Answered step by step

Verified Expert Solution

Question

1 Approved Answer

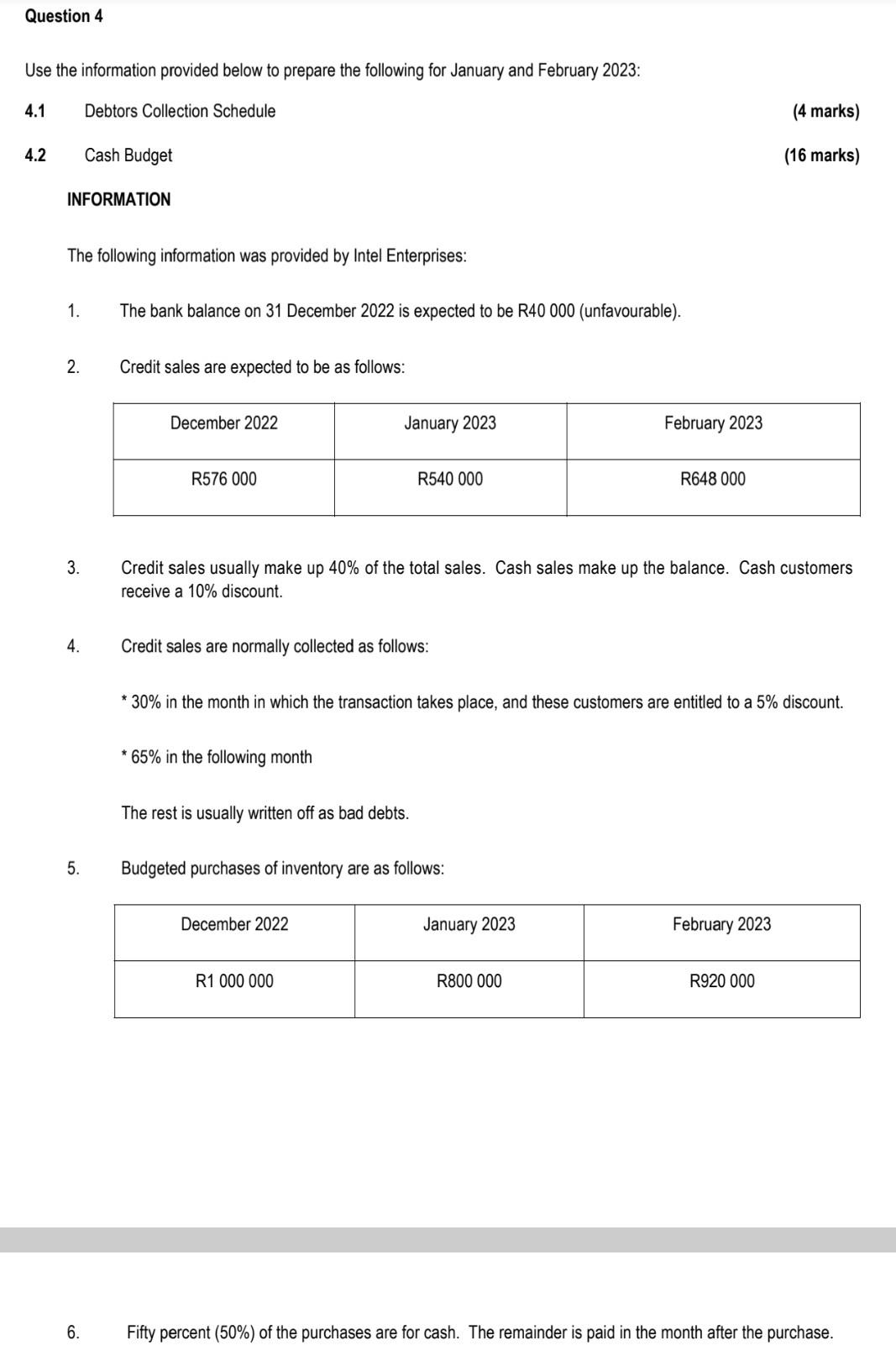

Please assist in answering all questions below Question 4 Use the information provided below to prepare the following for January and February 2023: 4.1 Debtors

Please assist in answering all questions below

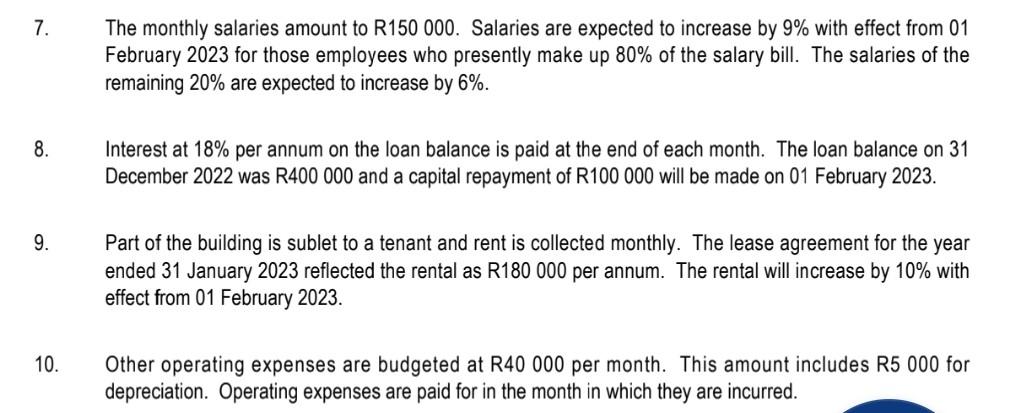

Question 4 Use the information provided below to prepare the following for January and February 2023: 4.1 Debtors Collection Schedule 4.2 INFORMATION The following information was provided by Intel Enterprises: 1. 2. 3. 4. Cash Budget 5. 6. The bank balance on 31 December 2022 is expected to be R40 000 (unfavourable). Credit sales are expected to be as follows: December 2022 R576 000 January 2023 Credit sales are normally collected as follows: * 65% in the following month R540 000 Credit sales usually make up 40% of the total sales. Cash sales make up the balance. Cash customers receive a 10% discount. The rest is usually written off as bad debts. December 2022 * 30% in the month in which the transaction takes place, and these customers are entitled to a 5% discount. Budgeted purchases of inventory are as follows: R1 000 000 February 2023 January 2023 R648 000 R800 000 (4 marks) (16 marks) February 2023 R920 000 Fifty percent (50%) of the purchases are for cash. The remainder is paid in the month after the purchase. 7. 8. 9. 10. The monthly salaries amount to R150 000. Salaries are expected to increase by 9% with effect from 01 February 2023 for those employees who presently make up 80% of the salary bill. The salaries of the remaining 20% are expected to increase by 6%. Interest at 18% per annum on the loan balance is paid at the end of each month. The loan balance on 31 December 2022 was R400 000 and a capital repayment of R100 000 will be made on 01 February 2023. Part of the building is sublet to a tenant and rent is collected monthly. The lease agreement for the year ended 31 January 2023 reflected the rental as R180 000 per annum. The rental will increase by 10% with effect from 01 February 2023. Other operating expenses are budgeted at R40 000 per month. This amount includes R5 000 for depreciation. Operating expenses are paid for in the month in which they are incurredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started