Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do all, last question of the month and have this due before friday, will leave up a good rating 10. Phillipe Isnaes bought a

please do all, last question of the month and have this due before friday, will leave up a good rating

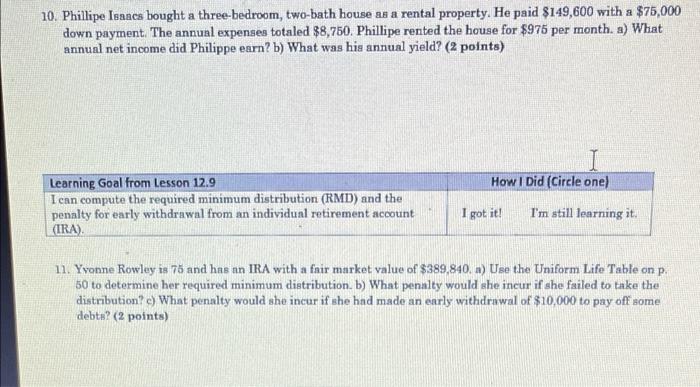

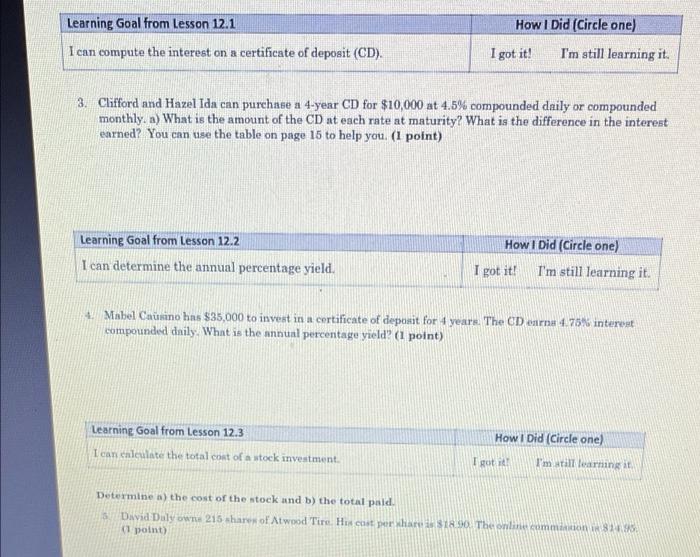

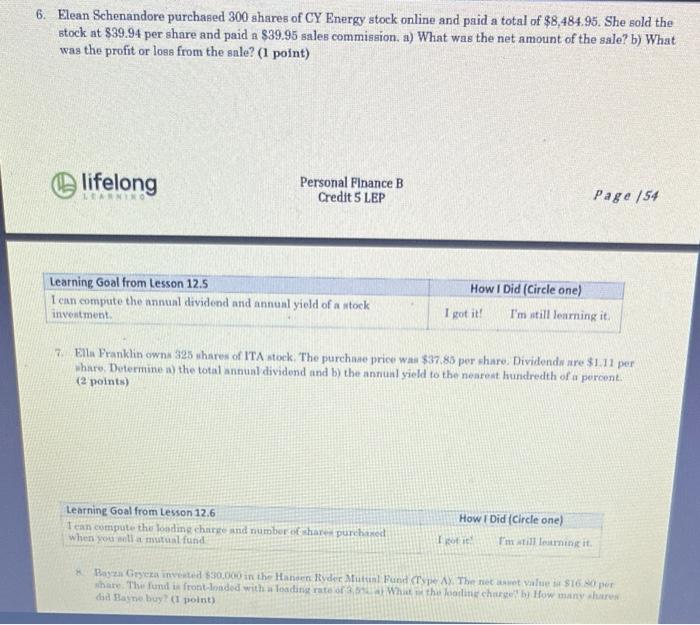

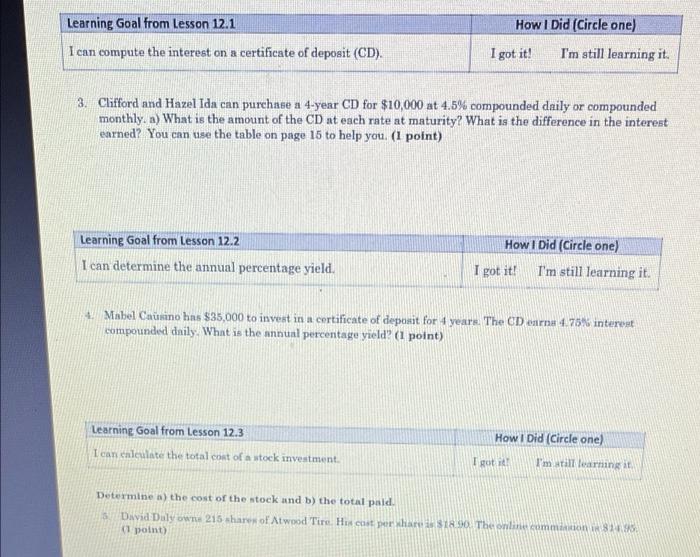

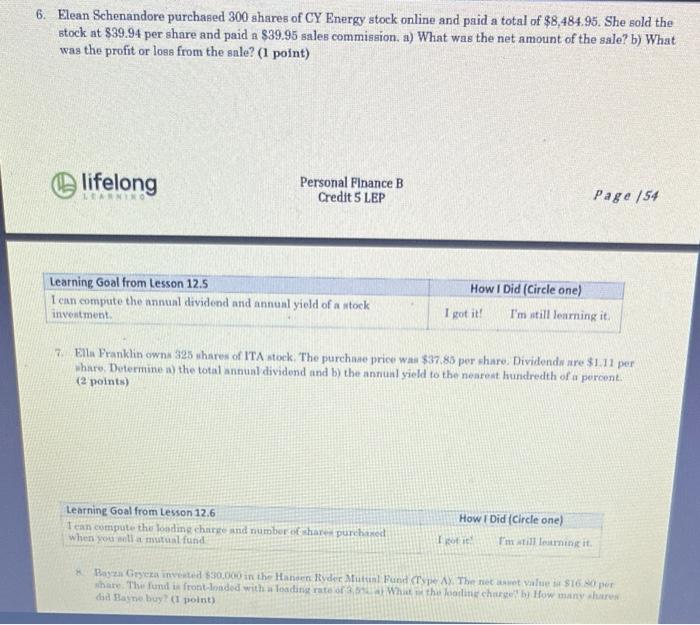

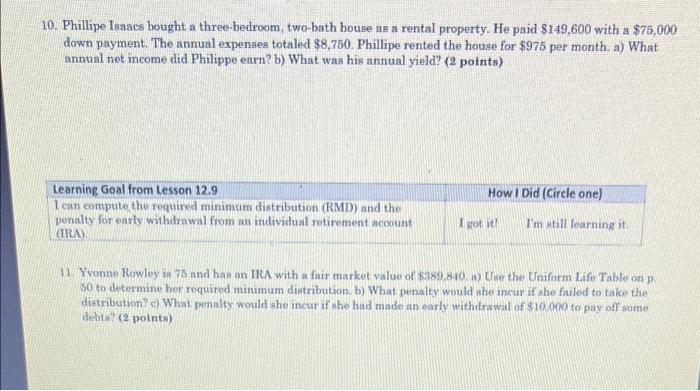

10. Phillipe Isnaes bought a three-bedroom, two-bath house as a rental property. He paid $149,600 with a $75,000 down payment. The annual expenses totaled $8,750. Phillipe rented the house for $975 per month. a) What annual net income did Philippe earn? b) What was his annual yield? (2 points) I How I Did (Circle one) Learning Goal from Lesson 12.9 I can compute the required minimum distribution (RMD) and the penalty for early withdrawal from an individual retirement account (IRA). I got it! I'm still learning it. 11. Yvonne Rowley is 75 and has an IRA with a fair market value of $389.840. a) Use the Uniform Life Table on p. 50 to determine her required minimum distribution. b) What penalty would she incur if she failed to take the distribution? What penalty would she incur if she had made an early withdrawal of $10,000 to pay off some debts? (2 points) Learning Goal from Lesson 12.1 How I Did (Circle one) I got it! I'm still learning it. I can compute the interest on a certificate of deposit (CD) 3. Clifford and Hazel Ida can purchase a 4-year CD for $10,000 at 4.5% compounded daily or compounded monthlyn) What is the amount of the CD at each rate at maturity? What is the difference in the interest earned? You can use the table on page 15 to help you. (1 point) Learning Goal from Lesson 12.2 I can determine the annual percentage yield. How I Did (Circle one) I got it! I'm still learning it. 4.Mabel Casino has $35,000 to invest in a certificate of deposit for 4 years. The CD enra 4.75% interest compounded daily. What is the annual percentage yield (1 point) Learning Goal from Lesson 12.3 I can enleulate the total cost of a stock investment How I Did (Circle one) I got it I'm still learning it Determines the cost of the stock and b) the total pald. David Daly w 215 shares of Atwood Tiru Hix cost per 18 The online common (1 point) 6. Elean Schenandore purchased 300 shares of CY Energy stock online and paid a total of $8,484.95. She sold the stock at $39.94 per share and paid a $39.95 sales commission, a) What was the net amount of the sale? b) What was the profit or loss from the snle? (1 point) lifelong Personal Finance B Credit 