Answered step by step

Verified Expert Solution

Question

1 Approved Answer

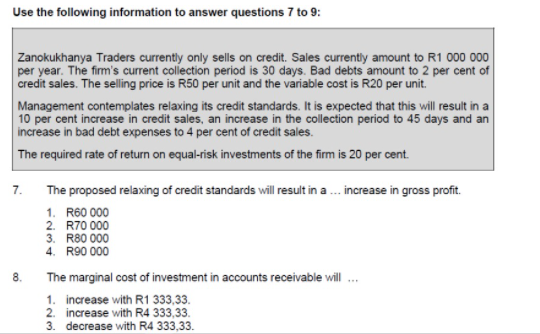

Please assist me with Question 8 Thank you Use the following information to answer questions 7 to 9: Zanokukhanya Traders currently only sells on credit.

Please assist me with Question 8

Thank you

Use the following information to answer questions 7 to 9: Zanokukhanya Traders currently only sells on credit. Sales currently amount to R1 000 000 per year. The firm's current collection period is 30 days. Bad debts amount to 2 per cent of credit sales. The selling price is R50 per unit and the variable cost is R20 per unit. Management contemplates relaxing its credit standards. It is expected that this will result in a 10 per cent increase in credit sales, an increase in the collection period to 45 days and an increase in bad debt expenses to 4 per cent of credit sales. The required rate of return on equal-risk investments of the firm is 20 per cent. 7. The proposed relaxing of credit standards will result in a ... increase in gross profit. 1. R60 000 2. R70 000 3. R80 000 4. R90 000 The marginal cost of investment in accounts receivable will 1. increase with R1 333,33. 2. increase with R4 333,33. 3. decrease with R4 333,33. BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started