justification/support for your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started