please anwser the journal entries asap from a-n and i will rate!!

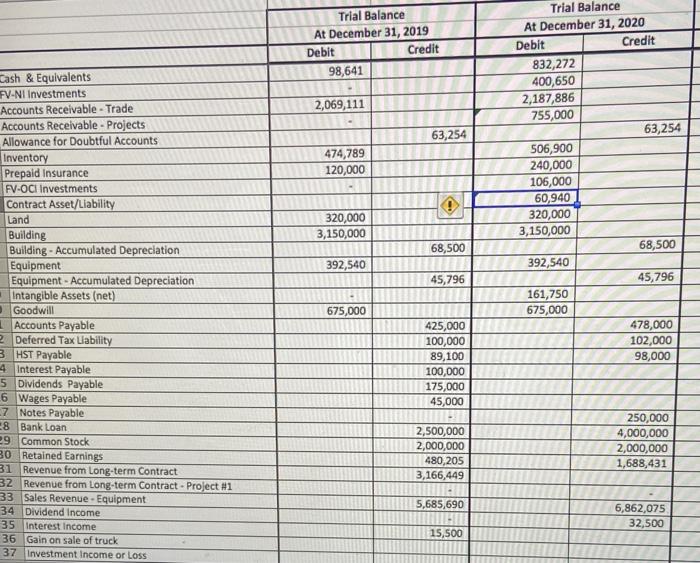

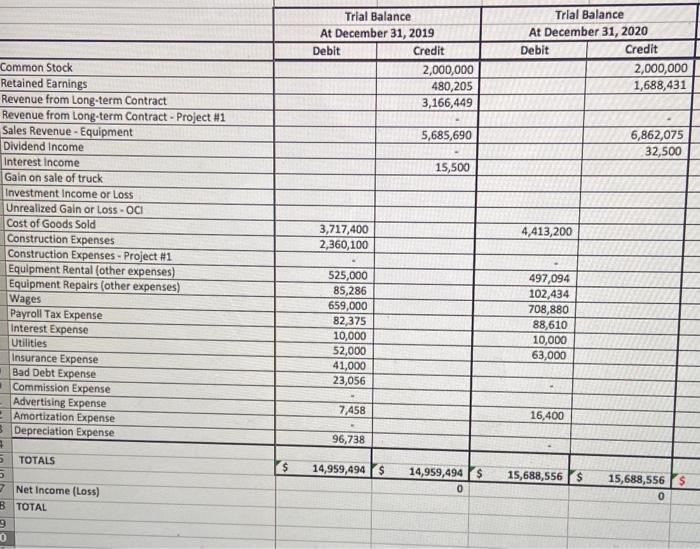

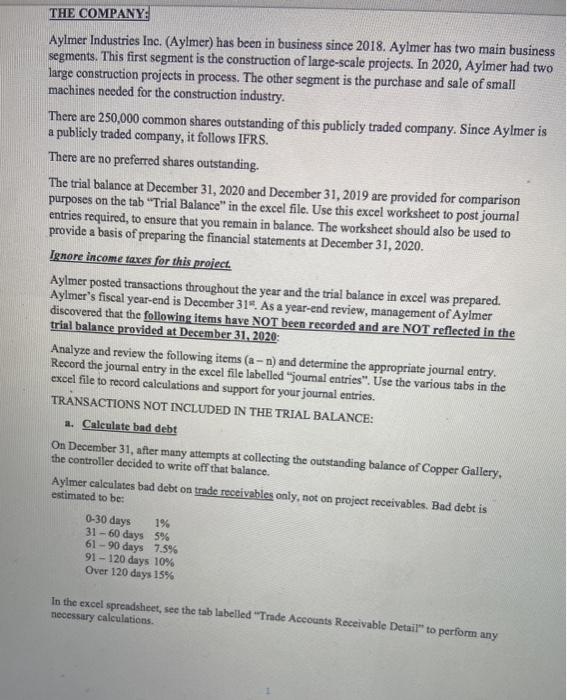

THE COMPANY Aylmer Industries Inc. (Aylmer) has been in business since 2018. Aylmer has two main business segments. This first segment is the construction of large-scale projects. In 2020, Aylmer had two large construction projects in process. The other segment is the purchase and sale of small machines needed for the construction industry. There are 250,000 common shares outstanding of this publicly traded company. Since Aylmer is a publicly traded company, it follows IFRS. There are no preferred shares outstanding. The trial balance at December 31, 2020 and December 31, 2019 are provided for comparison purposes on the tab "Trial Balance in the excel file. Use this excel worksheet to post journal entries required, to ensure that you remain in balance. The worksheet should also be used to provide a basis of preparing the financial statements at December 31, 2020. Ignore income taxes for this project. Aylmer posted transactions throughout the year and the trial balance in excel was prepared. Aylmer's fiscal year-end is December 31%. As a year-end review, management of Aylmer discovered that the following items have NOT been recorded and are NOT reflected in the trial balance provided at December 31, 2020: Analyze and review the following items (a - n) and determine the appropriate journal entry. Record the journal entry in the excel file labelled "journal entries". Use the various tabs in the excel file to record calculations and support for your journal entries. TRANSACTIONS NOT INCLUDED IN THE TRIAL BALANCE: a. Calculate bad debt On December 31, after many attempts at collecting the outstanding balance of Copper Gallery, the controller decided to write of that balance Ayimer calculates bad debt on trade receivables only, not on project receivables. Bad debt is estimated to be 0-30 days 1% 31-60 days 5% 61 - 90 days 7.5% 91 - 120 days 10% Over 120 days 15% In the excel spreadsheet, see the tab labelled "Trade Accounts Receivable Detail to perform any necessary calculations b. FV-NI Investments At December 31, 2020; the fair value of the short-term investments were: Redemption Corp ALM Corp $12.63 per share $23.98 per share In the excel spreadsheet, see the tab "FV-NI Investments" to perform any necessary calculations. e. Prepaid Insurance The prepaid amount on the trial balance consists of a payment made to State Farm Insurance on October 1, 2020. The policy lasts 18 months. d. Inventory - LCM The company has the policy of stating all inventory on hand at the lower of cost and net realizable value. The company uses the direct method for any adjustments to inventory. NOTE - on the income statement use "Cost of Goods Sold" from the trial balance - do not calculate the cost of goods sold. In the excel spreadsheet, see the tab "Inventory Detail" to perform any necessary calculations. e. Record Depreciation on assets Depreciate the fixed assets according to the schedule. Depreciation is calculated on an annual basis. In the excel spreadsheet, see the