5 LEP 1 Page/54 Learning Goal from Lesson 12.5 Lean compute the annual dividend and annual yield of a stock investment How I Did (Circle one) I got it! I'm still learning it Ella Franklin ownA 325 shares of ITA stock The purchase price was $37.85 per share. Dividendenre 31.11 per whare. Determine a) the total annual dividend and b) the annual yield to the nearest hundredth of a porcent. (2 points) Learning Goal from Lesson 12.6 Teen compute the loading charge and numbers are purchased when you wela mutual fund How I Did (Circle one) I'm still learning it Baya geta invested 30.000 in the Han der Mittel und CT AY The new value $16. share the fund te front loaded with loading rate. What the leading charge by How many didne buy point) 10. Phillipe Isaacs bought a three-bedroom, two-bath house is a rental property. He paid $149,600 with a $75,000 down payment. The annual expenses totaled $8,750. Phillipe rented the house for $975 per month a) What annual net income did Philippe enrn? b) What was his annual yield? (2 points) How I Did (Circle one) Learning Goal from Lesson 12.9 I can compute the required minimum distribution (RMD) and the penalty for early withdrawal from an individual retirement account (IRA I got it! I'm still learning it 11. Yvonne Rowley is 75 and has an IRA with a fair market value of $389.840. Use the Uniform Life Table on 50 to determine her required minimum distribution, b) What penalty would she incur if he failed to take the distribution What penalty would she incur if she had made an early withdrawal of $20.000 to pay off some debt? (2 points) 10. Phillipe Isnaes bought a three-bedroom, two-bath house as a rental property. He paid $149,600 with a $75,000 down payment. The annual expenses totaled $8,750. Phillipe rented the house for $975 per month. a) What annual net income did Philippe earn? b) What was his annual yield? (2 points) I How I Did (Circle one) Learning Goal from Lesson 12.9 I can compute the required minimum distribution (RMD) and the penalty for early withdrawal from an individual retirement account (IRA). I got it! I'm still learning it. 11. Yvonne Rowley is 75 and has an IRA with a fair market value of $389.840. a) Use the Uniform Life Table on p. 50 to determine her required minimum distribution. b) What penalty would she incur if she failed to take the distribution? What penalty would she incur if she had made an early withdrawal of $10,000 to pay off some debts? (2 points) Learning Goal from Lesson 12.1 How I Did (Circle one) I got it! I'm still learning it. I can compute the interest on a certificate of deposit (CD) 3. Clifford and Hazel Ida can purchase a 4-year CD for $10,000 at 4.5% compounded daily or