Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please as soon as possible An institutional investor is comparing management fees for two competing real estate investment funds. Both funds expect to begin operations

please as soon as possible

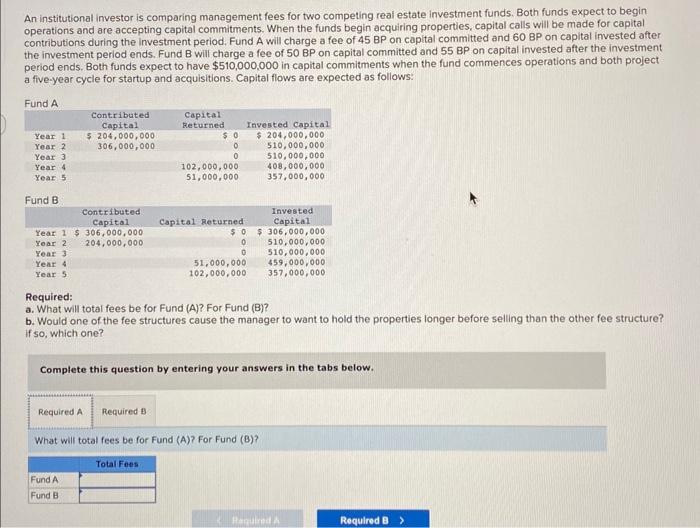

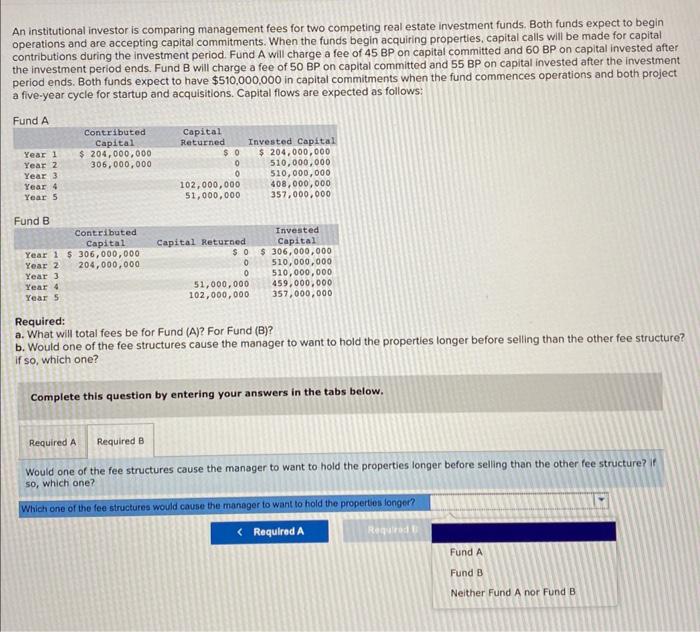

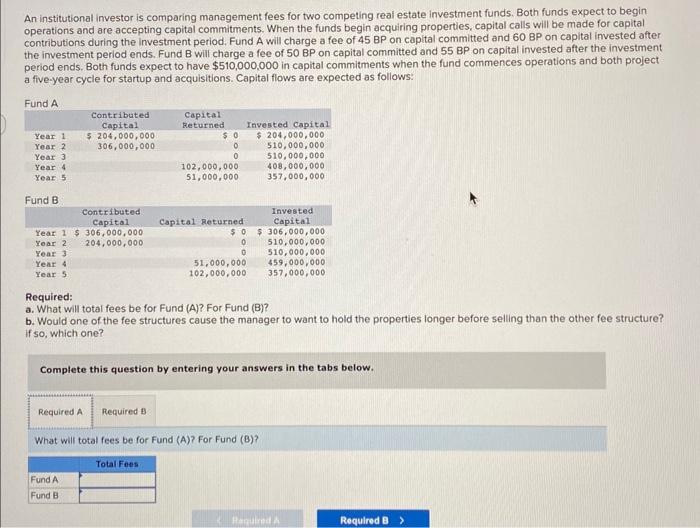

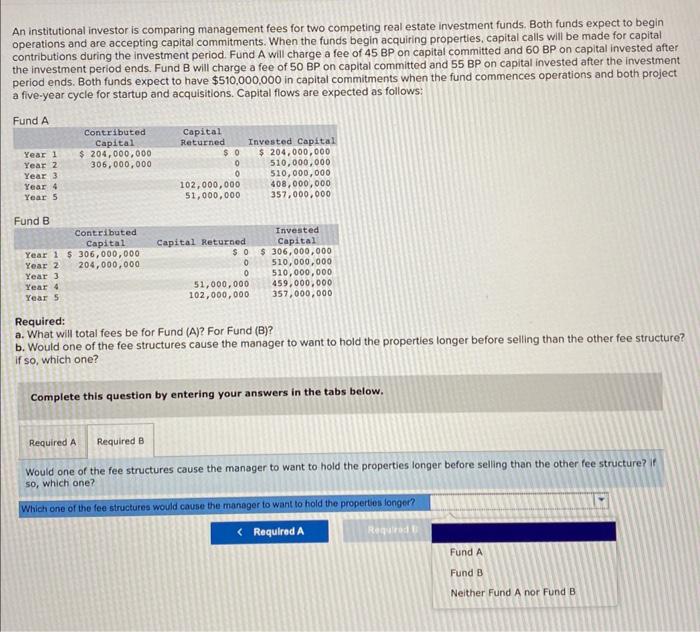

An institutional investor is comparing management fees for two competing real estate investment funds. Both funds expect to begin operations and are accepting capital commitments. When the funds begin acquiring properties, capital calls will be made for capital contributions during the investment period. Fund A will charge a fee of 45BP on capital committed and 60BP on capital invested after the investment period ends. Fund B will charge a fee of 50BP on capital committed and 55BP on capital invested after the investment period ends. Both funds expect to have $510,000,000 in capital commitments when the fund commences operations and both project a five-year cycle for startup and acquisitions. Capital flows are expected as follows: Required: a. What will total fees be for Fund (A)? For Fund (B)? b. Would one of the fee structures cause the manager to want to hold the properties longer before selling than the other fee structure? if so, which one? Complete this question by entering your answers in the tabs below. What will total fees be for Fund (A) ? For Fund (B) ? An institutional investor is comparing management fees for two competing real estate investment funds. Both funds expect to begin operations and are accepting capital commitments. When the funds begin acquiring properties, capital calls will be made for capital contributions during the investment period. Fund A will charge a fee of 45BP on capital committed and 60BP on capital invested after the investment period ends. Fund B will charge a fee of 50BP on capital committed and 55BP on capital invested after the investment period ends. Both funds expect to have $510,000,000 in capital commitments when the fund commences operations and both project a five-year cycle for startup and acquisitions. Capital flows are expected as follows: Required: a. What will total fees be for Fund (A)? For Fund (B)? b. Would one of the fee structures cause the manager to want to hold the properties longer before selling than the other fee structure? if so, which one? Complete this question by entering your answers in the tabs below. Would one of the fee structures cause the manager to want to hold the properties longer before selling than the other fee structure? if so, which one

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started