tab "Fixed Asset Details" to perform any necessary calculations f. Trade a vehicle On December 31, 2020 (after depreciation was recorded); the company traded asset 2018-04 for a 2012 Ford F150. In addition to the trade, the company paid $3,000 cash for the new truck. The fair value of asset #2018-04 was $9,000. Assume that this transaction HAS commercial substance. Once this new asset is purchased, do not depreciate it. In the excel spreadsheet, see the tab "Fixed Asset Details" to perform any necessary calculations; and update the schedule as needed. & Investments -FV-OCI On December 31, 2020, the fair value per share of Hub Cap Company was $11.25 per share. Aylmer decided to sell it's shares in Hub Cap Company at that time (sale was not recorded on the trial balance). Hint: after you record the sale, be sure to close the gain or loss on sale to retained earnings similar to how the sale was accounted for in TR11-7 in class. In the excel spreadsheet, see the tab "FV-OCI Investments" to perform any necessary calculations. h. Bank Loan The loan for $4,000,000 was borrowed at January 1, 2020. Interest on the bank loan is 2.75% annually. Interest has to be paid every January 2, so the first interest payment is due January 2, 2021. No principal payments were made during the year. Of the bank loan, $1,000,000 is due June 30, 2021 with the remainder due June 30, 2026. i. Notes Payable This is a short-term note. The company borrowed money from JRT Investments on October 31, 2020 for 3 months. The principle, along with interest is to be repaid on January 31, 2021. The interest rate is 1.5%. 1. Long-term contracts The company uses the percentage of completion method for recording long-term contracts. The company has two long-term contracts with details below Project 1- Downtown Hotel & Shopping Centre Contract price is $10,000,000. Expected completion date is in 2022 In the excel spreadsheet, see the tab "Revenue Recognition" to perform any necessary calculations k. Accrue wages Employees work Monday to Friday and employees are paid weekly, December 31, 2020 is a Thursday. Assume that hourly employees work 8 hours per day and that there are 52 weeks a year for salaried employees. In the excel spreadsheet, see the tab Payroll Details" to perform any necessary calculations. 1. Intangible Assets Amortize the intangibles according to the schedule. Amortization is recorded on an annual basis. In the excel spreadsheet, see the tab "Intangible Assets" to perform any necessary calculations m. Dividends On December 31, 2020 a dividend of $0.70 was declared to shareholders of record on January 10, 2021 to be paid January 29, 2021. n. Tares To be ignored for this project Trial Balance At December 31, 2019 Debit Credit 98,641 2,069,111 63,254 474,789 120,000 Trial Balance At December 31, 2020 Debit Credit 832,272 400,650 2,187,886 755,000 63,254 506,900 240,000 106,000 60,940 320,000 3,150,000 68,500 392,540 45,796 161,750 675,000 478,000 102,000 98,000 320,000 3,150,000 68,500 392,540 Cash & Equivalents FV-NI Investments Accounts Receivable - Trade Accounts Receivable - Projects Allowance for Doubtful Accounts Inventory Prepaid Insurance FV-OCI Investments