Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please assist me thank you very Question (25) Jangor olyclic is a Bricks enterprise that produces Advanced bricks which is based in Matango Township, a

please assist me thank you very

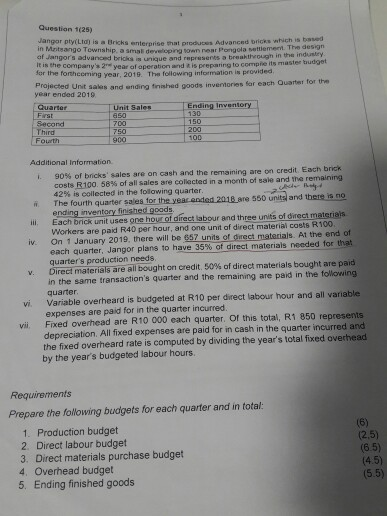

Question (25) Jangor olyclic is a Bricks enterprise that produces Advanced bricks which is based in Matango Township, a sms developing town near Pongola settlement. The design of Jangor's advanced brick is unique and represents a breakthrough in the industry It is the company's 2 year of operation and is preparing to comprelis master budget for the forthcoming year, 2010. The following information is provided Projected Unit sales and ending finished goods inventories for each Quarter for the year ended 2019 Quarter Unit Sales Ending Inventory First 650 130 Second 700 150 Third 750 200 Fourth 900 100 Additional Information 90% of bricks' sales are on cash and the remaining are on credit. Each brick costs R100.58% of all sales are collected in a month of sale and the remaining 42% is collected in the following quarter. The fourth quarter sales for the year ended 2018 are 550 units and there is no ending inventory finished goods ill Each brick unit uses one hour of direct labour and three units of direct materials Workers are paid R40 per hour, and one unit of direct material costs R100. iv. On 1 January 2019, there will be 657 units of direct materials. At the end of each quarter, Jangor plans to have 35% of direct materials needed for that quarter's production needs Direct materials are all bought on credit 50% of direct materials bought are paid in the same transaction's quarter and the remaining are paid in the following quarter vi Variable overheard is budgeted at R10 per direct labour hour and all variable expenses are paid for in the quarter incurred. vill Fixed overhead are R10 000 each quarter. Of this total, R1 850 represents depreciation. All fixed expenses are paid for in cash in the quarter incurred and the fixed overheard rate is computed by dividing the year's total fixed overhead by the year's budgeted labour hours. V. (6) Requirements Prepare the following budgets for each quarter and in total: 1. Production budget 2. Direct labour budget 3. Direct materials purchase budget 4. Overhead budget 5. Ending finished goods (2.5) (6.5) (45) (5.5)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started