Answered step by step

Verified Expert Solution

Question

1 Approved Answer

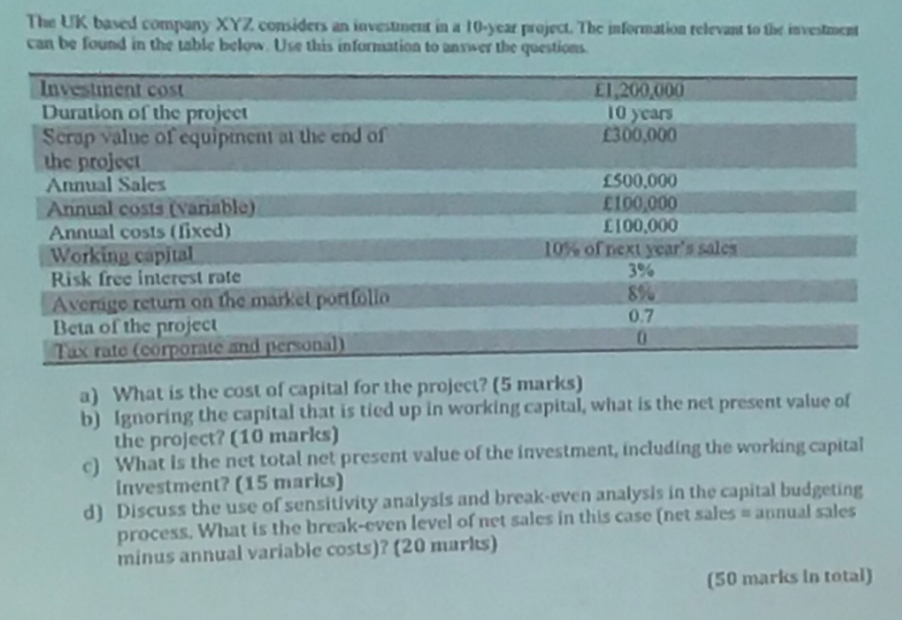

Please assist and help with the question, thank you!!! The UK based company XYZ comiders an investinent in a 10-year projeat. The information relevant to

Please assist and help with the question, thank you!!!

The UK based company XYZ comiders an investinent in a 10-year projeat. The information relevant to the invetcet can be found in the table below Use this information to answer the questions Investinent cost Duration of the project Scrap value of equipnent al the end of the project Annual Sales Annual costs (variable) Annual costs (fixed) Working capital Risk free interest rate Average return on the markel portfollo Beta of the project 1.200,000 10 years 2300,000 500,000 100,000 E100,000 10% ornext year'ssala. 3% 8% 0.7 What is the cost of capital for the project? (5 marks) the project? (10 marks) Investment? (15 marks process. What is the break-even level of net sales in this case (net sales annual sales a) b) Ignoring the capital that is tied up in working capital, what is the net present value of c) What is the net total net present value of the investment, including the working capital d) Discuss the use of sensitivity analysls and break-even analysis in the capital budgeting minus annual variable costs)? (20 marls) (50 marks In total) The UK based company XYZ comiders an investinent in a 10-year projeat. The information relevant to the invetcet can be found in the table below Use this information to answer the questions Investinent cost Duration of the project Scrap value of equipnent al the end of the project Annual Sales Annual costs (variable) Annual costs (fixed) Working capital Risk free interest rate Average return on the markel portfollo Beta of the project 1.200,000 10 years 2300,000 500,000 100,000 E100,000 10% ornext year'ssala. 3% 8% 0.7 What is the cost of capital for the project? (5 marks) the project? (10 marks) Investment? (15 marks process. What is the break-even level of net sales in this case (net sales annual sales a) b) Ignoring the capital that is tied up in working capital, what is the net present value of c) What is the net total net present value of the investment, including the working capital d) Discuss the use of sensitivity analysls and break-even analysis in the capital budgeting minus annual variable costs)? (20 marls) (50 marks In total)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started