Contract Asset/Liability Land Building Building - Accumulated Depreciation Equipment Equipment - Accumulated Depreciation Intangible Assets (net) Goodwill Accounts Payable 2 Deferred Tax Lability 3 HST Payable 4 Interest Payable 5 Dividends Payable 6 Wages Payable -7 Notes Payable 38 Bank Loan 29 Common Stock 30 Retained Earnings 31 Revenue from Long-term Contract 32 Revenue from Long-term Contract - Project #1 33 Sales Revenue - Equipment 34 Dividend Income 35 Interest Income 36 Gain on sale of truck 37 Investment Income or Loss 45,796 675,000 425,000 100,000 89,100 100,000 175,000 45,000 2,500,000 2,000,000 480,205 3,166,449 250,000 4,000,000 2,000,000 1,688,431 5,685,690 6,862,075 32,500 15,500 Trial Balance At December 31, 2019 Debit Credit 2,000,000 480,205 3,166,449 Trial Balance At December 31, 2020 Debit Credit 2,000,000 1,688,431 5,685,690 6,862,075 32,500 15,500 Common Stock Retained Earnings Revenue from Long-term Contract Revenue from Long-term Contract - Project #1 Sales Revenue - Equipment Dividend Income Interest Income Gain on sale of truck Investment Income or Loss Unrealized Gain or Loss - OCI Cost of Goods Sold Construction Expenses Construction Expenses - Project #1 Equipment Rental (other expenses) Equipment Repairs (other expenses) Wages Payroll Tax Expense Interest Expense Utilities Insurance Expense Bad Debt Expense Commission Expense Advertising Expense Amortization Expense 5 Depreciation Expense 3,717,400 2,360,100 4,413,200 525,000 85,286 659,000 82,375 10,000 52,000 41,000 23,056 497,094 102,434 708,880 88,610 10,000 63,000 7.458 16,400 96,738 TOTALS $ 14,959,494 3 14,959,494 $ 0 15,688,5565 7 Net Income (Loss) B TOTAL 15,688,5565 0 9 O THE COMPANY Aylmer Industries Inc. (Aylmer) has been in business since 2018. Aylmer has two main business segments. This first segment is the construction of large-scale projects. In 2020, Aylmer had two large construction projects in process. The other segment is the purchase and sale of small machines needed for the construction industry. There are 250,000 common shares outstanding of this publicly traded company. Since Aylmer is a publicly traded company, it follows IFRS. There are no preferred shares outstanding. The trial balance at December 31, 2020 and December 31, 2019 are provided for comparison purposes on the tab "Trial Balance in the excel file. Use this excel worksheet to post journal entries required, to ensure that you remain in balance. The worksheet should also be used to provide a basis of preparing the financial statements at December 31, 2020. Ignore income taxes for this project. Aylmer posted transactions throughout the year and the trial balance in excel was prepared. Aylmer's fiscal year-end is December 31%. As a year-end review, management of Aylmer discovered that the following items have NOT been recorded and are NOT reflected in the trial balance provided at December 31, 2020: Analyze and review the following items (a - n) and determine the appropriate journal entry. Record the journal entry in the excel file labelled "journal entries". Use the various tabs in the excel file to record calculations and support for your journal entries. TRANSACTIONS