Please assist me with answering questions 1-3. Please provide any excel work that may have been used or any way to work the problems out.

Thanks,

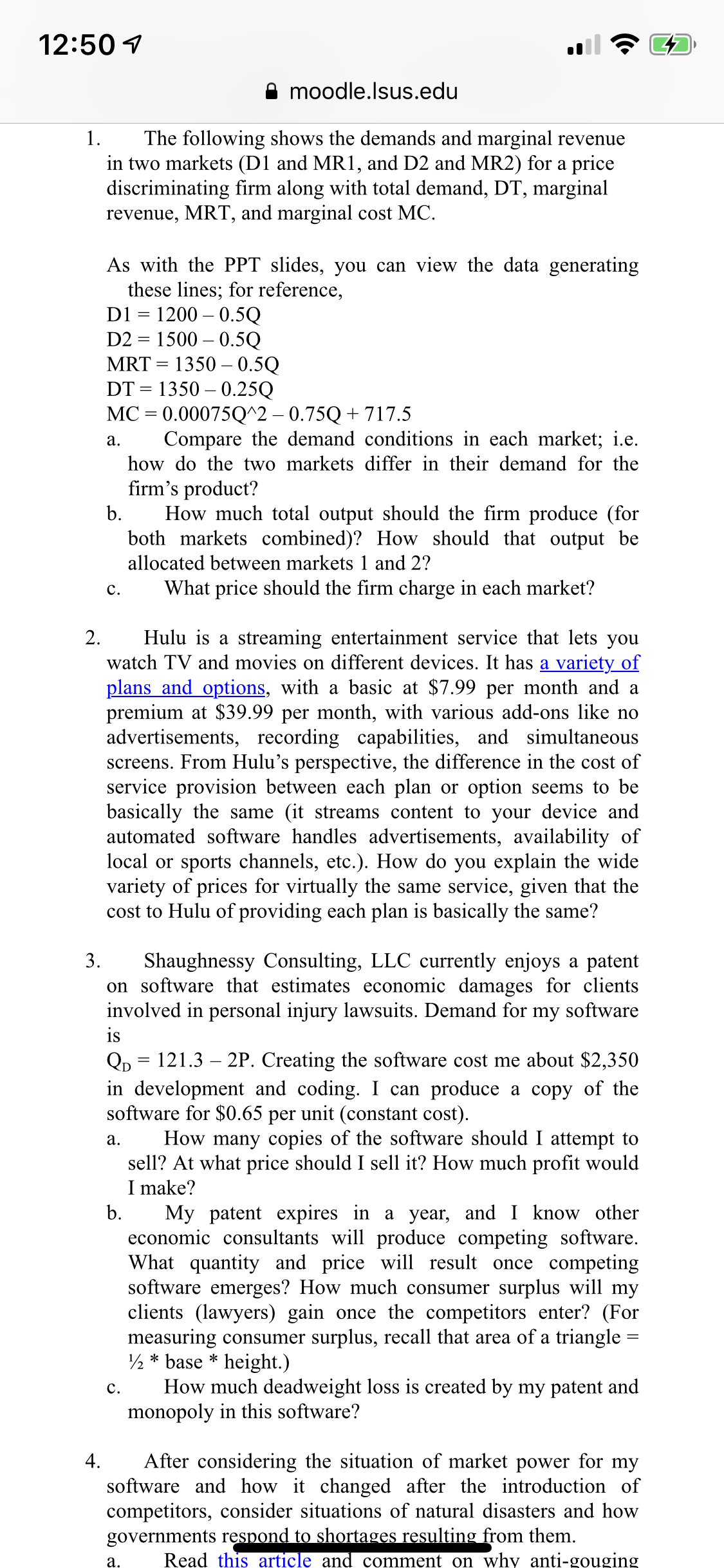

12150 4 .u'; . '5' @1' moodle.lsus.edu 1. The following shows the demands and marginal revenue in two markets (D1 and MR] , and D2 and MR2) for a price discriminating rm along with total demand, DT, marginal revenue, MRT, and marginal cost MC. As with the PPT slides, you can view the data generating these lines; for reference, D1 : 1200 0.5Q D2 = 1500 0.5Q MRT = 1350 0.5Q DT = 1350 0.25Q MC = 0.00075QA2 , 0.75Q + 717.5 3. Compare the demand conditions in each market; i.e. how do the two markets differ in their demand for the rm's product? b. How much total output should the rm produce (for both markets combined)? How should that output be allocated between markets 1 and 2? c. What price should the rm charge in each market? Hulu is a streaming entertainment service that lets you watch TV and movies on different devices. It has a variety of plans and 01m, with a basic at $7.99 per month and a premium at $39.99 per month, with various add-ons like no advertisements, recording capabilities, and simultaneous screens. From Hulu's perspective, the difference in the cost of service provision between each plan or option seems to be basically the same (it streams content to your device and automated software handles advertisements, availability of local or sports channels, etc.). How do you explain the wide variety of prices for virtually the same service, given that the cost to Hulu of providing each plan is basically the same? Shaughnessy Consulting, LLC currently enjoys a patent on software that estimates economic damages for clients involved in personal injury lawsuits. Demand for my software 15 Q, = 121.3 2P. Creating the software cost me about $2,350 in development and coding. I can produce a copy of the software for $0.65 per unit (constant cost). a. How many copies of the software should I attempt to sell? At what price should I sell it? How much prot would I make? b. My patent expires in a year, and I know other economic consultants will produce competing software. What quantity and price will result once competing software emerges? How much consumer surplus will my clients (lawyers) gain once the competitors enter? (For measuring consumer surplus, recall that area of a triangle = '/z * base * height.) c. How much deadweight loss is created by my patent and monopoly in this software? After considering the situation of market power for my software and how it changed after the introduction of competitors, consider situations of natural disasters and how governments respgnd g h9 rening from them. a. Read thls artic e an comment on whv anti-gouging