Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please anwser You're creating a pro forma to obtain financing for your latest developoment pro ject, a 20 un it apartment building at the comer

Please anwser

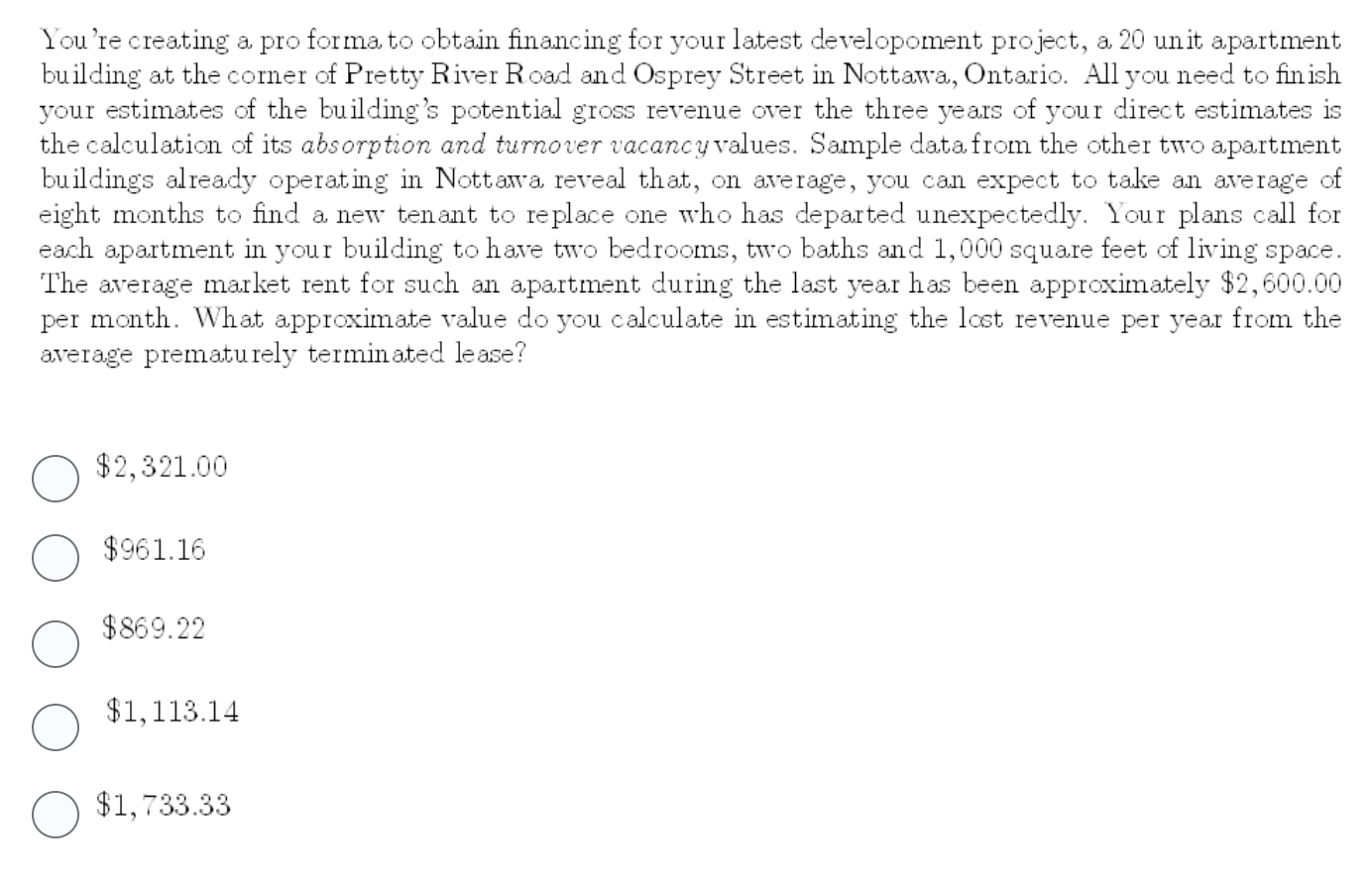

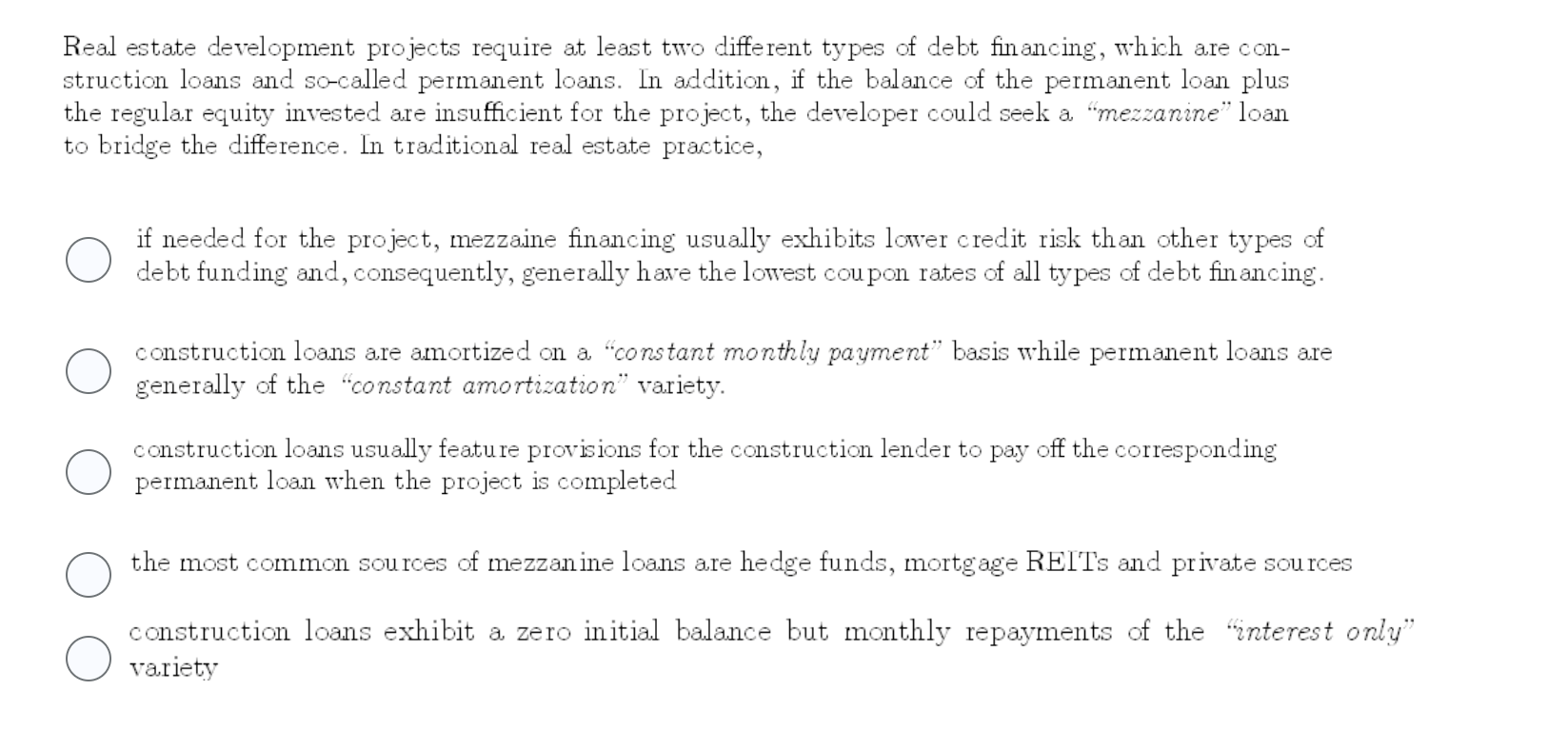

You're creating a pro forma to obtain financing for your latest developoment pro ject, a 20 un it apartment building at the comer of Pretty River Road and Osprey Street in Nottawa, Ontario. All you need to fin ish your estimates of the building's potential gross revenue over the three years of your direct estimates is the calculation of its absorption and turnover vacancy values. Sample data from the other two apartment buildings al ready operating in Nottawa reveal that, on average, you can expect to take an average of eight months to find a new tenant to replace one who has departed unexpectedly. Your plans call for each apartment in your building to have two bedrooms, two baths and 1,000 square feet of living space. The average market rent for such an apartment during the last year has been approximately $2,600.00 per month. What approximate value do you calculate in estimating the lost revenue per year from the average prematurely terminated lease? $2,321.00 $961.16 $869.22 $1,113.14 $1,733.33 Real estate development projects require at least two different types of debt financing, which are construction loans and so-called permanent loans. In addition, if the balance of the permanent loan plus the regular equity invested are insufficient for the project, the developer could seek a "mezzanine" loan to bridge the difference. In traditional real estate practice, if needed for the project, mezzaine financing usually exhibits lower credit risk than other types of debt funding and, consequently, generally have the lowest coupon rates of all types of debt financing: construction loans are amortized on a "constant monthly payment" basis while permanent loans are generally of the "constant amortization" variety. construction loans usually featu re provisions for the construction lender to pay off the corresponding: permanent loan when the project is completed the most common sources of mezzanine loans are hedge funds, mortgage REITs and private sources construction loans exhibit a zero initial balance but monthly repayments of the "interest only variety