NOT INCLUDED IN THE TRIAL BALANCE: a. Calculate bad debt On December 31, after many attempts at collecting the outstanding balance of Copper Gallery, the controller decided to write of that balance Ayimer calculates bad debt on trade receivables only, not on project receivables. Bad debt is estimated to be 0-30 days 1% 31-60 days 5% 61 - 90 days 7.5% 91 - 120 days 10% Over 120 days 15% In the excel spreadsheet, see the tab labelled "Trade Accounts Receivable Detail to perform any necessary calculations b. FV-NI Investments At December 31, 2020; the fair value of the short-term investments were: Redemption Corp ALM Corp $12.63 per share $23.98 per share In the excel spreadsheet, see the tab "FV-NI Investments" to perform any necessary calculations. e. Prepaid Insurance The prepaid amount on the trial balance consists of a payment made to State Farm Insurance on October 1, 2020. The policy lasts 18 months. d. Inventory - LCM The company has the policy of stating all inventory on hand at the lower of cost and net realizable value. The company uses the direct method for any adjustments to inventory. NOTE - on the income statement use "Cost of Goods Sold" from the trial balance - do not calculate the cost of goods sold. In the excel spreadsheet, see the tab "Inventory Detail" to perform any necessary calculations. e. Record Depreciation on assets Depreciate the fixed assets according to the schedule. Depreciation is calculated on an annual basis. In the excel spreadsheet, see the tab "Fixed Asset Details" to perform any necessary calculations f. Trade a vehicle On December 31, 2020 (after depreciation was recorded); the company traded asset 2018-04 for a 2012 Ford F150. In addition to the trade, the company paid $3,000 cash for the new truck. The fair value of asset #2018-04 was $9,000. Assume that this transaction HAS commercial substance. Once this new asset is purchased, do not depreciate it. In the excel spreadsheet, see the tab "Fixed Asset Details" to perform any necessary calculations; and update the schedule as needed. & Investments -FV-OCI On December 31, 2020, the fair value per share of Hub Cap Company was $11.25 per share. Aylmer decided to sell it's shares in Hub Cap Company at that time (sale was not recorded on the trial balance). Hint: after you record the sale, be sure to close the gain or loss on sale to retained earnings similar to how the sale was accounted for in TR11-7 in class. In the excel spreadsheet, see the tab "FV-OCI Investments" to perform any necessary calculations. h. Bank Loan The loan for $4,000,000 was borrowed at January 1, 2020. Interest on the bank loan is 2.75% annually. Interest has to be paid every January 2, so the first interest payment is due January 2, 2021. No principal payments were made during the year. Of the bank loan, $1,000,000 is due June 30, 2021 with the remainder due June 30, 2026. i. Notes Payable This is a short-term note. The company borrowed money from JRT Investments on October 31, 2020 for 3 months. The principle, along with interest is to be repaid on January 31, 2021. The interest rate is 1.5%. 