Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please assist Maloney, Inc., a manufacturer of plastic products, reports Maloney, Inc., produced 70,000 units of product the following manufacturing costs and account analysis in

please assist

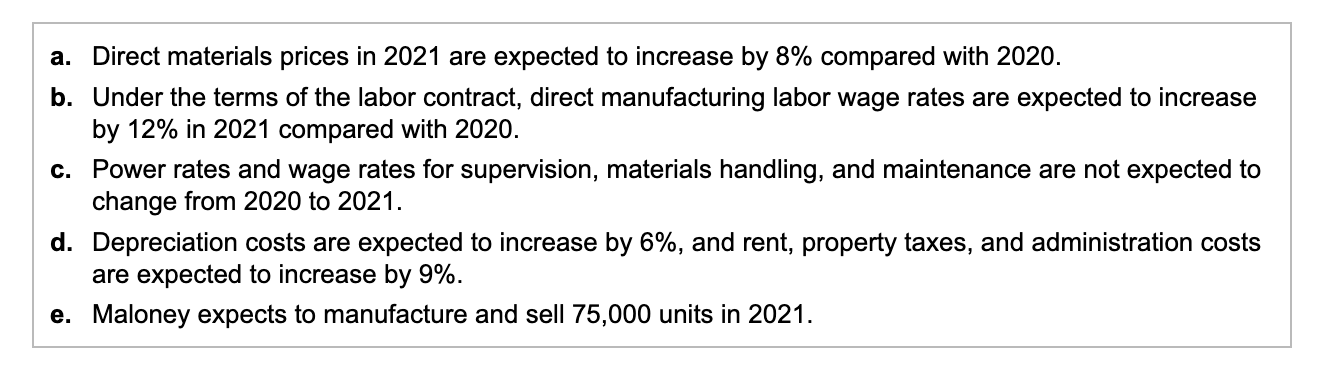

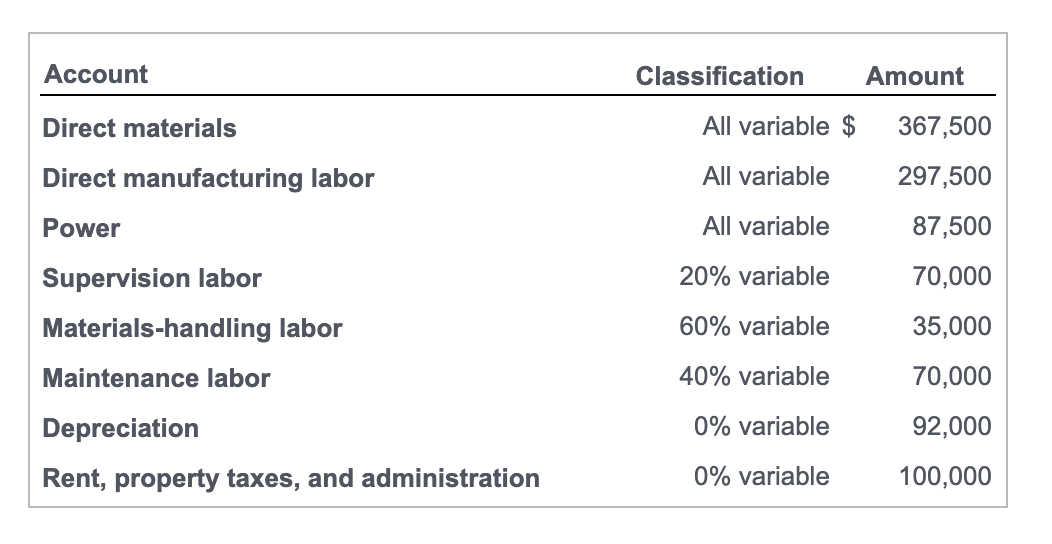

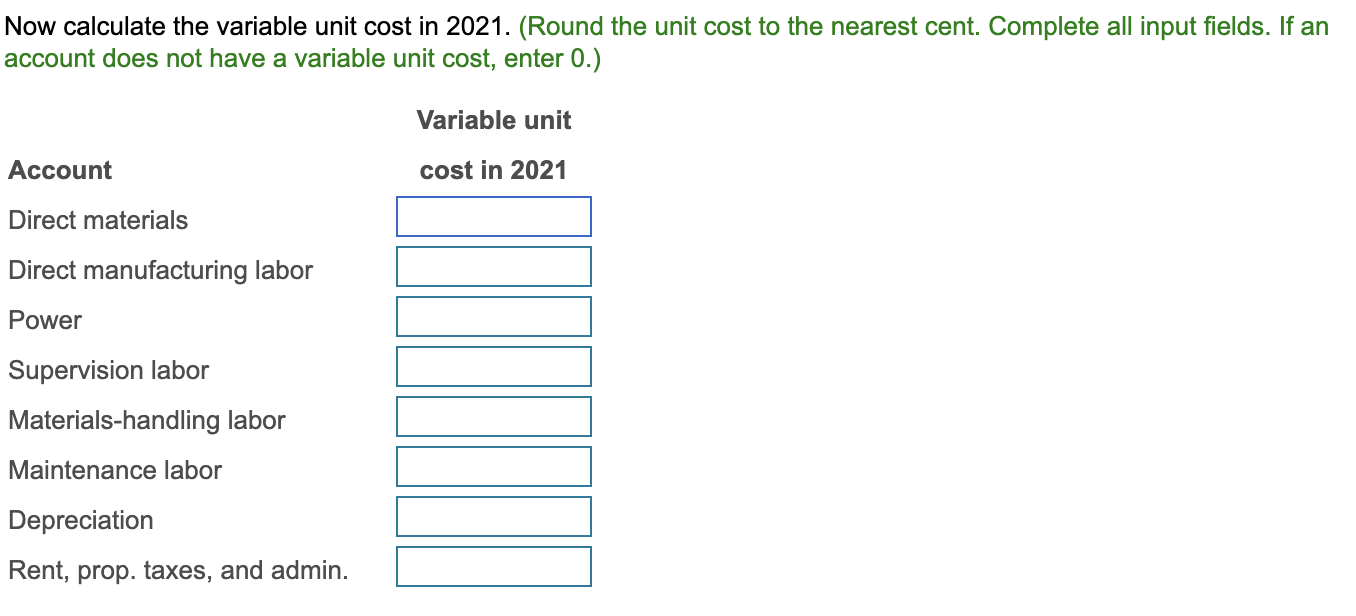

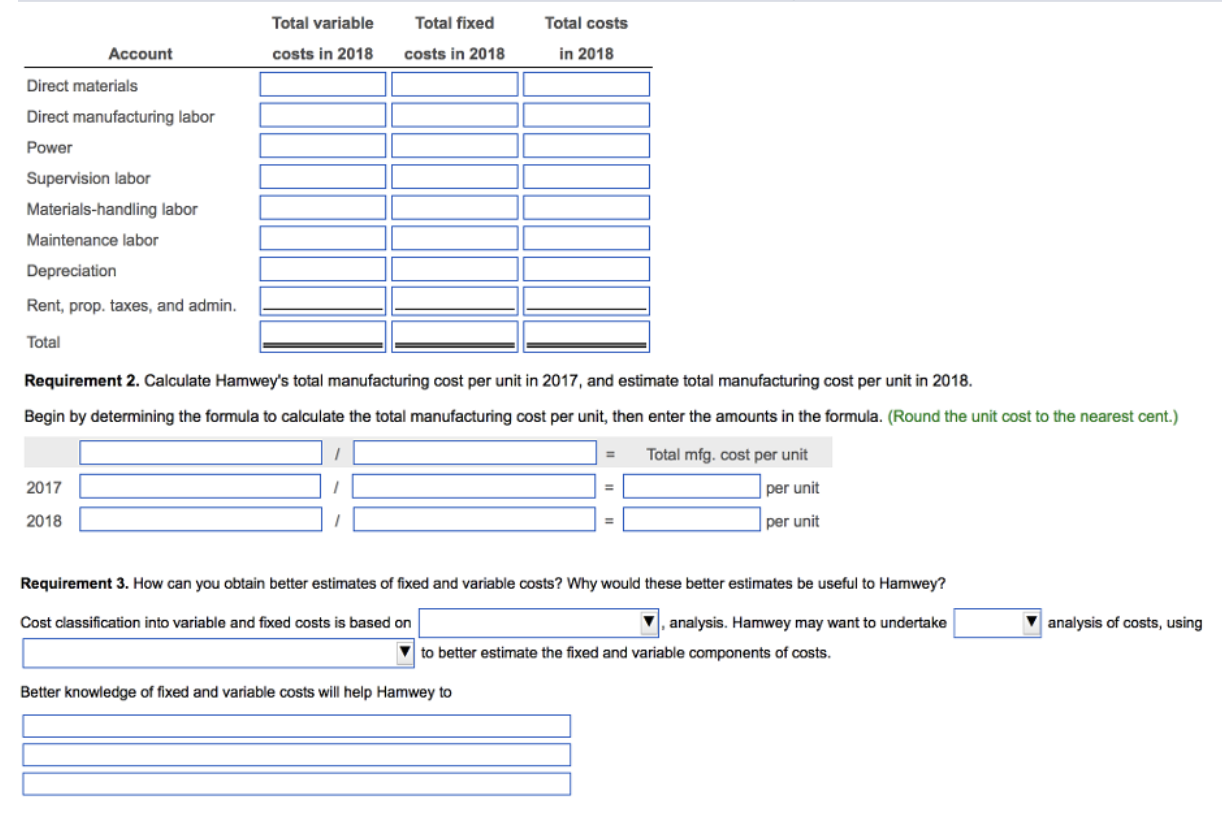

Maloney, Inc., a manufacturer of plastic products, reports Maloney, Inc., produced 70,000 units of product the following manufacturing costs and account analysis in 2020. Maloney's management is estimating classification for the year ended December 31, 2020. costs for 2021 on the basis of 2020 numbers. The (Click the icon to see the account information.) following additional information is available for 2021. (Click the