Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please assist 20000 24000 The Swift Company has just completed its operations for September 2005. The company's accountant resigned two weeks ago, subsequently a very

Please assist

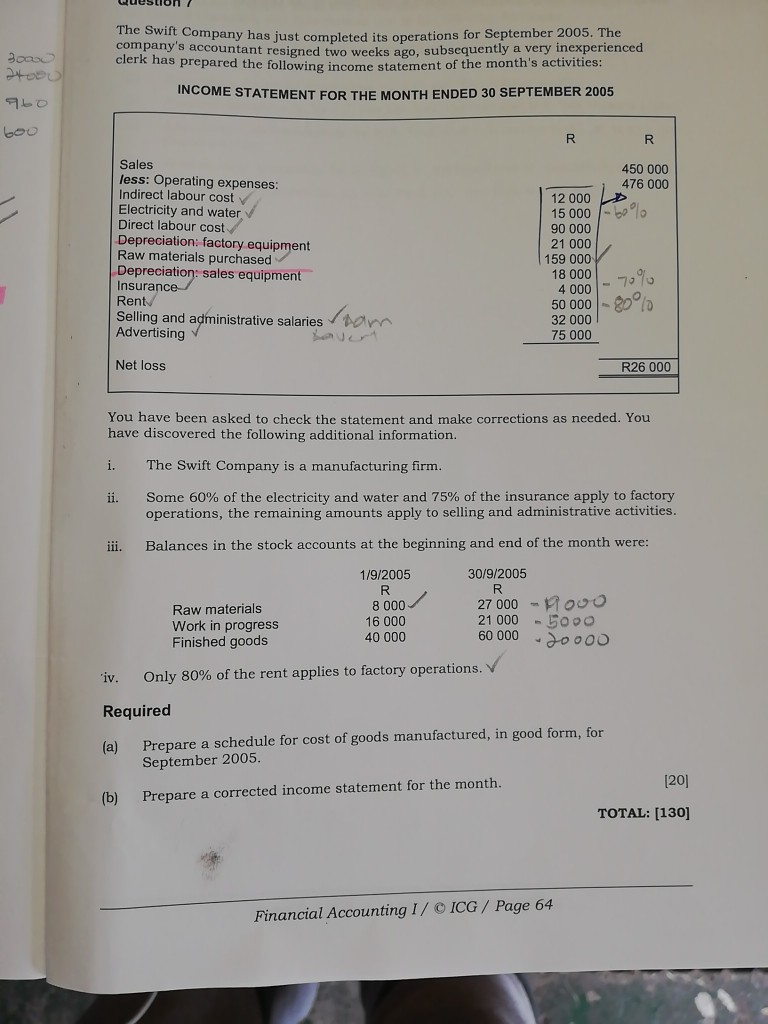

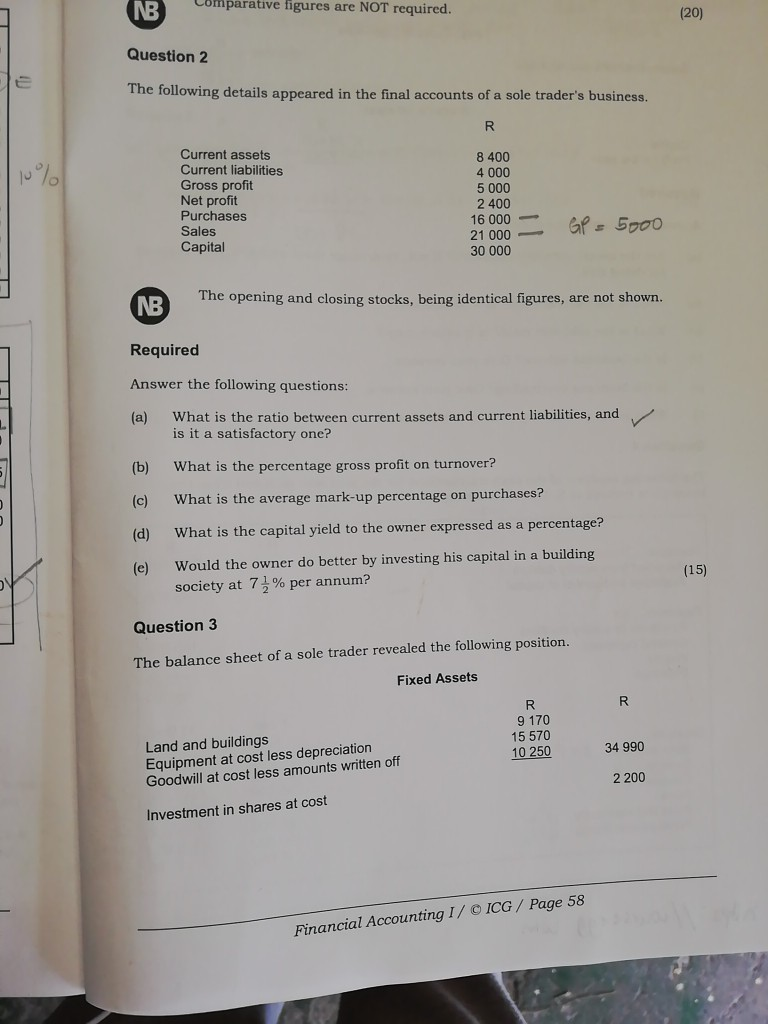

20000 24000 The Swift Company has just completed its operations for September 2005. The company's accountant resigned two weeks ago, subsequently a very inexperienced clerk has prepared the following income statement of the month's activities: INCOME STATEMENT FOR THE MONTH ENDED 30 SEPTEMBER 2005 960 600 R R Sales less: Operating expenses: Indirect labour cost Electricity and water Direct labour cost Depreciation: factory equipment Raw materials purchased Depreciation: sales equipment Insurance Rent 450 000 476 000 12 000 15 000 -100 90 000 21 000 159 000 18 000 4 000 50 000 - 80% 32 000 75 000 Selling and administrative salaries om Advertising Net loss R26 000 You have been asked to check the statement and make corrections as needed. You have discovered the following additional information. i. The Swift Company is a manufacturing firm. ii. Some 60% of the electricity and water and 75% of the insurance apply to factory operations, the remaining amounts apply to selling and administrative activities. Balances in the stock accounts at the beginning and end of the month were: 30/9/2005 Raw materials Work in progress Finished goods 