Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please assist me with part b and c of the problem. Americo's Earnings and the Fall of the Dollar. Americo is a U.S.-based multinational manufacturing

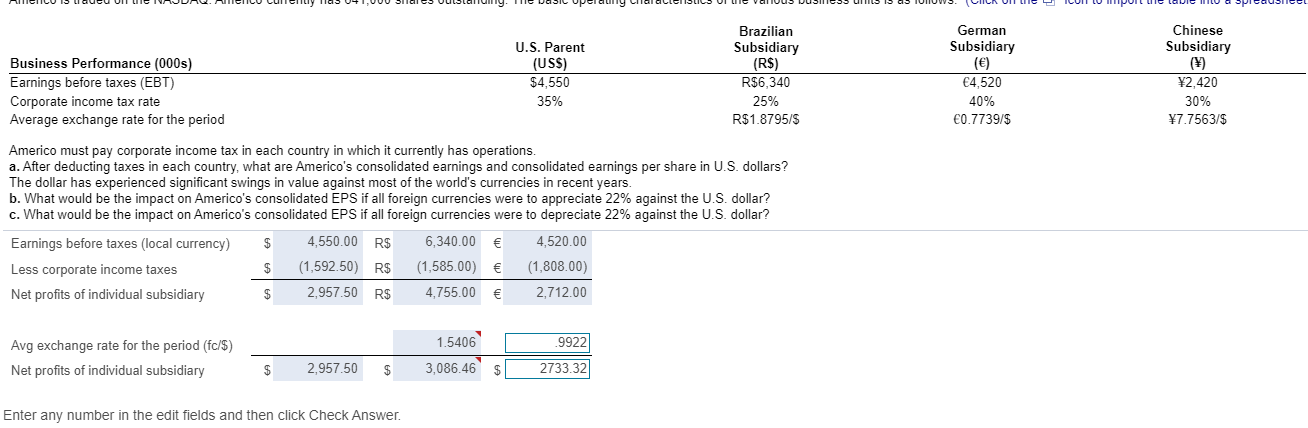

Please assist me with part b and c of the problem. Americo's Earnings and the Fall of the Dollar. Americo is a U.S.-based multinational manufacturing firm with wholly-owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Americo is traded on the NASDAQ. Americo currently has

Please assist me with part b and c of the problem. Americo's Earnings and the Fall of the Dollar. Americo is a U.S.-based multinational manufacturing firm with wholly-owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Americo is traded on the NASDAQ. Americo currently has

641 comma 000641,000

shares outstanding. The basic operating characteristics of the various business units is as follows

TILUS LICU UIT DR. welILU Lunelliy las 04 1,000 Slalo Uustaluny. Te DubIL Upel ally cual alle SLILS UI ile ValUUS UUSIllos U S 15 05 IUNIUWS. CILA UIT Lil Y ICUIT LUMIVUIL lile laule LU a Spieaugieel Chinese Subsidiary Business Performance (000s) Earnings before taxes (EBT) Corporate income tax rate Average exchange rate for the period U.S. Parent (USS) $4,550 35% Brazilian Subsidiary (R$) R$6,340 25% R$1.8795/5 German Subsidiary () 4,520 40% 0.7739/$ 2,420 30% 7.7563/$ Americo must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? The dollar has experienced significant swings in value against most of the world's currencies in recent years. b. What would be the impact on Americo's consolidated EPS if all foreign currencies were to appreciate 22% against the U.S. dollar? c. What would be the impact on Americo's consolidated EPS if all foreign currencies were to depreciate 22% against the U.S. dollar? Earnings before taxes (local currency) $ 4,550.00 R$ 6,340.00 4,520.00 Less corporate income taxes $ (1,592.50) R$ (1,585.00) (1,808.00) Net profits of individual subsidiary $ 2,957.50 R$ 4,755.00 2,712.00 Avg exchange rate for the period (fc/5) Net profits of individual subsidiary 1.5406 3,086.46 9922 2733.32 $ 2,957.50 $ $_ Enter any number in the edit fields and then click CheckStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started