Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please anwser t charts outline shown below 1. P. Simpson began business as an engineering consultant on October 1, 20-. He set up the following

please anwser

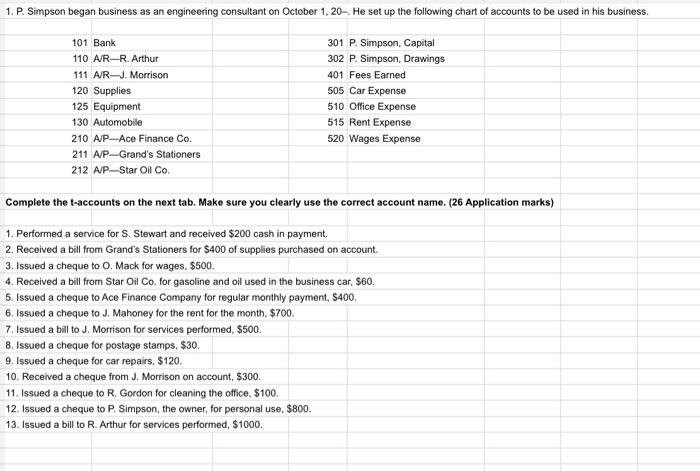

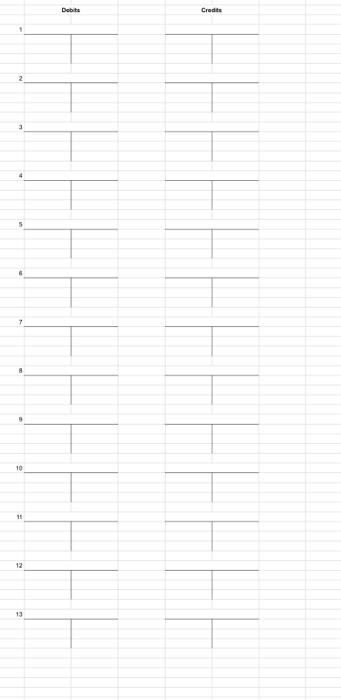

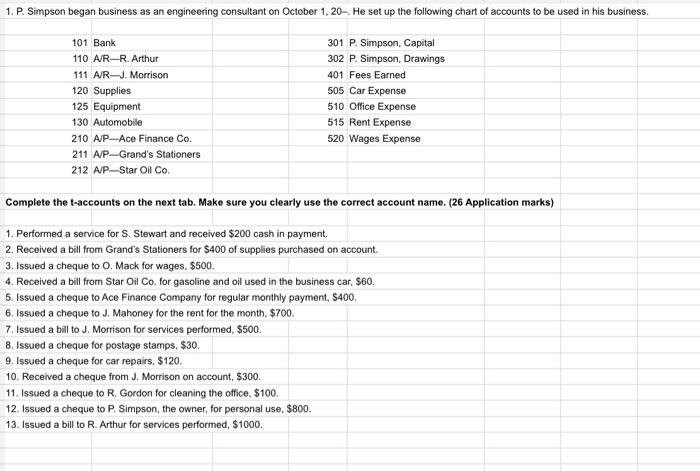

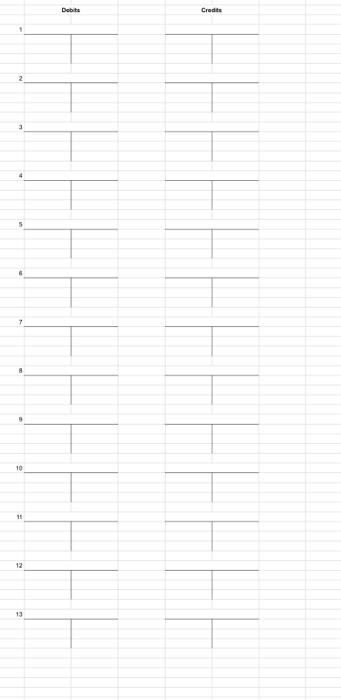

1. P. Simpson began business as an engineering consultant on October 1, 20-. He set up the following chart of accounts to be used in his business. 101 Bank 110 A/R-R. Arthur 111 AR-J. Morrison 120 Supplies 125 Equipment 130 Automobile 210 AP-Ace Finance Co. 211 AP-Grand's Stationers 212 AJP-Star Oil Co 301 P. Simpson, Capital 302 P. Simpson, Drawings 401 Fees Earned 505 Car Expense 510 Office Expense 515 Rent Expense 520 Wages Expense Complete the t-accounts on the next tab. Make sure you clearly use the correct account name. (26 Application marks) 1. Performed a service for S. Stewart and received $200 cash in payment 2. Received a bill from Grand's Stationers for $400 of supplies purchased on account. 3. Issued a cheque to O. Mack for wages. $500. 4. Received a bill from Star Oil Co for gasoline and oil used in the business car, $60. 5. Issued a cheque to Ace Finance Company for regular monthly payment, $400, 6, Issued a cheque to J. Mahoney for the rent for the month $700. 7. Issued a bill to J. Morrison for services performed. $500. 8. Issued a cheque for postage stamps, $30. 9. Issued a cheque for car repairs, $120. 10. Received a cheque from J. Morrison on account, $300. 11. Issued a cheque to R. Gordon for cleaning the office. $100 12. Issued a cheque to P. Simpson, the owner, for personal use, $800. 13. Issued a bill to R. Arthur for services performed, $1000. Dobits Credits 2 3 6 7 10 11 12 13

t charts outline shown below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started