icon to see the a. Direct materials prices in 2021 are expected to increase by 8% compared with 2020 . b. Under the terms of the labor contract, direct manufacturing labor wage rates are expected to increase by 12% in 2021 compared with 2020 . c. Power rates and wage rates for supervision, materials handling, and maintenance are not expected to change from 2020 to 2021. d. Depreciation costs are expected to increase by 6%, and rent, property taxes, and administration costs are expected to increase by 9%. e. Maloney expects to manufacture and sell 75,000 units in 2021 . \begin{tabular}{lrr} Account & Classification & \multicolumn{1}{c}{ Amount } \\ \hline Direct materials & All variable $ & 367,500 \\ Direct manufacturing labor & All variable & 297,500 \\ Power & All variable & 87,500 \\ Supervision labor & 20% variable & 70,000 \\ Materials-handling labor & 60% variable & 35,000 \\ Maintenance labor & 40% variable & 70,000 \\ Depreciation & 0% variable & 92,000 \\ Rent, property taxes, and administration & 0% variable & 100,000 \end{tabular} Now calculate the variable unit cost in 2021. (Round the unit cost to the nearest cent. Complete all input fields. If an account does not have a variable unit cost, enter 0 .) Requirement 3. How can you obtain better estimates of fixed and variable costs? Why would these better estimates be useful to Hamwey? Cost classification into variable and fixed costs is based on , analysis. Hamwey may want to undertake analysis of costs, using to better estimate the fixed and variable components of costs. Better knowledge of fixed and variable costs will help Hamwey toStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started