Answered step by step

Verified Expert Solution

Question

1 Approved Answer

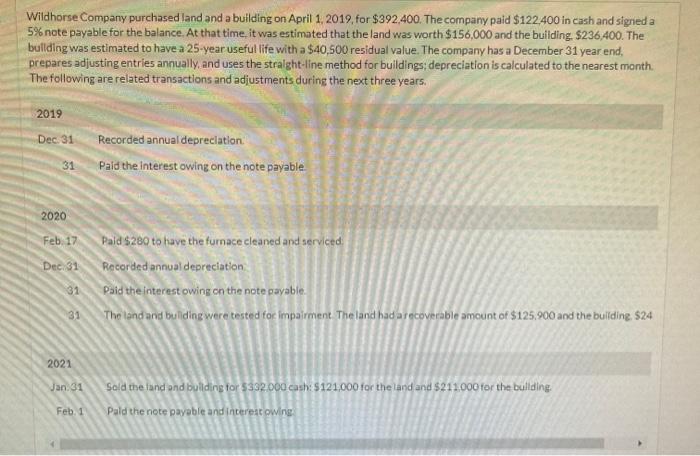

please assist me with my third question thanks Wildhorse Company purchased land and a building on April 1, 2019, for $392,400. The company paid $122.400

please assist me with my third question

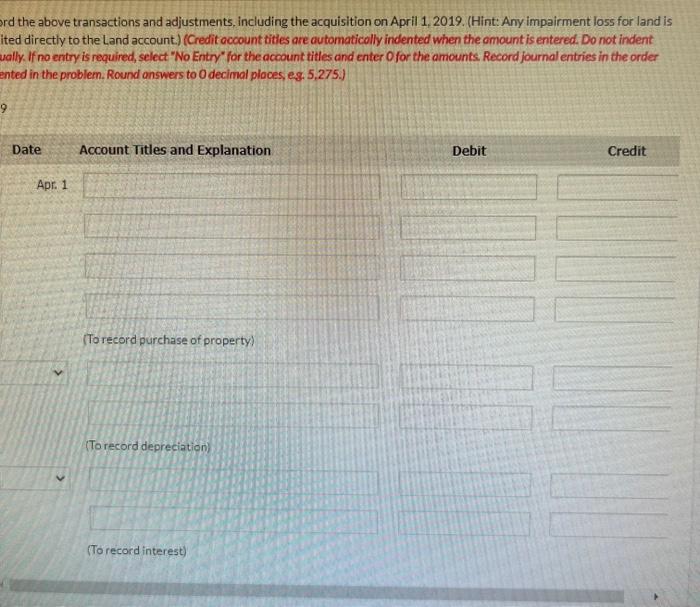

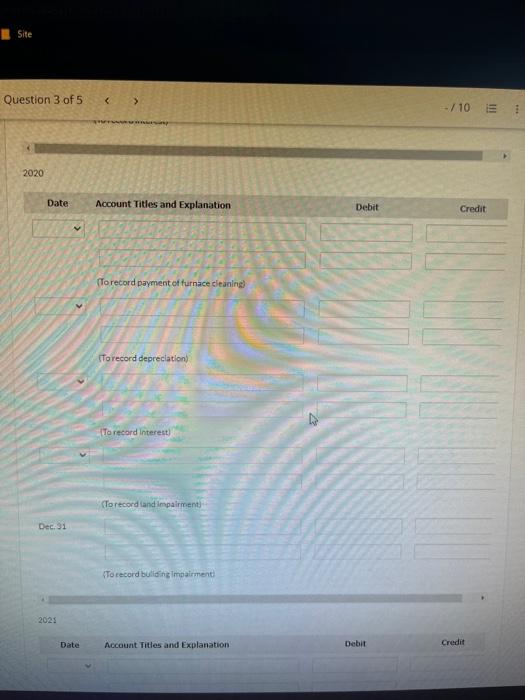

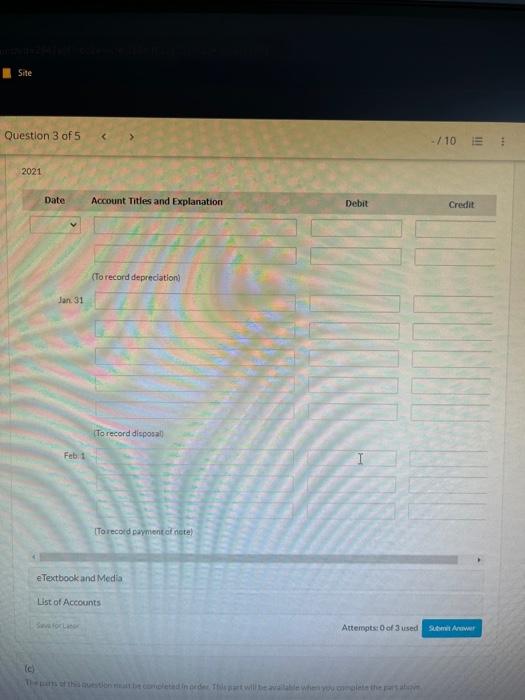

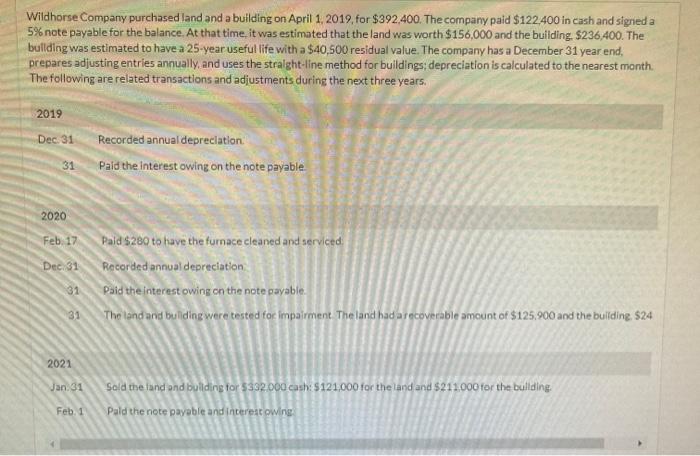

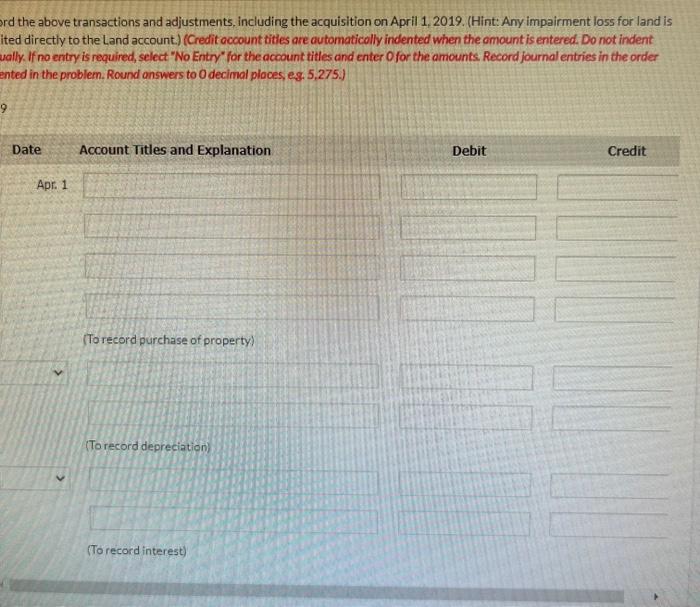

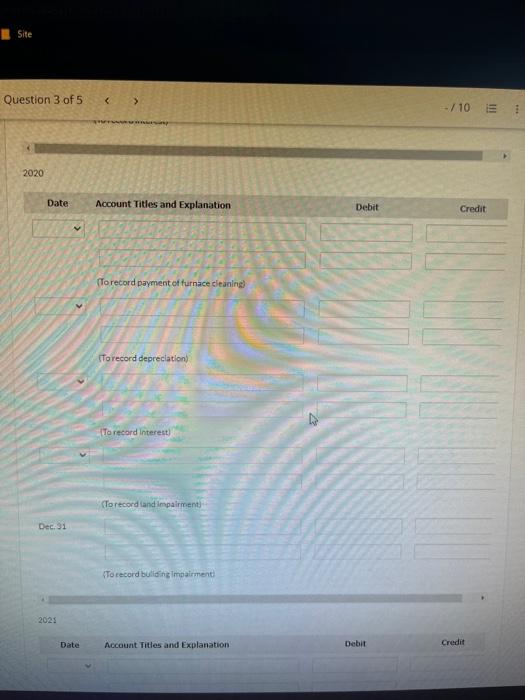

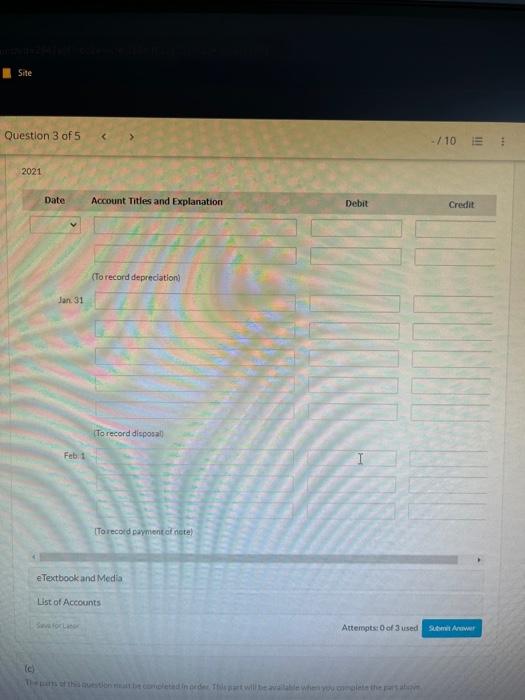

Wildhorse Company purchased land and a building on April 1, 2019, for $392,400. The company paid $122.400 in cash and signed a 5% note payable for the balance. At that time, it was estimated that the land was worth $156,000 and the building. $236,400. The building was estimated to have a 25-year useful life with a $40,500 residual value. The company has a December 31 year