1. Long-term contracts The company uses the percentage of completion method for recording long-term contracts. The company has two long-term contracts with details below Project 1- Downtown Hotel & Shopping Centre Contract price is $10,000,000. Expected completion date is in 2022 In the excel spreadsheet, see the tab "Revenue Recognition" to perform any necessary calculations k. Accrue wages Employees work Monday to Friday and employees are paid weekly, December 31, 2020 is a Thursday. Assume that hourly employees work 8 hours per day and that there are 52 weeks a year for salaried employees. In the excel spreadsheet, see the tab Payroll Details" to perform any necessary calculations. 1. Intangible Assets Amortize the intangibles according to the schedule. Amortization is recorded on an annual basis. In the excel spreadsheet, see the tab "Intangible Assets" to perform any necessary calculations m. Dividends On December 31, 2020 a dividend of $0.70 was declared to shareholders of record on January 10, 2021 to be paid January 29, 2021. n. Tares To be ignored for this project Trial Balance At December 31, 2019 Debit Credit 98,641 2,069,111 63,254 474,789 120,000 Trial Balance At December 31, 2020 Debit Credit 832,272 400,650 2,187,886 755,000 63,254 506,900 240,000 106,000 60,940 320,000 3,150,000 68,500 392,540 45,796 161,750 675,000 478,000 102,000 98,000 320,000 3,150,000 68,500 392,540 Cash & Equivalents FV-NI Investments Accounts Receivable - Trade Accounts Receivable - Projects Allowance for Doubtful Accounts Inventory Prepaid Insurance FV-OCI Investments Contract Asset/Liability Land Building Building - Accumulated Depreciation Equipment Equipment - Accumulated Depreciation Intangible Assets (net) Goodwill Accounts Payable 2 Deferred Tax Lability 3 HST Payable 4 Interest Payable 5 Dividends Payable 6 Wages Payable -7 Notes Payable 38 Bank Loan 29 Common Stock 30 Retained Earnings 31 Revenue from Long-term Contract 32 Revenue from Long-term Contract - Project #1 33 Sales Revenue - Equipment 34 Dividend Income 35 Interest Income 36 Gain on sale of truck 37 Investment Income or Loss 45,796 675,000 425,000 100,000 89,100 100,000 175,000 45,000 2,500,000 2,000,000 480,205 3,166,449 250,000 4,000,000 2,000,000 1,688,431 5,685,690 6,862,075 32,500 15,500 Trial Balance At December 31, 2019 Debit Credit 2,000,000 480,205 3,166,449 Trial Balance At December 31, 2020 Debit Credit 2,000,000 1,688,431 5,685,690 6,862,075 32,500 15,500 Common Stock Retained Earnings Revenue from Long-term Contract Revenue from Long-term Contract - Project #1 Sales Revenue - Equipment Dividend Income Interest Income Gain on sale of truck Investment Income or Loss Unrealized Gain or Loss - OCI Cost of Goods Sold Construction Expenses Construction Expenses - Project #1 Equipment Rental (other expenses) Equipment Repairs (other expenses) Wages Payroll Tax Expense Interest Expense Utilities Insurance Expense Bad Debt Expense Commission Expense Advertising Expense Amortization Expense 5 Depreciation Expense 3,717,400 2,360,100 4,413,200 525,000 85,286 659,000 82,375 10,000 52,000 41,000 23,056 497,094 102,434 708,880 88,610 10,000 63,000 7.458 16,400 96,738 TOTALS $ 14,959,494 3 14,959,494 $ 0 15,688,5565 7 Net Income (Loss) B TOTAL 15,688,5565 0 9 O