1/9/2005 R 8 000 16 000 40 000 27 000 - Novo 21 000 - 5ooo 60 000 - 20000 'iv. Only 80% of the rent applies to factory operations. Required (a) Prepare a schedule for cost of goods manufactured, in good form, for September 2005. [20] (b) Prepare a corrected income statement for the month. TOTAL: [130] Financial Accounting I/ CICG / Page 64 NB Comparative figures are NOT required. (20) Question 2 The following details appeared in the final accounts of a sole trader's business. R 10% Current assets Current liabilities Gross profit Net profit Purchases Sales Capital 8 400 4 000 5 000 2 400 16 000 21 000 30 000 GP = 5000 ( The opening and closing stocks, being identical figures, are not shown. Required Answer the following questions: (a) What is the ratio between current assets and current liabilities, and is it a satisfactory one? (b) (c) What is the percentage gross profit on turnover? What is the average mark-up percentage on purchases? What is the capital yield to the owner expressed as a percentage? (d) (e) Would the owner do better by investing his capital in a building society at 72% per annum? (15) Question 3 The balance sheet of a sole trader revealed the following position. Fixed Assets R R 9 170 15 570 10 250 34 990 Land and buildings Equipment at cost less depreciation Goodwill at cost less amounts written off 2 200 Investment in shares at cost Financial Accounting I/ CICG / Page 58

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started