Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please assist in finalizing work and answers. Unsure if calculator inputs are correct. 3. Assume that your monthly mortgage payment is $2,000. The original mortgage

Please assist in finalizing work and answers. Unsure if calculator inputs are correct.

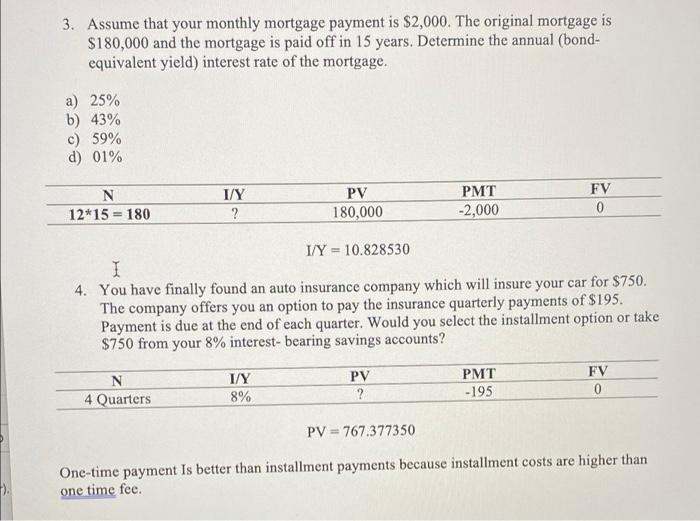

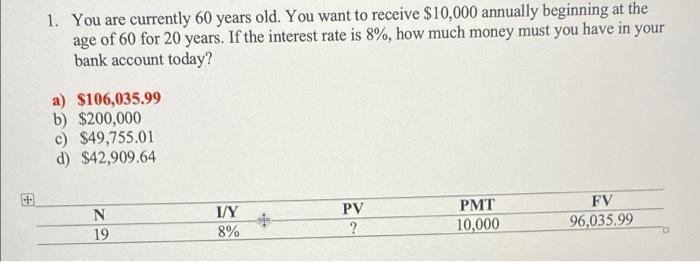

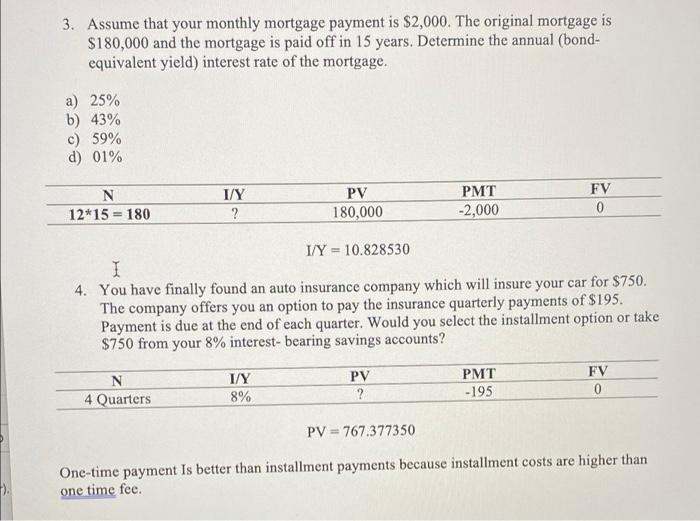

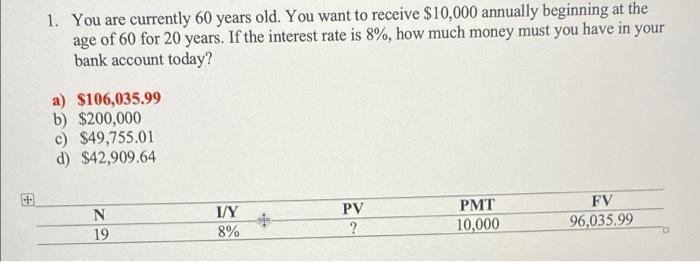

3. Assume that your monthly mortgage payment is $2,000. The original mortgage is $180,000 and the mortgage is paid off in 15 years. Determine the annual (bond- equivalent yield) interest rate of the mortgage. a) 25% b) 43% c) 59% d) 01% N I/Y FV PV 180,000 PMT -2,000 12*15= 180 ? 0 I/Y 10.828530 = I 4. You have finally found an auto insurance company which will insure your car for $750. The company offers you an option to pay the insurance quarterly payments of $195. Payment is due at the end of each quarter. Would you select the installment option or take $750 from your 8% interest- bearing savings accounts? N I/Y PMT FV PV ? 4 Quarters 8% -195 0 PV=767.377350 One-time payment Is better than installment payments because installment costs are higher than one time fee. 1. You are currently 60 years old. You want to receive $10,000 annually beginning at the age of 60 for 20 years. If the interest rate is 8%, how much money must you have in your bank account today? a) $106,035.99 b) $200,000 c) $49,755.01 d) $42,909.64 N PV PMT 10,000 FV 96,035.99 19 ? I/Y 8%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started