Please assist me

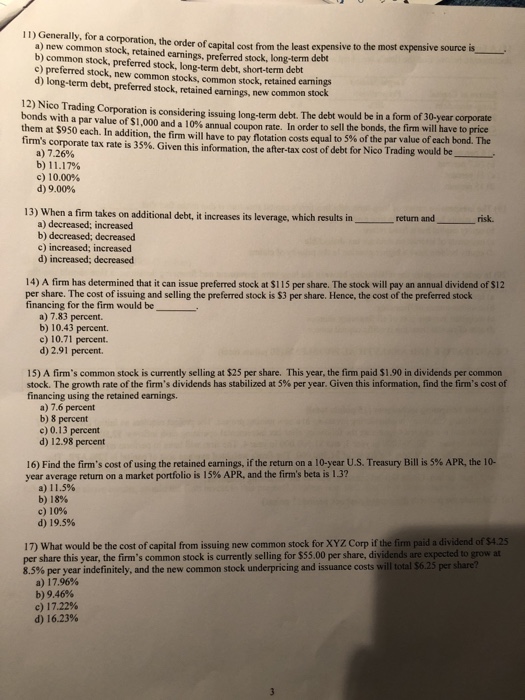

11) Generally, for a corporation, the order of capital cost from the least expensive to the most expensive source a) new common stock, retained earnings, preferred stock, long-term debt b) common stock, preferred stock, long-term debt, short-term debt c) preferred stock, new common stocks, common stock, retained earmimgs d) long-term debt, preferred stock, retained earnings, new common stock 12) Nico Trading Corporation is considering issuing long-term debt. The debt would be in a form of 30-year corporate bonds with a par value of $1,000 and a 10%annual coupon rate. them at $950 each. In addition, the firm will have to pay flotation costs equal firm's corporate tax rate is 35%. Given this information, the after-tax cost of debt for Nico Trading would be r In order to sell the bonds, the firm will have to price to 5% of the par value of each bond. The a) 7.26% b) 11.17% c) 10.00% d) 9.00% 13) When a firm takes on additional debt, it increases its leverage which results in return and risk. a) decreased; increased b) decreased, decreased c) increased; increased d) increased; decreased 14) A firm has determined that it can issue preferred stock at $115 per share. The stock will pay an annual dividend of $12 per share. The cost of issuing and selling the preferred stock is $3 per share. Hence, the cost of the preferred stock financing for the firm would be a) 7.83 percent. b) 10.43 percent c) 10.71 percent. d) 2.91 percent 15) A firm's common stock is currently selling at S25 per share. This year, the firm paid $1.90 in dividends per common stock. The growth rate of the firm's dividends has stabilized at 5% per year. Given this information, find the firm's cost of financing using the retained earnings a) 7.6 percent b) 8 percent c) 0.13 percent d) 12.98 percent 16) Find the firm's cost of using the retained earnings, if the return on a 10-year U.S. Treasury Bill is 5% APR, the 10- year average return on a market portfolio is 15% APR, and the firm's beta is 1.3? a) 1 1.5% b) 18% c) 10% d) 19.5% 17) What would be the cost of capital from issuing new common stock for XYZ Corp if the firm paid a dividend of S per share this year, the firm's common stock is currently selling for $55.00 per share, dividends are expected to grow at 8.5% per year indefinitely, and the new common stock underpricing and issuance costs will total S6.25 per share? a) 17.96% b) 9.46% c) 17.22% d) 16.23%