Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please ASAP Boeing Incorporation enters into a capital lease agreement as a lessee on January 1, 2019, to lease an airplane to Alpha Airlines. The

please ASAP

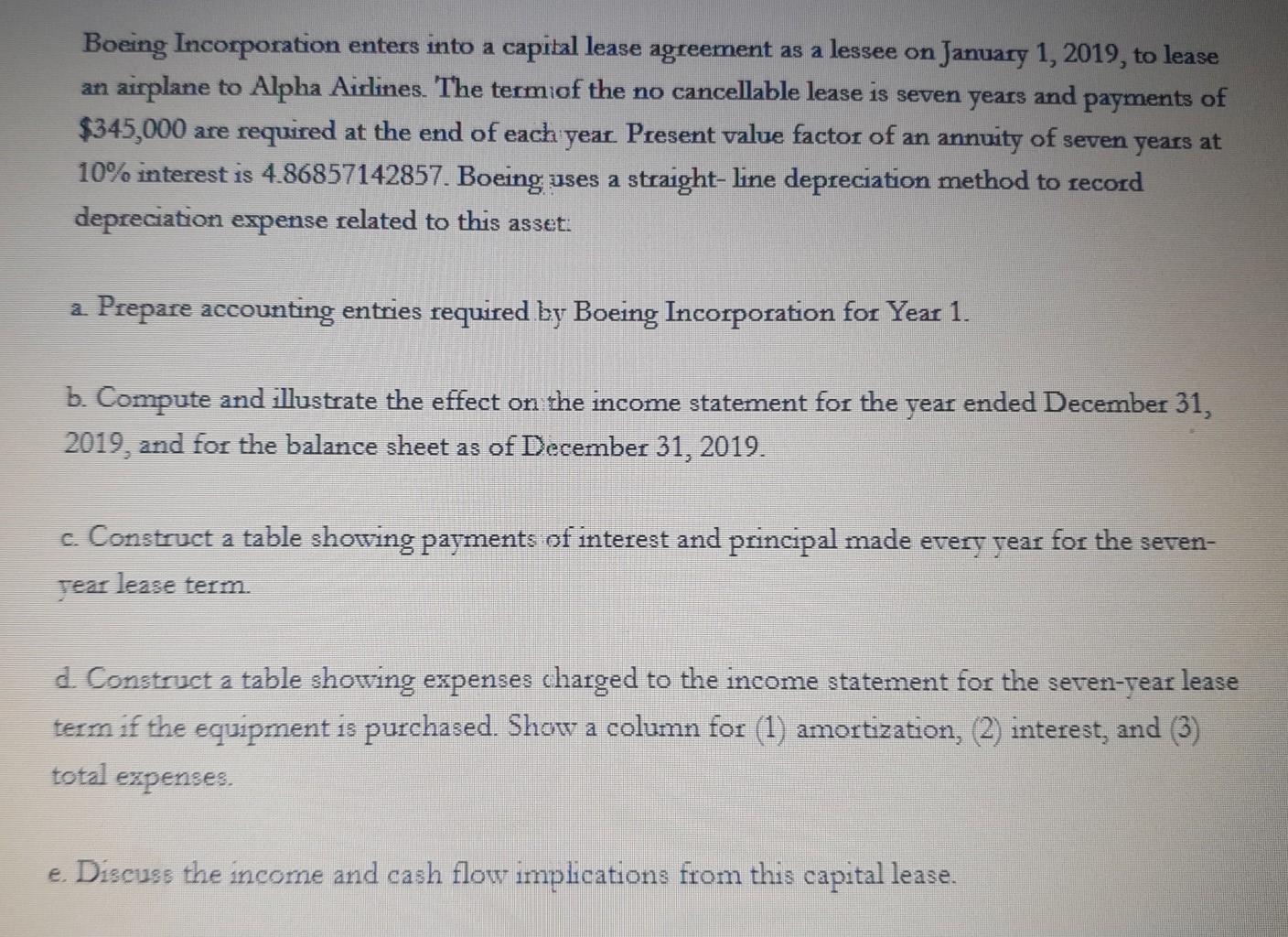

Boeing Incorporation enters into a capital lease agreement as a lessee on January 1, 2019, to lease an airplane to Alpha Airlines. The term of the no cancellable lease is seven years and payments of $345,000 are required at the end of each year Present value factor of an annuity of seven years at 10% interest is 4.86857142857. Boeing uses a straight-line depreciation method to record depreciation expense related to this asset: a Prepare accounting entries required by Boeing Incorporation for Year 1. b. Compute and illustrate the effect on the income statement for the year ended December 31, 2019, and for the balance sheet as of December 31, 2019. c. Construct a table showing payments of interest and principal made every year for the seven- Tear lease term d. Construct a table showing expenses charged to the income statement for the seven-year lease term if the equipment is purchased. Show a column for (1) amortization, (2) interest, and (3) total expenses. e. Discuss the income and cash flow implications from this capital leaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started