end, prepares adjusting entries annually, and uses the straight-line method for buildings; depreciation is calculated to the nearest month. The following are related transactions and adjustments during the next three years. 2019 Dec 31 Recorded annual depreciation. 31 Paid the interest owing on the note payable Feb. 17 Paid $280 to have the furnace cleaned and serviced Dec 31 Recorded annual depreciation 31 Paid the interest owing on the note payable. 31 The land and building were tested for impairment. The land had a recoverable amount of $125,900 and the building. $24 Sold the land and building for $332.000 cash: $121.000 for the land and $211.000 for the building Pald the note payable and interest owing 2020 2021 Jan 31 Feb. 1 ord the above transactions and adjustments, including the acquisition on April 1, 2019. (Hint: Any impairment loss for land is ited directly to the Land account.) (Credit account titles are automatically indented when the amount is entered. Do not indent ually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order ented in the problem. Round answers to 0 decimal places, eg. 5,275.) Date Account Titles and Explanation Debit Credit (To record purchase of property) (To record depreciation) (To record interest) Apr. 1 Site Question 3 of 5 2020 Date: Account Titles and Explanation (To record payment of furnace cleaning) To record depreciation) To record interest) (To record land impairment) (To record building Impairment Account Titles and Explanation Dec. 31 2021 V Date Debit bit -/10 E Credit III Credit *** Site Question 3 of 5 2021 Account Titles and Explanation (To record depreciation) (To record disposal) To record payment of note) i eTextbook and Media List of Accounts Seva for Lar (c) The parts of this question mit be completed in order. This part will be available when you complete the pars ali Date Jan 31 Feb 1 -/10 Debit III Credit Attempts: 0 of 3 used Submit thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started