compounded monthlyn) What is the amount of the CD at each rate at maturity? What is the difference in the interest earned? You can use the table on page 15 to help you. (1 point) Learning Goal from Lesson 12.2 I can determine the annual percentage yield. How I Did (Circle one) I got it! I'm still learning it. 4.Mabel Casino has $35,000 to invest in a certificate of deposit for 4 years. The CD enra 4.75% interest compounded daily. What is the annual percentage yield (1 point) Learning Goal from Lesson 12.3 I can enleulate the total cost of a stock investment How I Did (Circle one) I got it I'm still learning it Determines the cost of the stock and b) the total pald. David Daly w 215 shares of Atwood Tiru Hix cost per 18 The online common (1 point) 6. Elean Schenandore purchased 300 shares of CY Energy stock online and paid a total of $8,484.95. She sold the stock at $39.94 per share and paid a $39.95 sales commission, a) What was the net amount of the sale? b) What was the profit or loss from the snle? (1 point) lifelong Personal Finance B Credit 5 LEP 1 Page/54 Learning Goal from Lesson 12.5 Lean compute the annual dividend and annual yield of a stock investment How I Did (Circle one) I got it! I'm still learning it Ella Franklin ownA 325 shares of ITA stock The purchase price was $37.85 per share. Dividendenre 31.11 per whare. Determine a) the total annual dividend and b) the annual yield to the nearest hundredth of a porcent. (2 points) Learning Goal from Lesson 12.6 Teen compute the loading charge and numbers are purchased when you wela mutual fund How I Did (Circle one) I'm still learning it Baya geta invested 30.000 in the Han der Mittel und CT AY The new value $16. share the fund te front loaded with loading rate. What the leading charge by How many didne buy point) 10. Phillipe Isaacs bought a three-bedroom, two-bath house is a rental property. He paid $149,600 with a $75,000 down payment. The annual expenses totaled $8,750. Phillipe rented the house for $975 per month a) What annual net income did Philippe enrn? b) What was his annual yield? (2 points) How I Did (Circle one) Learning Goal from Lesson 12.9 I can compute the required minimum distribution (RMD) and the penalty for early withdrawal from an individual retirement account (IRA I got it! I'm still learning it 11. Yvonne Rowley is 75 and has an IRA with a fair market value of $389.840. Use the Uniform Life Table on 50 to determine her required minimum distribution, b) What penalty would she incur if he failed to take the distribution What penalty would she incur if she had made an early withdrawal of $20.000 to pay off some debt? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started