You're creating a pro forma to obtain financing for your latest developoment pro ject, a 20 un it apartment building at the comer of Pretty River Road and Osprey Street in Nottawa, Ontario. All you need to fin ish your estimates of the building's potential gross revenue over the three years of your direct estimates is the calculation of its absorption and turnover vacancy values. Sample data from the other two apartment buildings al ready operating in Nottawa reveal that, on average, you can expect to take an average of eight months to find a new tenant to replace one who has departed unexpectedly. Your plans call for each apartment in your building to have two bedrooms, two baths and 1,000 square feet of living space. The average market rent for such an apartment during the last year has been approximately $2,600.00 per month. What approximate value do you calculate in estimating the lost revenue per year from the average prematurely terminated lease? $2,321.00 $961.16 $869.22 $1,113.14 $1,733.33 Real estate development projects require at least two different types of debt financing, which are construction loans and so-called permanent loans. In addition, if the balance of the permanent loan plus the regular equity invested are insufficient for the project, the developer could seek a "mezzanine" loan to bridge the difference. In traditional real estate practice, if needed for the project, mezzaine financing usually exhibits lower credit risk than other types of debt funding and, consequently, generally have the lowest coupon rates of all types of debt financing: construction loans are amortized on a "constant monthly payment" basis while permanent loans are generally of the "constant amortization" variety. construction loans usually featu re provisions for the construction lender to pay off the corresponding: permanent loan when the project is completed the most common sources of mezzanine loans are hedge funds, mortgage REITs and private sources construction loans exhibit a zero initial balance but monthly repayments of the "interest only variety Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started